- Home

- »

- Clinical Diagnostics

- »

-

Rapid Medical Diagnostic Kits Market Size, Share Report, 2030GVR Report cover

![Rapid Medical Diagnostic Kits Market Size, Share & Trends Report]()

Rapid Medical Diagnostic Kits Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (OTC Kits, Professional Kits), By Technology (Lateral Flow, Solid Phase), By Application, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-987-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

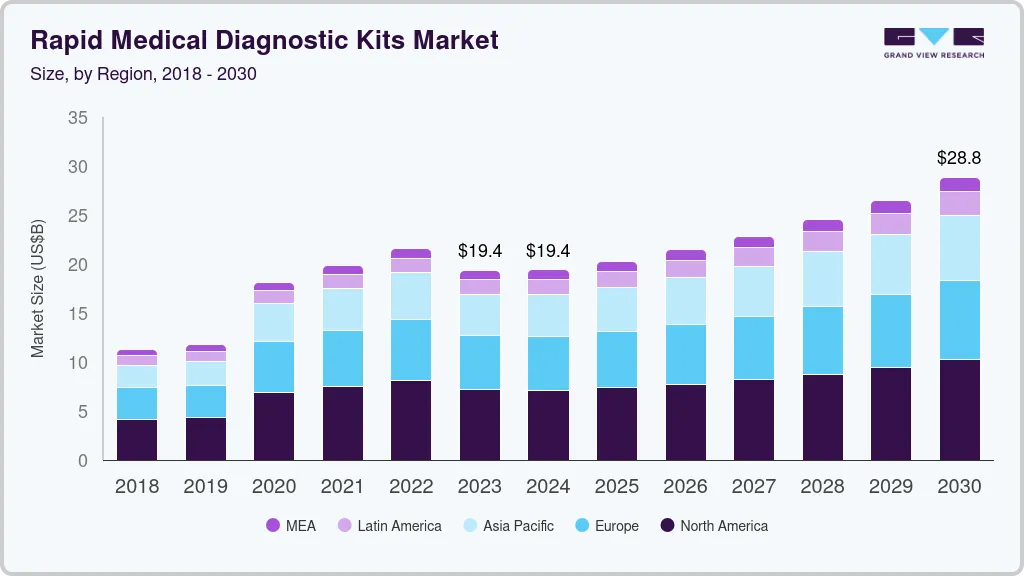

The global rapid medical diagnostic kits market size was estimated at USD 19.35 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.9% from 2024 to 2030. The market for rapid medical diagnostic kits is set to gain momentum in the coming years owing to the increasing awareness and demand for rapid medical diagnosis of chronic diseases, point of care diagnostics, increasing cases of infectious disease, as well as entry of portable rapid testing devices in the market. Collaborative efforts of the government bodies with local authorities to attain control of treatment and management of infectious diseases are expected to supplement the adoption of rapid tests.

The COVID-19 pandemic had a profound impact on the market for rapid medical diagnostic kits. The urgency for widespread testing and quick results has driven the demand for rapid diagnostic kits, particularly for COVID-19 detection. These kits offer advantages such as faster turnaround time, portability, and ease of use, making them invaluable tools in controlling the spread of the virus. The market has witnessed a surge in innovation, with numerous companies developing and commercializing rapid diagnostic kits specifically designed for COVID-19. The increased adoption of these kits by healthcare professionals and the general public has significantly contributed to the overall growth of the market.

The rapid medical diagnostic kits market is experiencing a notable trend of growth as these kits are becoming increasingly popular due to their ability to provide quick and on-site results that facilitate prompt medical decisions. The rising prevalence of infectious diseases, such as COVID-19, and the need for early detection and containment have fueled the demand for these kits. Furthermore, technological advancements have led to the development of innovative rapid diagnostic kits that offer improved sensitivity, specificity, and ease of use.

Serological rapid diagnostic tests (RDTs) are frequently utilized in various disorders because they can produce a straightforward, binary response (positive or negative). Since its inception in the early 1970s, this test has been primarily employed to govern pregnancy status for more than three decades. The uses of RDTs have greatly increased over time, and today we have tests for a wide range of analytes and pathogens, making them essential instruments for health management and diagnosis. However, manual reading and processing of test results had several drawbacks that are now being resolved through AI and machine learning.

Rapid diagnostic techniques for diagnosing SARS-CoV-2 have been developed partly due to the pandemic's rapid evolution. More than 176 SARS-CoV-2 serological RDTs were developed until June 2020. These quick tests have been employed in hospitals and drive-through testing facilities, allowing for quick testing of huge populations with little training and data collection to help close and reopen procedures as needed. The use of xRCovid, a smartphone app applies machine learning to identify SARS-CoV-2 serological RDT findings and lessen reading ambiguities. This has produced a 99.3% accuracy enabling clear diagnosis.

The market is witnessing a shift toward point-of-care testing, enabling healthcare professionals to perform diagnostics at the patient's bedside, in clinics, or in remote areas, thereby driving the market expansion. The increasing focus on personalized medicine and the growing demand for home-based testing solutions also contribute to the upward trajectory of the market for rapid medical diagnostic kits. For instance, in October 2021, Intrivo, launched On/Go, an at-home rapid COVID-19 antigen self-test that provides results with 95% accuracy in less than 10 minutes.

Product Insights

In terms of product, over-the-counter (OTC) kits dominated the rapid medical diagnostic kits market in 2022 with a revenue share of 62.55% and are projected to grow at the fastest CAGR of 9.57% during the forecast period. This is attributed to the fact that these tests are easy to use in the “near-patient setting” and are a cost-effective alternative to expensive laboratory testing. These tests are typically used in home care settings, providing an easy and cost-effective alternative to laboratory testing. RDTs commonly use saliva, urine, and blood as samples to diagnose diseases.

According to the Consumer Healthcare Products Association, clinical cost savings amounted to over USD 77 billion owing to the low pricing of OTC diagnostic products. These tests also aid in the detection of various infectious and chronic diseases that have limited or no symptoms, facilitating early treatment and reducing other complications associated with the disease. While these tests are most often used in home care settings, other end-use settings include hospitals, clinics, and diagnostic laboratories.

Technology Insights

The lateral flow technology segment accounted for the largest revenue share of 32.45% in 2022 and is projected to grow at the fastest CAGR of 9.11% over the forecast period. Lateral flow assays are commonly adopted across qualitative and quantitative identification of specific antigens, gene amplification products, and antibodies in hospitals, clinics, and diagnostic laboratories, thus further contributing to segment growth.

Lateral flow assays are cheap & easy to use and provide accurate results within a few minutes. These tests detect both immunoglobulin G and immunoglobulin M antibodies against SARS-CoV-2, which causes diseases such as COVID-19. In March 2020, Ozo Life launched OZO COVID-19 Rapid Test Kits, which offer a latex-enhanced, high-sensitivity lateral flow immunoassay solution for detecting COVID-19 in its early stages. Therefore, the increase in strategic initiatives undertaken by market players is expected to boost the lateral flow assays market growth during the forecast period.

Application Insights

Based on application, the blood glucose testing segment held the largest revenue share of 13.46% in 2022 and is projected to have the fastest CAGR of 9.73% over the forecast period. The high usage of these tests and the availability of several rapid blood glucose tests are factors responsible for segment growth. In addition, increasing adoption of these tests for the immediate measurement of elevated blood cholesterol levels across assisted living centers, home care, clinics, and laboratories is projected to drive the segment growth.

The infectious disease testing segment held the second-largest revenue share in 2022. The outbreak of the novel coronavirus (COVID-19) created an urgent demand for its rapid diagnostic solutions as it is a cornerstone of the management of the pandemic. As of December 2022, approximately 1.15 billion COVID-19 tests were performed in the U.S., contributing to the segment’s revenue.

End-use Insights

The end-use segment is divided into hospitals & clinics, homecare, and diagnostic laboratories. In 2022, hospitals and clinics held the largest revenue share of 45.19% of the rapid medical diagnostics kits market as they serve as a primary care setting for the diagnosis and treatment of all diseases. Constant changes in the healthcare industry have led to an increase in the need for hospitals with enhanced diagnostic services. As hospitals maintain and collect data on disease prevalence, regulatory bodies often collaborate with them for disease surveillance. On the other hand, with the advent of POC diagnostics or at-home diagnosis, there has been a steady rise in the number of rapid diagnostic tests being performed globally.

The home care end-use segment is expected to witness significant growth over the forecast period that can be majorly attributed to the aftereffects of the pandemic, which has urged people to become self-reliant. Most rapid influenza diagnostic kits are Clinical Laboratory Improvement Amendments (CLIA) waived and are typically used in POC settings. Lateral flow rapid antigen assay that helps detect pregnancy at home is extensively used, thus driving the demand for home use kits. Blood glucose testing strips are also commonly used at home, which is a safe, easy, and affordable way to check diabetes.

Regional Insights

North America dominated the market in 2022 with a revenue share of 31.25% and is expected to maintain its dominance over the forecast period. The U.S. emerged as the key revenue-generating segment in 2022. Diagnostics companies are focusing on the development of novel COVID-19 rapid diagnostic tests and are striving to gain approval from regulatory bodies to launch these tests in the U.S. For instance, as early as May 2020, Quidel Corporation received Emergency Use Authorization (EUA) for its new Sofia 2 SARS Antigen FIA from the FDA for rapid diagnosis of COVID-19.

Asia Pacific is projected to grow at the fastest CAGR of 10.26% over the forecast period. Developing economies such as Japan and China both generated robust revenues in 2022 and are expected to maintain this trend in the next 10 years owing to new product launches. For instance, in July 2023, EMPE Diagnostics launched a rapid test kit, mfloDX MDR-TB for diagnosing TB in India. It is a one-of-a-kind kit, approved by CDSCO and recognized by the WHO and with patents in 19 countries.

Key Companies & Market Share Insights

Key companies are focusing on adopting strategic initiatives such as product launches, distribution agreements, and collaborations. In January 2023, LordsMed and Hindustan Antibiotics distributed rapid antigen kits at affordable prices for numerous diseases. They were able to do this with the help of their qualified R&D team and produced in vitro diagnostic kits that are rapid in nature and extremely accurate. Some prominent players in the global rapid medical diagnostic kits market include:

-

ACON Laboratories, Inc.

-

Abbott

-

Artron Laboratories Inc.

-

Alfa Scientific Designs, Inc.

-

BD

-

bioMérieux SA

-

BTNX, Inc.

-

Bio-Rad Laboratories, Inc.

-

Danaher Corporation

-

Cardinal Health

-

Creative Diagnostics

-

F. Hoffmann-La Roche AG

-

McKesson Medical-Surgical, Inc.

-

Meridian Bioscience, Inc.

-

Sight Diagnostics Ltd.

-

Trinity Biotech

-

Zoetis

Rapid Medical Diagnostic Kits Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.42 billion

Revenue forecast in 2030

USD 28.83 billion

Growth rate

CAGR of 5.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

ACON Laboratories, Inc.; Abbott Laboratories; Artron Laboratories Inc.; Alfa Scientific Designs, Inc.; BD; BTNX, Inc.; bioMérieux SA; Cardinal Health; Bio-Rad Laboratories, Inc.; Danaher Corporation; Creative Diagnostics; Meridian Bioscience, Inc.; F. Hoffmann-La Roche AG; McKesson Medical-Surgical, Inc.; Sight Diagnostics Ltd.; Trinity Biotech; Zoetis

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Rapid Medical Diagnostic Kits Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global rapid medical diagnostic kits market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Over the Counter (OTC) Kits

-

Professional Kits

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Lateral Flow

-

Agglutination

-

Solid Phase

-

Other Technologies

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Blood Glucose Testing

-

Infectious Disease Testing

-

COVID-19

-

Hepatitis

-

HIV

-

Influenza

-

Others

-

-

Cardiometabolic Testing

-

Pregnancy and Fertility Testing

-

Fecal Occult Blood Testing

-

Coagulation Testing

-

Toxicology Testing

-

Lipid Profile Testing

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Home Care

-

Diagnostic Laboratories

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global rapid medical diagnostic kits market size was estimated at USD 21.63 billion in 2022 and is expected to reach USD 23.45 billion in 2023.

b. The global rapid medical diagnostic kits market is expected to grow at a compound annual growth rate of 9.03% from 2023 to 2030 to reach USD 42.94 billion by 2030.

b. The blood glucose testing segment held the largest revenue share of 13.46%% in 2022 owing to high usage of these tests and availability of number of rapid blood glucose tests

b. Some key players operating in the rapid medical diagnostic kits market include ACON Laboratories, Inc.; Abbott Laboratories; Artron Laboratories Inc.; Alfa Scientific Designs, Inc.; Becton, Dickinson and Company; BTNX, Inc.; bioMérieux SA; Cardinal Health; Bio-Rad Laboratories, Inc.; Danaher Corporation; Creative Diagnostics; Meridian Bioscience, Inc.

b. Key factors that are driving the rapid medical diagnostic kits market growth include the rise in the prevalence of chronic diseases, a growing number of government initiatives, and growing awareness about rapid diagnostic test kits for fast & easy diagnosis.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.