- Home

- »

- Next Generation Technologies

- »

-

Radar Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Radar Market Size, Share & Trends Report]()

Radar Market (2025 - 2033) Size, Share & Trends Analysis Report By Platform, By Offering (Components, Service), By Frequency Band, By Range, By End Use (Automotive, Military And Defense), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-742-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Radar Market Summary

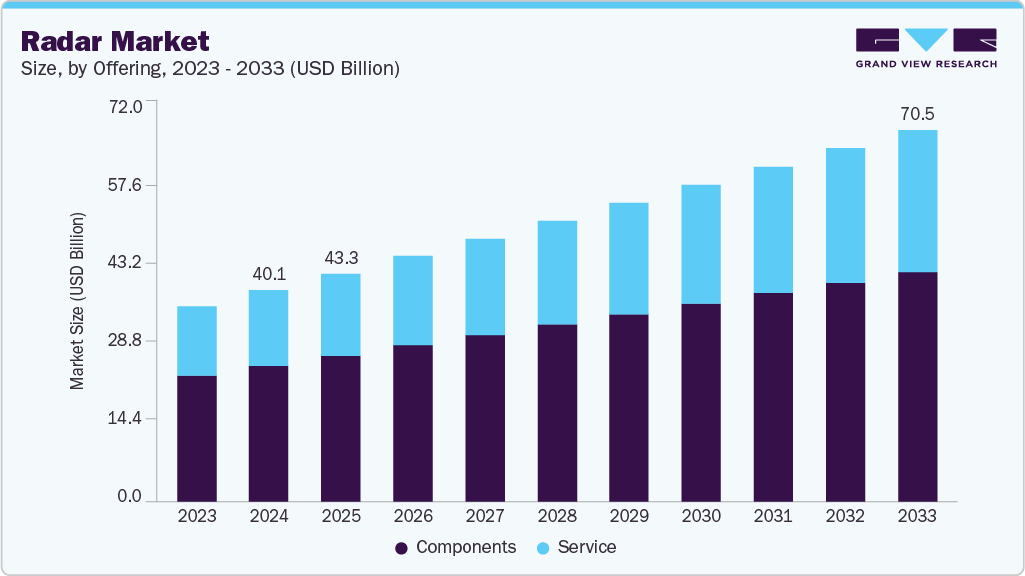

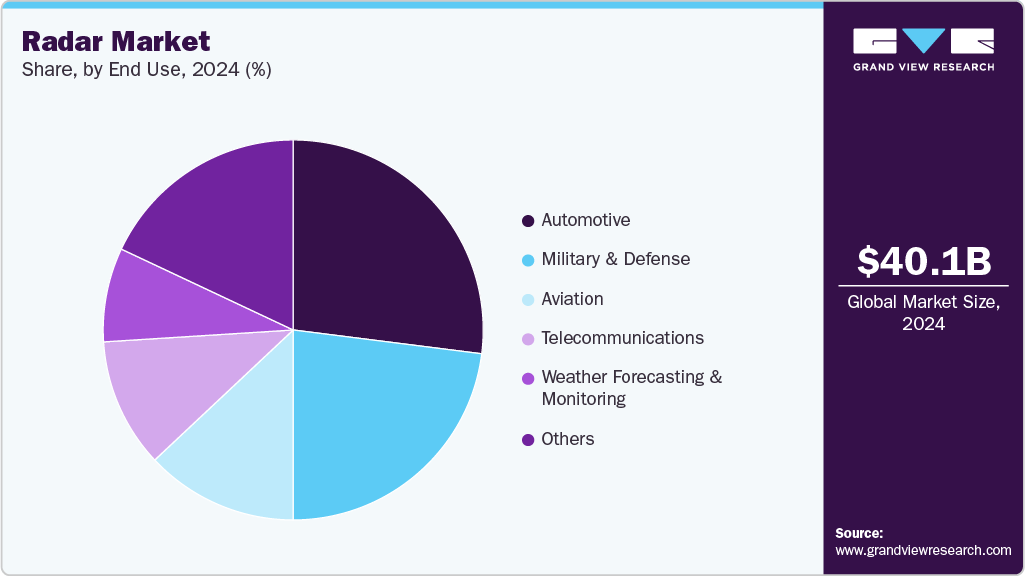

The global radar market size was estimated at USD 40.11 billion in 2024 and is projected to reach USD 70.54 billion by 2033, growing at a CAGR of 6.3% from 2025 to 2033. The market growth is primarily driven by rising defense modernization and border surveillance needs, growing adoption of radar in autonomous vehicles and ADAS, increasing integration of AI and software-defined technologies, and expanding civilian applications across weather forecasting, air traffic control, and smart infrastructure.

Key Market Trends & Insights

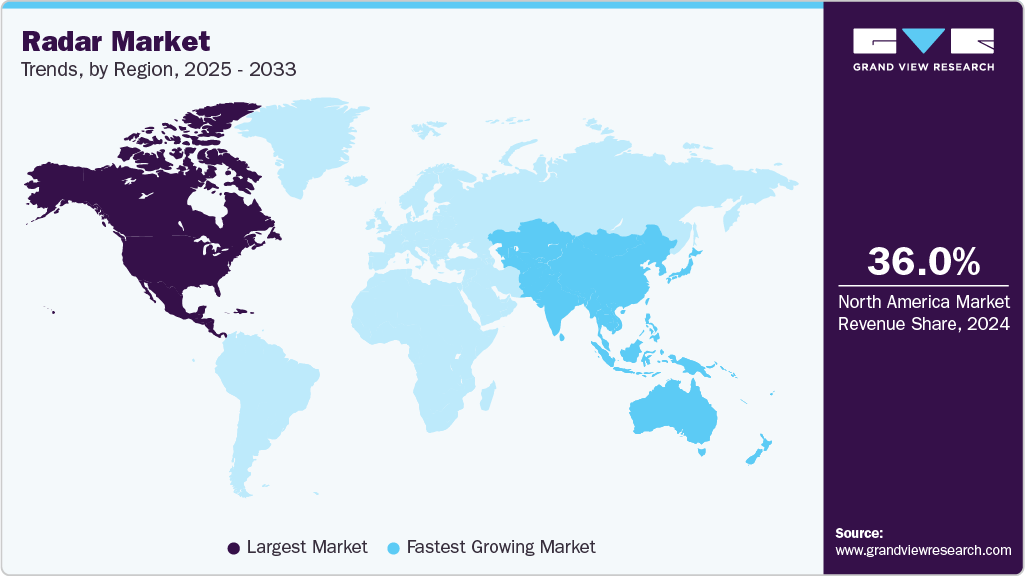

- North America dominated the global radar market with the largest revenue share of 36.2% in 2024.

- The Radar market in the U.S. led the North America market and held the largest revenue share in 2024.

- By platform, the ground-based segment led the market, holding the largest revenue share of 35.7% in 2024.

- By offering, the components segment held the dominant position in the market and accounted for the leading revenue share of 64.4% in 2024.

- By end use, the automotive segment is expected to grow at the fastest CAGR of 7.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 40.11 Billion

- 2033 Projected Market Size: USD 70.54 Billion

- CAGR (2025-2033): 6.3%

- North America: Largest market in 2024

The increasing demand for integrated air and missile defense solutions is accelerating the deployment of multi-mission radar platforms across global armed forces. Nations are prioritizing radar systems that offer long-range detection, electronic warfare resistance, and real-time situational awareness to counter evolving aerial threats. Major defense modernization programs are now focusing on ground-based and airborne radar capable of supporting joint-force operations. This surge is being driven by rising geopolitical tensions and the need for national security autonomy.

The growing demand for radar-enabled safety and automation features in vehicles is reshaping the automotive radar landscape. As ADAS and autonomous driving functions become mainstream, OEMs are integrating short-, mid-, and long-range radar to enable features such as adaptive cruise control, emergency breaking, and parking assist. Radar’s reliability in poor weather and low-light conditions gives it a competitive edge over other sensing technologies. This trend is positioning automotive radar as a core enabler of next-generation mobility.

The radar industry is undergoing transformation such as AI, machine learning, and software-defined architectures drive innovation in detection, tracking, and target classification. Defense and commercial users alike are adopting radar systems capable of real-time analytics, autonomous decision-making, and adaptive threat response. This evolution is reducing operator dependency while increasing radar system agility and mission versatility. As a result, vendors are focusing on scalable, modular radar designs to stay competitive in a rapidly evolving landscape.

The expansion of satellite constellations and space surveillance operations is driving demand for advanced radar systems capable of earth observation, climate monitoring, and space debris tracking. Agencies and private firms are deploying SAR (Synthetic Aperture Radar) in LEO and GEO orbits to enhance imaging precision and revisit rates. Miniaturization and lightweight radar payloads are becoming essential for commercial satellite operators. This trend is fostering growth in Ka-band and X-band radar systems with high-frequency, high-resolution capabilities.

Platform Insights

The ground-based segment dominated the market with a share of over 35% in 2024, primarily driven by rising defense modernization initiatives and increased cross-border threat perception. Governments across developed and emerging economies are prioritizing the deployment of advanced ground-based radar systems for air defense, missile tracking, and early warning capabilities. These systems offer extensive coverage and superior target discrimination, making them essential components of modern military infrastructure. Moreover, ongoing territorial tensions are further accelerating investments in long-range ground radar platforms.

The airborne segment is expected to register the fastest CAGR of 6.8% from 2025-2033, driven by the growing demand for multi-mission radar systems across both military and commercial aviation sectors. Defense forces worldwide are investing heavily in airborne surveillance, reconnaissance, and targeting radars to strengthen situational awareness and electronic warfare capabilities. These radar systems are now being integrated into a wide range of platforms, including fighter jets, UAVs, helicopters, and large reconnaissance aircraft. Furthermore, the expansion of unmanned aerial vehicles (UAVs) for ISR (Intelligence, Surveillance, and Reconnaissance) missions is reinforcing the need for lightweight, high-resolution radar systems.

Offering Insights

The components segment dominated the market in 2024, owing to the rising deployment of radar systems across defense, automotive, and industrial sectors, the demand for high-performance and scalable components has seen significant growth. The Components segment, including antennas, transmitters, receivers, and signal processors, forms the backbone of modern radar architectures. Manufacturers are prioritizing modularity, miniaturization, and improved thermal efficiency to support evolving platform requirements. This is particularly critical in applications with SWaP (Size, Weight, and Power) constraints such as UAVs and autonomous vehicles.

The service segment is expected to grow at the fastest CAGR in the coming years, driven by the increasing deployment of advanced radar systems across military, aviation, and commercial sectors, the demand for expert installation and integration services is accelerating. As radar technologies become more complex, seamless implementation and system calibration are critical to achieving operational effectiveness. Vendors are expanding service portfolios to include end-to-end setup, customization, and interoperability support. This growing reliance on specialized technical services is fostering long-term partnerships between radar manufacturers and end users.

Frequency Band Insights

The S-band segment dominated the market in 2024, the increasing demand for long-range, all-weather surveillance and tracking capabilities is propelling growth in the S-band radar industry segment. Known for its optimal balance between range and resolution, the S-band is widely adopted in air traffic control, weather monitoring, and naval surveillance systems. Governments and defense agencies are deploying S-band radars to enhance early warning systems, missile detection, and battlefield awareness. Its ability to perform reliably in harsh environments makes it a preferred choice for mission-critical applications.

The Ka-band segment is expected to grow at the fastest CAGR in the coming years, primarily driven by the growing need for high-resolution imaging and precision targeting, the Ka-Band segment is gaining significant traction across defense and aerospace applications. The Ka-band's shorter wavelength allows for enhanced resolution, making it ideal for synthetic aperture radar (SAR), drone surveillance, and satellite-based radar systems. Defense agencies are increasingly adopting Ka-band radar for its ability to detect small or low-observable targets at extended ranges. Its frequency agility and compact size also support integration into advanced airborne and space-based platforms.

Range Insights

The short range segment dominated the market in 2024, driven by the surge in demand for radar-based safety systems across automotive, industrial, and security sectors, the Short Range radar industry is experiencing rapid growth. These systems are increasingly used for applications such as collision avoidance, blind spot detection, perimeter surveillance, and industrial automation due to their precision in confined spaces. Technological advancements are enabling miniaturized, low-power, and cost-effective short-range radar modules suitable for mass deployment. In addition, the rise of smart cities and autonomous vehicles is further accelerating adoption, positioning the segment as a key enabler of real-time situational awareness in dense and dynamic environments.

The long range segment is expected to grow at the significant CAGR in the coming years, the increasing growth of cross-border threats, missile proliferation, and geopolitical tensions is fueling demand for Long Range radar systems worldwide. These radars are critical for airspace surveillance, early warning, and missile defense, offering extended detection ranges and high-resolution target tracking. Governments and defense organizations are investing in next-generation long-range radar technologies with enhanced electronic scanning and real-time data fusion. As nations prioritize strategic defense infrastructure, the Long Range segment continues to gain traction as a vital component of national security frameworks.

End Use Insights

The automotive segment dominated the market in 2024, the increasing growth of advanced driver-assistance systems (ADAS) and autonomous driving technologies is driving rapid adoption of automotive radar systems. Radar sensors particularly short- and mid-range are now essential for applications such as adaptive cruise control, lane-keeping assistance, blind spot detection, and emergency braking. Automakers are integrating multi-mode radar units to achieve 360-degree situational awareness and enhance vehicle safety standards. As electric and autonomous vehicle development accelerates globally, the automotive segment is expected to be one of the fastest-growing verticals in the radar industry.

The telecommunications segment is expected to grow at significant CAGR in the coming years, driven by the rapid densification of 5G infrastructure and the widespread deployment of small cells, radar is being explored to improve site planning, interference mitigation, and real-time environmental monitoring. Telecom operators are using radar-based sensing to understand movement patterns and physical obstructions in urban landscapes. This data helps optimize antenna placement, reduce blind spots, and enhance end user coverage. As networks become more dynamic, radar supports more responsive and self-healing architectures.

Regional Insights

North America radar market dominated the market with a share of over 36.0% in 2024, increased integration of radar with AI and sensor fusion technologies to enhance target detection accuracy and reduce false positives. There is a growing emphasis on multi-domain operations, leading to investment in interoperable radar systems across air, land, sea, and space. The commercial aviation sector is also driving demand for weather radar upgrades to improve safety. Furthermore, private aerospace and satellite firms are contributing to innovation in compact and space-borne radar systems.

U.S. Radar Market Trends

The U.S. radar market dominated the market with a share of over 89% in 2024, as technology is advancing rapidly through major defense contracts and innovation in space-based and ground-based radar systems. The Department of Defense is prioritizing the development of scalable and software-defined radar for next-generation platforms. There's also strong growth in automotive radar driven by ADAS and autonomous driving technologies.

Europe Radar Market Trends

The Europe radar market is expanding its radar capabilities in both civil and military sectors, particularly for weather monitoring, air traffic control, and defense readiness. Pan-European collaborations are advancing radar system standardization and interoperability, especially under NATO initiatives. The rise of electric and autonomous vehicles is also pushing radar sensor demand in transportation. Moreover, investment in dual-use radar applications for environmental monitoring and disaster management is gaining momentum.

The Germany radar market is advancing radar systems with enhanced signal processing, digital beamforming, and stealth target detection for national defense. The country is also exploring radar integration in smart logistics systems for real-time tracking and object recognition. The automotive sector is heavily investing in radar modules for driver monitoring, blind-spot detection, and traffic jam assist features. Additionally, research institutions in Germany are contributing to innovations in THz radar for non-destructive testing and biomedical applications.

The UK radar market is investing in radar solutions that support maritime situational awareness and cyber-resilient battlefield operations. Local firms are developing software-defined radar systems for easier upgrades and mission reconfigurations. There is growing interest in radar for railways, coastal monitoring, and autonomous drone navigation. The UK government is also funding early-stage radar startups focused on miniaturization and export-grade systems.

Asia Pacific Radar Market Trends

Asia Pacific radar market is expected to grow at the fastest CAGR of 7.8% from 2025 to 2033, owing to the need for reduced import dependence and enhanced defense sovereignty, countries are scaling up indigenous radar production. Coastal surveillance radar is witnessing growing demand to tackle challenges such as illegal fishing, piracy, and territorial intrusions. Urban development initiatives are accelerating the deployment of radar-based systems for smart traffic management and flood monitoring.

The China radar market is focusing on high-resolution radar imaging for both military intelligence and civilian disaster management. It is deploying ground-based radar systems along contested borders and in artificial island installations for surveillance. The country is also pushing forward with commercial radar satellite constellations for earth observation. Meanwhile, Chinese electric vehicle makers are embedding compact radar sensors for lane change, parking assist, and collision warning systems.

The Japan radar market is refining its radar capabilities to detect advanced aerial threats including stealth aircraft and hypersonic missiles. Its automotive sector is innovating with radar sensors that enable 360-degree perception for autonomous vehicles. The country is also exploring underwater radar technologies for maritime security and anti-submarine warfare. In the public sector, radar-based earthquake detection and infrastructure health monitoring are gaining importance.

Key Radar Company Insights

Some of the key players operating in the market include Lockheed Martin Corporation and RTX corporation and among others.

-

RTX Corporation, formerly Raytheon Technologies, is one of the leading defense contractors globally, with a dominant presence in the radar systems market. It specializes in next-generation radar technologies like the AN/SPY-6 (AMDR) for the U.S. Navy and ground-based Patriot radar systems. RTX’s radar solutions are widely adopted across airborne, naval, and missile defense platforms, with strong focus on scalability and integration. The company continues to innovate with software-defined radar and digital beamforming technologies.

-

Lockheed Martin Corporation is a global aerospace and defense giant, specializing in advanced radar systems for air, ground, and naval platforms. It is known for producing long-range missile defense radars such as the AN/TPY-2 and SPY-7, which are integral to U.S. and allied defense systems. The company heavily invests in multi-mission radar technologies with capabilities in ballistic missile tracking, threat detection, and integrated air and missile defense. Lockheed Martin’s radar offerings support both military surveillance and precision targeting applications.

Elbit Systems Ltd. and Infineon Technologies AG are some of the emerging market participants in the radar market.

-

Elbit Systems is an Israeli defense technology company making strides in the radar space with integrated and compact systems. It specializes in multi-mission tactical radars, border surveillance radar, and UAV-mounted radar systems. The company emphasizes modular radar solutions that can adapt to various terrains and mission requirements. Elbit is increasingly focusing on export markets, offering lightweight, high-performance radar for homeland security and defense applications.

-

Infineon Technologies is a semiconductor company carving a niche in the automotive radar segment, particularly in short- and mid-range applications. It specializes in 77 GHz radar chipsets used for driver-assistance systems such as adaptive cruise control, lane-keeping, and collision avoidance. The company provides compact radar sensors that integrate seamlessly with modern vehicle electronics. Infineon is driving innovation in radar-on-chip design, low power consumption, and mass-market scalability for autonomous driving.

Key Radar Companies:

The following are the leading companies in the radar market. These companies collectively hold the largest market share and dictate industry trends.

- Lockheed Martin Corporation

- NXP Semiconductors

- RTX

- Thales Group

- Northrop Grumman

- BAE Systems

- Leonardo S.p.A.

- AIRBUS

- L3Harris Technologies, Inc.

- Infineon Technologies AG

- Robert Bosch GmbH

- ASELSAN A.Ş.

- General Dynamics Corporation

- Elbit Systems Ltd.

Recent Developments

-

In May 2025, Scopic acquired ZoomRadar, a provider of real-time weather data and radar visualization tools. The acquisition aims to enhance ZoomRadar’s platform using Scopic’s expertise in AI and cloud technologies. This move strengthens Scopic’s position in delivering advanced weather intelligence solutions across various industries.

-

In March 2025, indie Semiconductor collaborated with GlobalFoundries to accelerate the development of high-performance radar SoCs for automotive applications. The partnership focuses on 77 GHz and 120 GHz radar solutions built on GF’s 22FDX platform. These compact and cost-efficient chips are designed to support a wide range of safety features, including collision avoidance and in-cabin monitoring.

-

In January 2025, Arbe partnered with NVIDIA to integrate its high-resolution MIMO radar with NVIDIA’s DRIVE AGX platform. The collaboration enables real-time free-space mapping and detection of small obstacles under all conditions. This joint solution aims to advance safety and performance in ADAS and autonomous driving systems.

Radar Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 43.28 billion

Revenue forecast in 2033

USD 70.54 billion

Growth rate

CAGR of 6.3% from 2025 to 2033

Base Year of Estimation

2024

Actual Data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Platform, offering, frequency band, range, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa

Key companies profiled

Lockheed Martin Corporation; NXP Semiconductors; RTX; Thales Group; Northrop Grumman; BAE Systems; Leonardo S.p.A.; AIRBUS; L3Harris Technologies, Inc.; Infineon Technologies AG; Robert Bosch GmbH; ASELSAN A.Ş.; General Dynamics Corporation; Elbit Systems Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Radar Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global radar market report based on platform, offering, frequency band, range, end use, and region.

-

Platform Outlook (Revenue, USD Million, 2021 - 2033)

-

Ground-based

-

Naval

-

Airborne

-

Space based

-

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Components

-

Antenna

-

Transmitter

-

Receiver

-

Others

-

-

Service

-

Installation/ Integration

-

Support & Maintenance

-

Training & Consulting

-

-

-

Frequency Band Outlook (Revenue, USD Million, 2021 - 2033)

-

L-Band

-

S-Band

-

C-Band

-

X-Band

-

Ku-Band

-

Ka-Band

-

Others

-

-

Range Outlook (Revenue, USD Million, 2021 - 2033)

-

Long Range

-

Medium Range

-

Short Range

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive

-

Military and Defense

-

Aviation

-

Weather Forecasting and Monitoring

-

Telecommunications

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.