Reclaimed Lumber Market Size, Share, & Trends Analysis Report By Application (Flooring, Paneling, Beams & Boards, Furniture, Others), By End-use (Residential, Commercial, Industrial), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-802-2

- Number of Report Pages: 94

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

Reclaimed Lumber Market Size & Trends

The global reclaimed lumber market size was valued at USD 54.34 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 4.7% from 2023 to 2030. Raising environmental awareness, increasing inclination towards recycling, and intensifying provisions to deal with waste management-related issues are some of the factors favoring market growth. The construction sector has been observing an emerging trend of sustainable construction using Cross-Laminated Timber (CLT). The increasing use of reclaimed lumber in CLT products, and the rising inclination of architectures, developers, and engineers towards tall wooden buildings to reduce the carbon footprint in the environment are expected to boost the product demand.

China is projected to have significant product demand owing to increasing awareness for reducing Greenhouse Gas (GHG) emissions and the presence of vast wood-based construction industry in the country. China has seen increased growth in wooden construction in recent years, as it offers excellent seismic performance and energy conservation and conserves the Chinese tradition.

The use of these products in construction results in a reduction in the percentage of materials being sent to landfills, facilitating a significant reduction in environmental pollution. The rising cost of landfill spaces and state mandates to reduce waste have encouraged wood waste recovery strategies, leading to growth in recovered wood from deconstruction activities. Application manufacturers attempt to retrieve both the quality and quantity of recyclable and reusable materials to reduce demolition debris and supply low-cost construction materials, which may otherwise be far too expensive. The availability of old structures for deconstruction and increasing labor costs have a major impact on the material prices at this stage.

Green buildings have gained momentum in the construction field as building practices and materials are being inspected for their environmental impact. The stringent regulatory framework, including various policies and regulations, such as The European Union Timber Regulation (EUTR), and certifications, such as the Forest Stewardship Council (FSC), restructures the market prospect.

The global market has witnessed significant growth and is projected to maintain its pace over the forecast period. However, the impact of the COVID-19 pandemic was witnessed on the overall market prospect. Temporary shutdown of the global industries, complete lockdown across several key regions, and supply chain interruptions severely affected the market growth in 2020.

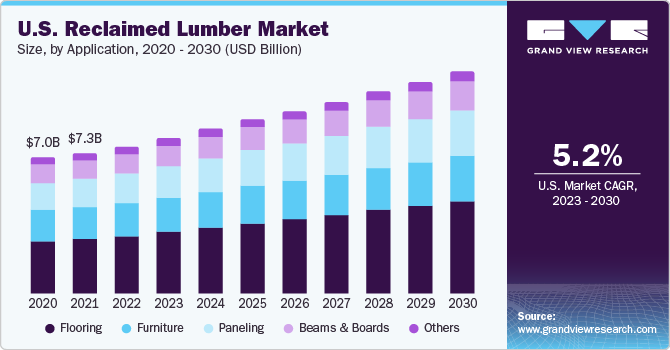

Application Insights

Based on application, the market is segmented into flooring, paneling, beams & boards, furniture, and others. The furniture segment accounted for the largest revenue share of 31.4% in 2022. High demand for antique furniture and custom-manufactured furniture, including chairs, shelves, etc. is expected to drive the segment growth over the forecast period.

The flooring segment is projected to grow at a CAGR of 4.7% over the forecast period. Flooring is one of the prominent applications. Materials ranging from clear, vertical grain to naily grade are preferred for flooring.

The others segment includes architectural millwork and small item manufacturing, such as gift boxes and slingshot handles. Small-item manufacturing requires small wood pieces, which can be easily obtained from the waste wood of primary and secondary wood manufacturing sectors. The material used is often inexpensive; however, the product cost is usually high due to high labor costs.

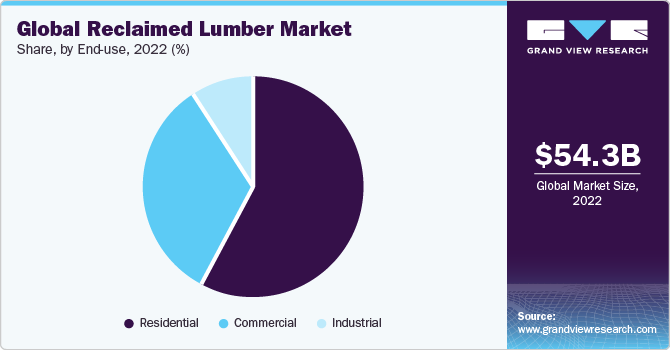

End-use Insights

The commercial segment held the largest revenue share of 57.9% in 2022. The product has several end-uses in the commercial sector, including wall coverings, flooring, tabletops, seats, and light fixtures. The product is preferred for its rustic design and unique look. The design aesthetic helps to disguise the wear and tear in high-traffic areas, which is a common occurrence in the commercial sector. Moreover, product usage for interior end-uses offers uniqueness to the design, which is often preferred by the operators.

The residential segment is expected to grow at a CAGR of 4.6% over the forecast period. Reclaimed wood products offer an ideal choice for many residential end-uses, such as framing, casework, paneling, flooring, trim, cabinets, and interior design components. The product demand for high-quality decorative end-uses is expected to fuel the segment growth over the forecast period. Reclaimed lumber products meet LEED and FSC certifications and are associated with responsible forestry and sustainability. However, the industrial end-uses accounted for a minor share of the market on account of the dynamic nature of the industrial processes and stringent policies & regulations regarding the materials used in the industrial premises.

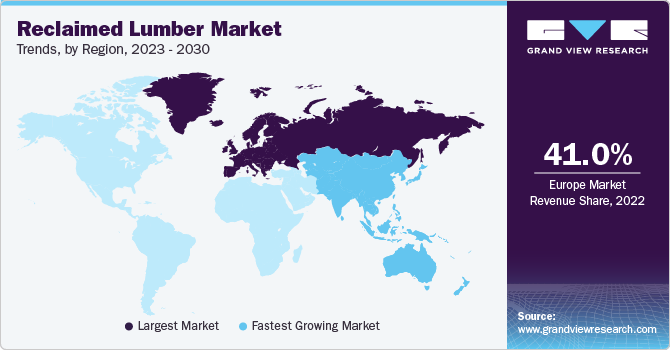

Regional Insights

Europe dominated the market and accounted for the largest revenue share of 41.0% in 2022 owing to significant growth and increased private investments in the construction sector. The regional market will expand further at a steady CAGR from 2023 to 2030 due to the rapidly growing residential sector in the region and rising product demand from developed economies, such as Germany and the UK.

Asia Pacific is expected to grow at the fastest CAGR of 5.7% owing to rapid urbanization, rising population, and an increasing number of construction activities in the region. According to Invest India, the construction Industry in India is expected to reach USD 1.4 trillion by 2025. The market is majorly driven by product penetration in the commercial sector. Flourishing tourism has led to growing requirements for restaurants and food chains in the region, which is projected to fuel the product demand.

North America exhibits a steady product demand due to increasing awareness regarding its functionality, look, feel, and cost in end-uses, such as flooring, furniture, and structural timbers. The U.S. dominates the North America regional market owing to the surge in demand from the commercial sector, including retail, hospitality, and offices.

Key Companies & Market Share Insights

The reclaimed lumber market is competitive and the players are undertaking various strategies including new launches, mergers & acquisitions to remain competitive and gain market share.

Key Reclaimed Lumber Companies:

- Vintage Timberworks, Inc

- Carpentier Hardwood Solutions, NV

- Imondi Flooring

- TerraMai

- Jarmak Corporation

- Elemental Republic

- Olde Wood Ltd.

- Trestlewood

- True American Grain Reclaimed Wood

- Beam and Board, LLC

- Altruwood

Recent Developments

-

In January 2020, USA Millwork completed the acquisition of Mission Bell, a prominent architectural millwork manufacturer located in Northern California. This strategic acquisition serves to enhance USA Millwork's national platform by providing contractors and engineers with increased capacity, expanded capabilities, and access to industry-leading practices. With the addition of Mission Bell, USA Millwork now operates from five locations spanning the entirety of the U.S. Collectively, these facilities encompass an impressive manufacturing footprint of nearly 400,000 square feet.

-

In September 2020, the UK government launched the ‘Green Homes Grant program’, aimed at promoting energy-efficient improvements in residential properties. This initiative provides homeowners with financial assistance to make their homes more sustainable and reduce their carbon footprint. The initiative is expected to increase the demand for reclaimed lumber in the country.

Reclaimed Lumber Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 56.79 billion |

|

Revenue forecast in 2030 |

USD 78.16 billion |

|

Growth rate |

CAGR of 4.7% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018- 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million, Volume in Million Square Meters, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Saudi Arabia; UAE |

|

Key companies profiled |

Vintage Timberworks, Inc.; Carpentier Hardwood Solutions, NV; Imondi Flooring; TerraMai; Jarmak Corporation; Elemental Republic; Olde Wood Ltd.; Trestlewood; True American Grain Reclaimed Wood; Beam and Board, LLC; Altruwood |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Reclaimed Lumber Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reclaimed lumber market based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million; Volume, Million Square Meters, 2018 - 2030)

-

Flooring

-

Paneling

-

Beams & Boards

-

Furniture

-

Others

-

-

End-Use Outlook (Revenue, USD Million; Volume, Million Square Meters, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Million; Volume, Million Square Meters, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global reclaimed lumber market size was estimated at USD 54.34 billion in 2022 and is expected to reach USD 56.79 billion in 2023.

b. The global reclaimed lumber market is expected to grow at a compounded annual growth rate of 4.7% from 2023 to 2030 to reach USD 78.16 billion in 2030.

b. Europe dominated the reclaimed lumber market with a share of 40% in 2022. Increasing product penetration in the construction industry owing to easy availability and properties including high durability and strength is expected to propel the market growth.

b. Some key players operating in the reclaimed lumber market include Longleaf Lumber, Inc., Vintage Timberworks, Inc., Atlantic Reclaimed Lumber, LLC, and Carpentier Hardwood Solutions NV.

b. Key factors driving the reclaimed lumber market growth include growing awareness regarding the environment coupled with degrading quality of new lumber as compared to well-preserved old wooden structures.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."