QR Code Payment Market Size, Share & Trends Analysis Report By Offerings, By Solution, By Payment Type, By Transaction Channel, By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-042-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Report Overview

The global QR code payment market size was valued at USD 9.98 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 16.9% from 2023 to 2030. The QR code payment industry has seen a surge in adoption in recent years, driven by several factors. One of the key drivers is the rise of smartphone usage, particularly in developing countries such as India. As more people gain access to affordable smartphones, they are increasingly turning to QR code payments as a convenient and easy way to make transactions. Moreover, the rapid adoption of digital payments is another key driver fueling the market growth. With consumers increasingly moving away from cash and towards electronic payments, merchants are looking for new ways to offer digital payment options. QR code payment provide a simple and cost-effective way to make transactions without requiring expensive point-of-sale terminals or other hardware.

In addition, QR code payments are also gaining popularity due to their ease of use. Customers can simply scan a QR code using their smartphone camera and complete a transaction in seconds. The ease of use is particularly appealing to younger consumers accustomed to using their smartphones for a wide range of activities, including shopping and banking.

As more and more people rely on smartphones for their daily activities, including banking and financial transactions, the convenience of using QR code payments becomes even more apparent. Moreover, the proliferation of mobile wallets and digital payment applications that support QR code payments is also driving the market's growth.

These apps allow users to easily store their payment information and initiate transactions with just a few taps on their mobile devices, making it a more seamless and user-friendly payment option. As a result, businesses are increasingly adopting QR code payment systems to cater to the growing number of customers who prefer mobile-based payment options.

Moreover, the advent of e-commerce also propels the QR code payments industry’s growth. As online shopping continues to grow, merchants are looking for new ways to offer secure and convenient payment options to their customers. QR code payments provide an ideal solution, allowing customers to make payments quickly and securely using their smartphones without needing credit cards or other payment methods.

Unlike traditional credit card payments, which require customers to enter sensitive information such as their card number and expiration date, QR code payments use encryption and other security measures to protect customer data.

However, one of the significant hindrances to the growth is the lack of standardization. Different QR code payment providers use different QR code payment gateway, standards, and protocols, leading to confusion among merchants and consumers. This fragmentation has limited the market's growth as users need multiple payment applications to scan different QR codes, which is inconvenient.

To overcome this restraint, industry players must establish a universal standard for QR codes that enables them to be interoperable across different payment providers, which is already a reality in India.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic positively impacted the QR code payments market. With social distancing measures in place, contactless payment methods have become more popular. The fear of virus transmission through cash or card handling has led to a surge in demand for QR code payments. Many governments and businesses have encouraged the use of QR code payments to reduce the spread of the virus.

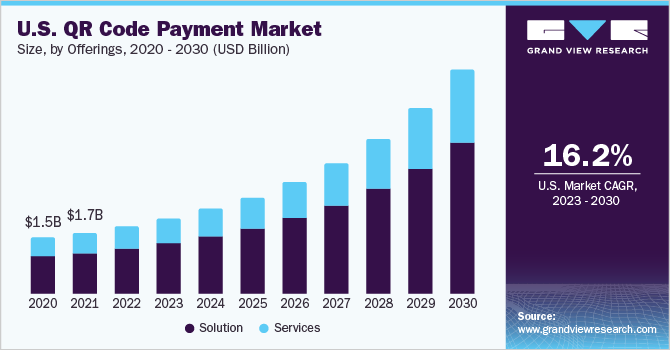

Offerings Insights

The solution segment dominated the market in 2022 and accounted for a revenue share of more than 68.00%. The QR code payment system is often customizable, which means that it can be tailored to the specific needs of a business, such as integrating with existing POS systems or online stores.

This level of flexibility and customization has made solution-based offerings, particularly appealing to small and medium-sized businesses that require a payment solution that can grow and evolve with their needs. Moreover, the versatility allows businesses to provide a payment experience that suits their customers' preferences and can help increase sales and revenue.

The services segment is anticipated to register significant growth over the forecast period. The services segment includes professional and managed services. The complexity of QR code payment systems requires specialized knowledge and expertise, which many businesses do not have in-house. As a result, they rely on professional and managed service providers to design, implement, and manage their QR code payment systems.

These providers offer a range of services, including consulting, design, implementation, customization, integration, testing, and ongoing maintenance and support. Moreover, the increasing adoption of QR code payments by businesses and consumers has led to a growing demand for professional and managed services.

Solution Insights

The dynamic QR code segment dominated the market in 2022 and accounted for a revenue share of more than 63.00%. Dynamic QR codes can be generated in real-time and can contain different amounts or data depending on the transaction, making them highly versatile. The flexibility allows businesses to create personalized payment experiences for their customers, such as offering discounts or promotions based on purchase history or customer data.

In addition, dynamic QR codes are more secure when compared to static QR codes because they can be encrypted with unique transaction information, preventing fraudulent transactions. As a result, security has made dynamic QR codes a popular choice for businesses, particularly those in high-risk industries such as e-commerce and finance.

The static QR code segment is expected to register significant growth over the forecast period. The segment's growth can be attributed to its simplicity, low cost, and ease of implementation. Static QR codes can be generated quickly and easily without the need for additional hardware or software, making them a cost-effective option for small and medium-sized businesses.

Moreover, static QR codes are easy to implement and can be used in various settings, such as printed on receipts or displayed on screens, making them a flexible option for businesses. Furthermore, static QR codes can be used for a range of transactions, from small retail purchases to bill payments, making them a popular choice for businesses in a range of industries.

Payment Type Insights

The push payment segment dominated the market in 2022 and accounted for a revenue share of more than 58.00%. Push payments allow customers to initiate the transaction by scanning the QR code and authorizing the payment, which is then pushed from their account to the merchant's account.

Consequently, the customer has complete control over each transaction and must explicitly authorize each payment, reducing the risk of fraudulent transactions or unauthorized charges. In addition, push payments are often used for one-time purchases, such as in-store retail transactions or online shopping, which can help further reduce the risk of fraud, propelling the segment's growth further.

The pull payments segment is anticipated to register significant growth over the forecast period. Pull payments allow merchants to generate a QR code and present it to the customer, who then scans the code and authorizes the payment, which is then pulled from their account to the merchant's account. As a result, the customer does not need to initiate each transaction, making pull payments a popular considerable option for recurring payments, such as subscriptions or bill payments.

Moreover, pull payments offer a seamless payment experience for customers, as they can complete transactions quickly and easily with just a few clicks, improving customer satisfaction and loyalty, particularly for businesses that prioritize convenience and ease of use. Furthermore, pull payments can be more cost-effective for businesses, particularly those that process a high volume of recurring payments.

Transaction Channel Insights

The face-to-face segment accounted for the largest revenue share of more than 59.00% in 2022. One of the main advantages of the face-to-face transaction channel is its familiarity with customers. Many customers are already accustomed to using QR codes for various purposes, such as accessing content or promotions, which makes scanning a QR code during a transaction natural and intuitive.

Moreover, the face-to-face transaction channel is highly secure, as the customer and the merchant are physically present. Consequently, it reduces the risk of fraud and unauthorized charges, providing added peace of mind for customers and merchants.

The remote segment is anticipated to register significant growth over the forecast period. The remote transaction channel growth can be attributed to its convenience and accessibility for customers, particularly in the wake of the COVID-19 pandemic. The channel involves customers scanning a QR code the merchant presents during a remote transaction, such as online shopping or ordering takeout from a restaurant.

One of the main advantages of the remote transaction channel is its accessibility. Customers can complete transactions from the comfort of their homes or on-the-go, without visiting a store or restaurant physically. This has become increasingly important during the pandemic, as more customers have shifted to online shopping and remote ordering to reduce their risk of exposure.

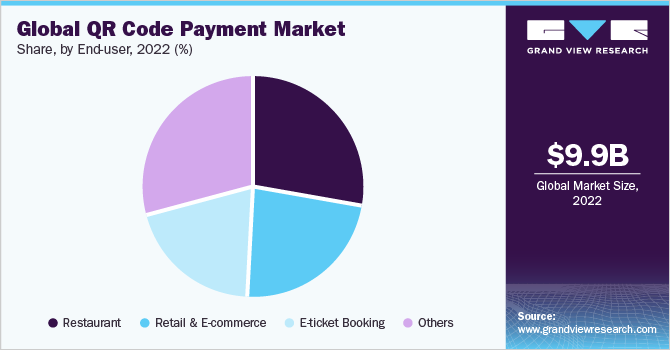

End-user Insights

The restaurant segment dominated the market in 2022 and accounted for a global revenue share of more than 28.00%. QR Code payment methods can help reduce transaction costs for restaurants, particularly those that process a high volume of small transactions, as they can avoid costly credit card processing fees. It allows restaurants to improve their profitability and competitiveness.

In addition, QR Code payments offer added benefits for restaurants during the COVID-19 pandemic, as they can help reduce the risk of transmission by reducing physical contact between customers and staff. Furthermore, QR Code payments can help restaurants improve customer engagement and loyalty by offering personalized promotions and loyalty rewards to customers using QR Code payments.

The retail & e-commerce segment is anticipated to register the fastest growth due to the increasing adoption of mobile payments and digital wallets among consumers. QR Code payments offer a secure and convenient payment option for customers who prefer to use their mobile devices for shopping and payments.

The retail and e-commerce industries are highly competitive and customer-centric, making it essential for businesses to offer fast and convenient payment options that meet their customers' evolving needs and preferences. As a result, QR Code payments have emerged as a popular and effective solution in this regard, driving the segment's growth.

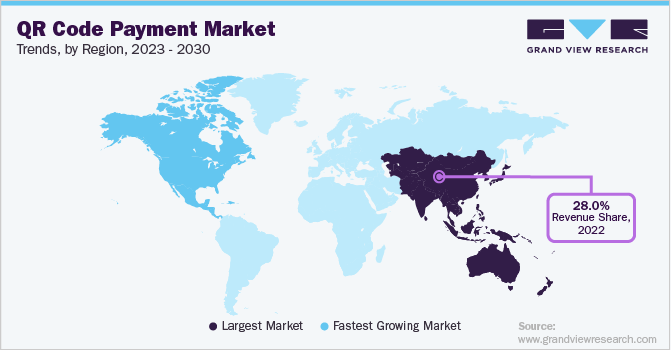

Regional Insights

Asia Pacific dominated the QR code payments industry in 2022 and accounted for a revenue share of more than 28.00%. The region's growth can be attributable to several factors, including a large and growing population, high smartphone penetration, and a significant unbanked population.

The region has diverse economies, from highly developed countries such as Japan, Singapore, and South Korea, to emerging markets such as India, Indonesia, and Vietnam. In many of these markets, QR code payments have emerged as a popular and convenient payment option, particularly among younger and tech-savvy consumers who value speed, convenience, and security in their payment transactions.

The North America regional market is expected to emerge at a significant CAGR over the forecast period. The region's growth is attributable to several factors, including high smartphone penetration, the popularity of digital payments, and a robust financial infrastructure. With a highly developed and mature economy, North America has a large and affluent consumer base that values convenience and speed in payment transactions.

The increasing adoption of mobile payments and digital wallets has fueled the growth of QR code payments in the region, with major players such as PayPal, Square, and Venmo offering QR code payment solutions. Moreover, the region has a highly competitive retail industry that has embraced QR code payments to offer customers a fast and convenient checkout experience.

Key Companies & Market Share Insights

Market players are implementing various strategic initiatives to expand their market presence, enhance their product offerings, and improve customer experience. Moreover, the players are also investing in advanced technology and infrastructure to improve the efficiency and security of QR code payments, including using blockchain and biometric authentication.

Furthermore, companies focus on improving user experience and accessibility with user-friendly interfaces, multilingual support, and easy integration with other payment systems. These strategic initiatives are helping market players stay ahead in the rapidly evolving QR code payments landscape.

In December 2022, Matera, a Brazilian firm that provides QR code technology and instant payment solutions to financial institutions, launched its operations in the U.S. and established new headquarters in San Francisco. The expansion was driven by the quick adoption of Pix, an instant payment system developed by the Central Bank of Brazil, which has been adopted by 70% of the Brazilian population. The move aims to expand Matera's international presence and keep up with the rapidly changing payments landscape. Some prominent players in the global QR code payment market include:

-

PaymentCloud

-

Clover Network, LLC

-

Revolut Technologies Inc.

-

Nearex Pte Ltd.

-

ACI Worldwide

-

Ecentric Payment Systems

-

Block, Inc. (Square)

-

UnionPay International

-

LINE Pay Corporation

-

PayPal, Inc.

QR Code Payment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 11.12 billion |

|

Revenue forecast in 2030 |

USD 33.13 billion |

|

Growth rate |

CAGR of 16.9% from 2023 to 2030 |

|

Base year of estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Offerings, solution, payment type, transaction channel, end-user, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; U.K.; Germany; France; India; China; Japan; South Korea; Australia; Kingdom of Saudi Arabia (KSA); UAE; South Africa |

|

Key companies profiled |

PaymentCloud; Clover Network, LLC; Revolut Technologies Inc.; Nearex Pte Ltd.; ACI Worldwide; Ecentric Payment Systems; Block, Inc. (Square); UnionPay International; LINE Pay Corporation; PayPal, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global QR Code Payment Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global QR code payment market report based on offerings, solution, payment type, transaction channel, end-user, and region:

-

Offerings Outlook (Revenue, USD Million, 2017 - 2030)

-

Solution

-

Services

-

-

Solution Outlook (Revenue, USD Million, 2017 - 2030)

-

Static QR code

-

Dynamic QR code

-

-

Payment Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Push Payment

-

Pull Payment

-

-

Transaction Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Face-to-Face

-

Remote

-

-

End-user Outlook (Revenue, USD Million, 2017 - 2030)

-

Restaurant

-

Retail & E-commerce

-

E-ticket Booking

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

India

-

China

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global QR code payment market size was estimated at USD 9.98 billion in 2022 and is expected to reach USD 11.12 billion in 2023.

b. The global QR code payments market is expected to grow at a compound annual growth rate of 16.9% from 2023 to 2030 to reach USD 33.13 billion by 2030.

b. Asia Pacific dominated the QR code payment market with a share of 28.69% in 2022. The region's growth can be attributable to several factors, including a large and growing population, high smartphone penetration, and a significant unbanked population.

b. Some key players operating in the QR code payment market include PaymentCloud, Clover Network, LLC, Revolut Technologies Inc., Nearex Pte Ltd., ACI Worldwide, Ecentric Payment Systems, Block, Inc. (Square), UnionPay International, LINE Pay Corporation, PayPal, Inc.

b. Key factors that are driving the market growth include increasing adoption of digital payment methods across developing countries and proliferation of smartphones

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."