Quaternary Ammonium Compounds Market Size, Share & Trends Analysis Report By Product (ATAC, BAC), By Application, By Distribution Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-090-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The global quaternary ammonium compounds market size was valued at USD 1.08 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This is attributable to a significant surge in the demand for disinfectants and sanitizers across various sectors including healthcare, food and beverage, and household cleaning, amidst growing awareness of hygiene and sanitation amongst consumers. Quaternary ammonium compounds (QACs) find extensive use as disinfectants, sanitizers, preservatives, and surface-active agents in various products. These applications include household cleaners, hand sanitizers, personal care products, fabric softeners, pesticides, and industrial disinfectants.

QACs are valued for their ability to kill or inhibit the growth of microorganisms, reduce surface tension, and provide emulsification and antistatic properties. Some QACs have been associated with environmental concerns and potential health risks. High concentrations of these compounds in water bodies can be toxic to aquatic life, and prolonged exposure to certain QACs has been linked to skin irritation and allergic reactions in humans.

Primary amines such as alkyl amines or aryl amines are generally used as the primary building blocks for the synthesis of quaternary ammonium compounds (QUATs). The key step in the production of QACs is the quaternization reaction, where the primary amines lead the reaction with the help of an alkylating agent. The agent is usually an alkyl halide such as methyl chloride, ethyl chloride, or benzyl chloride. The reaction takes place in a suitable reaction vessel under controlled conditions with respect to factors such as temperature and pressure. It is followed by other steps including purification, formulation & blending, and testing.

Product Insights

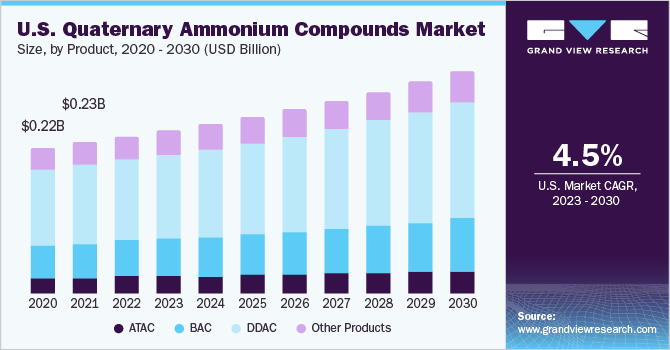

The didecyldimethylammonium chloride (DDAC) segment dominated the market with a revenue share of over 54% in 2022. This is attributed to its strong antimicrobial properties against a wide range of microorganisms, including bacteria, viruses, fungi, and algae. It is effective against both gram-positive and gram-negative bacteria, making it suitable for disinfection and sanitization purposes. It has residual antimicrobial activity, which means it continues to protect microbial growth even after application, making it particularly useful in situations where long-lasting antimicrobial effects are required.

The benzalkonium chloride (BAC) segment held a significant market share in 2022 and is predicted to grow at the highest CAGR of 4.7% over the forecast period. The growth is attributed to its compatibility with a variety of surfaces including metal, glass, plastics, and fabrics. It can be used on hard surfaces as well as in formulations for use on skin and mucous membranes. This versatility makes way for its application in a wide range of settings such as healthcare facilities, food processing plants, and household cleaning.

The alkyltrimethylammonium chloride (ATAC) compounds are excellent surfactants, meaning they can reduce the surface tension of liquids, and promote wetting and spreading on surfaces. This property makes them useful in formulations such as detergents, cleaners, and fabric softeners, where they aid in the removal of dirt, grease, and other contaminants from various surfaces.

Distribution Channel Insights

The offline segment dominated the market with a revenue share of over 63% in 2022. This is attributed to the established supply chains and procurement processes that are well-served by offline distribution channels. QACs are chemicals with specific applications and technical requirements. Offline distribution channels such as chemical distributors and industrial suppliers often have knowledgeable sales representatives who can provide technical guidance and support to customers. This expertise is valuable in industries where proper product selection, usage guidelines, and regulatory compliances are critical.

The online segment is predicted to grow at the highest CAGR of 4.7% over the forecast period. The growth is attributed to the availability of a wide range of QAC products from different manufacturers and brands. Customers can easily find and compare different formulations, concentrations, and package sizes to suit their specific requirements. This allows for greater product diversity and the ability to source products that may not be readily available in local brick-and-mortar stores.

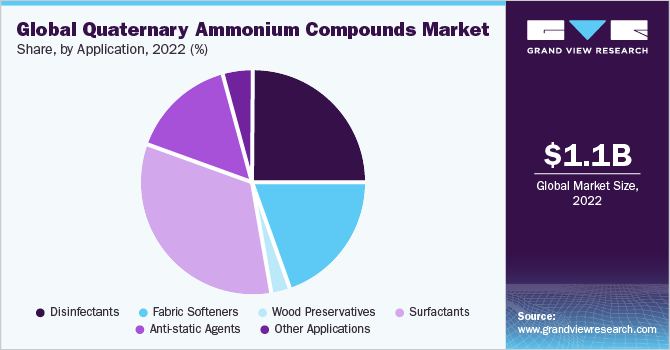

Application Insights

The surfactants segment dominated the market with a revenue share of over 33% in 2022. This is attributed to its wide usage in household and industrial cleaning products. QAC-based surfactants help remove dirt, grease, and other contaminants from surfaces by reducing the interfacial tension between the soil and the cleaning solution. They stabilize the foam structure and enhance the foaming capacity, making them suitable for applications such as shampoos, body washes, and dishwashing detergents.

The disinfectants segment held a significant market share in 2022 and is predicted to grow at a CAGR of 4.2% over the forecast period. The growth is attributed to the broad-spectrum antimicrobial activity of the product. The QAC-based disinfectants are widely used for surface disinfection in various settings, including healthcare facilities, laboratories, schools, offices, and public spaces. They are effective in controlling the spread of infectious diseases by reducing the microbial load on surfaces.

The anti-static agent segment is expected to grow at a significant CAGR of 4.5% over the predicted years. The product is commonly used as an anti-static agent due to its ability to reduce or eliminate static electricity on surfaces and materials. QACs act as surfactants and can adsorb onto surfaces, forming a thin layer that helps dissipate or neutralize electrostatic charges. This reduces the buildup and accumulation of static electricity, preventing or minimizing the electrostatic discharge (ESD) events.

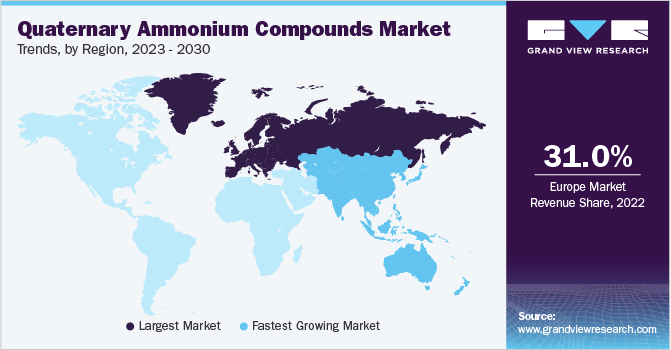

Regional Insights

European region dominated the market with a revenue share of over 31% in 2022. The growth is attributed to strict regulations and high standards for hygiene and cleanliness across various industries in the region. Consumer preferences in Europe are shifting towards products that promote cleanliness, health, and safety. This trend is evident in the increased use of disinfectant products for household cleaning, personal care, and surface sanitization. QACs are often used as active ingredients in these consumer products due to their effectiveness and versatility.

The Asia Pacific was the second-largest region in 2022 and is expected to grow at the highest CAGR of 4.6% over the forecast period. The growth is attributed to the increasing popularity of fabric softeners as essential laundry care products as consumers in the region seek to enhance the comfort and softness of their garments. The growing urbanization and the expanding middle class in countries like China, India, and Southeast Asian nations have created a larger consumer base with increased purchasing power. This has led to higher consumption of fabric softeners as consumers prioritize laundry care and fabric aesthetics.

The rise of e-commerce and online retail platforms has provided consumers in the Asia Pacific region with greater convenience and accessibility to purchase fabric softeners. Online channels offer a wide range of product options, competitive pricing, and doorstep delivery contributing to the growth of the industry in the region.

Key Companies & Market Share Insights

Continuous research and development efforts in the field of antimicrobial agents and surfactants have led to the development of new and improved quaternary ammonium compounds. Manufacturers are investing in innovative formulations that offer enhanced efficacy, reduced toxicity, and improved environmental profiles.

Companies are also engaged in adopting strategies such as partnerships and acquisitions to gain a competitive edge. For instance, In June 2023, Global Amines Company Pte. Ltd. acquired the quaternary ammonium compounds business of Clariant in Indonesia, Brazil, and Germany. Some prominent players in the global quaternary ammonium compounds market include:

-

Arkema

-

BASF SE

-

DuPont

-

Evonik AG

-

Ashland

-

Novo Nordisk Pharmatech

-

Global Amines Company Pte. Ltd.

Quaternary Ammonium Compounds Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 1.12 billion |

|

Revenue forecast in 2030 |

USD 1.52 billion |

|

Growth rate |

CAGR of 4.3% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Product, distribution channel, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; Italy; France; UK; Spain; China; Japan; India; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Arkema; BASF SE; DuPont; Evonik AG; Ashland; Novo Nordisk Pharmatech; Global Amines Company Pte. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Quaternary Ammonium Compounds Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, & country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global quaternary ammonium compounds market report based on product, distribution channel, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

ATAC

-

BAC

-

DDAC

-

Other Products

-

-

Distribution Channel Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Disinfectants

-

Fabric Softeners

-

Wood Preservatives

-

Surfactants

-

Anti-static Agents

-

Other Applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global quaternary ammonium compounds market size was estimated at USD 1.08 billion in 2022 and is expected to reach USD 1.12 billion in 2023.

b. The global quaternary ammonium compounds market is expected to grow at a compound annual growth rate of 4.3% from 2023 to 2030 to reach USD 1.52 billion by 2030.

b. Europe dominated the quaternary ammonium compounds market with a share of 31.79% in 2022. This is attributable to strict regulations and high standards for hygiene and cleanliness across various industries in the region. Consumer preferences in Europe are shifting towards products that promote cleanliness, health, and safety.

b. Some key players operating in the quaternary ammonium compounds market include Arkema, BASF SE, DuPont, Evonik AG, Ashland, Novo Nordisk Pharmatech, and Global Amines Company Pte. Ltd., among others.

b. Key factors that are driving the market growth include significant surge in the demand for disinfectants and sanitizers across various sectors including healthcare, food and beverage, and household cleaning, amidst growing awareness of hygiene and sanitation amongst consumers.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."