Recombinant Protein Therapeutics CDMO Market Size, Share & Trends Analysis Report By Type (Growth Hormones, Interferons, Vaccines, Immunostimulating Agents, Others), By Source, By Indication, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-116-2

- Number of Report Pages: 173

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

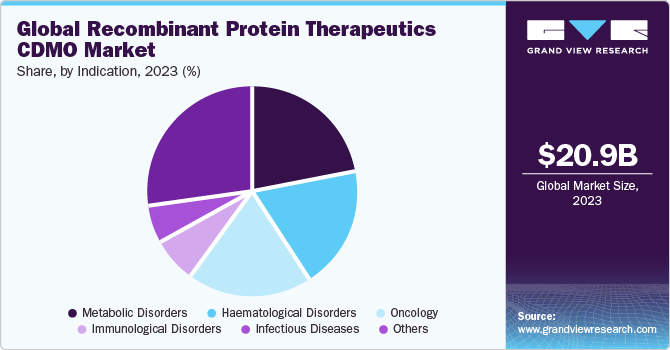

The global recombinant protein therapeutics CDMO market size was estimated at USD 20.89 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 13.95% from 2024 to 2030. The increasing demand for biological drugs, including recombinant protein therapeutics as an effective option in treating various diseases, is one of the major factors supporting the growth of the recombinant protein therapeutics industry. This increased demand is likely to drive the need for CDMOs, which can provide manufacturing & development services for the same. Moreover, advancements in biotechnology, such as the implementation of novel and enhanced technologies & techniques for producing recombinant protein drugs, are another significant factor supporting the market’s growth.

In addition, biological drug evolution has aided in overcoming the concern about the use of traditional synthetic drugs. Hence, biopharmaceutical companies are opting for various processes to develop biologics targeting 100+ diseases. Biologics help tackle the pitfalls associated with synthetic biosimilars/ drugs, which drives demand for pharmaceutical contract manufacturing services. This growing demand for outsourcing services for biologics development can be attributed to manufacturing complex biologics. These factors are anticipated to drive the growth of contract manufacturing services for biological production.

The COVID-19 pandemic positively impacted the market. There was a sudden increase in workload due to the shutdown or reduced internal recombinant protein therapeutics CDMO capacities of numerous pharmaceutical companies. Reduced lab capacity due to fear of spreading the virus, IT disturbances, and a hindrance in the procurement of raw materials were among the challenges initially faced by the workers. However, companies adopted strategies to mitigate or prevent these challenges, such as rotational shifts, reducing the workforce, and working from home.

Furthermore, there has been a surge in demand for outsourcing activities related to developing advanced therapeutics to minimize the COVID-19 burden. In addition, market players utilized various activities to enhance the growth of recombinant protein therapeutics, such as increasing collaboration, mergers, and acquisitions.

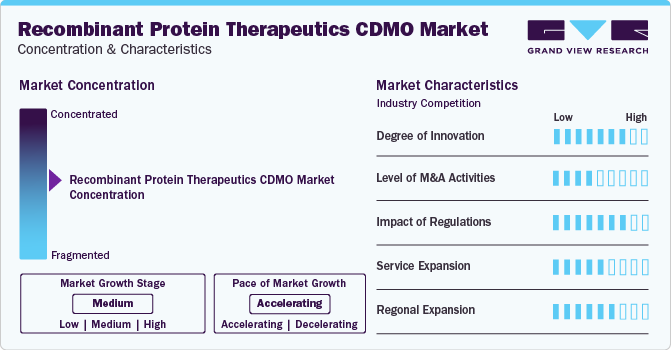

Market Concentration & Characteristics

The market growth stage is stable, and market growth is expected to accelerate over the estimated period. The recombinant protein therapeutics CDMO market is characterized by evolving technologies, regulatory considerations, and globalization & outsourcing of services processes to influence advantages and specialized capabilities.

The development of novel recombinant protein therapeutics has observed significant advancements due to various technological innovations.In addition, recent progress in various bioprocessing areas is being harnessed to create effective processes for the production of these proteins. These advancements collectively aim to achieve a higher yield of quality products.

Regulatory bodies and other health authorities can greatly influence the recombinant protein therapeutics CDMO industry. Regulations on clinical trials have rapidly evolved, and the pandemic accelerated the need for continual monitoring by regulatory authorities & clinical teams to maintain study integrity. In addition, the compliance standards, and industry guidelines drive the market growth.

Competitive strategies of competitors within the recombinant protein therapeutics CDMO industry are crucial influences. Understanding the competitive landscape helps businesses position themselves effectively and differentiate their offerings.

Increasing R&D activities, rising number of expansions, & growing disease burden can influence market dynamics positively.

Changes in global healthcare trends, existence of technologically advanced CDMOs, and an upsurge in the allocation of grants can impact the demand for recombinant protein therapeutics CDMO. Analyzing market influencers involves innovation & acquisitions, and the presence of pharmaceutical & biotech firms that may shape the market.

Type Insights

Based on type segment, the market is segregated into growth hormones, interferons, vaccines, immunostimulating agents, and others. The interferons segment led the market and accounted for 21.5% of global revenue in 2023. Interferons play an important role in limiting the spread of infection. There are three interferons: α, β, and γ. Furthermore, the rising burden of these diseases is expected to increase the interest of pharmaceutical companies in developing new protein therapeutics. This has led to a growing number of applications of interferons in recombinant therapeutics for the treatment of various human cancers and diseases of viral origin, further impacting the market positively.

In addition, the growth hormones segment is anticipated to grow at a rapid pace over the forecast period. The segment growth is driven by increasing requirements for proteins that regulate cellular processes and growing demand for treatment in patients with growth hormone deficiency. Moreover, recombinant growth hormones are proteins manufactured identical to the main form of human growth hormones. This recombinant growth hormone further stimulates tissue growth, linear growth (height), and metabolism (protein, carbohydrate, lipid, & mineral). Furthermore, other functions of growth hormones include immunomodulatory actions. Such factors are anticipated to drive the market.

Source Insights

Based on source segment, the market is segregated into mammalian systems, microbial systems, and others. The mammalian systems segment dominated the market in 2023, accounting for a revenue share of 67.4%. Mammalian cells are used widely for the production of complex human glycoproteins. They offer advantages such as correct protein folding and post-translational modifications. About 60% of therapeutic proteins, especially antibodies, are produced by mammalian cells, and therefore, many CDMOs offer mammalian upstream process development services. Cell lines such as CHO, baby hamster kidney, human embryo kidney, VERO, and human retinal cells are widely used for mammalian upstream formulation. In 2022, the Center for Drug Evaluation and Research (CDER) approved 37 biological and therapeutic drugs for various disease indications. Thus, mammalian biological drugs that are genetically engineered are site-specific and efficient. This factor is driving the mammalian systems segment.

The microbial systems segment is expected to grow at a CAGR of 13.89% over the forecast period. Currently, microbial cell lines are extensively used for the production of recombinant protein therapeutics. To develop microbial cell systems, host cell lines, expression vectors, & process parameters are considered, and the host cells are engineered to produce a specific protein. In addition, microbial systems are cost-effective and render consistent results in each batch. Hence, they are widely used by R&D companies to produce therapeutic products.

Indication Insights

Based on indication segment, the market is segregated into oncology, infectious diseases, immunological disorders, metabolic disorders, hematological disorders, and others. The metabolic disorders segment accounted for a 21.8% share in 2023. The growth of this segment can be attributed to increasing metabolic disorders globally. With a growing aging population, prevalence of diseases, and research in recombinant protein therapeutics. Negative changes in lifestyle and rapid urbanization led to an increase in the incidence of metabolic disorders. Hence, increasing incidence is anticipated to drive research activities for recombinant protein therapeutics in the treatment of metabolic disorders.

Furthermore, the oncology segment is expected to grow at a CAGR of 14.81% over the forecast period. Recent trends have shown vast migration in recombinant protein therapeutics with significant advancements in the treatment of cancer. These protein therapeutics are used as a combination treatment for various types of cancer. In addition, an extensive range of recombinant protein therapeutics product offerings among manufacturing has led core competencies to accelerate new product development. Recombinant protein therapeutics made it possible to generate large amounts of biologically active proteins with better therapeutic efficacy and safety.

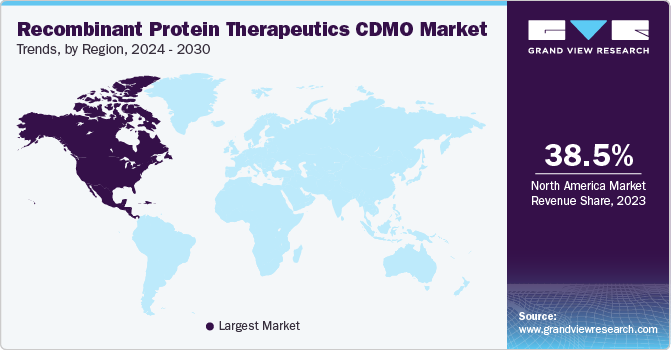

Regional Insights

North America dominated the market for recombinant protein therapeutics CDMO and accounted for the largest revenue share of 38.5% in 2023. A high share of the region is majorly due to the U.S. being established as a global leader in the production of recombinant protein drugs. The country has a strong research & development infrastructure and a robust biopharmaceutical industry, which has contributed to its prominence in this field. Furthermore, the U.S. has a sophisticated and well-developed manufacturing infrastructure for biopharmaceuticals, including recombinant protein therapeutics. This infrastructure includes advanced manufacturing technologies, large-scale production facilities, and stringent quality control processes.

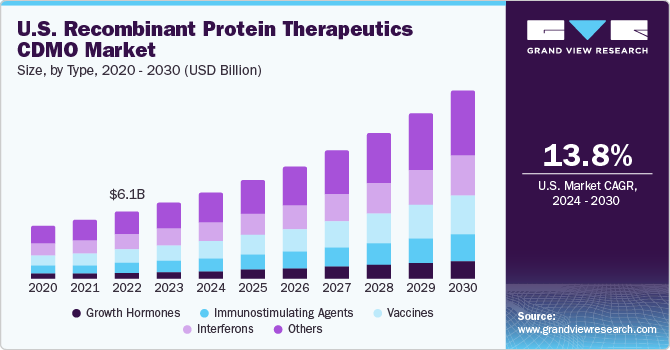

U.S. Recombinant Protein Therapeutics CDMO Market Trends

The recombinant protein therapeutics CDMO market in the U.S. held the largest share in 2023. An increase in R&D activities and a rise in the number of drug approvals in the country are among the major factors supporting market growth.Furthermore, pharmaceutical companies in the region are collaborating with other companies to outsource business activities to improve the cost-efficiency of production and focus more on product innovation. For instance, in January 2022, Thermo Fisher Scientific Inc. declared the purchase of PeproTech, Inc., a prominent producer and innovator of recombinant proteins, for an overall cash acquisition cost of around USD 1.85 billion.

Europe Recombinant Protein Therapeutics CDMO Market Trends

The recombinant protein therapeutics CDMO industry in Europe is expected to grow significantly owing to the presence of key pharmaceutical and biotechnology companies in this region. In addition, there is a large number of CDMOs specializing in therapy innovation in various European countries like the UK, Germany, and France, which is expected to contribute to market growth in this region.

Germany recombinant protein therapeutics CDMO market held the largest share in 2023, owing to increased requirements for improved product designs and related services in the country is expected to be a key factor driving market growth in the coming years. Advancements in technology and quality clinical resources are some of the key factors expected to propel market growth over the forecast period.

Recombinant protein therapeutics CDMO market in the UK is anticipated to grow over the forecast period. The market growth can be attributed to various factors, such as the presence of various multinational CDMOs, significant R&D spending, growing healthcare research, and rapidly evolving therapeutic approaches. For example, in March 2022, the UK government announced that over USD 347 million would be allocated for healthcare research to improve research activities in the region.

Asia Pacific Recombinant Protein Therapeutics CDMO Market Trends

Asia Pacific recombinant protein therapeutics CDMO market is expected to grow at a CAGR of 14.40% over the forecast period. The regional growth can be attributed to various amendments made by regulatory organizations to change clinical trial evaluation standards according to global requirements as well as various major players investing in Asia Pacific. Furthermore, the changing business model of MNC outsourcing and R&D activities is expected to propel recombinant protein therapeutics CDMO demand in the Asia Pacific owing to the cost-efficiency offered by CDMO in countries such as India and China. These countries are expected to witness lucrative growth in the market, whereas countries such as South Korea, Australia, and Thailand are also expected to witness steady growth. The establishment of several CDMOs across the Asia Pacific region has also strengthened innovation in therapies in the region.

Recombinant protein therapeutics CDMO market in China held the largest share in 2023 due to rising investments, growing adoption of R&D standards, and robust demand for CDMO. In addition, the country has witnessed growth in the demand for recombinant proteins in various disease studies.

Japan recombinant protein therapeutics CDMO market is expected to grow over the forecast period due to numerous factors such as the growing pharmaceutical industry, increasing demand for outsourcing services, and rising R&D activities. In addition, with growing R&D and demand for CDMOs, several drug candidates are in the pipeline.

Recombinant protein therapeutics CDMO market in India is anticipated to grow at the fastest CAGR over the forecast period owing to low labor costs, improved infrastructure, and a large number of technical experts are some of the major factors driving market growth.

Key Recombinant Protein Therapeutics CDMO Company Insights

The major players operating across the market are focused on adopting in-organic strategic initiatives such as mergers, partnerships, acquisitions, etc. The prominent strategies adopted by companies are service launches, mergers & acquisitions/joint ventures merger, partnerships & agreements, expansions, and others to increase market presence & revenue and gain a competitive edge drive market growth. Hence, increasing adoption of in-organic strategic initiatives is highly anticipated to boost the market share of prominent players operating across the market.

Key Recombinant Protein Therapeutics CDMO Companies:

The following are the leading companies in the recombinant protein therapeutics CDMO market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these recombinant protein therapeutics CDMO companies are analyzed to map the supply network.

- Richter-Helm BioLogics

- Lonza

- Catalent, Inc

- FUJIFILM Diosynth Biotechnologies

- WuXi Biologics

- Curia Global, Inc.

- Batavia Biosciences B.V.

- HALIX B.V.

- BIOVIAN

- Enzene Biosciences Ltd

Recent Developments

-

In June 2023, Richter-Helm BioLogics announced the expansion of a production site in Bovenau. In addition, with an investment of €95 million (USD 103.33 million), the company will triple production capacity with the two flexible & fully equipped production trains with interchangeable product flow installment, providing late-stage & commercial product capacities.

-

In October 2022, Catalent announced a USD 12 million expansion program to enhance biologics CGMP analytical capabilities in Kansas City, Missouri. It will add two analytical development laboratories to support the assay development for both traditional biologic & advanced biologic modality programs.\

-

In March 2022, Proteogenix launched XtenCHOTM transient CHO expression system to simplify recombinant protein production.

Recombinant Protein Therapeutics CDMO Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 23.7 billion |

|

Revenue forecast in 2030 |

USD 52.0 billion |

|

Growth Rate |

CAGR of 13.95% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

February 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, source, indication, service type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Richter-Helm BioLogics; Lonza; Catalent, Inc; FUJIFILM Diosynth Biotechnologies; WuXi Biologics; Curia Global, Inc.; Batavia Biosciences B.V.; HALIX B.V.; BIOVIAN; Enzene Biosciences Ltd |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Recombinant Protein Therapeutics CDMO Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global recombinant protein therapeutics CDMO market report based on type, source, indication, service type, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Growth Hormones

-

Interferons

-

Vaccines

-

Immunostimulating Agents

-

Others

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Mammalian Systems

-

Microbial Systems

-

Others

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Infectious Diseases

-

Immunological Disorders

-

Metabolic Disorders

-

Haematological Disorders

-

Others

-

-

Service Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Contract Manufacturing

-

Contract Development

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotech Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global recombinant protein therapeutics CDMO market size was estimated at USD 20.89 billion in 2023 and is expected to reach USD 23.7 billion in 2024.

b. The global recombinant protein therapeutics CDMO market is expected to grow at a compound annual growth rate of 13.95% from 2024 to 2030 to reach USD 52.0 billion by 2030.

b. North America dominated the market with a share of 38.5% in 20223. This is attributable to established CMOs, strong research & development infrastructure, and robust biopharmaceutical industry, which has contributed to its prominence in this field.

b. Some key players operating in the market include Richter-Helm BioLogics, Lonza, Catalent, Inc, FUJIFILM Diosynth Biotechnologies, WuXi Biologics, Curia Global, Inc., Batavia Biosciences B.V., HALIX B.V., BIOVIAN, and Enzene Biosciences Ltd among others.

b. The recombinant protein therapeutics CDMO market is driven by the rising adoption of biologics & biosimilars, outsourcing services trends, advancements in biotechnology, technological innovations, and increasing rate of clinical research.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."