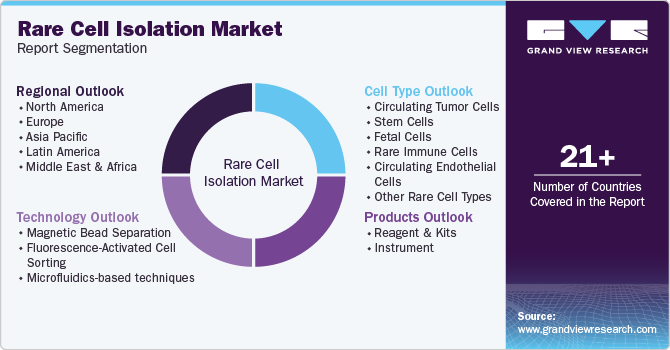

Rare Cell Isolation Market Size, Share & Trends Analysis Report By Product (Reagents & Kits, Instrument), By Cell Type (Circulating Tumor Cells, Stem Cells), By Technology, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-359-9

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Rare Cell Isolation Market Size & Trends

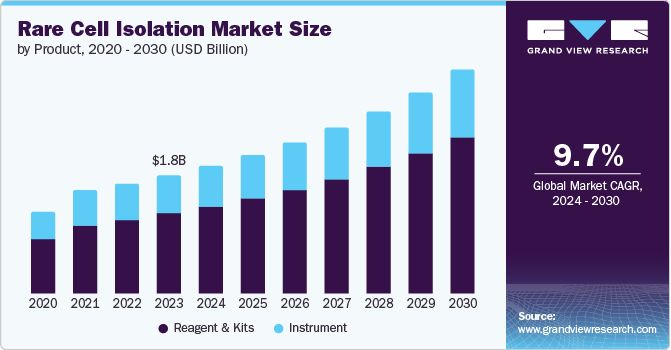

The global rare cell isolation market size was estimated at USD 1.83 billion in 2023 and is projected to grow at a CAGR of 9.71% from 2024 to 2030. The market has been experiencing significant growth, driven by advancements in biotechnology and the increasing need for precision medicine. Rare cells, which include circulating tumor cells (CTCs), stem cells, and fetal cells, play crucial roles in early disease detection, treatment monitoring, and personalized therapy. The market for rare cell isolation encompasses a wide range of technologies and methodologies designed to isolate and analyze these elusive cells from biological samples, such as blood, tissue, and other bodily fluids. Key players continually innovate to develop more efficient and accurate isolation techniques, catering to the growing demand in clinical diagnostics, research, and therapeutic applications.

Several firms, including NanoString Technologies, Levitas Bio, & Bionano Genomics, have implemented product development strategies and increased their offerings. For example, in April 2022, Levitas Bio announced the launch of the LeviCell EOS System, a next-generation cell isolation platform. The new product allows for targeted selection of viable cells & has a better throughput than the company's previous products. Furthermore, the COVID-19 pandemic has allowed researchers to examine and comprehend this novel infectious virus and develop medicines and diagnostic tools for it. A primary driver of the market growth is the increasing prevalence of cancer and other chronic diseases.

As per the American Cancer Society, in 2023, in the U.S. alone, more than 1.9 million new cases of cancer are projected to be diagnosed. The ability to isolate and analyze rare cells like CTCs provides critical insights into tumor biology and the metastatic process, aiding in early detection and developing targeted treatment strategies. Personalized medicine, which customizes healthcare based on individual genetic profiles, has fueled the demand for advanced rare cell isolation technologies. In response, companies are developing novel platforms that integrate isolation and analysis, improving the efficiency and accuracy of detecting these rare cells. For instance, advancements in next-generation sequencing (NGS) and digital PCR are enhancing the analytical capabilities of isolated rare cells, paving the way for more comprehensive and personalized diagnostic solutions.

Recent developments in the market underscore the competitive landscape and the pace of innovation in rare cell isolation. For example, in 2024, RareCyte Inc. announced the launch of its novel platform, CyteFinder II, which enhances the detection and analysis of rare cells through advanced imaging and AI-driven algorithms. This platform is expected to improve clinical diagnostics and research workflow significantly. Similarly, Menarini Silicon Biosystems recently expanded its product portfolio with the DEPArray PLUS system, designed to provide highly precise rare cell isolation for liquid biopsies and personalized medicine applications.

Market Concentration & Characteristics

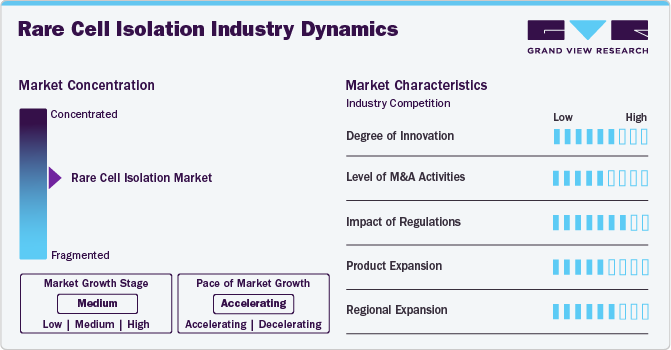

The development of advanced rare cell isolation tools has revolutionized therapeutic development and disease detection by enabling easier isolation of cells. This has led to numerous industry players introducing technologically advanced and innovative products

The market is also characterized by a moderate level of M&A activities undertaken by industry players. This is due to factors, such as the desire to gain a competitive advantage in the industry and the need to consolidate in a rapidly growing market.

The development and application of cell isolation technologies are subject to stringent regulations to ensure safety, efficacy, and ethical considerations. Ethical considerations also play a significant role in regulating cell isolation technologies. Many countries have bioethical committees or advisory boards assessing the ethical implications of cell isolation tools

The industry has seen significant growth in recent years, driven by the increasing demand for cell isolation technology due to the growing R&D activities. Moreover, companies are entering R&D deals, leveraging their cell isolation technologies against various therapeutic targets. In March 2024, Bio-Rad introduced validated antibodies for rare cell & circulating tumor cell enumeration

The industry is experiencing moderate regional expansion, driven by an increasing customer base for rare cell isolation products. In addition, companies are entering into license agreements to access new market regions

Products Insights

The reagent & kits segment dominated the market in 2023 and is anticipated to grow at a higher CAGR of 10.25% during the forecast period. The development of advanced reagents and kits has significantly improved the efficiency and precision of isolating rare cells, such as CTCs and stem cells. These specialized reagents and kits are designed to enhance the sensitivity and specificity of isolation methods, making them indispensable for both research and clinical applications.

Moreover, the ease of use associated with pre-packaged kits attracts laboratories and clinics. These kits often include all the necessary components and detailed protocols, reducing the complexity and time required for cell isolation procedures. This convenience is particularly appealing in clinical settings, where time and accuracy are critical. Moreover, the continuous innovation and customization offered by manufacturers in this segment cater to a wide range of applications and cell types. This adaptability ensures that reagents and kits can meet the diverse and evolving needs of researchers and clinicians.

Cell Type Insights

The stem cell segment dominated the market and accounted for a share of 39.46% in 2023. In addition, this segment is anticipated to grow at the highest CAGR of 11.23% from 2024 to 2030. The segment growth is attributed to the unique regenerative capabilities and therapeutic potential of stem cells, which make them a focal point in medical research and clinical applications. The broad range of applications drives a high demand for efficient and reliable stem cell isolation techniques.

The increasing prevalence of chronic diseases and the growing need for personalized medicine have significantly boosted the demand for stem cells. Stem cells play a crucial role in understanding disease mechanisms, developing targeted treatments, and conducting preclinical testing. For instance, in cancer research, isolating and studying cancer stem cells (CSCs) is critical for developing new therapies and understanding tumor progression and resistance.

Moreover, advances in stem cell research have led to the development of novel isolation techniques and technologies, which are more sophisticated and capable of isolating stem cells with high purity and viability. Innovations, such as magnetic-activated cell sorting (MACS), fluorescence-activated cell sorting (FACS), and microfluidics-based platforms, have enhanced the efficiency and accuracy of stem cell isolation, further driving the segment's growth.

Technology Insights

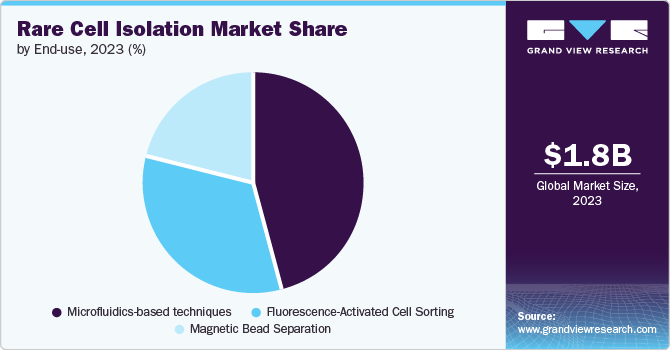

The microfluidics-based techniques segment held the largest market share in 2023. Microfluidics-based techniques dominate the market due to their unique advantages and innovative capabilities catering to the growing needs of research and clinical applications. These techniques leverage the precise control and manipulation of fluids at the microscale, enabling the isolation of rare cells, such as CTCs and stem cells, with unprecedented efficiency and accuracy. One of the primary reasons for the dominance of microfluidics-based techniques is their ability to handle and process very small sample volumes with high throughput. This is particularly advantageous in clinical diagnostics, where the availability of patient samples, such as blood, can be limited. Microfluidic platforms can efficiently process these small volumes to isolate rare cells without significant loss, making them ideal for clinical applications.

The magnetic bead separation segment is anticipated to grow at the highest CAGR over the forecast period. Magnetic Bead Separation is highly adaptable and compatible with various downstream applications. The isolated cells remain viable and functional, allowing further cultivation, genetic analysis, or therapeutic use. This flexibility makes it a preferred choice for researchers and clinicians who require isolated cells for multiple purposes, from basic research to clinical trials and therapeutic applications. Additionally, the ongoing advancements in magnetic bead technology and antibody development are enhancing the capabilities of this method. Newer generations of magnetic beads are smaller, more uniform, and have improved binding properties, increasing cell isolation's efficiency and yield. These technological improvements are driving greater adoption and expanding the range of applications for magnetic bead separation.

Regional Insights

The North America rare cell isolation market dominated the global industry and accounted for a share of 40.26% in 2023, attributed to the region’s advanced healthcare infrastructure, strong presence of leading biotechnology firms, and significant funding for cell research. Furthermore, growing healthcare expenditure, increasing awareness of cell therapies, and supportive government initiatives boost the market growth.

U.S. Rare Cell Isolation Market Trends

The rare cell isolation market in the U.S. is anticipated to grow over the forecast period due to increasing government funding & growing focus on cell studies, and the rising prevalence of diseases. Moreover, increasing research in the fields of drug discovery, personalized medicine, and targeted therapies is anticipated to fuel market growth.

Europe Rare Cell Isolation Market Trends

The Europe rare cell isolation market is anticipated to grow over the forecast period. Europe has been actively involved in cell research, contributing to its growth in the region. Moreover, as more companies invest in R&D, focusing on applications, such as disease treatment and personalized medicine, further propels the market growth.

The rare cell isolation market in the UK is experiencing robust growth, driven by advancements in medical research and increasing emphasis on personalized medicine. The UK's strong healthcare infrastructure, combined with its world-class research institutions and biotechnology sector, provides a fertile ground for the development and application of cutting-edge cell isolation technologies.

The Germany rare cell isolation market is expected to grow over the forecast period due to the rising incidence and prevalence of genetic disorders,favorable government policies supporting research activities, and the introduction of new drugs and therapies by key players.

The rare cell isolation market in France is expected to grow over the forecast period due to the rising prevalence of chronic disorders. To cure such disorders, several researchers are using cell isolation technologies. In addition, The market is also benefiting from substantial government and private sector investments aimed at accelerating biomedical research and fostering innovation in cell-based therapies.

Asia Pacific Rare Cell Isolation Market Trends

The Asia Pacific rare cell isolation marketis expected to experience rapid growth, with a projected CAGR of 10.64% from 2024 to 2030. This is attributed to the increasing incidence of chronic diseases, growing government support for cell research and development, and a rising preference for rare cell isolation technologies in therapeutics.

The rare cell isolation market in China is witnessing rapid growth, underpinned by the country's robust healthcare reforms, burgeoning biotechnology sector, and significant government investments in biomedical research and innovation. China's focus on advancing precision medicine and developing innovative therapies for cancer and other chronic diseases drives substantial demand for cutting-edge cell isolation technologies.

The Japan rare cell isolation market is expected to witness rapid growth over the forecast period. The Japanese government's strong support for medical innovation and research funding, alongside favorable regulatory policies, has catalyzed the development and commercialization of advanced cell isolation technologies, including microfluidics, magnetic bead separation, and automated systems. Leading research institutions and biotechnology companies in Japan are at the forefront of integrating these technologies into clinical and research applications, particularly in oncology and regenerative medicine.

The rare cell isolation market in India is anticipated to grow at a rapid CAGR over the forecast period. India faces a significant burden of chronic diseases, such as cancer and cardiovascular disorders, due to its large and diverse population. This, in turn, drives the need for advanced diagnostic and therapeutic solutions. Rare cell isolation technologies, including magnetic bead separation, microfluidics, and flow cytometry, are gaining traction as essential tools for early disease detection, personalized medicine, and regenerative therapies.

The Middle East and Africa Rare Cell Isolation Market Trends

The rare cell isolation market in the Middle East and Africais poised to grow in the near future, as increasing applications of biotechnology in healthcare are contributing to its expansion.

The rare cell isolation market in Saudi Arabia is expected to grow over the forecast period due to increasing investments in healthcare innovation and research. The country’s focus on advancing biotechnology, coupled with the rising awareness of personalized medicine, is driving the market expansion in Saudi Arabia.

Kuwait rare cell isolation market is anticipated to witness growth over the forecast period owing to the rising investment in scientific R&D by governmental and private entities. These investments boost advancements in rare cell isolation technologies, consequently presenting opportunities for developing novel and enhanced cell isolation tools and techniques.

Key Rare Cell Isolation Company Insights

Key players operating in the market undertake various initiatives to strengthen their market presence and increase the reach of their products. Strategies, such as expansion activities and partnerships, play a key role in propelling the market growth.

Key Rare Cell Isolation Companies:

The following are the leading companies in the rare cell isolation market. These companies collectively hold the largest market share and dictate industry trends.

- Miltenyi Biotec

- Thermo Fisher Scientific, Inc.

- Danaher

- QIAGEN N.V.

- Bio-techne

- STEMCELL Technologies

- CELLENION

- RareCyte

- Illumina, Inc.

- Bio-Rad Laboratories, Inc.

Recent Developments

-

In June 2024, Bio-Rad Introduced Celselect Slides 2.0 to Enhance Rare Cell & Circulating Tumor Cell Enrichment for Cancer Research

-

In March 2024, Bio-Rad introduced validated antibodies for rare cell & circulating tumor cell enumeration

-

In February 2024, Akadeum Life Sciences, Inc. and NanoCellect Biomedical, Inc. announced an additional partnership to improve rare-cell workflows. Both companies research and manufacture innovative and simple cell-sorting technology

Rare Cell Isolation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.98 billion |

|

Revenue forecast in 2030 |

USD 3.46 billion |

|

Growth rate |

CAGR of 9.71% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, cell type, technology, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Miltenyi Biotec; Thermo Fisher Scientific, Inc.; Danaher; QIAGEN N.V.; Bio-techne; STEMCELL Technologies; CELLENION; RareCyte; Illumina, Inc.; Bio-Rad Laboratories, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Rare Cell Isolation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rare cell isolation market report based on product, cell type, technology, and region:

-

Products Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagent & Kits

-

Instrument

-

-

Cell Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Circulating Tumor Cells

-

Stem Cells

-

Fetal Cells

-

Rare Immune Cells

-

Circulating Endothelial Cells

-

Other Rare Cell Types

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Magnetic Bead Separation

-

Fluorescence-Activated Cell Sorting

-

Microfluidics-based techniques

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global rare cell isolation market size was estimated at USD 1.84 billion in 2023 and is expected to reach USD 1.98 billion in 2024.

b. The global rare cell isolation market is expected to grow at a compound annual growth rate of 9.71% from 2024 to 2030 to reach USD 3.46 billion by 2030.

b. North America dominated the market and accounted for a 40.26% share in 2023, attributed to the region’s advanced healthcare infrastructure, strong presence of leading biotechnology firms, and significant funding for cell research.

b. Some key players operating in the rare cell isolation market include Miltenyi Biotec, Thermo Fisher Scientific, Inc., Danaher, QIAGEN N.V., Bio-techne, STEMCELL Technologies, CELLENION, RareCyte, Illumina, Inc., Bio-Rad Laboratories, Inc.

b. The rare cell isolation market has been experiencing significant growth, driven by advancements in biotechnology and the increasing need for precision medicine. Rare cells, which include circulating tumor cells (CTCs), stem cells, and fetal cells, play crucial roles in early disease detection, treatment monitoring, and personalized therapy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."