Rapid Application Development Platform Market Size, Share & Trends Analysis Report By Type, By Component, By Business Function, By Deployment, By Enterprise Size, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-368-4

- Number of Report Pages: 125

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The global rapid application development platform market size was estimated at USD 41.77 billion in 2023 and is expected to grow at a CAGR of 41.8% from 2024 to 2030. The increasing demand for faster software delivery drives market growth. Companies are pressured to deliver software solutions quickly to remain competitive in today's fast-paced business environment. Traditional development methodologies often involve long development cycles, delaying the time-to-market. Rapid application development (RAD), emphasizing iterative development, prototyping, and early testing, allows businesses to accelerate development, reduce time-to-market, and quickly respond to changing market demands. This agility is critical for businesses looking to stay ahead of competitors and rapidly address customer needs.

Moreover, modern businesses face increasingly complex and dynamic requirements driven by digital transformation, globalization, and evolving customer expectations. Rapid application development methodologies support software's iterative and incremental development, allowing developers to adapt to changing requirements throughout the project lifecycle. This adaptability is crucial for managing complexity and ensuring that the final product meets the evolving needs of the business.

In addition, traditional development methods often involve significant upfront planning and lengthy development cycles, which can lead to increased costs and resource allocation. On the other hand, a rapid application development platform emphasizes iterative development and early testing, which helps identify and address issues early in the project lifecycle. This approach reduces the likelihood of costly post-release fixes and modifications. Furthermore, using low-code/no-code platforms and reusable components in rapid application development can reduce development costs by minimizing the need for extensive custom coding and streamlining the development process.

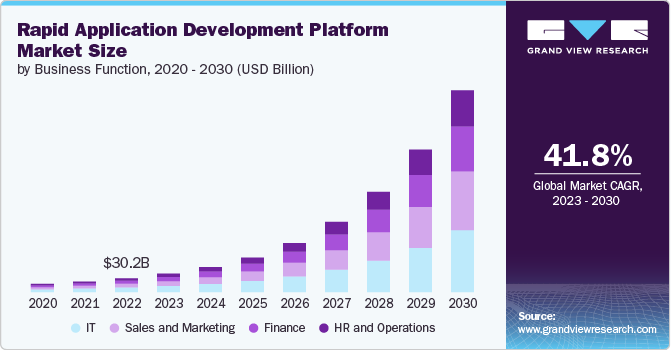

Business Function Insights

The IT segment held a market share of 32.63% in 2023 and is expected to grow significantly by 2030. Modern businesses rely heavily on data to make informed decisions and drive strategic initiatives. RAD enables IT functions to quickly develop and deploy data-driven applications that provide real-time insights and analytics. By integrating data sources and leveraging advanced analytics, RAD applications help businesses make better decisions, optimize operations, and improve customer experiences. The ability to rapidly develop and deploy data-driven solutions is a significant factor driving the growth of the rapid application development platform market in IT functions.

The sales and marketing segment is expected to grow at a CAGR of 43.3% over the forecast period. Customer engagement and retention are critical for long-term business success. RAD enables the development of applications that facilitate ongoing communication and interaction with customers. It includes customer relationship management systems, loyalty programs, and feedback tools. By maintaining regular engagement, businesses can build stronger customer relationships, understand their needs better, and foster loyalty. RAD’s iterative development approach ensures that these engagement tools can continuously improve based on user feedback and evolving business goals.

Type Insights

The low-code development platforms segment accounted for the largest market share of 66.37% in 2023. The shortage of skilled software developers has created a pressing need for solutions bridging the gap between demand and supply. Low-code platforms empower a broader range of individuals, including those with limited coding experience, to develop applications. By lowering the barrier to entry for application development, these platforms enable business users, often referred to as "citizen developers," to contribute to the development process.

The no-code development platform segment is expected to grow at a CAGR of 42.7% during the forecast period. Modern no-code platforms offer robust integration capabilities, allowing applications built on these platforms to connect seamlessly with existing systems and third-party services. This interoperability is crucial for organizations looking to enhance their digital ecosystems without overhauling their IT infrastructure. No-code platforms often come with pre-built connectors and APIs, enabling easy integration with popular enterprise software, cloud services, and databases. This feature enhances the versatility of no-code solutions, making them an attractive option for businesses seeking to streamline processes and improve operational efficiency.

Component Insights

The tools segment accounted for the largest market share in 2023. Effective collaboration between development teams and business stakeholders is crucial for successful software projects. RAD tools often include features that facilitate real-time collaboration, such as integrated project management, version control, and communication platforms. These tools enable seamless interaction among team members, ensuring everyone is aligned with the project goals and can contribute effectively. Enhanced collaboration leads to better decision-making, faster problem-solving, and higher-quality applications.

The services segment is expected to grow at a CAGR of 42.7% during the forecast period. Businesses often require customized solutions tailored to their specific needs and workflows. RAD services offer the expertise needed to customize applications beyond the capabilities of standard RAD tools and platforms. This customization ensures that applications align closely with business processes, enhancing efficiency and effectiveness. In addition, integrating new applications with existing systems and third-party services is critical for many organizations. RAD service providers offer the necessary skills and experience to ensure seamless integration, enabling businesses to create cohesive and interoperable solutions.

Deployment Insights

The cloud-based segment held a market share in 2023 and is expected to dominate by 2030. Cloud RAD platforms facilitate seamless collaboration among development teams, regardless of their geographical location. With an internet connection, developers can access development environments, tools, and resources from anywhere, promoting remote work and global collaboration. This accessibility enhances productivity and accelerates development by enabling real-time collaboration, code sharing, and version control across distributed teams.

The on-premise segment is expected to grow at a CAGR of 40.9% over the forecast period. Data security is paramount for industries handling sensitive or confidential data, such as healthcare, finance, and government sectors. On-premise deployment allows organizations to retain full control over their data and infrastructure. By keeping data in their secure environment, businesses can implement stringent security measures tailored to their needs. This includes implementing access controls, encryption protocols, and monitoring mechanisms to safeguard against unauthorized access and data breaches. The assurance of data security provided by on-premise deployment is a critical factor driving its adoption in the market.

Enterprise Size Insights

The large enterprises segment accounted for the largest market share of 63.33% in 2023. Large enterprises operate in dynamic and competitive markets where innovating and responding quickly to changing customer needs is crucial. RAD methodologies enable enterprises to accelerate the development and deployment of software applications, allowing them to bring new products and services to market faster. By adopting RAD, large enterprises can iterate rapidly, experiment with new ideas, and incorporate feedback from users and stakeholders early in the development process. This agility helps enterprises stay ahead of competitors and seize new business opportunities swiftly.

The SMEs segment is expected to grow at a CAGR of 42.3% over the forecast period. Compared to larger enterprises, SMEs often operate with limited budgets and resources. RAD methodologies offer cost-effective solutions by reducing development time and minimizing the need for extensive technical expertise. Low-code/no-code platforms within RAD enable SMEs to develop applications with reduced reliance on professional developers, lowering development costs while maintaining quality. This affordability makes RAD accessible to SMEs that may not have the financial capacity for traditional development approaches.

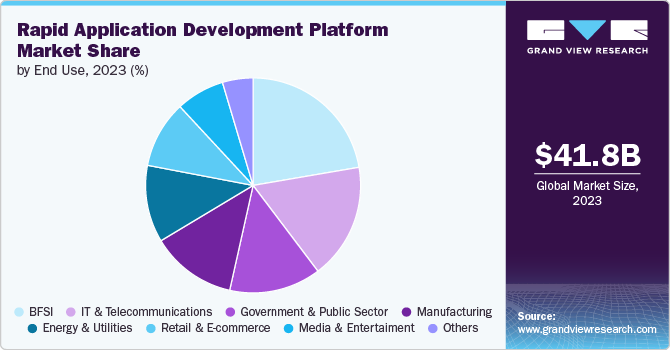

End Use Insights

The BFSI segment accounted for the largest market share of 22.34% in 2023. Compliance with stringent regulatory requirements is a top priority for the BFSI sector. RAD frameworks facilitate compliance by providing structured development processes and documentation that adhere to regulatory standards such as GDPR, PCI-DSS, and Basel III. RAD platforms often include built-in security features and compliance controls, ensuring that applications meet regulatory guidelines from the outset.

The retail and e-commerce segment is expected to grow at a CAGR of 43.9% during the forecast period. Retail and e-commerce businesses increasingly focus on delivering seamless and personalized customer experiences. RAD enables these businesses to quickly develop and deploy applications that enhance user interfaces, streamline checkout processes, and make customized recommendations based on customer behavior and preferences. By rapidly iterating and testing new features, RAD allows retailers to adapt their digital platforms to meet evolving consumer expectations, ultimately improving customer satisfaction and loyalty.

Regional Insights

North America held the largest market share of over 37.62% in the rapid application development platform market in 2023. North America has a mature and robust IT infrastructure with widespread access to high-speed internet, cloud computing services, and advanced digital technologies. This infrastructure provides a strong foundation for RAD implementation, facilitating seamless integration with existing systems and supporting the scalability of RAD-driven applications.

U.S. Rapid Application Development Platform Market Trends

The rapid application development platform market in the U.S. is growing significantly at a CAGR of 40.2% from 2024 to 2030. The competitive landscape in the U.S. demands agility and innovation from businesses to respond quickly to market changes and customer expectations. RAD enables organizations to shorten development cycles, iterate rapidly, and experiment with new ideas. This flexibility allows businesses to innovate, launch new products and services quickly, and seize market opportunities before competitors.

Asia Pacific Rapid Application Development Platform Market Trends

The rapid application development platform market in Asia Pacific is growing significantly at a CAGR of 43.6% from 2024 to 2030. With a high penetration of mobile devices and internet connectivity, the Asia Pacific region has become a hotspot for mobile-first applications. RAD tools support the development of mobile applications that cater to the preferences and behaviors of mobile-centric populations. These applications are designed to provide seamless user experiences, optimize performance for diverse mobile devices, and leverage mobile-specific features such as location-based services and mobile payments.

Europe Rapid Application Development Platform Market Trends

The rapid application development platform market in Europe is growing significantly at a CAGR of 41.3% from 2024 to 2030. Europe comprises diverse markets with varying cultural, linguistic, and regulatory landscapes. RAD's flexibility and customization capabilities enable businesses to tailor applications to meet specific market needs and localized requirements across European countries. Whether developing consumer-facing applications, enterprise solutions, or public sector services, RAD allows organizations to adapt quickly to local market conditions, user preferences, and regulatory frameworks.

Key Rapid Application Development Platform Company Insights:

Key players operating in the include Appian, Google LLC, International Business Machines Corporation, Microsoft, N-iX LTD; Oracle, OutSystems, Pegasystems Inc., Salesforce, Inc., and Zoho Corporation Pvt. Ltd. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals. The following are some instances of such initiatives.

Key Rapid Application Development Platform Companies:

The following are the leading companies in the rapid application development platform market. These companies collectively hold the largest market share and dictate industry trends.

- Appian

- Google LLC

- International Business Machines Corporation

- Microsoft

- N-iX LTD

- Oracle

- OutSystems

- Pegasystems Inc.

- Salesforce, Inc.

- Zoho Corporation Pvt. Ltd.

Recent Developments

-

In May 2024, FPT Software partnered with Siemens to offer the low-code application development platform Mendix in the South Korean and Japanese markets. As part of this collaboration, FPT Software will serve as a reseller and delivery partner for Mendix, allowing clients to achieve faster time-to-market and more cost-effective software projects. This partnership aims to enhance FPT Software's portfolio with rapid application prototyping, development, and deployment services while exploring opportunities to expand market reach through Mendix's partner ecosystem.

-

In April 2024, Comviva, a customer experience and data monetization solutions company, launched an innovative Low-Code/No-Code platform for digital payments and banking. The new platform, an extension of Comviva's existing mobility platform, is designed to revolutionize the development landscape for financial institutions, including FinTechs, banks, and digital wallet providers. The platform enables these organizations to quickly adapt to market regulations, changes, and evolving customer demands by visually constructing user journeys and workflows, as well as seamlessly integrating with third-party systems

Rapid Application Development Platform Market Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 59.04 billion |

|

Revenue forecast in 2030 |

USD 480.92 billion |

|

Growth rate |

CAGR of 41.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, component, business function, deployment, enterprise size, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa. |

|

Key companies profiled |

Appian; Google LLC; International Business Machines Corporation; Microsoft; N-iX LTD; Oracle; OutSystems; Pegasystems Inc.; Salesforce, Inc.; Zoho Corporation Pvt. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Rapid Application Development Platform Market

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends from 2018 to 2030 in each of the sub-segments. For this study, Grand View Research has segmented the global rapid application development platform market report based on type, component, enterprise size, deployment, business function, end use, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Low-code development platforms

-

No-code development platforms

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tools

-

Services

-

-

Business Function Outlook (Revenue, USD Billion, 2018 - 2030)

-

Sales and Marketing

-

HR and Operations

-

Finance

-

IT

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-premise

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

BFSI

-

IT and Telecommunications

-

Government and Public Sector

-

Energy and Utilities

-

Manufacturing

-

Retail and E-commerce

-

Media & Entertainment

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global rapid application development platform market size was estimated at USD 41.77 billion in 2023 and is expected to reach USD 59.04 billion in 2024.

b. The global rapid application development platform market is expected to grow at a compound annual growth rate of 41.8% from 2024 to 2030 to reach USD 480.92 billion by 2030.

b. North America dominated the rapid application development platform market with a share of over 37% in 2023. The presence of robust IT infrastructure with widespread access to high-speed internet, cloud computing services, and advanced digital technologies drives growth of the market in the region.

b. Some key players operating in the rapid application development platform market include Appian; Google LLC; International Business Machines Corporation; Microsoft; N-iX LTD; Oracle; OutSystems; Pegasystems Inc.; Salesforce, Inc.; and Zoho Corporation Pvt. Ltd.

b. Modern businesses face increasingly complex and dynamic requirements driven by digital transformation, globalization, and evolving customer expectations. Rapid application development methodologies support software's iterative and incremental development, allowing developers to adapt to changing requirements throughout the project lifecycle.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."