Pumps Market Size, Share & Trends Analysis Report By Type (Centrifugal Pump, Positive Displacement Pump), By End Use (Agriculture, Water & Wastewater, Oil & Gas, Mining, Infrastructure Application (HDD), Others), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-772-8

- Number of Report Pages: 200

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Pumps Market Size & Trends

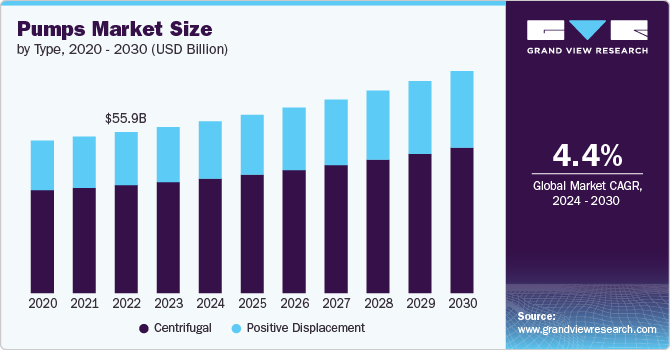

The global pumps market size was estimated at USD 57.66 billion in 2023 and is anticipated to grow at a CAGR of 4.4% from 2024 to 2030. Pumps serve dual functions: they are employed to boost fluid pressure and move the fluid at a greater flow rate. In sectors like oil & gas exploration and Infrastructure Application (HDD) manufacturing, pumps play a crucial role in elevating fluid pressure and in the precise metering of reagents and reactants throughout Infrastructure Application (HDD) synthesis processes. As the oil & gas exploration sector continues to thrive, the demand for pumps is anticipated to rise over the forecast period.

The demand for pumps is on the rise due to expanding fluid management needs in sectors like construction. Furthermore, growth in agricultural investments, urban development, and the necessity for wastewater treatment are anticipated to boost the market further. Moreover, advancements in technology along with the expansion of key industries such as water & wastewater treatment, Infrastructure Application (HDD), and agriculture are expected to propel the market's growth.

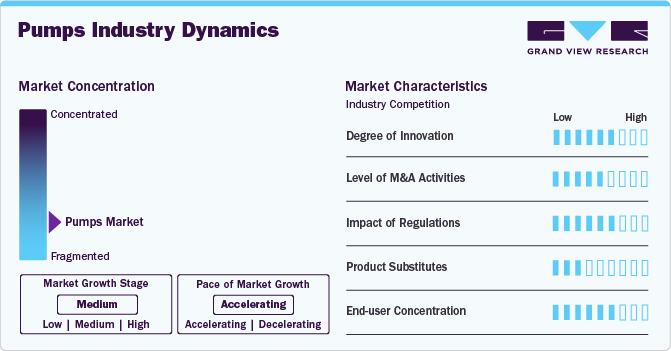

Market Concentration & Characteristics

The market for pumps is intensely competitive and features a high concentration of companies dedicated to the design and innovation of essential internal parts, including the design of impellers, the selection of suitable bearings, and the materials for diaphragms. Companies in the worldwide market are vigorously directing their investment toward research and development of pumps to preserve their standing in the market and to penetrate further into regional markets.

Notably, the market sees strong competition between local brands, which excel in meeting regional needs due to their deep understanding of specific market requirements, and global players that leverage their brand reputation and innovation capabilities to maintain or enhance their market presence.

Another critical factor influencing the market dynamics is the strategic expansion activities undertaken by companies, including mergers and acquisitions, collaborations, and partnerships. These strategies are not only aimed at expanding geographical reach but also at enhancing technological capabilities and product portfolios.

The competitive dynamics of the global pump market are further intensified by the rapid technological advancements and increasing demand for energy-efficient solutions. Companies are now more than ever focused on research and development (R&D) efforts to introduce more efficient and environmentally friendly products. This shift toward sustainability is not just driven by regulatory pressures but also by the growing awareness and demand from end-users for greener solutions. As a result, manufacturers who can offer innovative, high-efficiency pumps are likely to gain a competitive edge and capture greater market share.

Drivers, Opportunities & Restraints

The evolving needs of the consumer sector, along with a rising emphasis on sustainability and energy conservation, are shaping current market dynamics. Key players in the market are responding by engineering pumps that are not only more energy-efficient but also have a reduced carbon footprint. These modern pumps come equipped with Variable Frequency Drivers (VFDs), enabling better management of pump speed and flow. Additionally, the latest models of metering pumps are designed with digital control systems and are connected to the Industrial Internet of Things (IoT), enhancing their performance.

The growth of the global pump market is constrained by several factors, including high initial installation and maintenance costs, which can deter potential buyers. Additionally, the increasing adoption of energy-efficient and environmentally friendly alternatives poses a significant challenge. The market also faces restrictions due to stringent government regulations regarding energy consumption and emissions in various countries.

With the growing global emphasis on sustainable water use and stringent wastewater treatment regulations, there is a rising demand for pumps in water and wastewater management. This includes applications in desalination plants, water recycling, and sewage treatment facilities.

Type Insights

“The demand for the positive displacement pump segment is expected to grow at a notable CAGR of 5.0% from 2024 to 2030 in terms of revenue”

In the oil and gas extraction sectors, particularly for upstream exploration and production activities, there is a preference for using these pumps. They are also widely utilized in the construction and building services industry for the transfer of highly viscous substances like resins and paints. With anticipated expansion in both the construction and oil & gas sectors, it's expected that the demand for positive displacement pumps will increase during the forecast period.

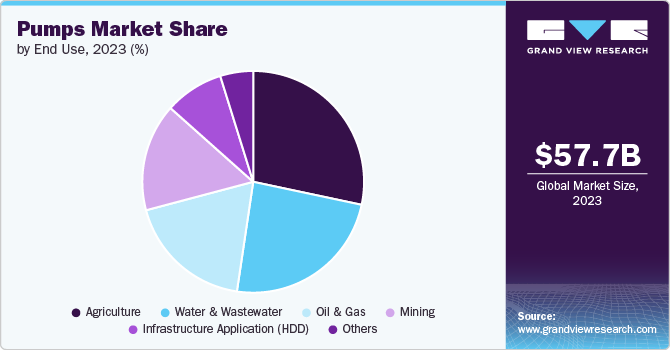

The centrifugal pump category has emerged as the dominant segment, capturing a significant revenue share of 66.9% in 2023. These pumps are favored in scenarios where the flow rate is a more critical factor than the pressure needed for a specific fluid. Widely used in urban water systems, centrifugal pumps are essential for delivering clean water to communities and securing a steady supply of fresh water. Additionally, they play a crucial role in agricultural irrigation processes, efficiently transporting water from various sources to fields and crops.

End Use Insights

“The growth of the water & wastewater segment is expected to grow at a considerable CAGR of 5.4% from 2024 to 2030 in terms of revenue”

The demand for pumps in the water and wastewater industry is on a significant rise, driven by the increasing need for water treatment and distribution infrastructure worldwide. This surge is attributed to the growing global population, rapid urbanization, and heightened awareness regarding water conservation and wastewater treatment. Governments and private entities are investing heavily in water infrastructure projects, which include the construction of desalination plants, sewage treatment facilities, and flood control systems. These initiatives necessitate the deployment of various types of pumps, such as centrifugal, positive displacement, and submersible pumps, to ensure efficient water management and recycling processes, thereby fueling the market growth in this sector.

The oil and gas segment accounted for 18.5% of the market share in 2023. The demand for pumps in the oil and gas industry continues to grow, propelled by the expanding exploration, production, and refining activities. In the oil and gas sector, pumps are indispensable for a myriad of operations, including upstream activities like offshore and onshore oil extraction, midstream processes involving transportation and storage, and downstream operations such as refining and distribution of petroleum products. The need for durable and high-performance pumping solutions in extreme conditions such as high-pressure and high-temperature environments has led to technological advancements and innovations in pump manufacturing. This demand is further amplified by the global demand for energy security and the exploration of new oil and gas fields, making pumps a critical component in ensuring the efficient and safe handling of hydrocarbons.

Regional Trends

North America pumps market accounted for 17.6% of the global revenue share in 2023. The demand for pumps in North America is on the rise, driven by a combination of population growth and increasing infrastructure needs. This growth is further supported by advancements in pump technology and a heightened focus on energy efficiency.

U.S. Pumps Market Trends

The pumps market in the U.S. is expected to grow at a CAGR of 2.5% over the forecast period. In the U.S., the growth of the pumps market is attributed to the modernization of infrastructure, stringent environmental regulations, and advancements in energy-efficient pump technologies. The increasing exploration activities in the oil and gas sector also contribute to the growth. Furthermore, the adoption of smart pumps equipped with IoT technology for predictive maintenance and efficiency optimization is a trend expected to positively impact market growth.

Europe Pumps Market Trends

The pumps market in Europe is growing due to the need for modernized water and wastewater systems. The market is experiencing a shift toward more energy-efficient solutions, such as heat pumps, which are becoming increasingly popular due to their substantially greater energy efficiency compared to traditional gas boilers. This trend is part of a broader movement toward sustainability and environmental responsibility, which is driving investments in pump technologies that reduce energy consumption and improve service delivery in urban areas.

Germany pumps market dominated the European industry, accounting for a share of 21.2% in 2023. Germany's market benefits from its strong engineering and manufacturing base, with a focus on energy-efficient, high-quality pump solutions. The emphasis on renewable energy sources and the Infrastructure Application (HDD) industry's requirements for specialized pumps are key growth drivers. Germany's commitment to sustainability and its leading position in the automotive industry, requiring sophisticated pumping systems, further enhance market prospects.

The pumps market in France held 18.1% of the regional market share in 2023. France's pumps market is growing due to the government's investment in water and wastewater management infrastructure, the nuclear energy sector's need for cooling pumps, and initiatives in energy efficiency. The country's focus on environmental sustainability also plays a vital role. Additionally, France's position as a hub for the pharmaceutical and food and beverage industries, which require high-quality and hygienic pumps, supports market growth.

Asia Pacific Pumps Market Trends

The pumps market in Asia Pacific contributed significantly in 2023 and is anticipated to experience considerable growth throughout the projected period. The surge in industrial and urban development, along with a rising need for managing fluids and ensuring access to safe drinking water in various countries, including China and India, are poised to enhance market prospects. Additionally, the economies within the Asia-Pacific area are projected to prosper over the forecast period, driven by heightened governmental investments in sectors such as agriculture, construction, and water and wastewater treatment. The ongoing expansion in key industries, including the Infrastructure Application (HDD) and hydrocarbon exploration sectors, is expected to further stimulate the demand for equipment designed for liquid management, thereby broadening the scope of the pump market.

China pumps market held a 37.3% revenue share in 2023. In China, the market is propelled by rapid industrialization, urbanization, and significant investments in water infrastructure and wastewater treatment plants. The country's focus on enhancing its manufacturing capabilities and environmental regulations also plays a crucial role. Additionally, the expansion of the Infrastructure Application (HDD) sector demands advanced pumping solutions, further driving market growth.

The pumps market in India accounted for a 17.0% revenue share in 2023, driven by the agriculture sector's demand for irrigation solutions, government initiatives for water conservation, and infrastructure development projects. The burgeoning real estate sector and industrial expansion further fuel demand. Moreover, increased investments in renewable energy projects, such as solar-powered pumps for agriculture and rural areas, contribute significantly to the market expansion.

Latin America Pumps Market Trends

The pumps market in the Latin American region faces challenges related to insufficient access to clean water and poor service quality, which are prompting investments in pump infrastructure. The water pumps market in Latin America is expected to see significant growth. This growth is essential for addressing public health concerns and enhancing the quality of life for residents across the region.

Brazil pumps market held a 33.1% share of the regional market in 2023. In Brazil, the growth of the pumps market is significantly influenced by the agriculture sector, which requires large-scale irrigation solutions to support its vast agricultural lands. Additionally, the country's focus on developing its oil and gas industry, particularly in offshore reserves, necessitates advanced pumping technologies for extraction processes. The government's investment in water and wastewater treatment infrastructure to address environmental concerns and improve public health further boosts the demand for pumps.

Middle East & Africa Pumps Market Trends

The pumps market in the Middle East & Africa is anticipated to witness substantial growth during the projected period, fueled by booming sectors such as oil & gas along with water & wastewater treatment. This region stands as a pivotal center for oil & gas production, where pumps play a crucial role in the transfer and refining of crude oil. Furthermore, nations in the Middle East are significantly investing in water treatment projects aimed at transforming saline water into drinkable water, utilizing pumps for processes like seawater intake, reverse osmosis, and brine disposal. Advances in pump technology have not only improved the efficiency of core processes but also increased the reliability of pumps and provided long-term operational cost savings in these countries. These modern pumps find applications across various industries, including agriculture, industrial wastewater treatment, and Infrastructure Application (HDD) production, promising an uptick in demand throughout the forecast period.

Saudi Arabia pumps market dominated the regional market in 2023, accounting for a 33.0% market share in 2023. The market is primarily driven by the oil and gas sector, where pumps are essential for a myriad of operations ranging from extraction to processing. The country's ambitious vision to diversify its economy and reduce its dependence on oil revenues has led to substantial investments in water desalination, wastewater treatment, and construction projects, all of which require extensive use of pumps. Moreover, the push toward renewable energy sources and modernization of infrastructure projects in the kingdom further catalyzes the growth of the pumps market.

Key Pumps Company Insights

Some of the key players operating in the market include Safety Jogger, Honeywell International Inc., and BATA CORPORATION.

-

Ingersoll Rand is headquartered in North Carolina, U.S., and has four major product lines, namely, industrial technologies & services, precision & science technologies, specialty vehicle technologies, and high-pressure solutions. The company offers its products to various industries, including, aerospace, Infrastructure Application (HDD)s, plastics & rubbers, consumer, electronics & semiconductors, environmental, food & beverage, general manufacturing, government & military, industrial gases, marine, oil & gas, PET bottle blowing, and water & wastewater treatment.

-

SPX Flow is a global industrial pump and pumping equipment company. The company designs and develops its products for customers to deliver enhanced high-value process solutions to diverse communities. It has two reportable business segments, namely food & beverage and industrial. The company’s product portfolio is concentrated on actuating, rotating, automated process systems, and hydraulic technologies for industrial and food & beverage markets

-

Sulzer Ltd. is a prominent fluid engineering solution provider that operates in four business segments including pump equipment, rotating equipment services, chemtech, and applicator systems. It markets its products in North America and Latin America for industries such as power, oil & gas, water, and general industry.

Key Pumps Companies:

The following are the leading companies in the pumps market. These companies collectively hold the largest market share and dictate industry trends.

- SLB

- Ingersoll Rand

- The Weir Group PLC

- Vaughan Company

- KSB SE & Co. KGaA

- Pentair

- Grundfos Holding A/S

- Xylem

- Flowserve Corporation.

- ITT INC.

- EBARA CORPORATION.

- IWAKI CO., LTD.

- Sulzer Ltd

- SPX FLOW, Inc.

Recent Developments

-

In July 2023, Grundfos Holding A/S completed the purchase of Metasphere, a top provider of intelligent sewer solutions. This move is poised to enhance their range in the pumps and hydraulics area. Additionally, in May 2023, KSB SE & Co. KGaA expanded its MegaCPK pump series by introducing nineteen new sizes. With now 55 sizes available and over 78 hydraulic systems to choose from, this expansion is likely to improve the company's offerings for the Infrastructure Application (HDD) industry.

-

In July 2024, Flowserve Corporation obtained the intellectual assets and ongoing research and development associated with cryogenic Liquefied Natural Gas (LNG) submerged pump technology, packaging, and systems from NexGen Cryogenic Solutions, Inc., a company based in Arizona that specializes in the design, engineering, and testing of LNG pumps and turbines.

Pumps Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 59.65 billion |

|

Revenue forecast in 2030 |

USD 77.07 billion |

|

Growth Rate |

CAGR of 4.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type and end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; China; India; Japan; Australia; Brazil; Argentina; UAE; Saudi Arabia |

|

Key companies profiled |

SLB, Ingersoll Rand, The Weir Group PLC, Vaughan Company, KSB SE & Co. KGaA, Pentair, Grundfos Holding A/S, Xylem, Flowserve Corporation., ITT INC., EBARA CORPORATION., IWAKI CO., LTD., Sulzer Ltd, and SPX FLOW, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

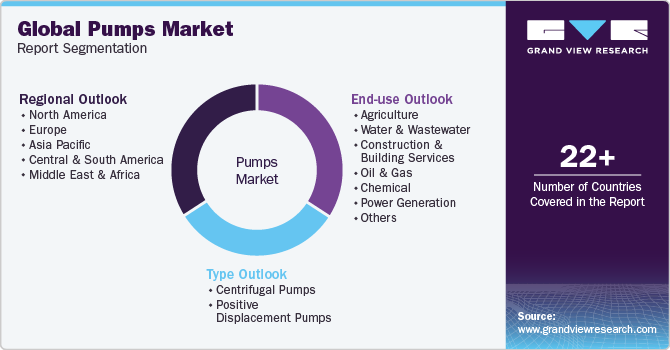

Global Pumps Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pumps market based on type, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Centrifugal Pumps

-

Centrifugal Pumps By Configuration

-

Single Stage

-

Multistage

-

-

Centrifugal Pumps By Design

-

Radial Flow Pump

-

Mixed Flow Pump

-

Axial Flow Pump

-

-

-

Positive Displacement Pump

-

Rotary Pump By Type

-

Gear Pump

-

Screw Pump

-

Vane Pump

-

Lobe Pump

-

Others

-

-

Reciprocating Pump By Type

-

Diaphragm Pump

-

Piston Pump

-

Plunger Pump

-

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Agriculture

-

Water & Wastewater

-

Mining

-

Oil & Gas

-

Infrastructure Application (HDD)

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global pumps market size was estimated at USD 57.66 billion in 2023 and is expected to reach USD 59.65 billion in 2024.

b. The global pumps market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.4% from 2024 to 2030 and reach USD 77.07 billion by 2030.

b. Asia Pacific dominated the pump market in 2023 with a share of 44.9%, owing to the rising growth and capital expenditure in end use industries such as in chemical, power generation, agriculture, and water treatment industries.

b. Some of the key players operating in the pump market include SLB, Ingersoll Rand, The Weir Group PLC, Vaughan Company, KSB SE & Co. KGaA, Pentair, Grundfos Holding A/S, Xylem, Flowserve Corporation., ITT INC., EBARA CORPORATION., IWAKI CO., LTD., Sulzer Ltd, and SPX FLOW, Inc

b. The increasing fluid handling requirements in various industries such as water & wastewater treatment and chemical, power generations has been propelling the market. Further, regulatory compliance and technological advancements in pump technology for energy efficient pumps are driving the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."