- Home

- »

- Digital Media

- »

-

Real-time Bidding Market Size, Share & Growth Report, 2030GVR Report cover

![Real-time Bidding Market Size, Share & Trends Report]()

Real-time Bidding Market Size, Share & Trends Analysis Report By Auction Type (Open Auction, Private Auction), By Advertisement Format (Display Ads), By Device, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-396-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Real-time Bidding Market Size & Trends

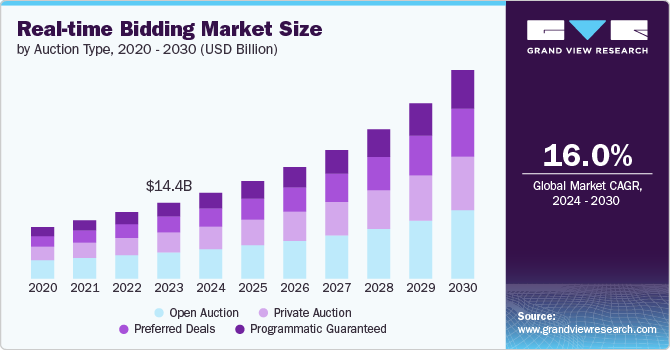

The global real-time bidding market was estimated at USD 14.37 billion in 2023 and is expected to grow at a CAGR of 16.0% from 2024 to 2030. The increasing demand for targeted advertising is one of the significant factor driving the market growth. Advertisers seek to reach specific audiences with personalized messages, and real-time bidding (RTB) enables precise targeting by leveraging user data. This precision enhances ad relevance, improving engagement rates and return on investment (ROI).

The proliferation of digital media consumption is fueling RTB growth. With more consumers spending time online across various devices, advertisers are shifting their budgets from traditional media to digital channels. This transition is facilitated by the scalability and efficiency of RTB, which allows for real-time adjustments to ad campaigns based on performance data. Third, technological advancements in programmatic advertising are propelling the RTB market. Innovations in artificial intelligence (AI) and machine learning (ML) algorithms enhance bidding strategies, optimize ad placements, and improve overall campaign effectiveness. These technologies enable advertisers to analyze vast amounts of data quickly, making informed decisions that drive better outcomes.

The rise of mobile advertising is a prominent trend, driven by the widespread adoption of smartphones and mobile apps. Mobile devices have become the primary medium for accessing digital content, leading advertisers to prioritize mobile RTB strategies. Additionally, the growing popularity of video advertising is transforming the RTB landscape. Video ads offer high engagement rates and better storytelling capabilities, making them a preferred format for brands. Programmatic video RTB is gaining traction, allowing advertisers to deliver targeted video content across multiple platforms. Another significant trend is the increasing focus on data privacy and compliance. Regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are influencing RTB practices, emphasizing the need for transparency and user consent. Advertisers are adapting by implementing privacy-compliant data strategies and ensuring that their RTB activities adhere to legal standards.

The expansion of programmatic advertising to new channels, such as connected TV (CTV) and digital out-of-home (DOOH) advertising is one of the notable market opportunity factors. These channels offer unique advantages, such as high-quality inventory and the ability to reach audiences in different environments. As the adoption of smart TVs and digital billboards increases, RTB can play a crucial role in optimizing ad placements and maximizing reach. Another opportunity is the integration of advanced analytics and AI-driven insights into RTB platforms. By leveraging AI, advertisers can enhance their bidding strategies, predict user behavior, and deliver more personalized ad experiences. Furthermore, the growth of emerging markets presents a significant opportunity for RTB expansion. Regions like Asia Pacific and Latin America are experiencing rapid digital transformation, providing a fertile ground for RTB adoption. As internet penetration and digital ad spending continue to rise in these markets, RTB can help advertisers tap into new audiences and drive business growth.

Auction Type Insights

The open auction segment dominated the market in 2023 and accounted for more than 34% share of global revenue. Open auctions dominate the Real-Time Bidding (RTB) market due to their wide accessibility and high levels of competition. In an open auction, all advertisers have the opportunity to bid on the available inventory, leading to maximum fill rates and potentially higher revenues for publishers. Transparency and ease of entry make open auctions particularly attractive to a broad range of advertisers, from small businesses to large enterprises. This auction type is also favored because it allows for real-time price discovery and optimization, ensuring that advertisers pay a fair market price. As the digital advertising ecosystem becomes more sophisticated, the efficiency and effectiveness of open auctions continues to attract a significant portion of the RTB market, reinforcing their dominant position.

The preferred deals segment is projected to witness significant growth from 2024 to 2030. This growth is driven by the need for more controlled and premium advertising environments. In preferred deals, advertisers and publishers negotiate a fixed price for inventory before it is made available to the open market. This setup ensures that advertisers gain access to high-quality inventory and audience segments, often with reduced competition and enhanced targeting capabilities. The appeal of preferred deals lies in their ability to offer more predictable pricing and inventory access, which is crucial for brands seeking to maintain brand safety and ad relevance. As advertisers increasingly value these factors, the adoption of preferred deals is accelerating, leading to substantial growth in this auction type.

Advertisement Format Insights

The display ads segment dominated the market in 2023. This growth is attributed to the significant share of digital ad spending. This is due to the versatility and widespread use of display ads across various websites and mobile applications. Display ads, which include banners, leaderboards, and skyscrapers, are highly effective for brand awareness and direct response campaigns. Their visual nature and ability to incorporate rich media elements such as animations and interactive features make them a staple for advertisers looking to capture user attention. Furthermore, advancements in targeting and retargeting technologies have enhanced the performance of display ads, making them even more attractive to marketers. As a result, display ads continue to hold a substantial market share in the RTB ecosystem.

Social media ads segment is the fastest-growing segment driven by the explosive growth of social media platforms and their increasing role in users' daily lives. These ads benefit from the rich user data available on social media platforms, allowing for precise targeting based on demographics, interests, and behaviors. The interactive and engaging nature of social media ads, including video, carousel, and story formats, further enhances their effectiveness. As consumers spend more time on platforms like Facebook, Instagram, Twitter, and TikTok, advertisers are allocating larger portions of their budgets to social media advertising. The continuous innovation in ad formats and targeting capabilities on these platforms fuels the rapid growth of social media ads in the RTB market.

Device Insights

The mobile devices segment dominated the market in 2023 and is expected to grow at the fastest CAGR over the forecast period, reflecting the global shift towards mobile-first internet usage. The proliferation of smartphones and tablets has revolutionized how consumers access information, communicate and engage with digital content. As a result, advertisers are increasingly focusing on mobile platforms to reach their target audiences effectively. The dominance and rapid growth of mobile advertising in the RTB market are driven by several factors. First, mobile devices offer unparalleled reach, with billions of users worldwide spending significant amounts of time on their smartphones and tablets. This creates numerous opportunities for advertisers to deliver personalized, contextually relevant ads to users on the go. Second, advancements in mobile technology, such as 5G, enhanced targeting capabilities, and location-based services, have significantly improved the effectiveness of mobile ads. Lastly, the integration of mobile ads with social media, gaming apps, and other popular mobile platforms has further solidified their dominance, making mobile advertising a critical component of any comprehensive digital marketing strategy.

The smart TV advertising segment is experiencing significant growth in the real-time bidding market, fueled by the increasing adoption of smart TVs and the rise of over-the-top (OTT) streaming services. As more consumers shift away from traditional cable and satellite TV to streaming platforms, advertisers are recognizing the value of reaching audiences through smart TVs. This device category offers a unique blend of traditional TV's visual impact and digital advertising's targeting precision. Smart TV ads can leverage rich data to deliver personalized content, improving engagement and conversion rates. The growth in smart TV advertising is also supported by advancements in programmatic TV buying, allowing advertisers to access premium inventory in real time. As the landscape of home entertainment continues to evolve, smart TV advertising is poised for substantial growth, offering advertisers a powerful channel to connect with consumers in their living rooms.

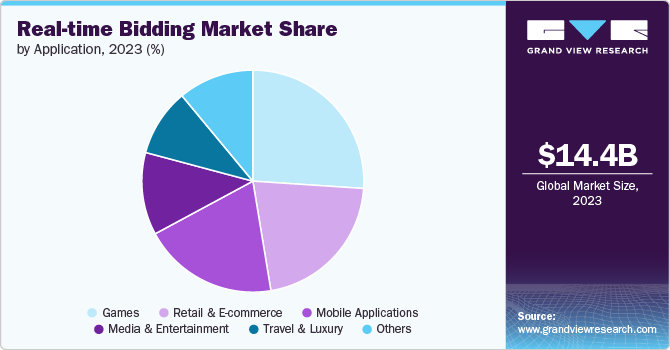

Application Insights

The gaming segment dominated the market in 2023 due to the immense popularity and engagement levels associated with mobile and online games. The gaming industry's diverse demographic and high user engagement present lucrative opportunities for advertisers. In-game advertising, rewarded video ads, and interstitials are common formats that allow brands to reach a captive audience without disrupting the gaming experience. The dominance of gaming in the RTB market is further supported by the integration of sophisticated analytics and targeting technologies, which enable advertisers to deliver relevant ads based on player behavior and preferences. As the gaming industry continues to expand with new titles, platforms, and technologies, its role as a leading application in the RTB market is expected to remain strong.

The mobile applications segment is experiencing significant growth in the market driven by the explosive growth in app usage across various categories, including social media, productivity, entertainment, and more. Advertisers are increasingly leveraging mobile apps to reach users with highly targeted and personalized ads. The growth of mobile applications in the RTB market is fueled by the proliferation of smartphones, the availability of diverse apps catering to different interests, and the ability to gather and utilize user data for precise targeting. Programmatic advertising within mobile apps offers advertisers the ability to engage users with relevant ads at the right time, enhancing the overall user experience and maximizing ad effectiveness. As the app ecosystem continues to thrive, the demand for RTB within mobile applications is set to accelerate, making it a critical area of focus for advertisers.

Regional Insights

North America is a leading region in the market, driven by the high adoption rate of digital advertising technologies and the presence of key industry players. The region's mature advertising market, coupled with a tech-savvy consumer base, creates an ideal environment for the growth of RTB. Advertisers in North America benefit from advanced programmatic platforms, extensive data resources, and a strong focus on innovation. The U.S., in particular, leads the charge with significant investments in digital advertising and a high concentration of technology companies. As a result, North America continues to dominate the RTB market, setting trends and driving advancements that influence the global landscape.

U.S. Real-time Bidding Market Trends

The U.S. plays a pivotal role in the North American market driven by its advanced digital advertising infrastructure, significant investments in technology, and a highly competitive marketplace. The country's leading role in innovation and its concentration of major tech companies contribute to its dominance in the RTB landscape. Advertisers in the U.S. benefit from a wealth of data resources, sophisticated programmatic platforms, and a strong emphasis on precision targeting. The market's focus on delivering personalized, data-driven advertising experiences ensures that the U.S. remains at the forefront of RTB developments. As the digital advertising ecosystem continues to evolve, the U.S. is poised to maintain its leadership position, driving trends and advancements that shape the global market.

Asia Pacific Real-time Bidding Market Trends

Asia Pacific region is the fastest-growing market for real-time bidding, fueled by the region's expanding digital economy and increasing internet penetration. The rise of mobile internet usage, particularly in countries like China, India, and Southeast Asia, has created a fertile ground for RTB adoption. Advertisers in Asia Pacific are increasingly embracing programmatic buying to reach a diverse and growing online audience. The region's youthful population, combined with the proliferation of smartphones and social media platforms, further accelerates the demand for real-time bidding. As digital advertising continues to evolve in Asia Pacific, the RTB market is expected to see sustained growth, driven by innovation, investment, and a focus on mobile-first strategies.

Europe Real-time Bidding Market Trends

The market in Europe is growing significantly and is characterized by a diverse and dynamic digital advertising ecosystem. The region's regulatory framework, particularly the General Data Protection Regulation (GDPR), has shaped the RTB landscape by emphasizing data privacy and user consent. Despite these challenges, Europe has seen robust growth in RTB adoption, driven by increased digital ad spending, the proliferation of mobile devices, and the expansion of programmatic advertising. Countries such as the UK, Germany, and France are at the forefront, leveraging advanced technologies to optimize ad placements and improve targeting accuracy. Europe's commitment to innovation and data-driven advertising continues to propel its growth in the RTB market.

Key Real-time Bidding Company Insights

Key players operating in the market are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Real-time Bidding Companies:

The following are the leading companies in the real-time bidding market. These companies collectively hold the largest market share and dictate industry trends.

- The Trade Desk

- AppNexus

- MediaMath

- Rubicon Project

- Criteo

- PubMatic

- OpenX

- Adobe Inc

- SpotX

- Amazon Advertising

- Meta

Recent Developments

-

In April 2024, SpotX introduced an upgrade to its existing server-to-server bidding product, allowing media owners to integrate yield management strategies with third-party header bidders. Utilizing SpotX's new ad serving technology, which has provided cloud-based server-to-server bidding, the product suite now encompasses both server-side and client-side header bidding options.

-

In September 2019, one year following its acquisition by AT&T, AppNexus announced plans to rebrand its exchange as Xandr Monetize. Alongside the rebrand, it also planned to introduce a range of new features aimed at supporting its goal of providing a comprehensive programmatic stack tailored for video-centric publishers.

Real-time Bidding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 16.27 billion

Revenue forecast in 2030

USD 39.61 billion

Growth rate

CAGR of 16.0% from 2024 to 2030

Actual Data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Auction type, advertisement format, device, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, China, India, Japan, South Korea, Australia, Brazil, Kingdom of Saudi Arabia (KSA), UAE, South Africa

Key companies profiled

Google; The Trade Desk; AppNexus; MediaMath; Rubicon Project; Criteo; PubMatic; OpenX; Adobe Inc; SpotX; Amazon Advertising; Meta

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scopes

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Real-time Bidding Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global real-time bidding market based on auction type, advertisement format, device, application, and region:

-

Auction Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Auction

-

Private Auction

-

Preferred Deals

-

Programmatic Guaranteed

-

-

Advertisement Format Outlook (Revenue, USD Million, 2018 - 2030)

-

Display Ads

-

Video Ads

-

Mobile Ads

-

Social Media Ads

-

Native Ads

-

-

Device Outlook (Revenue, USD Million, 2018 - 2030)

-

Mobile

-

Desktop

-

Smart TV

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Media & Entertainment

-

Retail and E-commerce

-

Games

-

Travel & Luxury

-

Mobile Applications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Kingdom of Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global real-time bidding market size was estimated at USD 14.37 billion in 2023 and is expected to reach USD 16.27 billion in 2024.

b. The global real-time bidding market is expected to grow at a compound annual growth rate of 16.0% from 2024 to 2030 to reach USD 39.61 billion by 2030.

b. North America dominated the real-time bidding market with a share of over 40.0% in 2023 due to the high adoption rate of digital advertising technologies and the presence of key industry players. The region's mature advertising market, coupled with a tech-savvy consumer base, creates an ideal environment for the growth of RTB.

b. Some key players operating in the real-time bidding market include Google, The Trade Desk, AppNexus, MediaMath, Rubicon Project, Criteo, PubMatic, OpenX, Adobe Inc, SpotX, Amazon Advertising, Meta.

b. Key factors driving market growth include the increasing demand for targeted advertising and the proliferation of digital media consumption

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."