Quetiapine Intermediate Chemicals Market Size, Share & Trends Analysis Report By Product (1-[2-(2-Hydroxyethoxy)ethyl] Piperazine, Dibenzo[b,f][1,4]thiazepin 11 (10 H)-one), By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-543-8

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

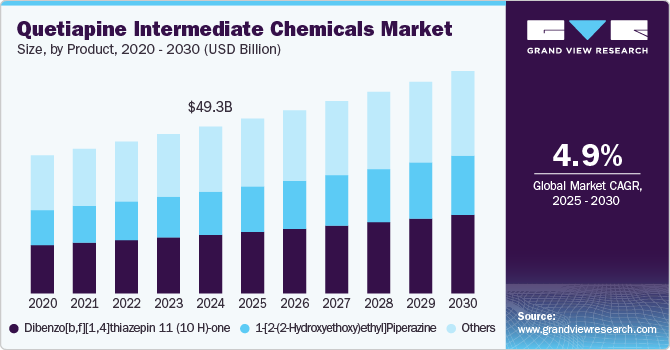

The global quetiapine intermediate chemicals market size was estimated at USD 49.3 billion in 2024 and is projected to grow at a CAGR of 4.9% from 2025 to 2030. The primary driver is the ongoing demand for quetiapine itself, used to treat schizophrenia and bipolar disorder, which necessitates the production of its intermediate chemicals. Improvements in the synthesis and processing of these intermediate chemicals, focusing on cost-effectiveness and yield, are crucial drivers in the pharmaceutical manufacturing sector.

The production of quetiapine, a widely used antipsychotic medication, hinges on the availability and quality of specific intermediate chemicals. Pharmaceutical manufacturers prioritize efficient and cost-effective methods for creating these intermediates, as their quality and availability directly influence the stable supply of quetiapine. The synthesis involves intricate organic chemistry, utilizing various solvents and reactions, highlighting the importance of precise control to achieve the necessary purity and yield for pharmaceutical applications.

Pharmaceutical intermediates are crucial building blocks in the synthesis of active pharmaceutical ingredients (APIs). In the case of quetiapine, these intermediates facilitate the creation of the complex molecular structure required for its therapeutic effects. The quality and purity of these intermediates directly influence the quality of the final quetiapine product. Impurities can affect the drug's efficacy and safety.

Drivers, Opportunities & Restraints

The key drivers for quetiapine intermediate chemicals are fundamentally rooted in the pharmaceutical sector's demand for the final drug. The increasing prevalence of mental health disorders like schizophrenia and bipolar disorder directly fuels the need for quetiapine, thus driving the production of its precursors. Advancements in pharmaceutical manufacturing, particularly concerning process optimization and yield improvement, play a crucial role. Efficient synthesis routes for these intermediates translate to lower production costs and a more stable supply of quetiapine.

Additionally, the growing focus on generic drug manufacturing amplifies the demand, as cost-effective production of these intermediates is vital for generic quetiapine. Regulatory compliance and quality control standards, while acting as constraints, also drive innovation in developing cleaner, more efficient synthesis pathways. The strategic importance of ensuring a consistent and reliable supply chain for essential psychiatric medications strengthens the focus on the robust production of these crucial chemical intermediates.

The development of more efficient and environmentally friendly synthesis routes offers a significant avenue for innovation, reducing production costs and minimizing waste. Exploring novel purification techniques to enhance the purity and quality of these intermediates can cater to the stringent demands of pharmaceutical manufacturers. The expansion of generic drug markets globally creates a demand for cost-effective production, opening opportunities for companies specializing in high-quality intermediate manufacturing.

Strategic partnerships between intermediate suppliers and pharmaceutical companies can ensure a stable supply chain and foster long-term growth. The development and application of advanced analytical techniques for quality control can ensure regulatory compliance and enhance product safety. The increasing focus on localized production and regional supply chains can create opportunities for companies to establish manufacturing facilities closer to end-users, reducing logistical challenges and costs.

Stringent regulatory requirements across different regions necessitate substantial investments in compliance and quality control, increasing production costs. The complexity of the chemical synthesis involved leads to high manufacturing costs, impacted by fluctuating raw material prices and energy consumption. The market is also susceptible to disruptions in the supply chain, particularly for specialized raw materials, causing production delays.

Intense competition from established manufacturers and the emergence of new players create pricing pressures. Intellectual property rights and patent restrictions can limit the development of novel synthesis routes and the introduction of generic versions. The need for specialized equipment and skilled labor adds to the overall operational expenses, hindering market entry for smaller companies.

Product Insights

The Dibenzo[b,f][1,4]thiazepin 11 (10 H)-one segment accounted for the largest revenue share of 35.2% in 2024 and is expected to continue to dominate the industry over the forecast period. It is a fundamental intermediate in quetiapine synthesis, forming the core ring structure. Its production efficiency directly impacts quetiapine output, thus influencing the demand for all upstream intermediates. Any bottleneck in its supply or quality affects the entire quetiapine production chain, creating fluctuations in the demand for associated chemicals.

1-[2-(2-Hydroxyethoxy)ethyl]piperazine is a key reagent used in the final stages of quetiapine synthesis, specifically for introducing the piperazine side chain crucial for the drug's activity. Its availability and purity directly influence the efficiency and yield of the final quetiapine product. Any disruption in its supply or inconsistencies in its quality can create bottlenecks in quetiapine production, directly affecting the demand for other intermediate chemicals used in the preceding synthetic steps.

End Use Insights

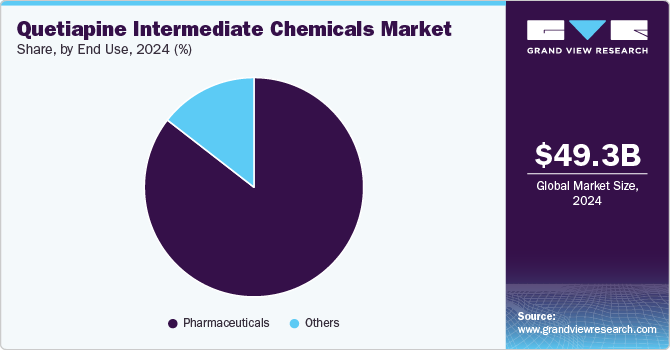

The pharmaceutical end use dominated the market with a revenue share of 85.5% in 2024, during the forecast period. The rising prevalence of mental health disorders, such as schizophrenia and bipolar disorder, is driving increased demand for quetiapine, consequently boosting the need for its intermediate chemicals. The pharmaceutical industry's focus on generic drug production further amplifies this demand, as cost-effective synthesis of these intermediates becomes crucial. Additionally, advancements in pharmaceutical manufacturing and process optimization enhance production efficiency, leading to a higher consumption of these precursor chemicals.

Increased research into novel quetiapine formulations, including extended-release and alternative delivery systems, drives demand for intermediates. Studies exploring new therapeutic applications of quetiapine, such as for neurodegenerative diseases, also require these chemicals. Furthermore, the development of generic versions and biosimilars necessitates ongoing research, leading to a consistent demand for quetiapine intermediate chemicals in R&D.

Regional Insights

Despite a mature pharmaceutical market, North America’s quetiapine intermediate chemicals market sees increased demand for quetiapine intermediates due to the persistent prevalence of mental health disorders. Ongoing research into new quetiapine formulations, including long-acting injectable and personalized medicine approaches, requires these chemical precursors. Additionally, the continued focus on generic drug manufacturing and cost-effective healthcare solutions sustains the demand for these intermediates.

U.S. Quetiapine Intermediate Chemicals Market Trends

The high prevalence of mental health disorders in the US, including schizophrenia and bipolar disorder, sustains a consistent demand for quetiapine and its intermediates. Ongoing pharmaceutical research and development, focusing on improved formulations and delivery systems, requires these chemicals. The continued emphasis on generic drug production, aiming to reduce healthcare costs, further contributes to the increasing demand for quetiapine intermediate chemicals market in the US.

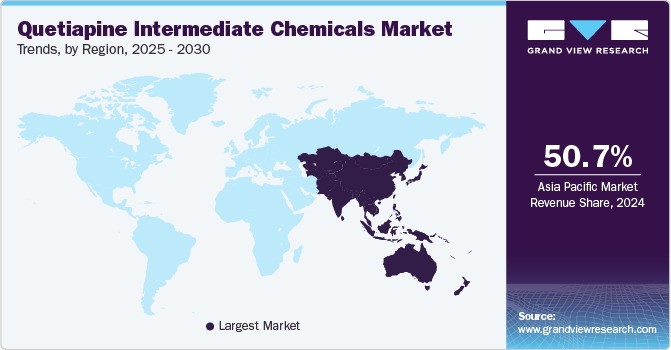

Asia Pacific Quetiapine Intermediate Chemicals Market Trends

The Asia-Pacific quetiapine intermediate chemicals market dominated with a revenue share of 50.7% in 2024. The rapidly growing pharmaceutical industry in the Asia-Pacific region, driven by increasing healthcare expenditure and a rising prevalence of mental health disorders, fuels demand for quetiapine intermediates. The expansion of generic drug manufacturing within the region, aiming to provide cost-effective medications, further amplifies the need for these chemicals. Additionally, increasing investments in pharmaceutical research and development across Asia-Pacific contribute to the growing demand for quetiapine intermediates.

In China quetiapine intermediate chemicals market, the expanding pharmaceutical sector, coupled with a rising awareness of mental health issues, is driving increased demand for quetiapine and, consequently, its intermediates. The country's strong focus on generic drug production, aiming for cost-effective healthcare solutions, further amplifies the need for these chemical precursors. Moreover, growing investments in domestic pharmaceutical research and development in China contribute to a sustained rise in demand for quetiapine intermediate chemicals.

Europe Quetiapine Intermediate Chemicals Market Trends

Europe's quetiapine intermediate chemicals market is driven by the region’s aging population and increasing awareness of mental health disorders that further accelerate a steady demand for quetiapine, thus increasing the need for its intermediate chemicals. The growing focus on generic drug production within the European Union, aimed at cost containment in healthcare, further boosts this demand. Ongoing pharmaceutical research and development, focusing on improved formulations and personalized medicine, also contributes to the rising demand for these chemical precursors.

Latin America Quetiapine Intermediate Chemicals Market Trends

The quetiapine intermediate chemicals in Latin America's expanding healthcare infrastructure and growing awareness of mental health conditions are driving increased demand for quetiapine and its intermediates. The region's rising pharmaceutical production, including generic medications, contributes to a higher consumption of these chemicals. Furthermore, government initiatives aimed at improving access to mental health treatments are fostering a greater need for quetiapine and its precursors.

Middle East & Africa Quetiapine Intermediate Chemicals Market Trends

The increasing prevalence of mental health disorders, coupled with growing healthcare investments, is driving demand for the Middle East & Africa quetiapine intermediate chemicals market, leading to a corresponding rise in the need for its intermediates. The expansion of local pharmaceutical manufacturing, particularly in generic drug production, further fuels this demand. Improved access to healthcare and rising awareness of mental health conditions are also contributing to the increased consumption of quetiapine and its precursor chemicals.

Key Quetiapine Intermediate Chemicals Company Insights

Some key players operating in the market include Merck KGaA and AstraZeneca

-

Merck KGaA is a leading science and technology company operating across healthcare, life science, and electronics. In healthcare, Merck focuses on developing and delivering innovative medicines for oncology, neurology, fertility, and immunology. Its life science division provides tools, technologies, and services for pharmaceutical and biotech research, development, and production. In electronics, Merck supplies specialty chemicals and materials for the semiconductor, display, and surface solutions industries. The company operates globally, employing thousands of people and maintaining a strong commitment to research and development.

-

AstraZeneca is a chemical manufacturing company with a presence across Asia Pacific, North America, Central & South America, Europe, and the Middle East & Africa. The company operates through six business segments, namely chemical, material, industrial solutions, surface technologies, agricultural solutions, and nutrition & care. The chemical segment includes petrochemicals and intermediaries. The material segment comprises performance polymers and monomers. The Industrial Solutions segment includes performance chemicals and dispersions & pigments. The agricultural solution segment includes products for farming, landscape management, and pest control. The nutrition & care segment is further sub-segmented into nutrition & health and care. The company provides a wide range of surfactants for textile, paint & coatings, homecare, and food processing industries.

Key Quetiapine Intermediate Chemicals Companies:

The following are the leading companies in the quetiapine intermediate chemicals market. These companies collectively hold the largest market share and dictate industry trends.

- Merck KGaA

- AstraZeneca

- Aarti Pharmalabs

- Luye Pharma Group

- Ami Organics Ltd.

- IOL Chemicals & Pharmaceuticals Ltd

- AR Lifesciences

- ALLCHEM LIFESCIENCE PVT. LTD.

- Aether Industries

- Shreeneel Chemicals

View a comprehensive list of companies in the Quetiapine Intermediate Chemicals Market

Recent Developments

-

In December 2024, Ami Organics Ltd. commenced construction of a second production line at its Cangzhou facility in Hebei Province, China, to manufacture the multifunctional additive Nylostab S-EED. This expansion, in partnership with Beijing Tiangang Auxiliary Co., Ltd., aims to meet the increasing demand from China's nylon industry, particularly in the textiles, automotive, and packaging sectors. The first production line, operational since 2021, has reached full capacity and earned a strong reputation for quality. Nylostab S-EED enhances nylon products by improving color stability, heat resistance, and process efficiency.

Quetiapine Intermediate Chemicals Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 51.7 billion |

|

Revenue forecast in 2030 |

USD 65.8 billion |

|

Growth rate |

CAGR of 4.9% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative Units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue & Volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Merck KGaA; Shreeneel Chemicals; Aarti Pharmalabs; Luye Pharma Group; Ami Organics Ltd.; IOL Chemicals & Pharmaceuticals Ltd; AR Lifesciences; ALLCHEM LIFESCIENCE PVT. LTD.; AstraZeneca; Aether Industries |

|

Customization scope |

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Quetiapine Intermediate Chemicals Market Report Segmentation

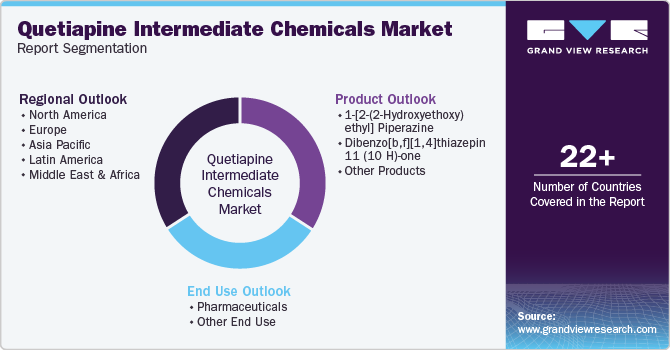

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global quetiapine intermediate chemicals market report based on product, end-use, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

1-[2-(2-Hydroxyethoxy) ethyl] Piperazine

-

Dibenzo[b,f][1,4]thiazepin 11 (10 H)-one

-

Other Products

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Other End Use

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global quetiapine intermediate chemicals market size was estimated at USD 49.3 billion in 2024 and is expected to reach USD 51.7 billion in 2025.

b. The global quetiapine intermediate chemicals market is expected to grow at a compound annual growth rate of 4.9% from 2025 to 2030 to reach USD 65.8 billion by 2030.

b. North America dominated the quetiapine intermediate chemicals market with a share of 50.7% in 2024. This is attributable to increasing healthcare expenditure and a rising prevalence of mental health disorders, fuels demand for quetiapine intermediates

b. Some key players operating in the quetiapine intermediate chemicals market include Merck KGaA, Shreeneel Chemicals, Aarti Pharmalabs, Luye Pharma Group, Ami Organics Ltd., IOL Chemicals & Pharmaceuticals Ltd, AR Lifesciences, ALLCHEM LIFESCIENCE PVT. LTD., AstraZeneca, and Aether Industries

b. Key factors that are driving the market growth include the ongoing demand for quetiapine itself, used to treat schizophrenia and bipolar disorder, which necessitates the production of its intermediate chemicals

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."