- Home

- »

- Petrochemicals

- »

-

Reactive Diluents Market Size, Share, Industry Report, 2030GVR Report cover

![Reactive Diluents Market Size, Share & Trends Report]()

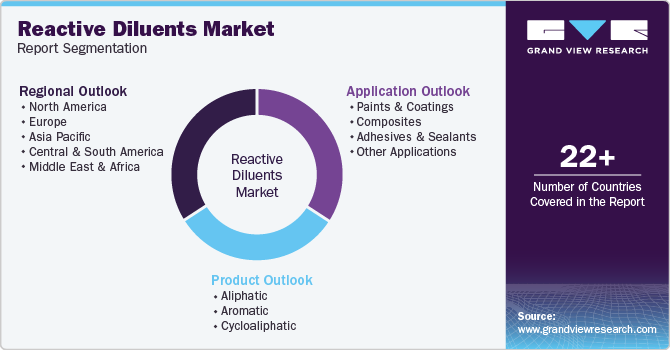

Reactive Diluents Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Aliphatic, Aromatic, Cycloaliphatic), By Application (Paints & Coatings, Composites, Adhesives & Sealants), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-420-4

- Number of Report Pages: 99

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Reactive Diluents Market Size & Trends

“2030 Reactive Diluents Market value to reach USD 1,591.54 million”

The global reactive diluents market size was valued at USD 1.05 billion in 2023 and is projected to grow at a CAGR of 6.2% from 2024 to 2030. The product market demands are growing, mainly due to their diverse applications as thinners, viscosity modifiers, and rheology modifiers. They are incorporated into adhesives, sealants, paints, and coatings to achieve the appropriate concentration for their intended purposes.

The growing need for environmentally friendly formulations in reactive diluents and related products is increasingly impacting market dynamics. This trend stems from a widespread rise in consumer environmental awareness, with people prioritizing products that minimize their environmental impact. Governments worldwide are implementing stringent regulations to restrict the use of harmful chemicals, prompting industry to adopt sustainable alternatives.

Drivers, Opportunities & Restraints

The increasing demand for solvent-free or environmentally friendly anticorrosion reactive diluents arises from a growing awareness of environmental issues and health hazards associated with traditional solvent-based coatings. These innovative diluents are formulated to significantly reduce or eliminate the emission of harmful volatile organic compounds (VOCs), improving air quality and reducing potential health risks. By offering a safer and more sustainable alternative, they address environmental and safety concerns, marking a pivotal shift towards greener and more responsible anticorrosion technologies.

The product market primarily stems from their potential health and environmental risks. Certain reactive diluents can release volatile organic compounds (VOCs), leading to regulatory challenges and safety concerns during manufacturing and application. Additionally, their use may comprise the mechanical properties of cured materials, limiting their suitability for some applications. These factors create constraints on the broader adoption of reactive diluents in various industries.

Several micro- and macro-economic factors contribute to fluctuating raw material prices and economic growth. These factors include the trade war between the world's two largest economies, China and the USA, geopolitical issues involving the US, Russia, Saudi Arabia, Iraq, and Iran, and declining production and sales of diesel-based automobiles worldwide. These factors are key drivers behind the fluctuation of raw material prices, such as crude oil, natural gas, and other commodities, and are also contributing to lower economic growth.

Product Type Insights & Trends

“Aromatic is expected to emerge as the fastest growing product with a CAGR of 6.6%”

The aliphatic segment dominated the market and accounted for a revenue share of 42.25% in 2023. This growth is attributed to aliphatic compounds offering exceptional performance characteristics, such as UV resistance, high chemical resistance, excellent weather ability, and superior durability, making them ideal for various applications, including composites, adhesives, and coatings. Additionally, the product market is known for its versatility and compatibility with a wide range of resins and formulations, providing manufacturers with flexibility in product development.

Aromatic segments are a specific type of reactive diluent characterized by their aromatic structure, which plays a significant role in enhancing the properties of composites. These diluents are mainly chosen for their ability to lower the viscosity of resin systems without sacrificing the composite's thermal or mechanical integrity. Due to their aromatic nature, they can provide better compatibility with specific resin formulations, improving the final product's processing characteristics and mechanical properties. Moreover, their reactivity ensures a seamless integration into the polymer matrix, maintaining the strength and durability of the composite.

Application Insights & Trends

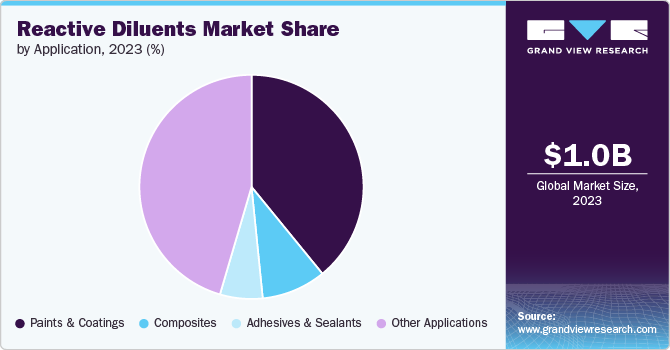

“Composites are expected to emerge as the fastest growing application with a CAGR of 6.9%”

The paints & coatings segment dominated the market with a market and accounted for a revenue share of 39.10% in 2023. Paints and coatings are the dominant products in the market because they are widely used in numerous sectors and applications. Reactive diluents are essential components in the formulation of paints and coatings. They serve multiple functions, including modifying viscosity, facilitating crosslinking, and improving adhesion and durability. The desire for high-performance coatings that possess exceptional qualities, including chemical resistance, scratch resistance, and weather ability, has driven the use of reactive diluents.

Reactive diluents play a crucial role in improving processing and mechanical properties in composites. They reduce the viscosity of resin systems, making them easier to work with during manufacturing processes like resin transfer molding or pultrusion. This also allows for better impregnation of the reinforcing fibers, ensuring a stronger bond and a higher quality final product. Additionally, because reactive diluents chemically react and integrate into the polymer matrix, they do not compromise the thermal or mechanical properties of the composite, unlike traditional solvents that can leave voids or weaken the structure.

Regional Insights & Trends

North America reactive diluents market is expected to grow due to the growing construction industry in the region. This growth will lead to a rise in demand for the product which is used in the paints & coatings industry, leading to a rise in demand for the product market.

Asia Pacific Reactive Diluents Market Trends

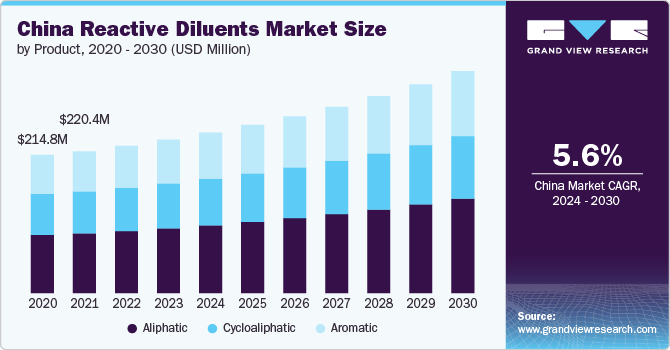

“China is expected to emerge as the fastest growing region in the Asia Pacific with a CAGR of 5.6% from 2024 - 2030”

The reactive diluents market in Asia Pacific dominated the global industry and accounted for a 34.19% share in 2023. This growth is attributed to increasing usage of the product market for construction purposes. Asia Pacific construction activities is also increasing due to growing number of construction activities in India, Japan, and South Korea.

China reactive diluents market accounted for a market share of 64.37% in 2023. This growth is attributed to increasing demand for the construction industry in the country. China. is one of the countries with the highest construction activities leading to a rise in demand for products in the region.

Europe Reactive Diluents Market Trends

The reactive diluents market in Europe plays a significant role, with countries such as Germany, UK, France, Italy, Spain, Russia, Netherlands, and Belgium being key contributors to the market. The region's market dynamics are influenced by factors such as the rise in demand for paints & coatings in the region leading to increased demand for the product market.

Key Reactive Diluents Company Insights

Some of the key players operating in the global reactive diluents market include Olin Corp and Cargill, among others.

-

Olin Corp is a manufacturer and distributor of chemicals and ammunition. Its chemical products include caustic soda, chlorine, vinyl, epoxy, hydrochloric acid, chlorinated organics, and bleach. The company's chemicals are widely used and upgraded into various downstream chemical products. The company has a global presence.

-

Cargill Inc. offers various products and services in the financial, food, industrial, agricultural, and risk management sectors. Cargill provides technical support, data asset solutions, transportation and logistics, risk management, and marketing services. The company has a global presence.

Mitsubishi Chemical Group and Evonik Industries AG. are some of the emerging market participants in the global reactive diluents market.

-

Evonik Industries AG is a specialty chemical company. Its product portfolio includes polymers, surfactants, additives, resins, and others. The company's products find application in various markets, including renewable energy, agriculture, paper and printings, paints and coatings, electrical and electronics, metal and oil products, consumer and personal care products, food and animal feed, plastics, pharmaceuticals, rubber, construction, and automotive. The company has a global presence.

- Mitsubishi Chemical Group Corp is a diversified chemical company. Its products and services include advanced high-performance chemicals, polymers, moldings, high-performance films, composites, petrochemicals, industrial gases, carbon, environment & living solutions, and methyl methacrylate. The company also has a global presence.

Key Reactive Diluents Companies:

The following are the leading companies in the reactive diluents market. These companies collectively hold the largest market share and dictate industry trends.

- SACHEM, Inc.

- Olin Corporation

- Grasim Industries Limited

- Cargill, Incorporated

- Cardolite Corporation

- Evonik Industries AG

- Guangdong Haohui New Material Co., Ltd.

- Nippon Kayaku Co., Ltd.

- Mitsubishi Chemical Group Corporation.

Recent Developments

-

In December 2021, The Bodo Möller Chemie Group announced that it is strengthening its partnership with Imerys. Imerys, a French mining company, is a global pioneer in mineral-based specialty solutions for various industries.

-

In February 2020, Huntsman introduced a new snap-cure VITROX RTM 00410 resin to facilitate increased volume manufacturing of cost-effective and lightweight composite parts. This innovation enables the company to address customer needs in the composites industry better.

Reactive Diluents Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.11 billion

Revenue forecast in 2030

USD 1.59 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kiloton, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, South Korea, Brazil, Argentina, Saudi Arabia, South Africa.

Key companies profiled

SACHEM, Inc.; Olin Corporation; Grasim Industries Limited; Cargill, Incorporated; Cardolite Corporation; Evonik Industries AG; Guangdong Haohui New Material Co., Ltd.; Nippon Kayaku Co., Ltd.; Mitsubishi Chemical Group Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Reactive Diluents Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global reactive diluents market report product, application, and region.

-

Product Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Aliphatic

-

Aromatic

-

Cycloaliphatic

-

-

Application Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Composites

-

Adhesives & Sealants

-

Other Applications

-

-

Regional Outlook (Volume, Kiloton; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global reactive diluents market was valued at USD 1.05 billion in 2023 and is expected to reach USD 1.11 billion in 2024.

b. The global reactive diluents market is anticipated to grow at a CAGR of 6.2% from 2024 to reach USD 1.59 billion by 2030.

b. Asia Pacific dominated the market and accounted for a 34.19% share in 2023. This growth is attributed to increasing usage of the product market for construction purposes. Asia Pacific construction activities is also increasing due to growing number of construction activities in India, Japan, and South Korea.

b. Cargill, Incorporated, Olin Group, Mitsubishi Chemical Group and Evonik Industries AG. are some of the market participants in the global reactive diluents market.

b. The demand for reactive diluents globally is growing, mainly due to their diverse applications as thinners, viscosity modifiers, and rheology modifiers. They are incorporated into adhesives, sealants, paints, and coatings to achieve the appropriate concentration for their intended purposes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.