- Home

- »

- Next Generation Technologies

- »

-

Recommendation Engine Market Size, Industry Report, 2030GVR Report cover

![Recommendation Engine Market Size, Share & Trends Report]()

Recommendation Engine Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Collaborative Filtering, Content Based Filtering, Hybrid Recommendation), By Deployment (Cloud), By Organization, By Application, End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-605-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Recommendation Engine Market Trends

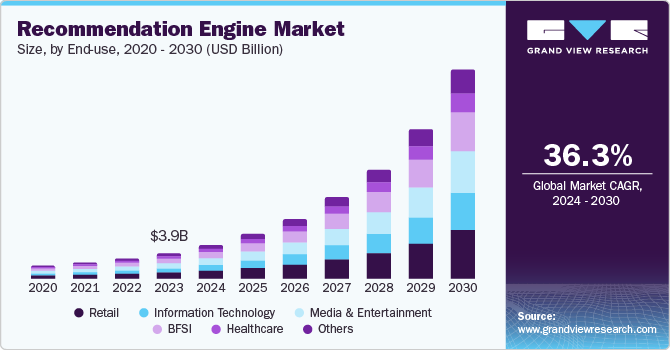

The global recommendation engine market size was valued at USD 3.92 billion in 2023 and is projected to grow at a CAGR of 36.3% from 2024 to 2030. As businesses strive to enhance customer experiences and streamline operations, recommendation engines have become increasingly essential tools. These engines leverage advanced algorithms, including machine learning (ML) and artificial intelligence (AI), to analyze vast amounts of data and provide personalized recommendations to users. This capability is particularly valuable in sectors such as e-commerce, media and entertainment, and healthcare, where personalized experiences can significantly impact customer satisfaction and retention.

The increasing need to enhance customer experience is fueling the demand for recommendation engines. The growing adoption of digital technologies among organizations is also resulting in the increased demand for recommendation engine solutions. The COVID-19 pandemic affected several industries, leading to a notable change in how businesses operate and buyers’ shop. These changes are expected to endure beyond the pandemic as well, having a lasting impact on businesses and people. For instance, the e-commerce giant Amazon.com, Inc. made approximately USD 33 million an hour in sales in the first quarter of 2020.

The e-commerce industry has witnessed a surge in the use of recommendation engines. With the growing reliance on online shopping in the post-pandemic era, businesses have increasingly turned to these engines to offer personalized product suggestions, thereby enhancing the shopping experience and boosting sales. Consumers’ changing shopping habits, coupled with the need for convenience and immediacy, have made e-commerce platforms heavily rely on recommendation engines.

Another significant driver is the proliferation of over-the-top (OTT) platforms and the demand for high-quality, personalized content. As consumers seek diverse and engaging content, OTT platforms have leveraged recommendation engines to suggest movies, TV shows, and other media based on users’ viewing histories and preferences. This enhances user engagement and helps platforms retain subscribers in a highly competitive market. The increasing availability of linguistically diverse content further fuels the demand for recommendation engines, as they can cater to a broader audience by offering tailored recommendations.

Furthermore, in the Banking, Financial Services, and Insurance (BFSI) sector, recommendation engines have been extensively used to enhance customer satisfaction through personalized banking experiences. By analyzing customer data, these engines suggest relevant financial products and services, thereby improving customer engagement and loyalty. The integration of recommendation algorithms in personalized banking systems has become increasingly common, driven by the need to provide better customer experiences and stay competitive in the market.

Moreover, technological advancements and the growing adoption of cloud-based solutions have stimulated the market forward. Cloud-based recommendation engines offer scalability, flexibility, and cost-effectiveness, which makes them attractive to businesses of all sizes. Small and Medium-Sized Enterprises (SMEs) have increasingly adopted these solutions to manage large volumes of data and engage users effectively.

Type Insights

Collaborative filtering held the dominant market share in 2023 owing to the increasing demand for personalized user experiences across various industries. Collaborative filtering, which relies on user behavior and preferences to make recommendations, is highly effective in providing tailored suggestions. This method is particularly popular in e-commerce platforms such as Amazon and Alibaba which use it to recommend products based on customer's past purchases and browsing history. For instance, Spotify uses collaborative filtering to recommend “Discover Weekly” and other playlists to the listeners based on their listening history. By analyzing viewing and listening patterns, such platforms can enhance user engagement and retention, which is crucial in a competitive market.

Hybrid recommendation is expected to grow at a CAGR of 37.7% over the forecast period. The increasing need for more accurate and reliable recommendations is one of the key market drivers. Hybrid recommendation systems combine the strengths of collaborative filtering and content-based filtering, resulting in more precise and personalized suggestions. For instance, Netflix uses a hybrid recommendation engine to get insights into the features of a show or movie and viewers’ preferences. This dual approach mitigates the limitations of using a single method, such as the cold start problem in collaborative filtering and the limited scope of content-based filtering.

Deployment Insights

The cloud segment dominated the market with 87.7% in 2023. Cloud-based recommendation engines allow businesses to scale their operations seamlessly, accommodating growing data volumes and user bases without significant infrastructure investments. This scalability is particularly beneficial for e-commerce platforms and streaming services, which experience fluctuating traffic and need to provide consistent, high-quality recommendations. In addition, cloud deployment reduces the need for extensive on-premises hardware and maintenance, leading to lower capital expenditures. Businesses can opt for pay-as-you-go models, which align costs with actual usage, making it a cost-effective solution for companies of all sizes.

On-premise deployment is expected to emerge considerably during the forecast period. The segment growth can be attributed to the rising need for enhancing data security and privacy. Large enterprises with higher spending capacity have increasingly opted for on-premise infrastructure and data security solutions. Moreover, businesses with unique operational needs or complex IT infrastructures often find on-premise solutions more adaptable to their specific requirements.

Organization Insights

Large enterprises held the largest market share in 2023 owing to the growing need to make better decisions, efficiently manage their business portfolio, and gain a competitive edge in the global market. These enterprises, with their extensive customer bases, leverage recommendation engines to analyze vast datasets and provide personalized recommendations. In addition, the integration of AI and ML in recommendation engines enables more accurate and efficient data processing, leading to better recommendation quality. This technological edge allows large enterprises to stay ahead of the competition by offering superior customer experiences.

Small and Medium-sized enterprises (SMEs) are anticipated to grow at a CAGR of 38.0% over the forecast period. The growth is attributable to the growing need for personalized customer experiences. SMEs have leveraged recommendation engines to analyze customer data and provide tailored product and service suggestions for enhanced customer satisfaction and loyalty. Furthermore, the increased need to find alternative solutions for saving marketing and advertising costs due to limited budgets has stimulated the demand for recommendation engines among SMEs.

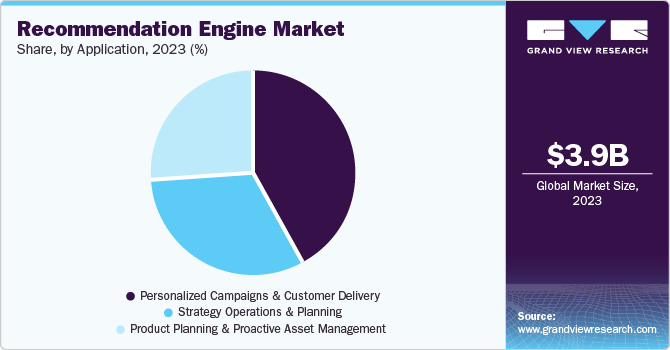

Application Insights

The personalized campaigns and customer delivery segment accounted for the largest revenue share of 42.0% in 2023. The dominance of this segment can be accredited to the rising emphasis on enhancing customer experience. Businesses across various sectors, including e-commerce, media, and financial services, have leveraged recommendation engines to deliver personalized marketing campaigns and tailored customer interactions. These engines help create highly targeted marketing campaigns to reach the right audience and build stronger customer relationships, increasing engagement, and boosting customer loyalty.

The product planning and proactive asset management segment is anticipated to grow substantially during the forecast period owing to the increasing need for efficient resource utilization and optimization. Industries including manufacturing, logistics, and retail have leveraged recommendation engines to analyze vast amounts of data and provide insights that help in planning product development and managing assets more effectively. Additionally, the rising adoption of ML and AI technologies by numerous organizations helps users generate insights through the data collected from their customers’ choices, preferences, and habits.

End-use Insights

The retail segment dominated the market with 25.0% share in 2023. The market surge can be attributed to the rapid digital transformation within the retail industry that has led to an increased adoption of recommendation engines to enhance customer experience and engagement. Retailers have leveraged these engines to provide personalized product recommendations, which improve customer satisfaction and boost sales and conversion rates. Moreover, the growing prevalence of e-commerce platforms has further amplified this trend, as online retailers seek to differentiate themselves in a highly competitive market by offering tailored shopping experiences.

The BFSI sector is projected to grow at the fastest CAGR over the forecast period. The increasing emphasis on personalized customer experiences has significantly driven market growth. These institutions have alarmingly leveraged recommendation engines to analyze vast amounts of customer data and provide tailored product and service recommendations to drive customer loyalty. Moreover, the shifting consumer preferences toward online and mobile banking has led to the rise of digital banking and fintech innovations. Fintech institutions have adopted advanced technologies including sophisticated recommendation algorithms. These technologies help with operational efficiency, thereby offering relevant financial products and services.

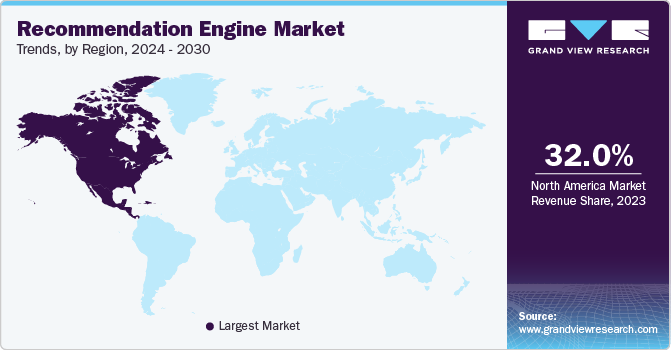

Regional Insights

The North America recommendation engine market secured 32.0% share in 2023 due to the widespread adoption of over-the-top (OTT) services, particularly in the video and audio domains. Streaming services such as Netflix, Hulu, and Spotify have heavily relied on recommendation engines to suggest content based on users’ viewing and listening histories. This personalized approach helps these platforms retain subscribers and keep them engaged, which is essential in a highly competitive market.

U.S. Recommendation Engine Market Trends

The U.S. recommendation engine market is expected to grow in the coming years owing to rapid digital transformation and the growing adoption of AI and ML technologies. These technologies enable more accurate and efficient recommendation engines, capable of processing large datasets and providing real-time recommendations.

Europe Recommendation Engine Market Trends

The recommendation engine market in Europe held a lucrative share of 27.4% in 2023. The rapid growth of e-commerce is a major contributor to the demand for recommendation engines in the region. As online shopping becomes more prevalent, e-commerce platforms have widely used these engines to offer personalized product suggestions to enhance the shopping experience and increase conversion rates and sales.

Asia Pacific Recommendation Engine Market Trends

The Asia Pacific (APAC) recommendation engine market held 26.3% of the global revenue share in 2023. Factors such as the rising penetration of e-commerce, an upsurge in online shopping transactions, and an increase in the number of OTT service providers have fueled the demand for recommendation engines in the region. Additionally, e-commerce, media, and entertainment businesses leveraged these engines to provide personalized recommendations based on user data to maintain customer satisfaction and loyalty in a competitive market.

Key Recommendation Engine Company Insights

The market for recommendation engines is fragmented. Key participants such as Adobe, Amazon Web Services, Inc., Google LLC, and others have entered into strategic collaborations and partnerships to expand their business footprints and survive the highly competitive environment. Moreover, service providers have significantly invested in research & development activities to incorporate new technologies in their offerings and develop advanced products to gain a competitive advantage.

-

Adobe is a global leader in digital media and digital marketing solutions. The company is known for its flagship products such as Photoshop, Illustrator, and Acrobat. Adobe’s Experience Cloud provides robust solutions for marketing, advertising, analytics, and commerce, helping businesses deliver personalized customer experiences.

Key Recommendation Engine Companies:

The following are the leading companies in the recommendation engine market. These companies collectively hold the largest market share and dictate industry trends.

- Adobe

- Amazon Web Services, Inc.

- Google LLC

- Hewlett Packard Enterprise Development LP

- International Business Machines Corporation

- Intel Corporation

- Microsoft Corporation

- Oracle

- Salesforce, Inc.

- SAP SE

Recent Development

- In January 2024, SAP SE launched new AI-powered features designed to help retailers streamline their business operations, boost profitability, and enhance customer loyalty.

Recommendation Engine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 5.19 billion

Revenue forecast in 2030

USD 33.23 billion

Growth Rate

CAGR of 36.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, deployment, organization, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE.

Key companies profiled

Adobe; Amazon Web Services, Inc.; Google LLC; Hewlett Packard Enterprise Development LP; International Business Machines Corporation; Intel Corporation; Microsoft Corporation; Oracle; Salesforce, Inc.; SAP SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Recommendation Engine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global recommendation engine market report based on, type, deployment, organization, application, end-use and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Collaborative Filtering

-

Content Based Filtering

-

Hybrid Recommendation

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud

-

On-Premise

-

-

Organization Outlook (Revenue, USD Million, 2018 - 2030)

-

SMEs

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Personalized Campaigns and Customer Delivery

-

Strategy Operations and Planning

-

Product Planning and Proactive Asset Management

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Information Technology

-

Healthcare

-

Retail

-

BFSI

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.