- Home

- »

- Petrochemicals

- »

-

Recovered Carbon Black Market Size, Industry Report, 2030GVR Report cover

![Recovered Carbon Black Market Size, Share & Trends Report]()

Recovered Carbon Black Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Tires, Rubber, High Performance Coatings, Plastics), By Region (North America, Europe, Asia Pacific, Central And South America, MEA), And Segment Forecasts

- Report ID: GVR-4-68038-538-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recovered Carbon Black Market Summary

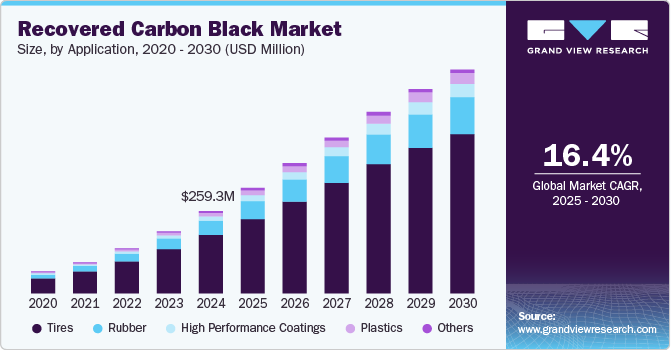

The global recovered carbon black market size was valued at USD 259.3 million in 2024 and is projected to reach USD 706.5 million by 2030, growing at a CAGR of 16.4% from 2025 to 2030. Innovations in recovered carbon black (rCB) recovery technologies, such as advanced pyrolysis and chemical processes, significantly improve the efficiency and quality of rCB production. These advancements reduce costs and make rCB a more competitive substitute for virgin carbon black.

Key Market Trends & Insights

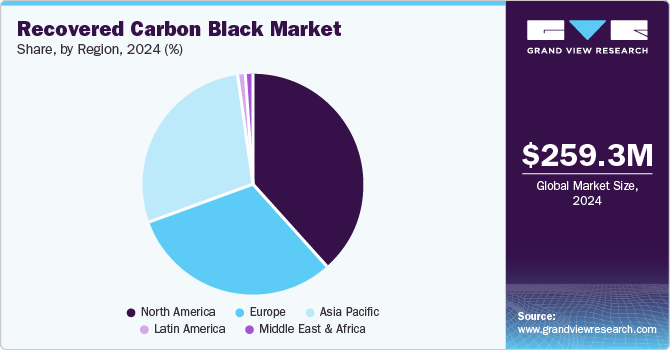

- The North America recovered carbon black industry held the largest market share of 39.5% in 2024.

- The U.S. held a significant position in the recovered carbon black industry in North America in 2024.

- Based on application, the tires segment dominated the market and accounted for the largest share of 71% in 2024.

- Based on application, the rubber segment is expected to record the highest CAGR of 16.1% from 2025 to 2030.

Market Size & Forecast

- 2024 Market Size: USD 259.3 Million

- 2030 Projected Market Size: USD 706.5 Million

- CAGR (2025-2030): 16.4%

- North America: Largest market in 2024

Increased investment in recycling infrastructure and supply chains is bolstering the growth of the rCB market by enhancing collection, processing, and distribution networks. Stringent environmental regulations and increasing demand for sustainable materials collectively drive the expansion of the recovered carbon black market and support circular economy goals while reducing dependence on fossil resources.

The rising focus on sustainability and reducing carbon emissions is driving demand for recovered carbon black as industries seek eco-friendly alternatives to virgin materials. The lower environmental impact of rCB aligns with growing regulatory pressures and consumer preferences for sustainable products. The expansion of its end-use applications, including tire manufacturing, plastics, coatings, and inks, further boosts its adoption. As industries increasingly recognize the economic and environmental benefits of using rCB, the market for this recycled material is set to experience substantial growth, supporting a circular economy.

Application Insights

The tires segment dominated the market and accounted for the largest share of 71% in 2024, driven by the high demand for durable, high-performance materials in tire manufacturing. Tire manufacturers are among the major consumers of carbon black, which enhances strength, wear resistance, and durability. As the automotive industry increasingly focuses on sustainability, rCB offers an eco-friendly alternative to virgin carbon black. Its adoption is expected to increase with manufacturers seeking to reduce environmental impact and lower production costs.

The rubber segment is expected to record the highest CAGR of 16.1% from 2025 to 2030. The surging demand for sustainable materials in tire manufacturing and other rubber products is the key factor favoring the growth of this segment. rCB, a recycled alternative to virgin carbon black, offers cost-effective and eco-friendly properties, making it attractive for rubber producers focused on reducing the environmental impact. As regulations tighten around carbon emissions and recycling gains prominence, the adoption of recycled carbon black is expected to rise, enhancing its market share within the rubber industry in the coming years.

Regional Insights

The North America recovered carbon black industry held the largest market share of 39.5% in 2024 due to a combination of regulatory support, advanced recycling technologies, and robust demand from key industries. The region's commitment to sustainability and stringent environmental policies have driven the adoption of rCB as an affordable and eco-friendly alternative. Furthermore, North America's well-established automotive and tire manufacturing sectors are major consumers of rCB, boosting market growth. Increased investment in green technologies and escalating consumer preference for sustainable products have further strengthened the dominance of North America in the global market.

U.S. Recovered Carbon Black Market Trends

The U.S. held a significant position in the recovered carbon black industry in North America in 2024, owing to its strong commitment to sustainability and innovation. With surging demand for biodegradable solutions in various industries, such as automotive, tire manufacturing, and rubber, the U.S. is witnessing ample investments in rCB recovery technologies and recycling infrastructure. Government regulations promoting circular economy practices and shifting toward sustainable production are key factors favoring market expansion. As companies adopt recycled materials, the U.S. is well-positioned to lead the rCB market, driving innovation and demand.

Canada is projected to achieve a noteworthy CAGR over the forecast period, owing to its robust environmental policies and focus on sustainable development. With sizable investments in recycling infrastructure and tire recovery technologies, Canada is embracing a shift toward circular economy approaches. The country’s burgeoning automotive and manufacturing sectors are increasingly adopting rCB as an efficient, eco-friendly alternative to virgin carbon black. Besides, Canada’s commitment to reducing carbon emissions and promoting sustainable industrial practices is also expected to promote the demand for rCB.

Europe Recovered Carbon Black Market Trends

Europe’s prominence in the recovered carbon black industry is attributed to the region’s strong regulatory framework promoting sustainability and circular economy practices. The European Union’s strict environmental regulations and incentives for recycling have driven the adoption of rCB, especially in industries such as automotive, tire manufacturing, and coatings. The region's emphasis on reducing carbon emissions and waste, along with advancements in rCB technology, has positioned Europe as a leader in eco-friendly material solutions. In addition, rising consumer demand for sustainable products further escalates the demand for rCB in the regional market.

Germany is anticipated to accumulate remarkable gains by 2030, propelled by its strong commitment to sustainability and environmental policies. With the European Union’s rigid regulations on waste management and carbon emissions, Germany is leading in efforts to recycle and repurpose materials such as carbon black. The automotive and tire industries, key consumers of rCB, are adopting eco-friendly practices. Also, Germany’s advanced technological infrastructure and ongoing research into efficient carbon black recovery processes position it as a growing hub for rCB production and usage.

The UK is expected to establish a considerable foothold by 2030, fueled by its adherence to sustainability and a circular economy. The government’s stringent environmental regulations, coupled with policies supporting recycling and waste reduction, are encouraging the use of rCB across industries. The UK’s booming automotive and manufacturing sectors are increasingly adopting rCB as a cost-effective, eco-friendly alternative to virgin carbon black. Advancements in tire recycling technologies and consumer demand for greener products are further expected to fuel market expansion in the UK.

Asia Pacific Recovered Carbon Black Market Trends

Asia Pacific is anticipated to record the highest CAGR of 16.9% from 2025 to 2030, driven by its expanding industrial sector, emphasis on sustainability, and increasing environmental regulations. Countries such as China, India, and Japan are investing heavily in advanced recycling technologies and infrastructure, which supports the efficient recovery of carbon black. Also, a surge in demand for recyclable materials, particularly in the automotive, tire, and rubber industries, is accelerating market growth. Moreover, Asia Pacific benefits from cost-efficient recycling processes and abundant raw materials, making rCB a more attractive option. With significant investments and government support, Asia Pacific is set to lead the global rCB market in the coming years.

China recovered carbon black industry accounted for a remarkable share in the regional market in 2024, due to its significant focus on environmental sustainability and waste management. The country’s escalating tire recycling industry, along with government initiatives to reduce carbon emissions and promote circular economy practices, is boosting demand for rCB. China’s large manufacturing base, particularly in the automotive, rubber, and plastics sectors, is adopting rCB as an efficacious and eco-friendly alternative to virgin carbon black.

The recovered carbon black market in India is anticipated to witness growth throughout the forecast period, driven by its booming industrial sectors and increasing environmental awareness. The country’s expanding automotive, tire, and manufacturing industries are fueling demand for sustainable materials such as rCB. Government initiatives promoting circular economy practices and waste management are further boosting the market growth. Moreover, India’s cost-effective labor and raw material availability, coupled with advancements in recycling technology, are facilitating the production of rCB. As sustainability becomes a key focus, India is set to witness substantial market expansion in the coming years.

Key Recovered Carbon Black Company Insights

Some of the key companies in the recovered carbon black industry include Black Bear Carbon, Pyrolyx AG, Scandinavian Enviro Systems AB, Radhe Group of Energy, DRON Industries, Klean Industries, Alpha Carbone, Delta Energy Group, and Bolder Industries.

-

Pyrolyx AG specializes in sustainable technology, offering solutions for recycling end-of-life tires into high-quality recovered carbon black (rCB), helping reduce waste and environmental impact while supporting circular economy goals.

-

Delta Energy Group focuses on sustainable carbon black recovery through its proprietary pyrolysis processes, helping reduce waste and carbon emissions while producing high-value rCB for use in various industries, including automotive and manufacturing.

Key Recovered Carbon Black Companies:

The following are the leading companies in the recovered carbon black market. These companies collectively hold the largest market share and dictate industry trends.

- Black Bear Carbon

- Delta Energy Group

- Pyrolyx AG

- Scandinavian Enviro Systems AB

- Radhe Group of Energy

- Klean Industries

- Bolder Industries

- DRON Industries

- Alpha Carbone

Recent Developments

-

In June 2024, Klean Industries Inc. signed a non-binding Letter of Intent (LOI) to supply advanced equipment and proprietary technologies for converting char from end-of-life tire thermal processing into high-quality recovered carbon black (rCB). This initiative will focus on advancing rCB production in India and Malaysia.

-

In April 2024, Smithers launched the Recovered Carbon Black (rCB) Conference in Asia with the goal of promoting sustainable practices, fostering industry collaboration, and showcasing cutting-edge innovations. The event aims to support growth and advancements in the rapidly expanding and evolving rCB market.

-

In September 2023, Continental strengthened its commitment to the circular economy by integrating recovered carbon black (rCB) into its Super Elastic solid tires, manufactured at its Korbach plant in Germany. This move helps reduce dependence on fossil raw materials, contributing to lower CO2 emissions and promoting sustainability.

Recovered Carbon Black Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 331.1 million

Revenue forecast in 2030

USD 706.5 million

Growth Rate

CAGR of 16.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Netherlands; China; India; Japan; South Korea; Brazil; Saudi Arabia

Key companies profiled

Pyrolyx AG; Delta Energy Group; Black Bear Carbon; Scandinavian Enviro Systems AB; Klean Industries; Radhe Group of Energy; Bolder Industries; DRON Industries; Alpha Carbone

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recovered Carbon Black Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global recovered carbon black market report on the basis of application and region:

-

Application Outlook (Revenue, Kilotons, USD Million, 2018 - 2030)

-

Tires

-

Rubber

-

High Performance Coatings

-

Plastics

-

Others

-

-

Regional Outlook (Revenue, Kilotons, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central and South America

-

Brazil

-

-

Middle East and Africa

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.