Ready To Drink Mocktails Market Size, Share & Trends Analysis Report By Type (Virgin Mojito, Shirley Temple), By Flavor (Flavored, Unflavored), By Distribution Channel (Foodservice, Retail), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-382-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

RTD Mocktails Market Size & Trends

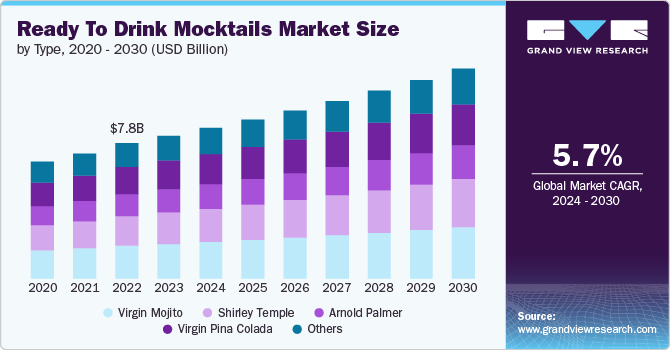

The global ready to drink mocktails market size was valued at USD 8.26 billion in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. A combination of factors such as changing consumer preferences toward healthier choices, rising demand for non-alcoholic alternatives, evolving social trends, innovative product offerings, and convenience-driven consumption patterns are collectively propelling the growth of the market.

A key factor driving the ready to drink (RTD) mocktails market is the increasing focus on health and wellness. Consumers, particularly from younger demographics such as Gen Z and millennials are becoming more conscious of what they consume and are actively seeking products that align with their health goals. This shift in consumer behavior has led to a surge in demand for products that are perceived as healthier alternatives to traditional offerings. Non-alcoholic beverages such as RTD mocktails have gained popularity as consumers are increasingly looking for alternatives to traditional alcoholic drinks. These beverages often cater to individuals who want to enjoy a flavorful drink without the alcohol content, offering options that are low in sugar, calories, and artificial ingredients.According to the WORLDMETRICS REPORT 2024, 35% of millennials in the U.S. surveyed indicated a preference for non-alcoholic beverages over alcoholic options. Additionally, 42% of respondents mentioned health reasons as the main factor influencing their choice of mocktails.

Social trends, such as a reevaluation of the role of alcohol in social experiences and the impact of social media on behavior perception, are also impacting the RTD mocktails market. Consumers are recognizing that alcohol may not be essential for a rich social experience, leading them to explore non-alcoholic options such as mocktails. Moreover, social media and its trends too play a crucial role in shaping consumer preferences for non-alcoholic RTD mocktails. Influencers, celebrities, and lifestyle bloggers often promote these beverages as part of a trendy and sophisticated lifestyle choice. For instance, the sober curious movement gained significant traction on social media platforms, with the hashtag “sober curious” spreading rapidly across various outlets. This campaign aims to redefine the concept of sobriety by shifting the focus from addiction to a healthier lifestyle choice for individuals looking to reduce their alcohol consumption or abstain from it entirely. As per a 2024 article by DIG THE TEA, the concept of “Sober Curious” gained significant traction globally, particularly impacting American consumers. Surveys conducted in the U.S. show that approximately 40% of American consumers identify with the Sober Curious lifestyle to varying extents.

Furthermore, the convenience offered by ready-to-drink mocktails in terms of availability through online and offline channels is another factor driving market growth. Convenience of access to RTD mocktails plays a pivotal role in attracting consumers who are seeking quick yet enjoyable drink options due to their busy lifestyles. The ease of being able to purchase pre-mixed mocktail beverages either online or from physical stores appeals to busy individuals looking for convenient solutions.

The availability of a wide range of innovative flavors and unique combinations in RTD mocktails is another driving factor. Consumers are increasingly looking for diverse taste experiences beyond traditional beverage offerings. Manufacturers are responding to this demand by introducing creative flavor profiles, exotic ingredients, and appealing packaging designs to attract consumers seeking novel drinking experiences. In September 2023, J2O introduced a line of pre-made Mocktails in three flavors: White Peach & Mango Daiquiri, Blackberry & Blueberry Martini and Strawberry & Orange Blossom Mojito.

Type Insights

Ready to drink virgin mojitos accounted for a revenue share of 24.3% in 2023. There is a growing consumer trend toward healthier lifestyle choices, including reduced alcohol consumption. Virgin mojitos provide a refreshing alternative that aligns with this preference, leading to an increase in its demand. RTD virgin mojitos often emphasize the use of natural ingredients such as fresh mint, lime, and cane sugar, appealing to health-conscious consumers. In May 2023, The Mindful Drinking Company introduced ISH Mojito, its new non-alcoholic canned cocktail. The new beverage is made using natural lime flavoring, ISH Caribbean Spiced Spirit, and Moroccan spearmint. The combination of these ingredients aims to deliver an authentic and refreshing non-alcoholic Mojito experience.

Ready to drink Shirley temple is expected to witness a CAGR of 6.3% during 2024 to 2030, due to its enduring popularity and timeless appeal. The Shirley Temple drink holds a special place in the hearts of consumers as a classic mocktail that transcends age groups. Its association with Hollywood glamour, refreshing sweetness, and nostalgic charm has made it a favorite choice for both children and adults, contributing to its consistent demand and growth in the market. Additionally, as more people are opting for non-alcoholic beverages and mocktails, the Shirley Temple’s status as a well-known and beloved drink further propels its rapid growth in the ready-to-drink market segment.

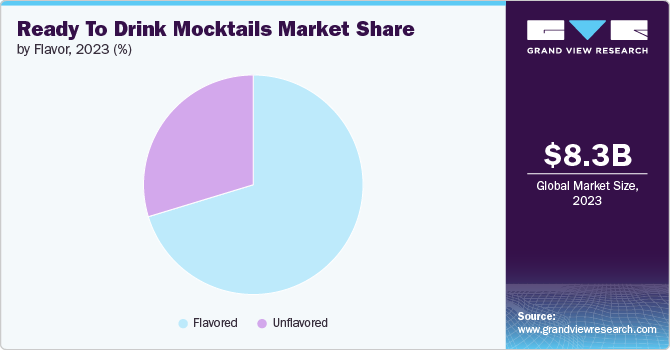

Flavor Insights

The flavored ready to drink mocktails held a market share of 70.3% in 2023 and is anticipated to witness a CAGR of 6.2% from 2024 to 2030. A notable driver of flavored ready-to-drink mocktails is the increasing consumer demand for a wide range of non-alcoholic flavors and varieties. Consumers are constantly looking for unique and diverse taste experiences, and flavored mocktails cater to this demand by offering a variety of exciting flavor profiles.

Furthermore, brands are constantly introducing new and unique flavor profiles to cater to diverse consumer preferences. From fruity blends to herbal infusions, the variety offered in flavored mocktails appeals to consumers looking for exciting taste experiences. For instance, Free AF Drinks launched a new Cucumber G&T flavor, as a part of its non-alcoholic mocktails range. The drink caters to the sober curious movement, offering a cocktail alternative with Afterglow, a natural botanical extract mimicking alcohol warmth. Cucumber G&T provides a clean, slightly sweet, and refreshing taste for those seeking non-alcoholic options.

Distribution Channel Insights

The distribution of RTD mocktails through retail channels accounted for a revenue share of 75.2% in 2023 and is expected to grow with a CAGR of 6.5%. The primary factor driving the distribution of RTD mocktails through retail channels is convenience. Retail channels provide convenient access to a wide range of products, including RTD mocktails, making it easier for consumers to discover and purchase these beverages.

The availability of mocktails in retail stores enhances accessibility for consumers who prefer to buy ready-to-drink options for home consumption or social gatherings. In May 2024, Free AF, the non-alcoholic RTD canned cocktail brand, collaborated with Walmart for a nationwide launch in more than 800 stores in the U.S. The launch featured four popular flavors - Apero Spritz, Cucumber G&T, Sparkling Rosé, and Paloma at Walmart stores.

Regional Insights

North America ready to drink mocktails market captured a revenue share of 27.38% in 2023. The market is primarily driven by the growing consumer preference for non-alcoholic beverages due to health and wellness trends, as well as the increasing demand for convenient, on-the-go refreshment options that cater to busy lifestyles. Additionally, the market benefits from the expanding social acceptance and innovation in mocktail flavors, which attract a broader consumer base looking for sophisticated, adult beverage alternatives without alcohol content.

U.S. Ready to Drink Mocktails Market Trends

The ready to drink mocktails market in the U.S. accounted for a notable revenue share in 2023.The market in the U.S. is significantly propelled by the rise in sobriety and moderation movements, leading more consumers to seek flavorful, alcohol-free alternatives for social occasions. Moreover, market players are continuously innovating and introducing new flavors, ingredients, and packaging formats to attract consumers. For instance, In August 2022, Mingle Mocktails, a company specializing in alcohol-free beverages, has recently partnered with Peacock TV’s Love Island USA for the official launch of their new Key Lime Margarita flavor. This collaboration aims to introduce a refreshing and flavorful mocktail option to consumers who are looking for a non-alcoholic alternative.

Europe Ready to Drink Mocktails Market Trends

The ready to drink mocktails market in Europe is anticipated to grow with a CAGR of 5.7% from 2024 to 2030. The ready to drink mocktails market in Europe is fueled by the rapidly growing cultural shift toward conscious drinking, where consumers are actively looking for sophisticated, non-alcoholic options that mimic the complexity of alcoholic beverages.

Asia Pacific Ready to Drink Mocktails Market Trends

The ready to drink mocktails market in Asia Pacific is expected to grow with a CAGR of 6.5% from 2024 to 2030. The growth in the region is closely tied to the escalating health consciousness among consumers, leading to a preference for non-alcoholic beverages. Additionally, the dynamic cultural landscape and expanding urban populations have bolstered the demand for convenient, on-the-go drinks that cater to a variety of tastes, driving the popularity of mocktails as a versatile and appealing choice.

Key Ready to Drink Mocktails Company Insights

Key market players such as Mocktail Beverages; The Mocktail Company; Sipling Beverage Co.; Curious Elixirs; Mocktail Drinks Ltd.; and Keurig Dr Pepper Inc among others contribute significantly to the innovation and growth of the market through launching new flavors, packages strategic marketing strategies and campaigns, strategic partnerships with industry experts.

Key Ready To Drink Mocktails Companies:

The following are the leading companies in the ready to drink mocktails market. These companies collectively hold the largest market share and dictate industry trends.

- Mocktail Beverages

- The Mocktail Company

- Sipling Beverage Co.

- Curious Elixirs

- Mocktail Drinks Ltd.

- Keurig Dr Pepper Inc.

- Mocktails Uniquely Crafted

- Free AF

- Molson Coors

- CRAVOVA

Recent Developments

-

In May 2024, Waterloo Sparkling Water, a brand known for its innovative and refreshing beverages, introduced three new mocktail flavors to its lineup. The new flavors include All Day Rosé, Pi-ño Colada, and Mojito, offering consumers a unique and exciting twist on traditional sparkling water options.

-

In April 2024, The Free Spirits Company launched a new line of ready-to-drink, non-alcoholic California Craft Cocktails. This innovative collection is skillfully made to provide a freshly mixed effervescence, real fruit juice, and an authentic cocktail experience - all without the aftereffects of alcohol. The initial offerings in this range include two timeless cocktails: The Kentucky Mule and The Margarita.

-

In March 2024, Britvic announced its expansion of its J2O brand into the non-alcoholic RTD market with the launch of Schweppes a new Mocktails range. The range includes flavors such as Peach & Apricot Punch, Apple & Raspberry Spritz, and Mango & Passionfruit Cooler.

Ready To Drink Mocktails Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.71 billion |

|

Revenue forecast in 2030 |

USD 12.15 billion |

|

Growth rate |

CAGR of 5.7% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, flavor, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S, Canada, Mexico, U.K., Germany, France, Italy, Spain, China, Japan, India, Australia & New Zealand, South Korea, Brazil, South Africa |

|

Key companies profiled |

Mocktail Beverages; The Mocktail Company; Sipling Beverage Co.; Curious Elixirs; Mocktail Drinks Ltd.; Keurig Dr Pepper Inc.; Mocktails Uniquely Crafted; Free AF; Molson Coors and CRAVOVA |

|

Customization scope |

Free r Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options. |

Global Ready To Drink Mocktails Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ready to drink mocktails market report based on type, flavor, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Virgin Mojito

-

Shirley Temple

-

Arnold Palmer

-

Virgin Pina Colada

-

Others

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavored

-

Unflavored

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Foodservice

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ready to drink mocktails market size was estimated at USD 8.26 billion in 2023 and is expected to reach USD 8.71 billion in 2024.

b. The global ready to drink mocktails market is expected to grow at a compounded growth rate of 5.7% from 2024 to 2030 to reach USD 12.15 billion by 2030.

b. The ready to drink mocktails market in North America captured a revenue share of 27.38% in 2023.The market in the region is boosted by the increasing popularity of sobriety and moderation movements, prompting consumers to opt for non-alcoholic alternatives during social events.

b. Some key players operating in the market include Mocktail Beverages; The Mocktail Company; Sipling Beverage Co.; Curious Elixirs; Mocktail Drinks Ltd.; Keurig Dr Pepper Inc.; Mocktails Uniquely Crafted; Free AF; Molson Coors and CRAVOVA

b. The growth can be attributed to changing consumer preferences towards healthier choices, rising demand for non-alcoholic alternatives, evolving social trends, innovative product offerings, and convenience-driven consumption patterns.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."