Railing Market Size, Share & Trends Analysis Report By Material (Metal, Composite), By Application, By Installation, By Railing Style, By Distribution Channel (Direct, Indirect), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-092-9

- Number of Report Pages: 104

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Railing Market Size & Trends

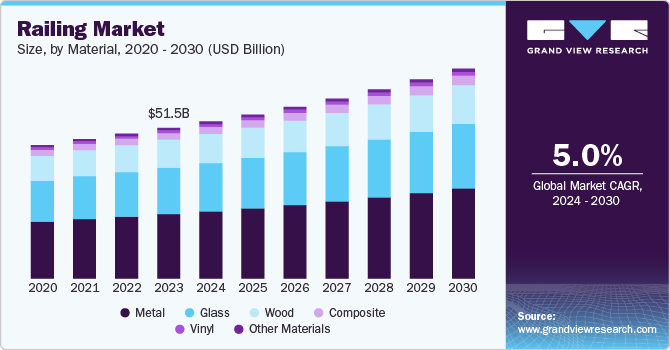

The global railing market size was estimated at USD 51.52 billion in 2023 and is expected to grow at a CAGR of 5.0% from 2024 to 2030. The market’s growth is anticipated to be driven by the increasing government investments in residential and non-residential construction. Moreover, the migration of people from rural to urban areas for better growth opportunities is expected to increase the demand for modern railing, thus positively influencing demand. With rapid urbanization, modernization and people shifting from rural areas to urban areas for better growth opportunities for the market. In addition, government investments in residential and infrastructural construction are further expected to increase the product demand globally.

Manufacturers of stunning, low-maintenance, and eco-friendly railing solutions are concentrating on a highly desirable, sizable, and quickly expanding market of composite railing. The market for conventional materials, notably wood, is shifting as homeowners continue to invest in their home renovations and new constructions, which are increasingly recognizing the benefits of durable items.

However, the cost of several commodities has increased, especially the price of well-known industrial metals, as economies worldwide have begun to recover. Since metal railings are used in the residential sector, an increase in the prices of metal is anticipated to negatively impact the market for the residential segment.

Contractors have direct tie-ups with manufacturing companies that help them to procure large volumes of railings at low prices. Distributors have their committed stores, and the general public can purchase the products from these stores. This offers end users a broad range of options in terms of materials and designs. In addition, it also allows customers to touch and feel the product for an improved understanding of their quality.

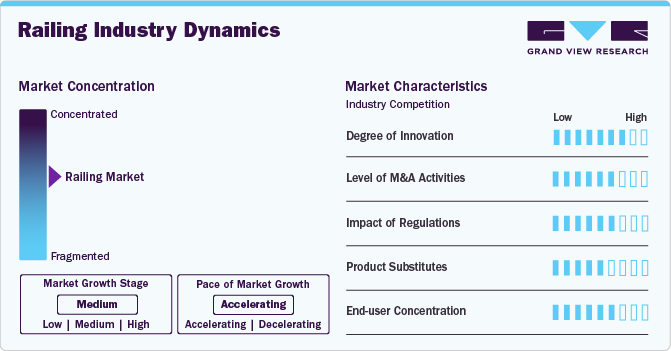

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The industry tends to have a consolidated market concentration owing to the presence of established players in this industry. Key players are also engaged in the adoption of technologies to improve the quality of raw materials, components, and installation processes, thus, creating strong competition for new entrants.

The degree of innovation is high owing to the rising usage of several technologies for the production and installation of railings. For instance, 3D laser scanning technology is widely used in different applications as it allows quick and accurate measurements, as well as the designing of complex structures.

The railings industry is characterized by several regulations and standards. For instance, the Occupational Safety and Health Administration (OSHA) under 1910.29(f)(1)(i) stated that “handrails are not less than 30 inches (76 cm) and not more than 38 inches (97 cm) in height as measured from the leading edge of the stair tread to the top surface of the handrail.”

End-user concentration in the market involves the presence of residential and non-residential balconies, stairs, walkways, decks, and galleries. Commercial spaces such as car parking areas, retaining walls, community centers, footbridges, pedestrian pathways, roof areas and edges, and public transport also install railings.

Material Insights

Metal dominated the material segment and accounted for a revenue share of 42.8% in 2023. Metal railings are developed from stainless steel, aluminum, brass, bronze, wrought iron, and cast iron. Metal is robust and sturdy, and it requires minimal maintenance. This, in turn, is expected to lead to the growth of the metal segment globally.

The wood segment accounted for the revenue of USD 9.55 billion in 2023. Wood is the most conventional and classic railing material. Due to its distinctive aesthetic appeal and easy and low-cost procurement, wood is favored for use in residential applications, particularly in semi-urban and rural areas. These factors fuel the growth of the wood railing segment across the world.

A composite segment is projected to witness the fastest growth of 5.3% from 2024 to 2030 owing to their low maintenance requirements. Composite railings are also witnessing surging global demand owing to their lower costs, higher durability, lighter weight, and little or no maintenance requirements, along with ease of replacement than conventional wood and metal.

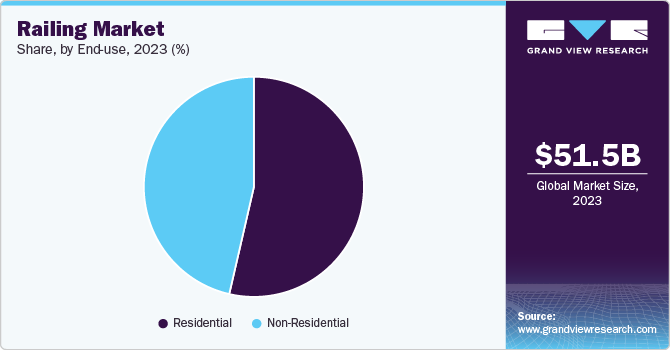

End-use Insights

The residential segment of the market is projected to grow at the fastest rate from 2024 to 2030 owing to the significant rise in both, renovation and new residential construction activities across the world. In addition, the surge in global demand for railings used in residential buildings is driven by increased disposable income of consumers in regions such as Asia Pacific and Central & South America. These factors led to the dominance of this segment in the 2023.

The demand for railings for use in non-residential buildings is expected to increase from 2024 to 2030 owing to the reopening of offices and commercial spaces after recovering from the impact of the pandemic. As railings are installed in corporate buildings, hotels, retail centers, and industrial facilities for security purposes, a non-residential segment of the market is expected to grow globally during the forecast period.

Application Insights

The interior application segment it is expected to grow at the fastest CAGR of 5.1% over the forecast period. Interior applications of railings include staircases and indoor balconies. Materials such as wood, carbon steel, aluminum, glass, and stainless steel are preferred for interior applications, owing to the durability and aesthetic appeal imparted by these materials. Furthermore, the flourishing construction industry across the globe, has resulted in the high adoption of railings on staircases and indoor balconies for fall protection.

The exterior application accounted for the largest revenue share of 67.3% in 2023. Railings are used in a variety of exterior applications including balconies, terraces, decks, walkways, bridges, porches, and patios. In these applications, the most commonly used materials are aluminum, stainless steel, wrought iron, and vinyl, owing to their durability and ability to withstand extreme weather conditions.

Installation Insights

The professional installation segment is projected to continue its dominance in the market with a 5.1% CAGR in terms of volume over the forecast period. Professionally installed railings are of high quality, take less time and effort for erecting them, are durable and long-lasting, and can tolerate weather changes. Additionally, without experts, the installation of railings is of poor quality, which lowers the value and attractiveness of the property wherein they have been used. These factors are projected to fuel the professional installation segment.

Do-it-yourself (DIY) segment is anticipated to grow at a significant rate from 2024 to 2030 owing to surging demand for customized railings. There are several do-it-yourself (DIY) kits available as customers are increasingly using them to improve the look of their homes since these kits save labor costs.

Railing Style Insights

The glass panel segment is projected to reach USD 12.88 billion by 2030 as glass panels are generally expensive and mainly preferred by high-income customers. They are considered modern materials that provide an unobstructed view and improve the aesthetics of places where they are installed. Glass panels are durable, easy to maintain, and increase the resale value of buildings. These factors are expected to boost the demand for the glass panel railing style segment over the coming years.

In 2023, balusters led the market with a 64.7% revenue share. They are short vertical pillars that support the top rail in railing systems. They are commonly made from wood, concrete, iron, stone, vinyl, steel, and aluminum. There has been growing usage of balusters in residential buildings as they enhance their beauty and are more affordable than glass panels. These factors are projected to surge the demand for balusters across the world over the forecast period.

Distribution Channel Insights

The direct distribution channel includes direct contact between manufacturers and end users, thereby eliminating the role of middlemen. This channel enables the purchase of products directly from their manufacturers which also increases the profit margins of the manufacturers. Moreover, the rising penetration of e-commerce platforms across the world is expected to fuel the adoption of direct distribution channels for selling railings over the forecast period.

The indirect channel segment accounted for the fastest and largest revenue share in 2023. An indirect distribution channel is the most used one for selling residential railings. It comprises wholesalers, contractors, retail stores, and online third-party distributors. The segment’s growth can be attributed to the preference of consumers to visually inspect the materials, products, colors, aesthetics, and specifications of railings before finalizing their purchase.

Regional Insights

The North American market for railing is anticipated to witness growth at a CAGR of 4.5% over the forecast period on account of the growing construction industry in the region. The region has been witnessing an increased demand for residential and commercial spaces on account of the growing population and rising buyer power in countries such as Canada and Mexico.

U.S. Railing Market Trends

The railing market in the U.S. revenue is expected to grow with a CAGR of 4.5% over the forecast period driven by steady demand across residential, commercial, and public infrastructure projects. Modern architectural trends, such as open plan designs and glass facades, are increasing the demand for aesthetically pleasing and durable railing solutions.

Asia Pacific Railing Market Trends

The railing market in Asia Pacific accounted for the fastest and largest revenue share of 44.3% in 2023. The region includes many developing as well as developed economies such as India, China, Japan, and Bangladesh. The countries in the region are witnessing growth in infrastructural development, which is driving the demand for railings.

India railing market is expected to grow at a CAGR of 5.4% over the forecast period due to rapid urbanization, growing middle-class housing demand, and increasing infrastructure development. The government’s focus on affordable housing projects, coupled with a rising preference for modern designs in residential and commercial spaces, is driving demand for materials like stainless steel, glass, and wrought iron railings.

The railing market in China accounted for the largest revenue share of 28.7% in 2023, driven by large-scale infrastructure projects, urbanization, and the booming construction sector. Additionally, government initiatives promoting sustainable construction are pushing the market towards more eco-friendly and durable materials.

Europe Railing Market Trends

The Europe railing market was estimated at USD 16.45 billion in 2023. As per the European Parliament report, over 90% of the buildings in Europe were built before 1990, and over 40% of the buildings were built before 1960. Thus, several buildings require renovation and reconstruction. These factors are projected to augment the demand for railing products.

The railing market in Germany dominated the European market and accounted for the highest revenue share in 2023. In Europe, Germany is characterized by a strong focus on precision engineering, high-quality materials, and stringent safety standards. The demand for railings is driven by both new construction and renovation projects, particularly in the residential and commercial sectors.

The railing market in the UK is expected to grow at a CAGR of 3.9% in terms of revenue in the European market over the forecast period. Demand for stylish, contemporary railing designs made from glass, stainless steel, and wrought iron is growing, especially in the high-end housing market. The ongoing construction of commercial and public infrastructure, such as transportation networks and city-center redevelopment, also drives market demand.

Central & South America Railing Market Trends

The Central & South American railing market is expected to grow at a significant rate from 2024 to 2030. The growth of the residential construction industry is also being supported by an increase in the construction of single-family homes in Central and South America. In addition, growing investments in various infrastructure development projects by both domestic and international players are anticipated to support the expansion of the region's construction industry.

Middle East & Africa Railing Market Trends

The railing market in the Middle East & Africa is expected to reach USD 3.50 billion by the end of 2030. Upcoming government construction projects in Saudi Arabia, UAE, Nigeria, Ethiopia, and Uganda are expected to drive the growth of the construction industry in the coming years. Furthermore, new government policies in South Africa to invest more in the infrastructure sector are likely to boost the growth of the South African construction sector in the coming years, further supporting the product demand

Key Railing Company Insights

Some key players operating in the market are Trex Company, Inc., BOL (Barrette Outdoor Living), and The Azek Company, Inc.:

-

Trex Company, Inc. is engaged in the manufacturing and supply of composite decking and railing products. It offers custom-engineered railing and stage systems for commercial and multi-family sectors, as well as sports stadiums and performing arts facilities. Trex Company, Inc.'s product line includes decking, railing, cladding, fascia, outdoor lighting, and fasteners & accessories, among others.

-

The Azek Company, Inc. designs and manufactures sustainable outdoor living solutions and items such as decking and railing. The company operates through six business units that includes AZEK Building Products, TimberTech, AZEK Exteriors, ULTRALOX INTERLOCKING, StruXure, and INTEX Millwork Solutions.

Regal Ideas, Inc., INVISIRAIL, Deckorators, Inc., RailFX, Century Aluminum Railings, and Viewrail are some emerging market participants:

-

Regal Ideas, Inc. is a manufacturer and distributor of aluminum railing systems. The company’s product portfolio includes picket system, glass system, LED system, crystalrail, pool | wind wall, ADA | secondary handrail, quickstep stair system, and wood in-fill.

-

Viewrail is engaged in the designing and manufacturing of railings. The company’s products include floating stairs, cable railing, glass railing, and stair treads.

Key Railing Companies:

The following are the leading companies in the railing market. These companies collectively hold the largest market share and dictate industry trends.

- Regal Ideas, Inc.

- Viewrail

- IG Railing

- Trex Company, Inc.

- The Azek Company, Inc.

- BOL (Barrette Outdoor Living)

- Deckorators, Inc.

- INVISIRAIL

- Digger Specialties, Inc.

- Peak Products (USA)

- RailFX

- Glassupply.com

- Century Aluminum Railings

Recent Developments

-

In November 2021, BOL (Barrette Outdoor Living, Inc.) partnered with the Hernando County Office of Economic Development and Wagner Construction to build a 175,000 sq. ft. PVC manufacturing plant in Brooksville, Florida, thus, increasing its vinyl fencing and railing production capacity.

Railing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 53.67 billion |

|

Revenue forecast in 2030 |

USD 71.73 billion |

|

Growth rate |

CAGR of 5.0% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in million linear foot, revenue in USD billion, CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, application, installation, railing style, distribution channel, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; France; Italy; Spain; Germany; China; India; Japan; South Korea; Brazil; Saudi Arabia |

|

Key companies profiled |

Regal Ideas, Inc.; Viewrail; IG Railing; Trex Company, Inc.; The Azek Company, Inc.; BOL (Barrette Outdoor Living); Deckorators, Inc.; INVISIRAIL; Digger Specialties, Inc.; Peak Products (USA); RailFX; Glassupply.com; Century Aluminum Railings. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Railing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global railing market report based on material, application, installation, railing style, distribution channel, end-use, and region.

-

Material Outlook (Volume, Million Linear Foot; Revenue, USD Billion, 2018 - 2030)

-

Wood

-

Metal

-

Aluminum

-

Steel

-

Iron

-

Others

-

-

Composites

-

Vinyl

-

Glass

-

Others

-

-

Application Outlook (Volume, Million Linear Foot; Revenue, USD Billion, 2018 - 2030)

-

Interior Application

-

Exterior Application

-

-

Installation Outlook (Volume, Million Linear Foot; Revenue, USD Billion, 2018 - 2030)

-

Professional Installation

-

Do-It-Yourself (DIY)

-

-

Railing Style Outlook (Volume, Million Linear Foot; Revenue, USD Billion, 2018 - 2030)

-

Glass Panel

-

Baluster

-

Others

-

-

Distribution Channel Outlook (Volume, Million Linear Foot; Revenue, USD Billion, 2018 - 2030)

-

Direct

-

Indirect

-

-

End-use Outlook (Volume, Million Linear Foot; Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Single-Family

-

Multifamily

-

-

Non-Residential

-

-

Regional Outlook (Volume, Million Linear Foot; Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

France

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global railing market size was estimated at USD 51.52 billion in 2023 and is expected to reach USD 53.67 billion in 2024.

b. The global railing market is expected to grow at a compound annual growth rate, CAGR of 5.0% from 2024 to 2030, to reach USD 71.73 billion by 2030.

b. The metal railing type accounted for the largest revenue share of 42.8% in 2023. The metal railing market is driven by its characteristics, such as high strength, and durability. In addition, metal railings are robust and sturdy and require less maintenance.

b. Some key players operating in the railing market include Regal Ideas, Inc., Viewrail, IG Railing, Trex Company, Inc., The Azek Company, Inc., BOL (Barrette Outdoor Living), Deckorators, Inc., INVISIRAIL, Digger Specialties, Inc., Peak Products (USA), RailFX, Glassupply.com, Century Aluminum Railings.

b. Key factors driving the market growth include rising residential and non-residential construction investments. Moreover, the migration of people from rural to urban areas for better growth opportunities is further expected to support market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."