RAN Intelligent Controller Market Size, Share & Trends Analysis Report By Component (Platforms, Services), By Function (Non-RT RIC, Near-RT RIC), By Technology (4G, 5G), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-047-3

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

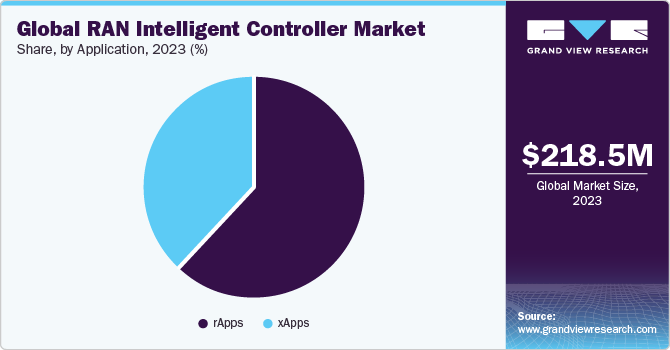

The global RAN intelligent controller market size was valued at USD 218.5 million in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 61.0% from 2024 to 2030. Increasing digitization and the growing need to manage network traffic are driving market growth. RAN intelligent controller (RIC) is an end-to-end automation platform that manages network performance by optimizing algorithms and software applications. It is an element of the Open Radio Access Network (Open RAN) and enables hardware and software components interoperability. RAN intelligent controller provides benefits such as improved network performance, better network control, and reduced costs for mobile operators. RAN intelligent controller use cases include optimizing Quality-of-Experience (QoE) and Quality-of-Service (QoS), traffic steering, and resource utilization.

Evolving RAN intelligent controller technology adds data science to Open RAN solutions because it is an Artificial Intelligence (AI) and Machine Learning (ML)-based system. It aids mobile operators in making better-informed decisions by providing real-time analytics. Mobile operators worldwide are witnessing exponential data traffic growth due to the growing demand for video streaming and conferencing services. In February 2023, U.S.-based Mavenir announced the launch of Open-RAN Intelligent Controller (O-RIC), a next-generation Open-RAN network intelligence solution. With this launch, the company aimed to offer better network control and solve unique business problems.

RAN intelligent controllers have been adopted rapidly in the Asia Pacific, a region with a large number of smartphone users & growing technological infrastructure. The presence of prominent market players is driving market growth in Asia Pacific. The RAN intelligent controller industry is consolidated, with the presence of a few market players dominating the space. The established market players and new entrants are investing in Research & Development (R&D) to offer advanced solutions.

Concentration Insights

The market growth stage is high, and the pace of the market growth is accelerating. The RAN intelligent controller industry is consolidated and is likely to witness moderate competition in the market. Major players are investing in Research & Development (R&D) to drive innovation. The players are introducing new features to improve customer experience. In March 2021, Finland-based Nokia announced the launch of a Service Enablement Platform (SEP). It was the first commercial solution delivering Artificial Intelligence (AI), Machine Learning (ML), and radio network programmability. With this launch, the company aimed to provide innovative use cases and unique value.

The market players are adopting strategic partnerships & collaborations to increase the reach of their products and services in the market and increase the availability of their products & services in diverse geographical areas. For instance, in February 2023, Deutsche Telekom AG partnered with Mavenir for its Open RAN deployment in a European country within its network coverage. Mavenir planned to deliver third-party O-RAN-based Radio Units (O-RU) and OpenBeam massive MIMO radios for open Fronthaul.

As the use of RAN intelligent controllers expands, there is growing concern over the security and privacy of user data. Governments are implementing regulations to protect personal data and prevent cyber threats, which may impact the development and deployment of RAN intelligent controllers over the forecast period. Vendors would have to ensure compliance with these regulations to remain competitive in the market.

The threat of substitutes is moderate in the RAN intelligent controller market. The challenges associated with deploying RIC compel companies to integrate advanced technological solutions, such as open-source software and open standards, that could potentially disrupt the RIC market. For example, the development of Software Defined Networking (SDN) and Network Functions Virtualization (NFV) technologies can lead to the creation of alternative solutions that might compete with RIC.

RIC solutions help mobile operators maximize network resource utilization. It helps operators enhance network management and services and also aids mobile operators in reducing operational and infrastructure costs. In recent years, there has been a growing interest among buyers in RAN intelligent controller solutions in Open RAN (O-RAN) architecture. O-RAN is an open and interoperable framework for building RAN solutions that can be customized and integrated by different vendors, providing buyers with more flexibility and choice in their network deployments.

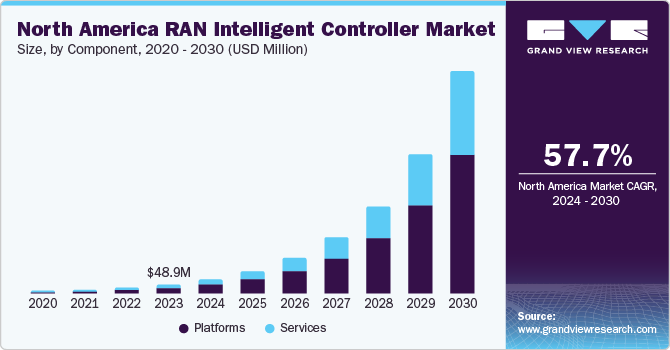

Component Insights

The platform segment dominated the overall market, gaining a revenue share of over 63.0% in 2023. It is expected to grow at a CAGR of around 60.4% throughout the forecast period. RAN intelligent controller consists of software solutions that help manage RAN to reduce costs and optimize performance. Many market players, such as Sweden-based Telefonaktiebolaget LM Ericsson, U.S.-based VMware, Inc., and Mavenir, provide RAN intelligent controller platforms. Belgium-based Accelleran NV provides dRAX RAN Intelligent Controller provides real-time analytics helping mobile network operators make informed decisions and improve network performance.

The services segment is anticipated to grow at the fastest CAGR of 62.0% throughout the forecast period. Services include integration, deployment, support, and consulting services for the RAN intelligent controller. RAN deployment can face challenges such as integrating with legacy systems, high complexity, and technological immaturity. Hence, support, integration, and deployment services can help mobile network operators deploy the platform efficiently and cost-effectively.

Function Insights

The Non-RT RIC segment held the largest revenue share of over 59.0% in 2023. It is expected to grow at a CAGR of over 60.0% throughout the forecast period. Functionalities of Non-RT RIC include device management, fault management, and performance management, among others. It supports the optimization of intelligent RAN by providing model management, information, and policy-based guidance to the Near-RT RIC. It can use AI, ML, and data analytics to determine actions for RAN optimization. In February 2023, Turkey-based P.I. announced the launch of a Non-RT RIC. With this launch, the company aimed to drive open RAN adoption and improve network performance.

The Near-RT RIC segment is expected to grow at the fastest CAGR of 62.1% during the forecast period. Near-RT RIC provides programmatic control for time cycles between 10 milliseconds and one second. In February 2023, Japan-based NEC Corporation announced the completion of a successful demonstration of multi-vendor interoperability and integration of a Near-RT RIC at the Japan-held O-RAN Global PlugFest 2022. With this launch, the company aimed to meet customers’ demands for open RAN solutions.

Technology Insights

The 4G segment dominated the overall market, gaining a revenue share of over 64.0% in 2023, and is expected to grow at a considerable CAGR of over 51.9% throughout the forecast period. 4G is the fourth generation of wireless cellular standards and is widely adopted worldwide. According to the GSM Association (GSMA)’s 2022 mobile economy report, in 2021, 4G accounted for 58% of the connections. Moreover, it can grow in developing regions such as Sub-Saharan Africa, and operators are looking to migrate existing 2G and 3G customers to 4G. The mobile network operators will be looking to use intelligent technologies such as RAN intelligent controllers to offer better services to 4G customers.

The 5G segment is anticipated to grow at the fastest CAGR of over 71.4% throughout the forecast period. 5G is witnessing rapid adoption owing to growing sales of 5G-enabled handsets and the expansion of network coverage. According to the GSM Association (GSMA)’s 2022 mobile economy report, in 2021, 5G accounted for 8% of the connections. Moreover, government initiatives are likely to boost the growth of this segment. For instance, in October 2022, the Indian government announced the launch of 5G services in India. Hence, mobile operators will likely use RAN intelligent controllers in 5G networks to improve QoS.

Application Insights

The rApps segment dominated the overall RAN intelligent controller industry, gaining a revenue share of over 61.0% in 2023, and is expected to witness a CAGR of around 61.0% during the forecast period. rApp is an application that is designed to run on the Non-RT RIC, not requiring response times of less than one second.

According to Sweden-based Telefonaktiebolaget LM Ericsson, the four main rApp categories are Network evolution rApps, network deployment rApps, network optimization rApps, and network healing rApps, enabled by Artificial Intelligence (AI) and automation. Applications that do not need changes every 100 milliseconds would be an example of rApp. For instance, transmit power optimization is a rApp example, which would require change usually in the order of hours.

The xApps segment is anticipated to witness a CAGR of 60.2% throughout the forecast period. xApps are applications designed to run on the Near-RT RIC, requiring execution within a second. The services or functions of xApps include security, mobility management, and radio resource management. Optimizing network handovers is an example of xApps, as the algorithm would need to run in the order of tens or hundreds of milliseconds to ensure user network connectivity. Moreover, xApps can be used for implementing QoS functions such as congestion or traffic control.

Regional Insights

Asia Pacific led the overall market in 2023, with a revenue share of over 39.0%. It is expected to grow at the fastest CAGR of over 64.0% throughout the forecast period. Asia Pacific has prominent market players such as China-based Huawei Technologies Co., Ltd., ZTE Corporation, and South Korea-based SAMSUNG. Moreover, improving smartphone penetration and 5G infrastructure will likely aid market growth in the region.

According to GSM Association, as of May 2022, 14 Asia Pacific countries have launched commercial services, and ten more are expected to launch by the end of 2025. In March 2022, the Australian government announced the launch of the second round of the Australian 5G Innovation Initiative, a financial grant scheme of USD 16.5 million. The government aimed to aid businesses in testing projects and implementing 5G technology.

North America is expected to grow notably with a CAGR of 57.7%. North America has a developed technology infrastructure and has high internet and smartphone penetration. Moreover, government initiatives in the region are likely to aid the growth of the 5G and RIC market.

For instance, in April 2021, the government of Canada announced an investment of USD 11.2 million in Redline Communications (Aviat Networks, Inc.), a Canada-based wireless technology company later acquired by U.S.-based Aviat Networks, Inc. The government aimed to develop wireless technology for industries such as oil & gas, utilities, and mining.

China RAN Intelligent Controller Market Trends

The RAN intelligent controller market in China is projected to grow at a CAGR of 65.2% from 2024 to 2030. It is gaining significant traction in the country owing to the increasing demand for 5G networks. There is a substantial increase in smartphone penetration in China, with 71% of mobile subscribers connected to the internet. According to the “The Mobile Economy 2022” report published by GSMA, China is anticipated to witness 33 million new mobile subscribers, and the rate of 5G adoption is expected to increase to 52% by 2025.

Japan RAN Intelligent Controller Market Trends

The RAN intelligent controller market in Japan is witnessing significant growth owing to increasing 5G deployment, growing penetration of smartphones, and market players actively engaging in partnerships and collaborations to expand 5G offerings. The need for network virtualization and cloud computing is also propelling the market growth in the country.

India RAN Intelligent Controller Market Trends

The RAN intelligent controller market in India is expected to grow significantly over the forecast period. India is one of the fastest-growing markets for mobile network services. With the growing 5G rollouts in India, the demand for affordable 5G smartphones and devices is expected to increase significantly, leading to a surge in mobile subscriber growth. These trends are likely to drive the RAN intelligent controller market growth as these controllers are crucial in optimizing network performance and enhancing the end-user experience.

The RAN intelligent controller market in Europe was valued at USD 65.5 million in 2023. The RAN intelligent controller market in Europe has witnessed significant growth in recent years in line with the rising demand for high-speed mobile internet services, and subsequently, the continued rollout of 5G networks. As IoT devices continue to proliferate and mobile networks continue to get complex, network operators are increasingly implementing intelligent RAN technology to optimize the usage of network resources.

U.K. RAN Intelligent Controller Market Trends

The RAN Intelligent Controller market in the U.K. accounted for over 28.0% share of the European market in 2023. It is poised for significant growth over the forecast period as a result of the favorable initiatives being pursued by the government to encourage research and development of new, innovative connectivity technologies and the rising demand for high-speed connectivity.

Germany RAN Intelligent Controller Market Trends

The RAN intelligent controller market in Germany is expected to grow at a CAGR of 58.1% from 2024 to 2030. In Germany, the RAN intelligent controller market is witnessing significant growth in line with the growing demand for higher network capacity, reduced latency, and better user experience.

France RAN Intelligent Controller Market Trends

The RAN intelligent controller market in France is projected to grow due to the increasing focus on energy efficiency and sustainability. Telecom operators are under pressure to reduce their carbon footprint and adopt more environmentally friendly practices. RIC helps optimize energy consumption in the network, thereby reducing costs and environmental impact.

The RAN intelligent controller market in Middle East and Africa (MEA) is anticipated to reach USD 181.3 million by 2030. The growing 5G infrastructure, coupled with the increasing smartphone penetration and digital service adoption, is contributing to the market growth. Additionally, the early adoption of 5G technology and the growing number of Internet of Things (IoT) devices are accelerating the need for more advanced and intelligent network management solutions.

Saudi Arabia RAN Intelligent Controller Market Trends

The RAN intelligent controller market in Saudi Arabia is witnessing significant growth owing to the growing demand for high-speed data connectivity and the increasing adoption of 5G networks. The Meqyas report for 2021, which quantifies internet usage and penetration in Saudi Arabia, published by the Communications and Information Technology Commission (CITC), claimed that the country’s internet penetration reached 98%.

Company Insights

Some of the key RAN intelligent controller vendors operating in the market include Telefonaktiebolaget LM Ericsson, Nokia, and VIAVI Solutions Inc.

-

Telefonaktiebolaget LM Ericsson is a global provider of a variety of Information and Communication Technology (ICT) services, such as 5G and IoT-powered networks, managed services, and digital services. These services form the segment structure of the company and are based on the company’s customer requirements. The company has marked its presence across North America, Europe, Latin America, Middle East & Africa (MEA), and Asia. It has manufacturing sites located in Brazil, China, Estonia, India, Mexico, Poland, and the U.S.

-

Nokia is a mobile and fixed network infrastructure company that provides software, hardware, and services. The company is also engaged in the deployment of 5G networks. The company caters to various service providers, including fixed network operators; mobile network operators; converged network operators; cable network operators; public sector firms; hyper-scale enterprises; and businesses across industries such as transportation, energy & resources, and consumer goods.

Juniper Networks, Inc., and Mavenir are some of the emerging RAN intelligent controller vendors.

-

Juniper Networks, Inc. develops and sells automated products and services for high-performance networks. Its network and service offerings comprise network security, Wi-Fi, switching, routing, Software-Defined Networking (SDN), and artificial intelligence-enabled enterprise networking operations (AIOps) technologies. The company offers its products and services through direct sales, distributors, Value-Added Resellers (VARs), and Original Equipment Manufacturers (OEMs). Its specialties include Networking, Junos Operating System, VPN, Junos Space, and Junos Pulse.

-

Mavenir is a cloud-native network software provider, which focuses on redefining network economics and accelerating software network transformation for Communications Service Providers (CSPs). The company offers a broad range of end-to-end products, including 5G applications/services, packet core, and Radio Access Networks (RAN).

Key RAN Intelligent Controller Companies:

The following are the leading companies in the RAN intelligent controller market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these RIC companies are analyzed to map the supply network.

- Telefonaktiebolaget LM Ericsson

- Nokia

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- SAMSUNG

- Cisco Systems, Inc.

- Juniper Networks, Inc.

- Mavenir

- Broadcom

- VIAVI Solutions Inc.

Recent Developments

-

In April 2023, Telefonaktiebolaget LM Ericsson released two new O-RAN automation apps (rApps) aimed at helping communications service providers enhance the energy efficiency of their operations and improve network performance. The newly announced apps, namely RAN Energy Cockpit and Ericsson RAN Energy Control, would assist telecom companies in their intelligent automation journey, with an emphasis on energy efficiency. The apps claim to enable users to reduce their network energy consumption by up to 25%.

-

In March 2023, Nokia collaborated with AT&T to test innovative near real time RAN Intelligent Controller (RIC) xApps that feature the E2 interface. Through this partnership, the company aimed to demonstrate the potential of near real-time RIC to enable RAN programmability.

-

In October 2021, Juniper Networks, Inc., Intel Corporation, and Rakuten Symphony joined forces to create Symware, an advanced Open RAN solution designed to upgrade radio cell sites with the latest cloud-native architecture. Symware is a versatile edge appliance that meets carrier-grade standards and allows mobile network operators to improve network density, support multiple network topologies, and introduce new features while decreasing the amount of hardware needed per site.

RAN Intelligent Controller Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 218.5 million |

|

Revenue forecast in 2030 |

USD 6,071.7 million |

|

Growth rate |

CAGR of 61.0% from 2024 to 2030 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, Function, Technology, Application, and Region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; India; China; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); U.A.E.; South Africa |

|

Key companies profiled |

Telefonaktiebolaget LM Ericsson; Nokia; Huawei Technologies Co., Ltd.; ZTE Corporation; SAMSUNG; Cisco Systems, Inc.; Juniper Networks, Inc.; Mavenir; Broadcom; VIAVI Solutions Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global RAN Intelligent Controller Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global RAN intelligent controller market report based on component, function, technology, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Platforms

-

Services

-

-

Function Outlook (Revenue, USD Million, 2017 - 2030)

-

Non-RT RIC (Non-Real-Time-RAN Intelligent Controller)

-

Near-RT RIC (Near-Real-Time-RAN Intelligent Controller)

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

4G

-

5G

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

rApps

-

xApps

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global RAN intelligent controller market size was estimated at USD 137.1 million in 2022 and is expected to reach USD 218.5 million in 2023.

b. The global RAN intelligent controller market is expected to grow at a compound annual growth rate of 60.8% from 2023 to 2030 to reach USD 6,071.7 million by 2030.

b. Asia Pacific led the overall market in 2022 gaining a market share of 38.9%, with the China being a major contributor to the industry. Improving smartphone penetration and 5G infrastructure will likely aid market growth in the region

b. Some key players operating in the RAN intelligent controller market include Telefonaktiebolaget LM Ericsson, Nokia, Huawei Technologies Co., Ltd., ZTE Corporation, SAMSUNG, Cisco Systems, Inc., Juniper Networks, Inc., Mavenir, Quectel Wireless Solutions Co., Ltd., and VMware, Inc

b. The growth of RAN intelligent controller market is anticipated to grow rapidly in recent years due to increasing digitization and the growing need to manage network traffic driving the market growth. RAN intelligent controller is an end-to-end automation platform that manages network performance optimizing algorithms and software applications

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."