- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Reclaimed Rubber Market Size, Share, Industry Report 2030GVR Report cover

![Reclaimed Rubber Market Size, Share & Trends Report]()

Reclaimed Rubber Market (2025 - 2030) Size, Share & Trends Analysis Report Product (Whole Tyre Reclaim, Butyl Reclaim Rubber, EPDM Reclaim Rubber), By End-use (Automotive & Aircraft Tyres, Retreading), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-307-2

- Number of Report Pages: 102

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Reclaimed Rubber Market Summary

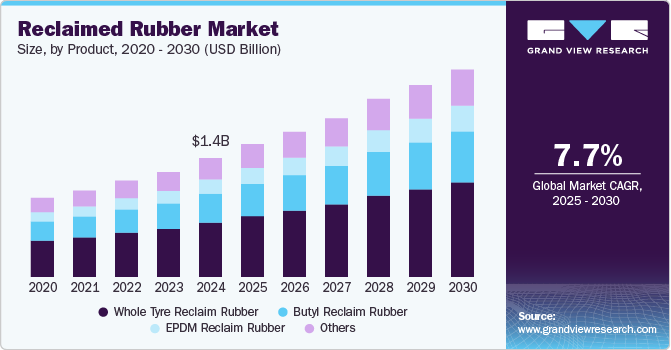

The global reclaimed rubber market was valued at USD 1,440.87 million in 2024 and is projected to reach USD 2,514.88 million by 2030, growing at a CAGR of 7.72% from 2025 to 2030. In recent years, global demand for reclaimed rubber has been driven by favorable regulations implemented by governments across the globe to promote sustainable materials as a substitute for conventional virgin rubber and the rising demand for reclaimed rubber from end use sectors such as automotive & aircraft tyres, footwear, belts & hoses, retreading, and molded rubber goods manufacturing.

Key Market Trends & Insights

- Asia Pacific dominated the market with a 52.93% revenue share in 2024.

- By product, whole tyre reclaim rubber dominated the product segment accounting for 45.74% in 2024.

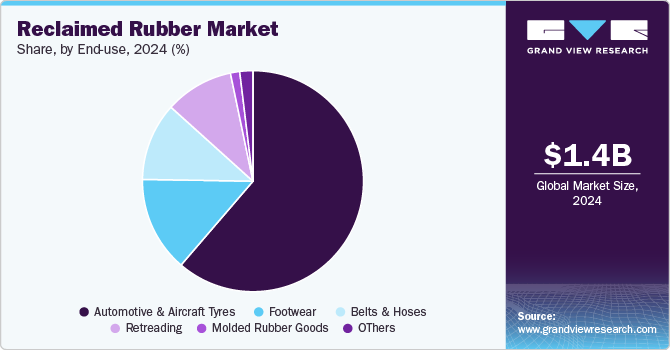

- By end use, automotive & aircraft tyres held the largest share in end-use, at 61.29% in 2024.

Market Size & Forecast

- 2024 Market Size: USD USD 1,440.87 Million

- 2030 Projected Market Size: USD 2,514.88 Million

- CAGR (2025-2030):7.72%

- Asia Pacific: Largest market in 2024

The market has witnessed collaborations between end users and chemical manufacturers to develop new products from used tyres. For instance, as of December 2021, Ralf Bohle GmbH, a bicycle tyre manufacturer, Pyrum Innovations AG, and TH Köln University entered into a collaborative partnership to develop new bicycle tyres from old tyres. Initiatives such as these are expected to help companies source raw materials and manufacture reclaimed rubber at economical costs.

According to the International Organization of Motor Vehicle Manufacturers (OICA), the U.S. was the leading producer of commercial vehicles in the world in 2020. Despite the outbreak of the pandemic, the country witnessed a rise in demand for pickup trucks in 2020. Ford Motor’s F-Series truck retained its dominance followed by pickups from Fiat Chrysler and General Motors.

Drivers, Opportunities & Restraints

The cost advantage of reclaimed rubber over virgin rubber is a key driver for its growing demand. Reclaimed rubber not only offers substantial material cost savings but also reduces energy consumption during processing, translating into lower overall production costs for manufacturers. This economic appeal is particularly crucial for industries operating in cost-sensitive markets, such as automotive components, footwear, and consumer goods.

The rapid industrialization and urbanization in emerging economies present a significant growth opportunity for the reclaimed rubber market. Countries in Asia, Africa, and Latin America are witnessing expanding automotive, construction, and consumer goods industries, all of which are major end users of reclaimed rubber. In addition, the presence of an abundant supply of used tyres and rubber waste in these regions creates a favorable environment for establishing reclaimed rubber production facilities. Governments in these nations are also encouraging recycling initiatives, further boosting market potential.

Despite its advantages, reclaimed rubber faces challenges related to quality consistency and performance limitations compared to virgin rubber. Variability in the properties of raw materials used for reclamation can result in uneven quality, which is a concern for high-performance applications. Moreover, reclaimed rubber may not always match the tensile strength, elasticity, and durability of virgin rubber, limiting its usage in demanding applications such as high-speed tyres and heavy-duty industrial components. These factors can deter manufacturers from fully adopting reclaimed rubber, particularly in sectors where stringent quality standards are non-negotiable.

Product Insights

Whole tyre reclaimed rubber dominated the reclaimed rubber market across the product segmentation in terms of revenue, accounting to a market share of 45.74% in 2024. Whole tyre reclaimed rubber is manufactured from tread peelings and end-of-life tyres. The product exhibits better elongation and tensile strength, good abrasion resistance, tear resistance, long shelf life, and energy efficiency while mixing. These above-mentioned properties make it suitable for use in the production of tyre sidewalls, tyre piles, and tyre treads & retreads.

Butyl reclaim rubber is manufactured from used butyl tubes through desulfurization. It is a synthetic rubber, a copolymer of isobutylene with isoprene, and exhibits impermeability to air. This allows it to be used in applications requiring airtight rubber. Butyl reclaimed rubber has a faster vulcanization rate and higher polarity as compared to virgin butyl rubber, which provides it higher compatibility with other types of rubber and better aging resistance.

EPDM rubber is a terpolymer of propylene, ethylene, propylene, and a diene component. It has ethylene content in the range of 45% to 85% and higher ethylene content offers better mixing and extrusion. EPDM reclaim rubber is manufactured from manufactured EPDM factory reject profiles used in insulators for dust protection, weather channels, aluminum profiles, UPVC profiles, and door packing.

End-use Insights

Automotive & aircraft tyres dominated the reclaimed rubber market across the application segmentation in terms of revenue, accounting to a market share of 61.29% in 2024. Aircraft tyres are made from conductive elastomer, which consists of natural rubber, and are subjected to extreme conditions. They are reinforced with strong and flexible materials such as Kevlar to absorb more of the shock of landing and support the natural rubber. Natural rubber exhibits excellent abrasion resistance, tear resistance, and excellent green strength & tack, which allows it to stick to other materials.

Aircraft tyres have conducting strips built into the tyre grooves, which discharge any static electricity charges that may have built up. Natural rubber in the tyres acts as an insulator because of its ability to limit the transfer of electricity. The growing international logistics business and passenger travel post the relaxation of travel restrictions on a regional and country basis has revamped the demand for aircraft tyres. Many aviation companies do not purchase tyres but have set up contracts with tyre manufacturing companies to replace tyres upon requirement. Retreading is a common practice in aircraft tyres since the tyres are expensive.

Tyre companies such as Dunlop Tyres provide tyre retreading services to aviation companies under the inspection of airworthiness authorities such as the EASA and FAA. Thus, the growing aviation industry along with the high cost of aircraft tyre replacement is expected to positively impact the market.

Regional Insights

Asia Pacific reclaimed rubbermarket dominated the global market and accounted for largest revenue share of 52.93% in 2024, which is attributable to the rapid growth of the automotive and construction industries, fueled by increasing urbanization and infrastructure development. Countries such as India, Indonesia, and Thailand are experiencing a surge in demand for cost-effective materials, with reclaimed rubber gaining prominence due to its affordability and environmental benefits. In addition, the region’s strong focus on recycling initiatives, supported by government policies and incentives, has created a robust supply chain for reclaimed rubber production, positioning Asia Pacific as a key market hub.

China Reclaimed Rubber Market Trends

China’s reclaimed rubber market benefits significantly from government-led recycling initiatives aimed at managing the country’s substantial tyre and rubber waste. The Chinese government’s focus on reducing environmental pollution has resulted in the implementation of strict policies that promote tyre recycling and resource recovery. Additionally, the booming automotive and industrial manufacturing sectors in China provide a consistent demand for cost-efficient and sustainable materials such as reclaimed rubber, making it a crucial market for both domestic and international producers.

North America Reclaimed Rubber Market Trends

In North America, the adoption of reclaimed rubber is propelled by the region’s growing emphasis on circular economy practices. Companies across industries are actively seeking ways to reduce waste and improve resource efficiency, aligning with stringent environmental regulations. The availability of advanced recycling technologies and the strong presence of tyre retreading facilities have further facilitated the use of reclaimed rubber in various applications, including automotive, footwear, and industrial components.

The U.S. reclaimed rubber market is driven by a strong push for green manufacturing practices as businesses aim to meet stringent federal and state-level environmental standards. The rise in consumer demand for eco-friendly products has also encouraged manufacturers to integrate sustainable materials such as reclaimed rubber into their production processes. Moreover, the country’s robust infrastructure for collecting and processing end-of-life tyres has ensured a steady supply of raw materials for reclamation, supporting market growth.

Europe Reclaimed Rubber Market Trends

The reclaimed rubber market in Europe is heavily influenced by the adoption of stringent environmental regulations aimed at minimizing landfill waste and promoting recycling. Countries in the region, particularly Germany, France, and the UK, are leading initiatives to repurpose waste materials such as used tyres into valuable resources. The European Union’s focus on achieving carbon neutrality has further incentivized industries to switch to sustainable materials, with reclaimed rubber becoming a key solution for meeting these goals in the automotive, construction, and industrial sectors.

Key Reclaimed Rubber Company Insights

The Reclaimed Rubber market is highly competitive, with several key players dominating the landscape. Major companies GRP Ltd.; J. Allcock & Sons Ltd.; Rolex Reclaim Pvt. Ltd.; Fishfa Rubbers Ltd.; HUXAR; Tianyu (Shandong) Rubber & Plastic Products Co., Ltd.; Swani Rubber Industries; Minar Reclaimation Private Limited; and SRI Impex Pvt. Ltd. The reclaimed rubber polymers market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Reclaimed Rubber Companies:

The following are the leading companies in the reclaimed rubber market. These companies collectively hold the largest market share and dictate industry trends.

- GRP Ltd

- J. Allcock & Sons Ltd

- Rolex Reclaim Pvt. Ltd.

- Fishfa Rubbers Ltd.

- HUXAR

- Tianyu (Shandong) Rubber & Plastic Products Co., Ltd.

- Swani Rubber Industries

- Minar Reclaimation Private Limited

- SRI Impex Pvt. Ltd.

- SNR Reclamations Pvt. Ltd.

- High Tech Reclaim Pvt. Ltd.

- Balaji Rubber Industries (P) Ltd.

- Star Polymers Inc.

Recent Developments

-

In November 2024, Ecore International received a significant investment from General Atlantic's BeyondNetZero fund to enhance its rubber recycling operations. This funding aims to support Ecore's efforts in developing sustainable solutions for recycling rubber materials. The investment aims to expand the company’s capabilities and contribute to a circular economy by reducing waste and promoting the reuse of rubber products.

-

In November 2022, Tyromer partnered with Continental Tyres to incorporate reclaimed & recycled rubber materials into tyre production. This collaboration marks a significant shift in the tyre industry, which has been hesitant to use recycled materials. The recycled rubber is produced through Tyromer's environmentally friendly process that avoids chemicals and focuses on devulcanizing end-of-life tyres.

Reclaimed Rubber Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,609.77 million

Revenue forecast in 2030

USD 2,514.88 million

Growth rate

CAGR of 7.72% from 2025 to 2030

Historical data

2018 - 2023

Base year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S., Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Brazil; GCC Countries

Key companies profiled

GRP Ltd.; J. Allcock & Sons Ltd.; Rolex Reclaim Pvt. Ltd.; Fishfa Rubbers Ltd.; HUXAR; Tianyu (Shandong) Rubber & Plastic Products Co., Ltd.; Swani Rubber Industries; Minar Reclaimation Private Limited; SRI Impex Pvt. Ltd.; SNR Reclamations Pvt. Ltd.; High Tech Reclaim Pvt. Ltd.; Balaji Rubber Industries (P) Ltd.; Star Polymers, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reclaimed Rubber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global reclaimed rubber market report on the basis of product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Whole Tyre Reclaim Rubber

-

Butyl Reclaim Rubber

-

EPDM Reclaimed Rubber

-

Others

-

-

End-use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Aircraft Tyres

-

Retreading

-

Belts & Hoses

-

Footwear

-

Molded Rubber Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

GCC Countries

-

-

Frequently Asked Questions About This Report

b. The global reclaimed rubber market size was estimated at USD 1.44 billion in 2024 and is expected to reach USD 1.61 billion in 2025.

b. The global reclaimed rubber market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2030 to reach USD 2.51 billion by 2030.

b. Asia Pacific dominated the reclaimed rubber market with a share of 52.93% in 2024. This is attributable to expanding automotive & aerospace industry specifically in China, Thailand & India.

b. Some key players operating in the reclaimed rubber market include GRP Ltd.; J. Allcock & Sons Ltd.; Rolex Reclaim Pvt. Ltd.; Fishfa Rubbers Ltd.; HUXAR; Tianyu (Shandong) Rubber & Plastic Products Co., Ltd.; Swani Rubber Industries; Minar Reclaimation Private Limited; SRI Impex Pvt. Ltd.; and SNR Reclamations Pvt. Ltd., among others.

b. Key factors that are driving the reclaimed rubber market growth include the shift in trend towards rubber recycling to improve sustainability in the automotive tires industry and expanding automotive & aerospace industries in emerging economies such as Thailand, Malaysia, India and China.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.