Purging Compound Market Size & Trends

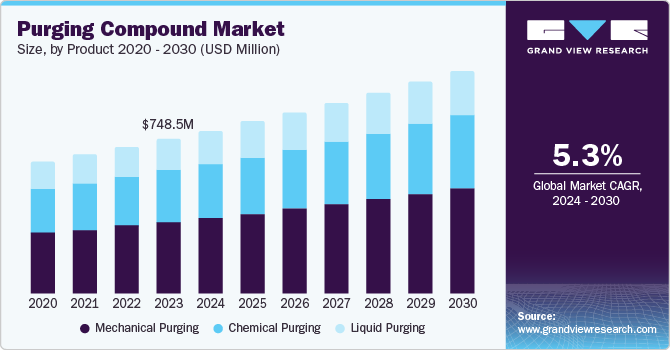

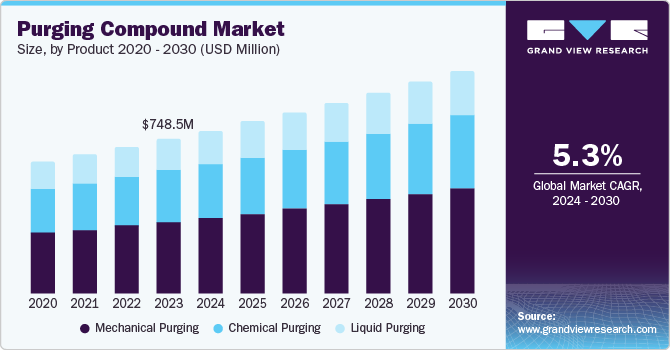

The global purging compound market size was valued at USD 748.5 million in 2023 and is projected to grow at a CAGR of 5.3% from 2024 to 2030. The growing plastic industry along with increasing demand for plastic processing machinery and reduction in purging cost are likely to propel the market growth over the forecast period.Purging compounds help reduce the time required to clean equipment, resulting in higher production efficiency and cost savings. It is also utilized for cleaning hot runner molds, performing color and material alterations, and eliminating color and carbon deposits.

Furthermore, the expansion of the automotive industry is driving market growth in various countries including China, Japan, Brazil, and others. The development of customised purging compoundstailored to specific use cases both improves their efficiency and broadens their appeal in the market. In recent years, plastic compounds have been more commonly employed in industries such as consumer goods, automotive, and industrial machinery as substitutes for metals and alloys.

The purging compounds minimize waste and optimize resource utilization by efficiently eliminating residual materials, driving the demand in the market. Some industries follow strict cleanliness regulations such as food and pharmaceuticals, this sector propels the demand for purging compounds. These compounds assist in guaranteeing adherence by effectively cleaning machinery.

Type Insights

The mechanical purging segment dominated the market and accounted for the largest revenue share of 46.3% in 2023 owing to the efficiency of these compounds in eliminating impurities and leftover materials from processing equipment. It is appropriate for various types of resins and machinery, offering versatility to manufacturers.Mechanical purging compounds help environmental sustainability by cutting waste and reducing the use of cleaning solvents.

The chemical purging segment is expected to grow at a significant CAGR of 5.4% over the forecast years. The chemical cleaning agents are highly effective in eliminating tough residues such as dyes, additives, and carbon deposits. These substances frequently need less time for cleaning than mechanical purging, resulting in higher productivity. Chemical purging compounds have the potential to be utilized in diverse industries and for a variety of plastic materials, increasing their market opportunities.

Process Insights

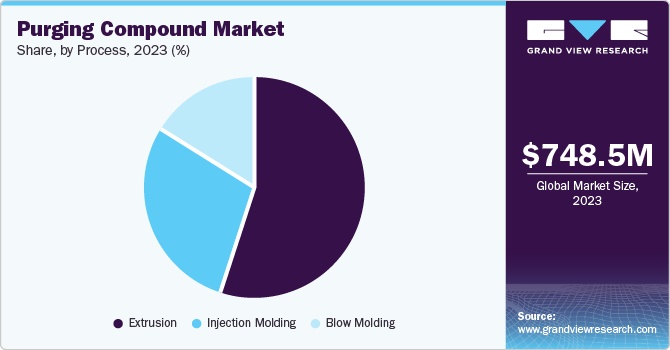

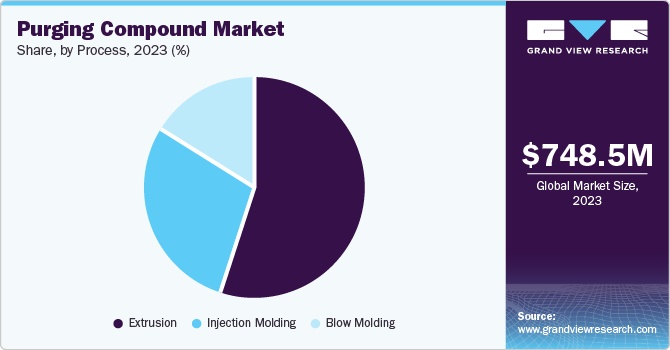

The extrusion segment dominated the market and accounted for the largest revenue share in 2023. The process of extrusion is utilized for manufacturing various items such as films, profiles, pipes, and sheets. The increasing need for extruded plastic products, especially in packaging and construction, requires regular machine cleaning and purging, increasing the use of purging compounds.Accurate management of material flow and uniformity is essential in extrusion procedures.

The injection molding segment is expected to grow at the fastest CAGR over the forecast years. Injection molding is the most common processing method for plastic parts on account of a faster rate of production and its ability to produce plastic components with multiple colors. The method is ideal to produce a single component in high volume. The utilization of purging compounds in injection molding machine results in the reduction of carbon build-up & total changeover time, increase in uptime of the machine, and reduction of scrap parts, which is likely to augment the growth over the coming years.

Regional Insights

The North America purging compound market held a market share of 26.4% in 2023. The increasing need for plastic processing equipment to manufacture different components is expected to increase the demand for purging compounds in the region. The compounds are essential for upholding clean production environments and guaranteeing product safety. The continuous development in technology is propelled by the creation of specialized purging compounds for specific applications.

U.S. Purging Compound Market Trends

The purging compound market in the U.S. experienced significant growth in 2023 due to the U.S. automotive industry's significant use of plastics.The packaging sector in the country is steadily expanding, driven by online shopping and customer ease.This results in higher plastic consumption and the demand for effective cleaning products.The use of plastic processing equipment, particularly injection molding, in different industries is expected to rise in the coming years, leading to a higher demand for the product.

Asia Pacific Purging Compound Market Trends

The Asia Pacific purging compound market dominated the global market with a share of 36.1% in 2023 due to the emergence of major plastic manufacturing sectors in countries such as India, China, and Japan.Extrusion and injection molding processes are becoming more prevalent in the automotive, construction, and industrial machinery industries. In addition, the rising urbanization and industrialization are also contributing to the significant demand for purging compounds.

The purging compound market in China is expected to grow significantly during the forecast period. Chinese manufacturers face ongoing pressure to enhance efficiency and cut expenses.Purge compounds provide a solution by decreasing machine downtime, cutting waste, and improving overall production output, resulting in high demand in the market. The competitive labour and production costs in China make it an appealing option for manufacturing.The demand for purging compounds is boosted by the cost advantage they offer in enhancing production efficiency.

Europe Purging Compound Market Trends

Europe purging compound market is expected to grow at a CAGR of 5.2% over the forecast years. The market demand is driven by sectors such as aviation, automotive, industries, electronics, and other industries. The extensive support from research institutions boosts the growth of the market. The primary suppliers of purging compounds in this region are the UK, Germany, and Italy.

UK Purging Compound Market Trends

The purging compound market in the UK is expected to grow significantly due to rapid growth in the manufacturing sector, especially in areas such aspackaging, construction, and automotive. These sectors depend greatly on plastic processing, requiring effective cleaning options such as purging compounds. These compounds provide real advantages by decreasing downtime and minimizing material waste. Moreover, cleaning compounds assist in keeping sanitary conditions and averting product pollution.

Key Purging Compound Company Insights

Some of the key participants in the global purging compound market are Calsak Corporation, Plastic Solutions, Inc., and others. The sector is extremely competitive due to the many multinational producers and distributors operating globally.

-

Calsak Corporation is a prominent supplier of a variety of products, including polymers, plastic colorants, fine & pharmaceutical chemicals, plastic optic fibers, functional films, industrial fabrics, and other commercial specialty products.The company caters to a range of sectors such as automotive, packaging, electronics, and healthcare.

Key Purging Compound Companies:

The following are the leading companies in the purging compound market. These companies collectively hold the largest market share and dictate industry trends.

- Calsak Corporation

- Plastic Solutions, Inc.

- Neutrex, Inc.

- Perfect Colourants & Plastics Pvt. Ltd.

- Asahi Kasei Corporation

- Chem‑Trend L.P.

- 3M

- Clariant

- Kuraray Co., Ltd.

- Daicel Corporation

Recent Developments

Purging Compound Market Report Scope

|

Report Attribute

|

Details

|

|

Market size value in 2024

|

USD 788.5 million

|

|

Revenue forecast in 2030

|

USD 1.08 billion

|

|

Growth Rate

|

CAGR of 5.4% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in Kilotons, Revenue in million/billion, and CAGR from 2024 to 2030

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, process, region

|

|

Regional scope

|

North America, Europe, Asia Pacific, Latin America, MEA

|

|

Country scope

|

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, The Netherlands, China, India, Japan, South Korea, Thailand, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

|

|

Key companies profiled

|

Calsak Corporation; Plastic Solutions, Inc.; Neutrex, Inc.; Perfect Colourants & Plastics Pvt. Ltd.; Asahi Kasei Corporation; Chem‑Trend L.P.; 3M; Clariant ; Kuraray Co., Ltd.; Daicel Corporation

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global Purging Compound Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyses the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global purging compound market report based on type, process, and region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Mechanical purging

-

Chemical purging

-

Liquid purging

-

Process Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Extrusion

-

Injection molding

-

Blow molding

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)