Recombinant Cell Culture Supplements Market Size, Share & Trends Analysis Report By Products (Recombinant Albumin, Recombinant Insulin), By Application, By, Type, By End-use, By Region, And Segment Forecasts, 2025 - 2033

- Report ID: GVR-4-68040-488-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

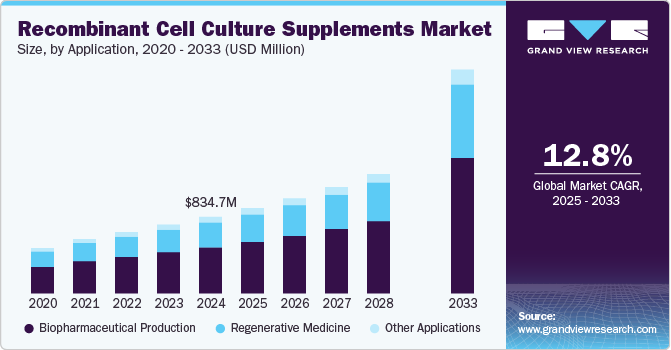

The global recombinant cell culture supplements market size was estimated at USD 834.7 million in 2024 and is expected to grow at a CAGR of 12.83% from 2025 to 2033. The market growth can be attributed to the increasing demand for biopharmaceuticals, rising focus on animal-free supplements, advancements in recombinant technology, and increased R&D in regenerative medicine and cell therapies. Furthermore, with the increasing prevalence of chronic diseases, there’s a growing demand for effective biologic drugs and therapies, further driving the market for recombinant supplements over the forecast period.

The COVID-19 pandemic positively impacted the market, as the urgent need for vaccines and biologics accelerated demand for high-quality, scalable cell culture supplements. These supplements were critical in ensuring rapid, consistent production, supporting research, and enabling efficient manufacturing processes to meet global vaccine demand. Thereby propelling the growth of the global market for recombinant cell culture supplements.

Furthermore, the surge in R&D investments in regenerative medicine and cell therapies drives demand for recombinant cell culture supplements. These supplements are essential in developing cell and gene therapies, particularly for rare or chronic diseases with few available treatments. By enhancing cell viability and consistency, recombinant supplements ensure treatment scalability and effectiveness, supporting personalized medicine and therapeutic innovation breakthroughs.

In addition, rising global demand for biopharmaceuticals, including biologics, vaccines, and cell-based therapies, has increased the need for advanced cell culture supplements. These advanced supplements are crucial in biomanufacturing as they enhance cell growth, optimize protein yield, and ensure cell viability, ultimately supporting high-quality production. As biopharma companies scale to meet healthcare needs, cell culture supplements are pivotal in improving productivity and product consistency. Thereby anticipated propelling the demand for recombinant cell culture supplements over the forecast period.

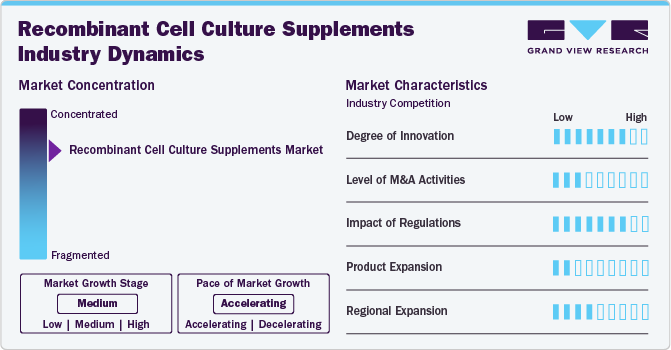

Market Concentration & Characteristics

The recombinant cell culture supplements industry's growth stage is medium, and the pace is accelerating. This growth is fueled by rising demand for biologics, advancements in cell-based therapies, and increased biopharmaceutical R&D investments.

In the industry, collaboration activities are low to moderate due to the niche nature of the market. However, as the demand for advanced bio-manufacturing solutions grows, some companies are exploring partnerships to accelerate innovation and expand their market reach.

Regulations significantly impact the industry. Regulations boost the demand for animal-free supplements due to increasing concerns over ethical sourcing, the need for consistent and reliable product quality, and stricter guidelines aimed at reducing animal-derived components in biopharmaceutical production.

The recombinant cell culture supplements industry currently exhibits moderate product expansion. This is attributed to the high specialization required for developing effective supplements, regulatory challenges, and the dominance of a few established players controlling the market. However, as the demand for biologics and personalized medicine increases, there is a gradual shift towards product diversification, with companies exploring new formulations and applications to meet evolving market needs.

The recombinant cell culture supplements industry demonstrates moderate regional expansion. This is attributed to the varying levels of investment in biotechnology across regions, regulatory differences, and the growing demand for biologics and cell therapies in emerging markets. However, as global healthcare investments increase and more regions focus on strengthening their biopharmaceutical sectors, the industry is expected to experience accelerated regional expansion, particularly in Asia-Pacific and the Middle East.

Products Insights

The recombinant albumin accounted for the largest revenue share of 30.99% in 2024 and is anticipated to grow at the highest CAGR over the forecast period. Segment growth is attributed to widespread use in cell culture processes, enhancing cell growth and productivity, increased production of biopharmaceuticals, and investment in cell culture innovations. These factors are expected to propel the market's growth over the forecast period.

The recombinant cytokines segment is projected to witness a significant growth rate of 12.81% over the forecast period owing to the rising demand for targeted therapies, especially in cancer and autoimmune disease treatments. Recombinant cytokines enhance cell growth and regulate immune responses, making them essential in the research and production of biopharmaceuticals. Furthermore, increased R&D investments and advancements in personalized medicine are further boosting demand. Thus, propelling the growth of the segment over the forecast period.

Type Insights

The powder segment accounted for the largest revenue share in 2024. Owing to the longer shelf life, ease of storage and transport, and cost-effectiveness, making it highly preferable for large-scale production drives the segment's growth over the forecast period. Furthermore, the rising adoption of powdered supplements in biopharmaceutical and vaccine manufacturing further strengthens the position in the market, thereby boosting the demand over the forecast period.

The liquid segment is projected to witness the fastest growth rate from 2025 to 2033 due to its ability to provide faster and more efficient cell culture setups. Liquid formulations are often preferred for high-throughput processes due to their ease of integration into automated systems. Moreover, the growing trend towards personalized medicine and small-batch production in biotech is driving demand for liquid supplements. Thus, propelling the growth of the segment over the forecast period.

Application Insights

Biopharmaceutical production dominated the market with a revenue share of 60.22% in 2024 due to increasing demand for biologics, such as monoclonal antibodies and recombinant proteins, which rely heavily on high-quality cell culture media. The growth in biopharmaceutical R&D, advancements in biomanufacturing technologies, and rising investments in cell-based therapies are further expected to drive the use of recombinant supplements in this sector.

The regenerative medicine segment is projected to witness the fastest growth rate from 2025 to 2033 due to the increasing focus on cell and gene therapies, which require advanced culture media for cell expansion and differentiation. The rising prevalence of chronic diseases, coupled with advancements in stem cell research and tissue engineering, is fueling demand for recombinant cell culture supplements. Thus, propelling the segment’s growth over the forecast period.

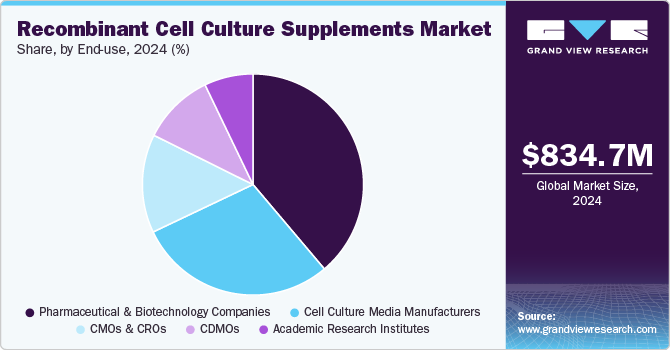

End-use Insights

The pharmaceutical & biotechnology companies segment dominated the market and accounted for the largest revenue share of 38.83% in 2024. The segment growth is attributed to the high demand for recombinant supplements in drug development, biologics production, and vaccine manufacturing. Furthermore, the increasing focus on biologics & biosimilars and expanding R&D activities in companies are further anticipated to drive market growth.

The CDMOs segment is expected to witness the fastest growth rate from 2025 to 2033. This is attributed to the growing trend of outsourcing biopharmaceutical production to reduce costs and improve scalability. Additionally, CDMOs are investing in advanced technologies and capacity expansion to meet the needs of personalized medicine and cell and gene therapies, further driving the adoption of recombinant cell culture supplements.

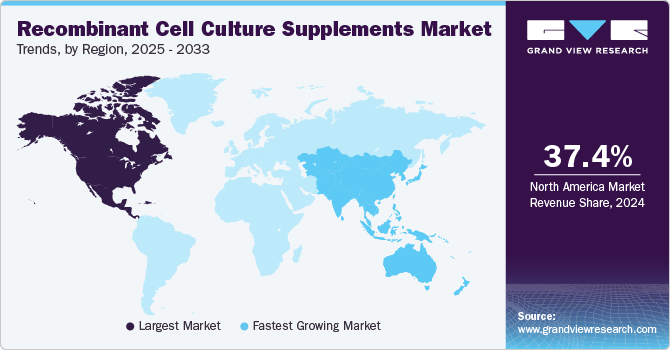

Regional Insights

North America recombinant cell culture supplements market has dominated the market, with a share of 37.43% in 2024. The region has a strong biopharmaceutical industry, significant investments in biotechnology R&D, and a well-established regulatory framework supporting biologics and cell-based therapies. The presence of major pharmaceutical companies and advanced healthcare infrastructure further impelled the market growth over the forecast period.

U.S. Recombinant Cell Culture Supplements Market Trends

The recombinant cell culture supplements market in the U.S. is expected to grow over the forecast period. The increasing adoption of cell and gene therapies, along with robust funding from the government and private sectors, has fueled the demand for recombinant cell culture supplements.

Europe Recombinant Cell Culture Supplements Market Trends

The European recombinant cell culture supplements market is experiencing significant growth, driven by increasing investment in biopharmaceuticals and biotechnology and a growing emphasis on personalized medicine and regenerative therapies.

The recombinant cell culture supplements market in the UK is expected to grow over the forecast period. The rising prevalence of chronic diseases and the need for innovative treatment options contribute to adopting recombinant cell culture supplements in drug discovery and production, propelling the growth.

France recombinant cell culture supplements market is expected to grow over the forecast period. The investment in biopharmaceutical research, particularly in gene and cell therapies, is boosting demand for cell culture supplements.

Germany recombinant cell culture market is expected to grow over the forecast period. This is attributed to the strong infrastructure for biopharmaceutical manufacturing and increasing investments in cell-based therapies and biologics.

Asia Pacific Recombinant Cell Culture Supplements Market Trends

Asia Pacific recombinant cell culture supplements market is anticipated to grow at the fastest rate of 13.54% over the forecast period. This growth is primarily attributed to the rapid expansion of the biopharmaceutical and biotechnology industries in countries like China, India, and Japan. Increased investments in healthcare infrastructure, growing demand for biologics and vaccines, and rising adoption of advanced therapies such as cell and gene therapies drive the market.

The recombinant cell culture supplements market in China is expected to grow over the forecast period. The improving manufacturing capabilities and the shift towards animal-free and cost-effective production methods further fuel the demand for recombinant cell culture supplements.

Japan recombinant cell culture supplements market is expected to grow over the forecast period. Advancements in biopharmaceuticals, regenerative medicine, and government support for biotech innovation drive the market.

The recombinant cell culture supplements market in India is expected to grow over the forecast period. The expanding biopharmaceutical and vaccine production sectors drive the market. Furthermore, increased government support for biotech innovation and a growing focus on affordable biologics are also boosting market demand.

Middle East & Africa Recombinant Cell Culture Supplements Market Trends

The Middle East & Africa recombinant cell culture supplements market is expected to experience substantial growth over the forecast period. An expanding interest in regenerative medicine drives this growth, the rising prevalence of chronic diseases requiring biologics, and increased collaborations with global biotech companies.

The recombinant cell culture supplements market in Saudi Arabia is expected to grow over the forecast period. The market is driven by increasing investments in biotechnology and efforts to boost local biopharmaceutical production

Kuwait recombinant cell culture supplements market is expected to grow over the forecast period. This is attributed to the rising healthcare investments and a growing focus on advancing biotech and pharmaceutical capabilities.

Key Recombinant Cell Culture Supplements Company Insights

The market players operating in the market are adopting product approval to increase the reach of their products in the market and improve the availability of their products in diverse geographical areas, along with expansion as a strategy to enhance production/research activities. In addition, several market players are acquiring smaller players to strengthen their market position. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key Recombinant Cell Culture Supplements Companies:

The following are the leading companies in the recombinant cell culture supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- STEMCELL Technologies

- Merck KGaA

- Sartorius AG

- Lonza

- Miltenyi Biotec

- Capricorn Scientific

- InVitria

- Biotechne

- Sino Biological, Inc.

- Novo Nordisk Pharmatech A/S

Recent Developments

-

In April 2022, Lonza, along with Luzhu Biotech, developed a recombinant Herpes Zoster vaccine and a bispecific antibody using Lonza’s GS Xceed Gene Expression System, highlighting the growing demand for advanced recombinant cell culture supplements in the biopharma industry.

-

In March 2022, FUJIFILM Irvine Scientific, Inc. acquired Shenandoah Biotechnology, Inc. to expand and enhance its cell culture solutions and bioprocessing capabilities. This acquisition also gives FUJIFILM access to Shenandoah’s extensive range of recombinant proteins, including cytokines and growth hormones.

-

In January 2022, Thermo Fisher Scientific Inc. acquired PeproTech, Inc., a company specializing in the research and production of recombinant proteins, for USD 1.85 billion.

Recombinant Cell Culture Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 929.2 million |

|

Revenue forecast in 2033 |

USD 2.44 billion |

|

Growth rate |

CAGR of 12.83% from 2025 to 2033 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2033 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2033 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, application, end-use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait |

|

Key companies profiled |

Thermo Fisher Scientific Inc.; STEMCELL Technologies; Merck KGaA; Sartorius AG; Lonza; Miltenyi Biotec; Capricorn Scientific; InVitria; Biotechne; Sino Biological, Inc.; Novo Nordisk Pharmatech A/S |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Recombinant Cell Culture Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2033. For this study, Grand View Research has segmented the global recombinant cell culture supplements market report based on products, type, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2033)

-

Recombinant Albumin

-

Recombinant Insulin

-

Recombinant Transferrin

-

Recombinant Cytokines

-

Others

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2033)

-

Liquid

-

Powder

-

-

Application Outlook (Revenue, USD Million, 2018 - 2033)

-

Biopharmaceutical Production

-

Monoclonal Antibodies

-

Vaccines Production

-

Other Therapeutic Proteins

-

-

Regenerative Medicine

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2033)

-

Pharmaceutical & Biotechnology Companies

-

Cell Culture Media Manufacturers

-

CMOs & CROs

-

CDMOs

-

Academic Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global recombinant cell culture supplements market size was estimated at USD 834.7 million in 2024 and is expected to reach USD 929.2 million in 2025.

b. The global recombinant cell culture supplements market is expected to grow at a compound annual growth rate of 12.83% from 2025 to 2033 to reach USD 2.44 billion by 2033.

b. The recombinant albumin segment dominated the recombinant cell culture supplements market with a share of 30.99% in 2024.

b. Some key players operating in the recombinant cell culture supplement market include Thermo Fisher Scientific Inc., STEMCELL Technologies, Merck KGaA, Sartorius AG, Lonza, Miltenyi Biotec, and Capricorn Scientific.

b. Key factors that are driving the recombinant cell culture supplements market are growing demand for biopharmaceuticals, rising focus on animal-free supplements, advancements in recombinant technology, and increased R&D in regenerative medicine & cell therapies

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."