- Home

- »

- Medical Devices

- »

-

Pupillometer Market Size, Share And Growth Report, 2030GVR Report cover

![Pupillometer Market Size, Share & Trends Report]()

Pupillometer Market (2024 - 2030) Size, Share & Trends Analysis Report By Mobility (Table-top, Hand-held), By Type (Video, Digital), By End-use (Hospitals, Eye Clinics), By Application (Ophthalmology, Oncology), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-850-3

- Number of Report Pages: 119

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pupillometer Market Size & Trends

The global pupillometer market size was estimated at USD 423.9 million in 2023 and is anticipated to expand at a CAGR of 6.4% from 2024 to 2030. Pupillometry is utilized extensively to measure pupil dilation to understand various underlying conditions. Various imaging modalities such as MRI and CT have identified that changes in brain activity have a direct impact on pupil dilation. Thus, measuring pupil dilation helps in understanding cognitive processes at a deep level. The demand for pupilometers is anticipated to be driven by the rising number of vision-related issues. According to the article published by the WHO in August 2023, around 2.2 billion individuals worldwide have distant or near vision impairment. Thus, the large number of people suffering from vision problems is expected to boost the market growth in the coming years.

In addition, the growing number of neurological disorders, such as Parkinson’s disease, is expected to support the market growth. The 2022 Parkinson’s Foundation-backed study demonstrated that about 90,000 individuals are diagnosed with Parkinson’s disease in the U.S. each year. This denotes a steep 50% growth from the earlier estimated rate of 60,000 diagnoses yearly. Furthermore, as per the Parkinson’s Prevalence Project by the Parkinson’s Foundation, .nearly 1.2 million individuals in the U.S. will be living with Parkinson’by 2030

Moreover, various studies are being conducted regarding the usage of pupillometry in diagnosing neurological disorders. For instance, the study published by Springer Nature Limited in September 2021 demonstrated the possibility of monitoring the disorder progression of Parkinson’s disease by calculating the constriction velocity of the pupil utilizing a pupilometer. Thus, the rising number of neurological disorders and growing focus on using pupilometers to treat and diagnose neurological diseases is anticipated to boost the market growth over the forecast period.

Furthermore, the rising adoption of pupilometers in various healthcare units is anticipated to help boost market growth. Various critical care units such as medical intensive care, neurocritical care, cardiac intensive care, surgical intensive care, pediatric intensive care, trauma, and emergency departments are adopting pupillometers. Frequent pupil evaluation is now becoming the protocol in critical care units. Pupil size and pupillary light reflex (PLR) are used as a prognostic indicator and clinical parameters by various associations and centers. The American Association of Neurological Surgeons and the Brain Trauma Foundation recommend the usage of pupillary light reflex for each eye as a prognostic parameter. Usage of this on patients with neurological injury helps facilitate the measurement of pupil dynamics of the patients provided with prescribed medications such as sedatives, analgesics, and anesthetic agents. Thus, the rising adoption of pupilometers is expected to propel the market growth.

Market Concentration & Characteristics

The industry growth stage is moderate, and the pace of the industry growth is accelerating due to the growing launches of products, the presence of prominent players offering various types of pupillometry products and numerous initiatives undertaken by them.

The degree of innovation is high due to the rising development of advanced products. Major and emerging players are innovating continuously to offer better products. For instance, in September 2021, NeurOptics, a key player in pupillometry, introduced a next-generation automated pupillometer, NPi-300, in the U.S. This device improves pupillary assessment to help detect cerebral insult and informs prognosis for clinicians. Several enhanced features associated with this device include advanced wireless charging technology, an updated graphical user interface, and an integrated barcode scanner. These improved features allow clinicians to scan a new patient’s ID instantaneously and accurately and improve the visibility of the results screen. Thus, such novel developments and enhancements in earlier products are anticipated to drive the market growth in the coming years.

The industry is also represented by moderate merger and acquisition (M&A) activity. This is due to several factors, including the desire to gain a competitive edge in the industry and the requirement to consolidate in a rapidly growing industry. Prominent participants are purchasing smaller firms operating across the industry. Some of the participants adopting this strategy include Haag-Streit Group, NIDEK CO., LTD, and Baxter International, Inc., among others.

Regulations are governed by regulatory bodies such as the Food and Drug Administration (FDA) in the U.S. and equivalent authorities globally. The agencies have published a regulatory framework to assure product safety, effectiveness, and quality standards. A pupillometer is classified as a Class I medical device by the FDA.

Currently some companies are launching digital products such as electro-optic measurement system that can help in measuring pupillary distance.

The market is represented by the presence of several small, medium and large players. The presence of key players like HAAG-STREIT GROUP and NeurOptics is anticipated to boost the competitive rivalry in the market further. Major and minor participants are undertaking several strategies, such as collaborations, product launches, acquisitions & mergers, to boost their presence in the market.

The industry is undergoing robust global expansion due to the rising focus of industry participants on improving the accessibility of products in various countries. For instance, in June 2022, NeurOptics, a major industry player, introduced NPi-300 Automated Pupillometer in 15 nations, including France, Italy, Germany, the U.K., and Australia, among others.

Mobility Insights

Based on mobility, the table-top segment dominated the market with the largest revenue share in 2023. Many pupillometers come in combination with other devices, such as pachymeters, keratometers, corneal topographers, wavefront aberrometers, and others. These integrated pupillometers are mainly table-top pupillometers installed in numerous facilities such as hospitals. Market players like Johnson & Johnson Vision, HAAG-STREIT GROUP, and SCHWIND eye-tech solutions are developing combined table-top pupillometer devices. Thus, the rising focus of major participants on table-top pupillometers is anticipated to propel the segment growth in the coming years.

The hand-held segment is anticipated to grow with the highest CAGR of 6.5% over the forecast period. A hand-held pupillometer allows the user to acquire the pupil image accurately and efficiently, which can help diagnose myriad neurological disorders such as Alzheimer's disease. Furthermore, the easy mobility of the hand-held pupillometer is leading to its rising development and adoption. In addition, the availability of major players like NeurOptics and Adaptica, which offer hand-held pupillometers, is anticipated to drive the segment growth in the coming years. NeurOptics is one of the leading participants in the market that manufactures hand-held pupillometers for critical care as well as applied research. Moreover, the development of an advanced hand-held pupillometer is anticipated to propel the segment growth.

Type Insights

The video pupillometer segment dominated the market in 2023. Video pupillometer enables capture of the complete activity of pupil dilation, which aids in understanding the changes and reason for the same. NeurOptics, a key industry participant, has developed diverse video pupillometers for critical care and applied research. NeurOptics designed the NPi-200 video pupillometer for critical care. The product's video feature allows capture of the modifications in pupil size.PLR-3000 pupillometer, VIP-300 pupillometer, and DP-2000 are also video pupillometers used for applied research. These devices accumulate data on pupil measurement, which can be recalled or played on a screen. These products help improve clinicians' efficiency in capturing pupil size, pupil movement, and other modifications in the pupil due to medication or disorder. Thus, the availability of numerous video pupillometers from major participants like NeurOptics is anticipated to boost the segment growth in the coming years.

The digital pupillometer segment shows the fastest CAGR over the forecast period. The digital pupillometer helps in the rapid and accurate assessment of pupil size. This device catches numerous frames in a second and averages the measurements to define pupil dilation. This pupillometer aids in capturing all the changes in the pupillary response, enhancing the detection of neurological disorders. Market players such as Reichert Technologies, Essilor, and Luneau Technology Group have developed digital pupillometers for appropriate diagnosis.

Application Insights

The ophthalmology segment dominated the market in 2023 due to the increasing use of pupillometry for inspecting pupil dilation, which helps evaluate retinal conditions. The pupillary light reflex assists in evaluating visual system functionality. Moreover, measuring pupil size allows refractive surgeons to comprehend the after-effects of LASIK treatment. Large pupils measured patients are likely to have augmented post-LASIK visual disruptions in scotopic conditions. Therefore, the growing adoption of pupillometry in ophthalmic diagnostics is anticipated to propel the segment growth.

The other segment shows the fastest CAGR over the forecast period. Other areas of application include diabetic neuropathies, optic neuritis, acute brain injuries, and relative afferent pupillary defects or glaucoma. Moreover, all critical patients require a routine neurological assessment, including pupillary examination as a standard of care, which helps detect the changes that led to neurologic deterioration and determine effective treatment.

End-use Insights

The hospital segment accounted for the largest market share in 2023. This high revenue share of the segment is due to the increasing adoption of the pupillometer in the hospital setting. The pupillometer developed by NeurOptics is adopted by 400 hospitals around the U.S., thus contributing towards the segment's growth. In addition, the rising use of pupillometers in critical care units is also anticipated to propel the segment growth. NeurOptics pupillometer is utilized in numerous critical care units such as medical intensive care, neurocritical care, emergency department, and cardiac intensive care.

The other segment is anticipated to grow at the fastest CAGR during the forecast period. Other segments include research centers, research institutions, and education centers/associations. Research institutions and centers are researching to understand the effectiveness and efficiency of pupillometry in other applications, such as oncology. On the other hand, since the adoption of pupillometry is rising in the field of neurology, this is propelling education centers or associations to include it as one of the segments. The new Core Curriculum for Neuroscience Nursing by the American Association of Neuroscience Nurses (AANN) has included a section on automated pupillary assessment. This section articulates about using a pupillometer to understand pupillary reactivity.

Regional Insights

North America dominated the overall global pupillometer market in 2023 and accounted for 26.03% of the revenue share. The rising collective efforts of key participants to enhance their product portfolios and ensure high-quality standards are anticipated to boost the demand for pupilometers across this region. In addition, the growing presence of prominent market players, such as NeurOptics, Inc., J&J Vision, and Konan Medical, in the U.S. has contributed to the growth of the regional market.

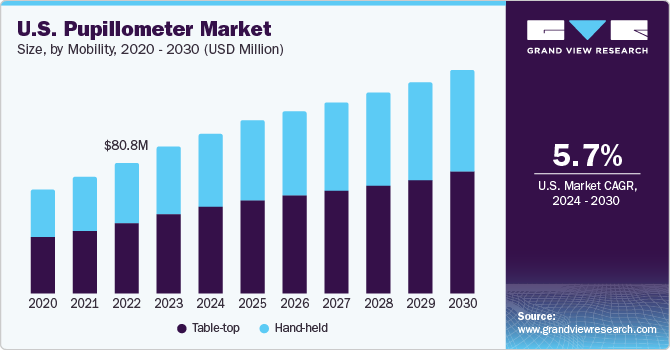

U.S. Pupillometer Market Trends

The pupillometer market in the U.S. accounted for the largest share of the North American market in 2023 due to the favorable reimbursement regulations, the presence of key players, and the increasing prevalence of eye-related issues. Furthermore, major players are launching programs focusing on pupillometry in various centers and organizations across the U.S. For instance, in March 2021, NeurOptics introduced the Pupillometry Program at the teaching hospital, Vanderbilt University Medical Center in Tennessee, U.S. The launches of such programs are anticipated to support the growth of the U.S. market.

Europe Pupillometer Market Trends

The pupillometer market in Europe is anticipated to show lucrative growth in this industry due to the growing prevalence of vision-related problems, developed healthcare infrastructure, and favorable reimbursement scenarios.

The UK pupillometer market is anticipated to grow over the forecast period due to the growing launches of pupillometry products, high healthcare expenditure across the UK, and the increasing prevalence of several eye disorders, such as glaucoma, cataracts, and others. For instance, according to the article published by the Laser Eye Surgery Hub in December 2020, nearly 330,000 cataract surgeries are conducted yearly in England alone.

The pupillometer market in France is expected to grow over the forecast period due to the rising disposable income, growing use of eye care services for treating diabetic retinopathy and improvement in patient awareness about pupillometer.

The Germany pupillometer market is expected to grow over the forecast period due to the rising prevalence of vision problems and high healthcare expenditure. According to the statistics published by the OECD for 2023, Germany disburses USD 8011 per capita on health, which is more than the OECD average of USD 4986 (USD PPP).

Asia Pacific Pupillometer Market Trends

The pupillometer market in Asia Pacific region is anticipated to witness the fastest growth during the forecast period. This growth is driven by the ongoing developments in India & China and the presence of well-developed healthcare infrastructure in countries such as Japan. In addition, with the increasing prevalence of eye disorders in the APAC region, governments are focusing on supporting diagnostics and treatment procedures, which is expected to contribute to the region's growth.

The Japan pupillometer market is expected to grow significantly in the coming years. The increasing geriatric population in the country is expected to drive the risk of vision-related problems, which is likely to boost the need for treatment options. An article published by the European Parliament in December 2020 reported that around 28.7 % of the people living in Japan are 65 or older.

The pupillometer market in China is expected to grow over the forecast period due to the rising healthcare expenditure, the presence of several pupillometry product suppliers and manufacturers, and the growing burden of various eye diseases.

The India pupillometer market is expected to grow over the forecast period due to advancing healthcare infrastructure, improved R&D activities, low cost of production, increasing per capita GDP, and steady economic growth. Furthermore, the companies operating in the country market are launching innovative products. For instance, in August 2020, Acep Direct introduced the Digital Pupillometer to protect the eyeglass wearer and optician while taking in-store measurements during the COVID-19 pandemic.

The MEA Pupillometer Market Trends

The pupilometer market in the MEA is growing as the region has a growing population and an increasing focus on healthcare is expected to boost the growth of pupillometers market. Some countries in the MEA region have limited access to advanced medical equipment such as pupillometers. Government in the MEA region invests in improving healthcare infrastructure, that may benefit the pupillometer market.

The Saudi Arabia pupillometer market is anticipated to grow over the forecast period due to advances in ophthalmic instruments, a high rate of urbanization, and an increasing prevalence of eye disorders across the country.

The pupillometer market in Kuwait is expected to grow in the coming years due to increased healthcare professionals and high expenditure on the health sector. Kuwait’s healthcare expenditure budgeted for 2021-2022 amounted to USD 8.9 billion.

Key Pupillometer Company Insights

Both new entrants and established players drive the competitive scenario in the pupillometer market. These participants adopt strategies such as innovative product launches, partnerships, and mergers & acquisitions. Furthermore, increasing investments in research and development activities are expected to propel market competition.

Key Pupillometer Companies:

The following are the leading companies in the pupillometer market. These companies collectively hold the largest market share and dictate industry trends.

- NeurOptics, Inc.

- Adaptica

- Essilor Instruments USA

- HAAG-STREIT GROUP

- Johnson & Johnson Vision

- Luneau Technology Group

- NIDEK CO., LTD.

- Reichert Technologies

- SCHWIND eye-tech-solutions

- US Ophthalmic

- Konan Medical

- brightlamp, Inc.

Recent Developments

-

In September 2023, a new multicenter study newly issued in The Lancet Neurology demonstrated the Neurological Pupil index (NPi) significant predictive value in assessing disorder progression and predicting consequences for patients with acute brain injury. This study used the NeurOptics NPi Pupillometer.

-

In June 2022, NeurOptics, a key industry player, launched NPi-300, an automated pupillometer in Europe and Asia Pacific.

Pupillometer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 464.6 million

Revenue forecast in 2030

USD 674.0 million

Growth rate

CAGR of 6.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mobility, type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

NeurOptics, Inc.; Adaptica; Essilor Instruments USA; HAAG-STREIT GROUP; Johnson & Johnson Vision; Luneau Technology Group; NIDEK CO., LTD. ;Reichert Technologies; SCHWIND eye-tech-solutions; US Ophthalmic; Konan Medical; brightlamp, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pupillometer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pupillometer marketreport based on mobility, type, end-use, application, and region:

-

Mobility Outlook (Revenue, USD Million, 2018 - 2030)

-

Table-top

-

Hand-held

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Video

-

Digital

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Eye Clinics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Ophthalmology

-

Neurology

-

Oncology

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pupillometer market size was estimated at USD 423.9 million in 2023 and is expected to reach USD 464.6 million in 2024.

b. The global pupillometer market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 674.0 million by 2030.

b. North America dominated the pupillometer market with a share of 26.03% in 2023. This is attributable to the increasing prevalence of vision-related problems, neurological disorders, and the growing installation of pupillometer in hospitals in the U.S.

b. Some key players operating in the pupillometer market include NeurOptics, Inc., Adaptica, Essilor Instruments USA, HAAG-STREIT GROUP, Johnson & Johnson Vision, Luneau Technology Group, NIDEK CO., LTD., Reichert Technologies, SCHWIND eye-tech-solutions, US Ophthalmic, Konan Medical, and brightlamp, Inc.

b. Key factors that are driving the pupillometer market growth include an increasing number of neurological disorders, an increasing number of vision-related issues, and a growing number of product launches.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.