Real-time Monitoring Solutions For Cold Chain Market Size, Share & Trends Analysis Report By Component (Hardware, Software), By Application (Food & Beverages, Pharmaceuticals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-467-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

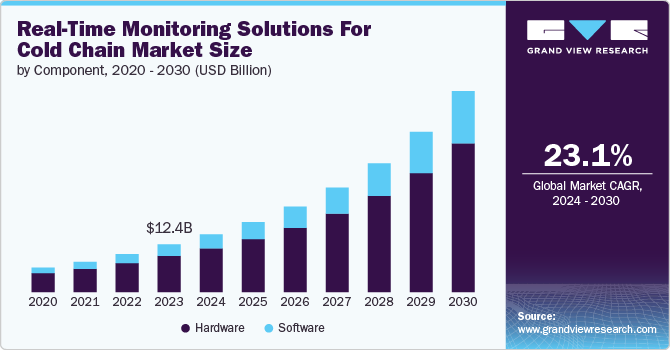

The global real-time monitoring solutions for cold chain market size was valued at USD 12,427.8 million in 2023 and is expected to grow at a CAGR of 23.1% from 2024 to 2030. The rising demand for global real-time monitoring solutions in the cold chain market is driven by the need for greater control and efficiency in temperature-sensitive supply chains, particularly in industries such as pharmaceuticals, food and beverages, and chemicals. With stricter regulations on product safety, companies are increasingly adopting these solutions to ensure compliance with international standards.

Additionally, the growing trend of online retail, particularly for groceries and pharmaceuticals, is amplifying the need for precise cold chain management. Companies delivering fresh food, dairy, frozen products, and medicines must guarantee that their goods remain within ideal temperature conditions from dispatch to doorstep. Real-time monitoring solutions allow companies to provide end-to-end visibility into cold chain logistics, helping mitigate the risks of spoilage, reducing waste, and enhancing customer satisfaction through reliable delivery of fresh goods.

The integration of IoT (Internet of Things) devices in cold chain logistics is further driving demand for real-time monitoring solutions. IoT sensors placed within storage units and transport vehicles can continuously track environmental conditions and transmit data in real-time to centralized monitoring platforms. This ensures uninterrupted monitoring and reporting, providing companies with the ability to act immediately if parameters deviate from safe levels. The advent of AI and machine learning is also helping companies predict potential risks in the cold chain, optimize routes, and manage fleet operations more efficiently.

However, real-time monitoring solutions for the cold chain market face several restraints that limit their widespread adoption and implementation. Implementing real-time monitoring solutions requires significant upfront costs, including expenses related to hardware, software, and installation. For small and medium-sized enterprises (SMEs), these costs can be a substantial barrier, as they may lack the financial resources to invest in advanced technology compared to larger organizations.

Component Insights

Based on the component, the real-time monitoring solutions for the cold chain market are segmented into hardware and software. The hardware segment held the largest market share of 76.2% in 2023. Hardware components, such as temperature and humidity sensors, RFID tags, and GPS trackers, are fundamental to monitoring and ensuring the integrity of cold chain logistics. These devices are crucial for collecting real-time data on environmental conditions, making them indispensable for effective cold chain management. Additionally, recent advancements in sensor technology, including increased accuracy, miniaturization, and enhanced durability, have made hardware more effective and reliable. This has encouraged companies to invest in sophisticated monitoring devices, boosting the hardware segment’s share.

The software segment registered the highest CAGR of 24.7% over the forecast period. With the proliferation of IoT devices and monitoring systems, companies are generating vast amounts of data. Advanced software solutions that provide data analytics, visualization, and reporting capabilities enable organizations to derive actionable insights from this data, driving demand for software. Additionally, the rise of cloud computing has facilitated the development of scalable and accessible software solutions. Cloud-based software allows for real-time monitoring and remote access, which enhances flexibility and efficiency in cold chain management.

Application Insights

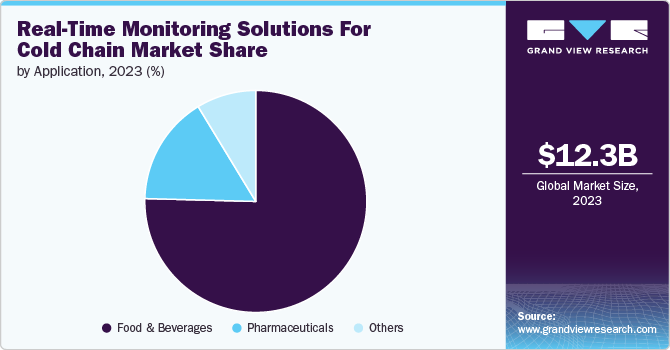

On the basis of application, the market is segmented into food & beverages, pharmaceuticals, and others. The food & beverages segment dominated the market with a revenue share of 75.4% in 2023. The food and beverage industry is subject to strict regulations regarding product safety, quality, and traceability. Real-time monitoring is essential for ensuring compliance with these regulations, which drives demand for monitoring solutions. Additionally, many food products have limited shelf lives and require precise temperature and humidity control throughout the supply chain. This urgency for maintaining optimal conditions makes real-time monitoring solutions critical for preventing spoilage and ensuring product freshness.

The pharmaceuticals segment is anticipated to register the highest CAGR of 24.3% over the forecast period in the target market. The increasing prevalence of biologics and vaccines, which often require strict temperature control, is a significant driver for the pharmaceuticals segment. The need for robust monitoring solutions to maintain the efficacy of these products contributes to the segment's rapid growth. Additionally, the pharmaceutical industry is heavily regulated, with stringent guidelines governing the transportation and storage of temperature-sensitive products. Compliance with these regulations necessitates effective monitoring solutions to ensure that products are kept within specified temperature ranges when driving.

Regional Insights

North America accounted for the largest revenue share of 33.7% in 2023 and is expected to continue its dominance over the forecast period. North America is a hub for technological innovation, with many companies investing in the development and implementation of advanced real-time monitoring solutions. The region's strong focus on research and development fosters the emergence of cutting-edge technologies, enhancing market growth. Additionally, North America boasts a well-developed logistics and transportation infrastructure, facilitating efficient cold chain operations. The availability of advanced technologies and a skilled workforce further supports the implementation of real-time monitoring solutions.

U.S. Real-time Monitoring Solutions for Cold Chain Market Trends

The U.S. healthcare and food industries are subject to strict regulations regarding product safety and quality. Agencies such as the FDA enforce guidelines that require effective monitoring of temperature-sensitive products, prompting companies to adopt advanced monitoring solutions to ensure compliance.

Asia Pacific Real-time Monitoring Solutions for Cold Chain Market Trends

Countries in the Asia Pacific region are increasingly adopting advanced technologies, including IoT and data analytics. This technological shift enhances the capabilities of cold chain monitoring systems, making them more effective and attractive to businesses looking to improve operational efficiency. Additionally, the Asia Pacific region is witnessing significant growth in the pharmaceutical sector, particularly in countries such as India and China. The rise in biopharmaceuticals, vaccines, and advanced therapies necessitates stringent temperature control during storage and transportation, driving demand for real-time monitoring solutions.

Europe Real-time Monitoring Solutions for Cold Chain Market Trends

The rising demand for real-time monitoring solutions for cold chain logistics in Europe is fueled by regulatory requirements, a focus on food safety, e-commerce growth, sustainability initiatives, and technological advancements. European countries have stringent regulations regarding food safety and pharmaceutical product quality. Regulations such as the EU’s Falsified Medicines Directive and General Food Law necessitate effective monitoring solutions to ensure compliance and maintain high standards throughout the supply chain.

Key Real-time Monitoring Solutions for Cold Chain Company Insights

Some of the key companies operating in the market include Carrier (Sensitech), among others.

-

Carrier (Sensitech) is a prominent player in real-time monitoring solutions for cold chain logistics, specializing in temperature monitoring and data logging technologies. Sensitech is a subsidiary of Carrier Global Corporation, a leading global provider of heating, ventilation, air conditioning, refrigeration, and fire and security solutions. It offers a range of temperature monitoring solutions designed to ensure the integrity of temperature-sensitive products throughout the cold chain. Their products include data loggers, wireless monitoring systems, and integrated software platforms that provide real-time tracking and data management.

Accent Advanced Systems, SLU and Velvetech, LLC are some of the emerging market companies in the target market.

-

Accent Advanced Systems, SLU is a technology company specializing in advanced solutions for real-time monitoring in various industries, including cold chain logistics. Their offerings include advanced monitoring systems that track temperature and humidity, utilizing Internet of Things (IoT) technology for seamless data collection and transmission. These solutions provide stakeholders with real-time access to critical environmental data and alerts, supported by analytics software that helps optimize logistics operations and ensure compliance with regulatory standards.

Key Real-time Monitoring Solutions for Cold Chain Companies:

The following are the leading companies in the real-time monitoring solutions for cold chain market. These companies collectively hold the largest market share and dictate industry trends.

- Accent Advanced Systems, SLU

- ELPRO-BUCHS AG

- Carrier (Sensitech)

- Velvetech, LLC.

- Savi Technology

- ORBCOMM

- Geotab Inc.

- Controlant hf

- Zebra Technologies Corp

- Infratab, Inc

Recent Developments

-

In August 2024, Carrier (Sensitech) announced that it had completed the acquisition of Berlinger & Co. AG, a provider of temperature monitoring solutions for the cold chain logistics industry. This strategic acquisition aims to enhance Sensitech's product offerings and strengthen its position in the pharmaceutical and food sectors. This move aligns with Sensitech's commitment to delivering comprehensive solutions that meet the evolving demands of customers in global supply chains.

-

In June 2024, ELPRO-BUCHS AG and Cold Chain Technologies announced a partnership to enhance cold chain monitoring solutions. This collaboration aims to integrate ELPRO's advanced temperature monitoring technology with Cold Chain Technologies' logistics expertise. Together, they will provide comprehensive solutions for temperature-sensitive products, ensuring compliance with regulatory standards and maintaining product integrity throughout the supply chain.

Real-time Monitoring Solutions for Cold Chain Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 15,039.0 million |

|

Revenue forecast in 2030 |

USD 52,396.74 million |

|

Growth rate |

CAGR of 23.1% from 2024 to 2030 |

|

Actual Data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

|

Key companies profiled |

Accent Advanced Systems, SLU; ELPRO-BUCHS AG; Carrier (Sensitech); Velvetech, LLC.; Savi Technology; ORBCOMM; Geotab Inc.; Controlant hf; Zebra Technologies Corp; Infratab, Inc |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Real-time Monitoring Solutions For Cold Chain Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global real-time monitoring solutions for cold chain market report based on component, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Sensors

-

RFID Devices

-

Telematics

-

Networking Devices

-

Others

-

-

Software

-

On-premise

-

Cloud

-

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

-

Food & Beverages

-

Pharmaceuticals

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global real-time monitoring solutions for cold chain market size was estimated at USD 12,424.8 million in 2023 and is expected to reach USD 15,039.0 million in 2024.

b. The global real-time monitoring solutions for cold chain market is expected to grow at a compound annual growth rate of 23.1% from 2024 to 2030 to reach USD 52,396.7 million by 2030.

b. The hardware segment claimed the largest market share of 76.2% in 2023 in the real-time monitoring solutions for cold chain market, driven by the increasing need for temperature and humidity sensors, GPS tracking devices, and IoT-enabled systems in pharmaceutical, food, and beverage industries.

b. Some of the prominent players in the real-time monitoring solutions for the cold chain market are Accent Advanced Systems, SLU, ELPRO-BUCHS AG, Carrier (Sensitech), Velvetech, LLC., Savi Technology, ORBCOMM, Geotab Inc., Controlant hf, Zebra Technologies Corp, Infratab, Inc.

b. The real-time monitoring solutions for the cold chain market is driven by factors such as rising demand for temperature-sensitive products like vaccines, pharmaceuticals, and fresh food, along with stringent regulatory requirements to ensure product safety and compliance. Technological advancements in IoT, GPS, and wireless communication have enhanced monitoring accuracy and efficiency, while the growth of pharmaceutical and biotech sectors, particularly post-pandemic, has further fueled demand.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."