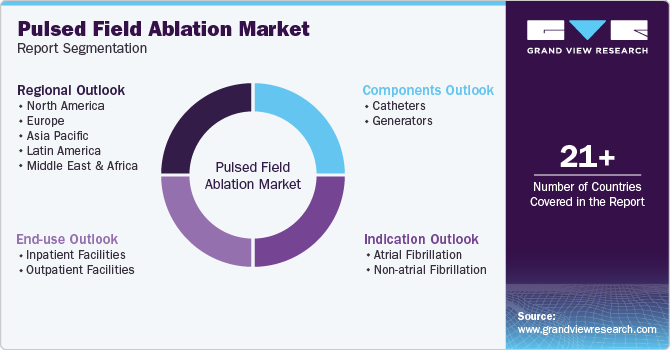

Pulsed Field Ablation Market Size, Share & Trends Analysis Report By Components (Catheters, Generators), By Indication (Atrial Fibrillation, Non Atrial Fibrillation), By End Use (Inpatient, Outpatient), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-411-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Pulsed Field Ablation Market Size & Trends

The global pulsed field ablation market size was estimated at USD 913.1 million in 2024 and is projected to grow at a CAGR of 33.1% from 2025 to 2030. This is driven by its promise as a safer and more effective alternative to traditional thermal ablation methods. As the global prevalence of atrial fibrillation (AF) rises, there is an increasing demand for innovative treatment options that offer fewer complications and improved outcomes. pulsed field ablation (PFA) non-thermal mechanism significantly reduces the risk of damaging surrounding tissues, a major limitation of conventional ablation techniques like radiofrequency and cryoablation. This unique advantage has led to growing interest from healthcare providers and patients, accelerating its adoption in clinical settings.

Cardiac arrhythmias, particularly atrial fibrillation (AF), are increasingly prevalent, affecting millions worldwide. AF, characterized by an irregular and often rapid heart rate, is the most common type of sustained arrhythmia, significantly raising the risk of stroke, heart failure, and other serious cardiovascular complications. As global populations age and the incidence of lifestyle-related risk factors, such as hypertension and obesity, rises, the number of AF cases continues to grow. According to the Johnson & Johnson Services, Inc. article published in February 2024, more than 37.5 million people globally live with this condition, emphasizing its widespread impact. The risk of developing AFib is notably high; statistics reveal that about one in four adults over the age of 40 experience this arrhythmia at some point in their lives. This growing prevalence highlights the urgent need for effective management and prevention strategies.

This escalating burden has created a substantial demand for effective, minimally invasive treatment options. Traditional therapies such as antiarrhythmic drugs and catheter-based ablation have limitations, leading to an unmet need for safer, more efficient approaches. The increasing prevalence of arrhythmias is thus a key driver of market growth for advanced treatment technologies like pulsed field ablation (PFA), which offer improved safety profiles and efficacy compared to conventional methods. In February 2024, an article in The Lancet Regional Health - Europe highlighted that atrial fibrillation (AF) affects 1.5-2% of European adults, expected to rise to 9.5% in those over 65 by 2060. AF is a significant risk factor for stroke, dementia, heart failure, and premature mortality, posing challenges for the aging population and healthcare systems.

Technological advancements are a key driver of the PFA industry's growth, as ongoing innovations enhance ablation procedures precision, safety, and efficacy. Leading medical device companies are investing heavily in the development of next-generation PFA systems, focusing on improving energy delivery, catheter design, and procedural efficiency. Innovations in catheter flexibility and the integration of real-time imaging and mapping technologies allow for more targeted and controlled ablation, reducing the risk of complications and improving patient outcomes. In October 2024, Abbott announced important advancements in its pulsed field ablation technologies for electrophysiology. The company finished enrolling participants in the VOLT-AF IDE Study aimed at evaluating the Volt PFA System and initiated the FOCALFLEX trial to test the TactiFlex Duo Ablation Catheter for treating paroxysmal atrial fibrillation. These initiatives mark significant progress for Abbott's PFA catheters.

Regulatory approvals are critical in influencing the PFA industry, as they validate the safety and efficacy of these novel devices, paving the way for broader clinical adoption. In recent years, several PFA systems have received CE marking in Europe, allowing them to be marketed and used across the continent. These approvals are often based on positive clinical trial results that demonstrate the benefits of PFA over traditional methods, particularly in terms of reduced procedure times and fewer complications. In October 2024, Medtronic received FDA approval for the Affera Mapping and Ablation System with Sphere-9 Catheter, designed for persistent atrial fibrillation and atrial flutter treatment. This makes Medtronic the first company with two FDA-approved pulsed-field ablation (PFA) technologies for AFib. The Sphere-9 catheter offers flexible treatment options with its 9mm lattice tip, complementing the PulseSelect PFA System, which provides a single-shot solution for pulmonary vein isolation.

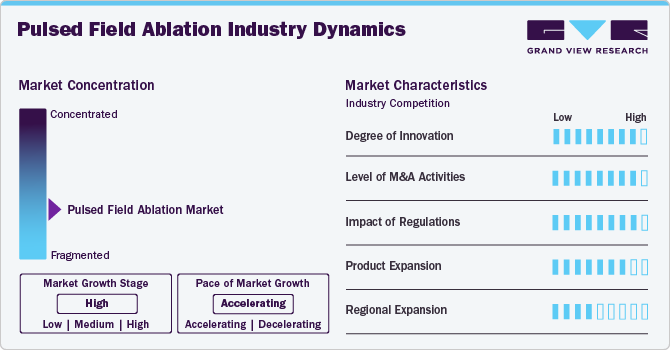

Market Concentration & Characteristics

The degree of innovation in the pulsed field ablation industry is high. Cutting-edge developments in catheter technology, energy delivery precision, and real-time monitoring have revolutionized PFA, offering significant improvements over traditional ablation methods. This high innovation level is driving rapid adoption and growth in the cardiac treatment landscape. In October 2024, Abbott received FDA approval for the Advisor HD Grid X Mapping Catheter. This clearance will enhance the mapping process in both pulsed field and radiofrequency ablation procedures, among others. It is expected to improve patient outcomes by providing better visualization of cardiac anatomy during these critical interventions.

The level of M&A activities in the industry is high. Major medical device companies are actively acquiring innovative startups and technology leaders to strengthen their portfolios and capitalize on the growing demand for advanced cardiac arrhythmia treatments. For instance, in June 2024, Boston Scientific Corporation revealed a conclusive agreement to purchase Silk Road Medical, Inc., which specializes in preventing strokes through transcarotid artery revascularization techniques. The acquisition is worth USD 1.16 billion, with each share priced at USD 27.50.

The impact of regulation in the industry is high. Regulatory approvals are crucial for market growth, as they validate the safety and efficacy of PFA devices, influencing adoption rates. Regions with streamlined regulatory pathways, such as Europe, have seen faster market expansion. Conversely, stringent or delayed approvals, particularly in the U.S., can slow down the introduction and adoption of PFA technologies, affecting overall market dynamics.

Product expansion in the industry is high. Companies are rapidly developing and introducing new PFA systems with enhanced features, such as improved catheter designs and advanced energy delivery mechanisms. This aggressive expansion is driven by the growing demand for safer and more effective cardiac arrhythmia treatments, leading to a broader range of product offerings and increased competition within the market.

Regional expansion in the industry is moderate. Companies are actively targeting new geographic markets, driven by increasing demand for advanced cardiac treatments. Expansion efforts are particularly focused on regions with growing healthcare infrastructure and rising prevalence of cardiac arrhythmias, such as Asia-Pacific and Latin America. This regional growth is crucial for market penetration and establishing a global presence for PFA technologies.

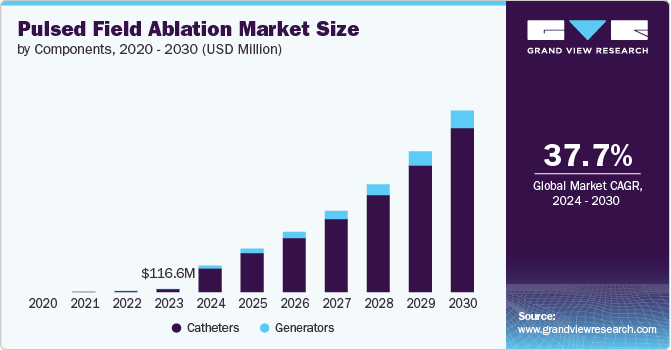

Components Insights

The catheter segment held the largest revenue share of 89.6% in 2024 and is expected to grow at the fastest CAGR from 2025 to 2030, fueled by rising demand for advanced treatment options for cardiac arrhythmias and continuous technological innovations.In June 2024, EP Europace reported on pulsed field ablation (PFA) catheters for cardiac arrhythmias. PFA utilizes pulsed electric fields for targeted tissue destruction, promising better outcomes and reduced collateral damage compared to traditional methods. These devices use pulsed electric fields to create precise lesions on cardiac tissue, offering a safer and more targeted approach for treating atrial fibrillation (AFib) and ventricular tachycardia, positioning PFA catheters as a compelling alternative to traditional ablation methods.

The generators segment is experiencing significant growth, driven by advancements in technology and the rising prevalence of cardiac arrhythmias. The demand for PFA generators is increasing as they offer precise, non-thermal ablation with improved safety profiles. Technological innovations in generator design enhance efficacy and ease of use, further boosting market expansion. The growing need for effective treatment options for arrhythmias supports this upward trend. In September 2024, an article published in TCTMD discussed the results of the admIRE trial for the Varipulse Pulsed Field Ablation (PFA) system. The trial demonstrated that the system is safe and effective in treating paroxysmal atrial fibrillation, achieving its safety and efficacy goals. Despite a low complication rate and high success in pulmonary vein isolation, concerns were raised about a 1.1% rate of cerebrovascular events, including strokes.

Indication Insights

The atrial fibrillation accounted for a significant 97.4% revenue share in 2024, largely due to the widespread occurrence of AFib around the world. As the most common form of sustained arrhythmia, AFib impacts millions, leading to a strong demand for effective treatment options. PFA technology presents a promising alternative to conventional ablation techniques, providing improved precision and safety that enhance treatment results. AFib is a common and serious arrhythmia, particularly in the elderly population. Accurately determining the frequency of AFib can be challenging because of its paroxysmal nature and potential inaccuracies in diagnostic coding. A September 2024 article in the National Heart, Lung, and Blood Institute reported that researchers found 2 million adults (6.8%) in California had atrial fibrillation, correlating to an estimated 10.55 million adults (4.48%) nationwide. This figure is three times higher than projections from over 20 years ago, which estimated 3.3 million cases for 2020.

The non-atrial fibrillation segment is expected to grow at a significant rate from 2025 to 2030. Non-atrial fibrillation encompasses a range of heart rhythm disorders that do not include AFib. This segment includes conditions such as ventricular tachycardia, bradycardia, and other arrhythmias that can significantly impact patient health. In October 2024, an article in the European Heart Journal reported on 172 episodes of ventricular tachycardia from 97 patients, with a median age of 69. The study found that 55% had a stable sinus node response, 24% had a sympathetic response, and 21% had a vagal response. A vagal response was linked to higher rates of ATP-refractory VT and symptoms of presyncope or syncope. As awareness of these conditions increases, there is a growing demand for specialized devices and treatments aimed at effectively managing non-AFib arrhythmias.

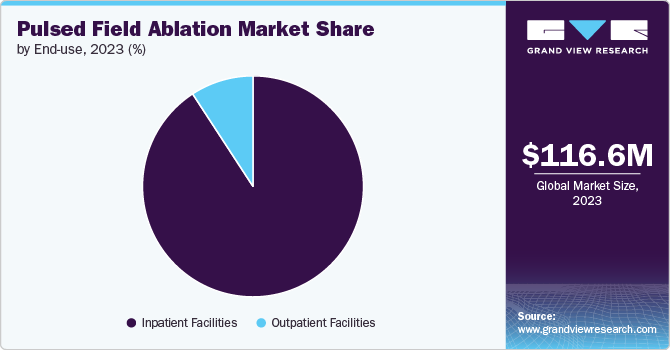

End Use Insights

The inpatient facilities segment held the largest revenue share of 80.3% in 2024. Inpatient facilities are increasingly providing comprehensive care for patients with cardiac arrhythmias through advanced diagnostic testing, medication management, and interventional procedures, including pulsed field ablation (PFA). This market growth is driven by the rising prevalence of arrhythmias and related cardiac conditions that require specialized treatments.

The inpatient facilities sector focusing on PFA is expanding rapidly, with hospitals and healthcare organizations investing in cutting-edge equipment and skilled professionals to meet the growing demand for these advanced services. In March 2024, Methodist Hospital, recognized for cardiology in Texas, introduced Pulsed Field Ablation (PFA) in San Antonio—the first cardiac ablation procedure of its kind in the area. This technology offers a safer and more effective treatment option for patients with atrial fibrillation.

The outpatient facilities segment is growing at the fastest CAGR of 34.2% from 2025 to 2030. Technological advancements in pulsed field ablation (PFA) have led to the growth of outpatient facilities, complementing the advanced infrastructure of hospitals and clinics. These outpatient centers now offer specialized diagnostic testing, consultations, and minimally invasive PFA procedures.

The incorporation of cutting-edge technology in these settings enhances both accessibility and efficiency, ensuring patients receive timely and comprehensive care. In October 2024, USA Health Providence Hospital in Mobile conducted the area's first successful treatment using a new pulsed field ablation (PFA) system for atrial fibrillation. Recently approved by the FDA, this innovative technology offers a safe and effective solution for patients with periodic or persistent AF.

Regional Insights

North America pulsed field ablation market is experiencing robust growth, driven by the rising prevalence of atrial fibrillation (AFib), which affects millions in the region.Key players such as Boston Scientific, Medtronic, and Abbott are leading the market with innovative PFA technologies. The increasing adoption of PFA for its precision and safety benefits is contributing to the market's expansion. In May 2024, CardioFocus, Inc. participated in the Heart Rhythm 2024 conference at the Boston Convention & Exhibition Center, showcasing its innovative ablation systems. This included the HeartLight X3, an ultra-compliant PFA balloon for efficient pulmonary vein isolation, along with the Centauri Pulsed Electric Field System and QuickShot large-area focal PFA catheter, which uses a unique proprietary waveform compatible with various ablation catheters and mapping systems.

U.S. Pulsed Field Ablation Market Trends

ThePFAmarket in the U.S.held a significant share of the North American market in 2024, due to the high prevalence of cardiac arrhythmias, including atrial fibrillation.According to the CDC, in May 2024, cardiac arrhythmias will rise significantly, reaching 12.1 million by 2030. With millions affected nationwide, the demand for effective, minimally invasive treatments like PFA is increasing, driving significant market expansion and adoption of advanced technologies. In July 2024, an article published in Nature Medicine highlighted the findings of the MANIFEST-17K study, the largest international study on Pulsed Field Ablation (PFA) for treating atrial fibrillation (AF). Led by the Icahn School of Medicine at Mount Sinai, the study demonstrated that PFA is a safe and effective alternative to conventional ablation techniques.

Europe Pulsed Field Ablation Market Trends

The Europe pulsed field ablation marketis experiencing significant growth, including rapid technological advancements and growing adoption. Key market players are driving innovation with advanced PFA systems. The integration of cutting-edge technology and expanding clinical evidence is enhancing the market’s growth and application across Europe.

In February 2024, Medtronic announced the successful completion of the first commercial cases using the PulseSelect pulsed field ablation system in conjunction with the 10F FlexCath Contour sheath. A cardiologist from St. Antonius Hospital in the Netherlands highlighted the technology's potential to improve atrial fibrillation treatment, noting its ease of use, excellent signal quality, and short procedure times of just over 30 minutes.

The pulsed field ablation market in the UK is witnessing notable growth due to the increasing incidence of arrhythmias in the country, anticipated to drive market growth. In December 2024, an article published in Open Heart analyzed the real-world use of a pentaspline PFA catheter for atrial fibrillation ablation in National Health Service England centres. The study, covering 1,034 procedures, showed high efficacy with 99.5% acute pulmonary vein isolation success. Complications were low, with a 1.3% major complication rate. The follow-up data from 870 procedures revealed a hospital readmission rate for arrhythmias and complications of 3.2% and 0.9%, respectively.

Germany pulsed field ablation market is experiencing significant growth. In June 2024, EP Europace published an article discussing pulsed field ablation (PFA) catheters for cardiac arrhythmias, noting advancements from Germany. PFA employs pulsed electric fields for targeted tissue destruction, offering advantages over traditional methods, including improved procedural outcomes and reduced collateral damage. According to the Deutscher Herzbericht 2022, approximately 121,172 deaths in Germany in 2021 were due to coronary heart diseases, including 45,181 from acute heart attacks.

Asia Pacific Pulsed Field Ablation Market Trends

The PFA market in the Asia Pacific is growing rapidly, driven by the region's expanding elderly population. In 2023, approximately 697 million individuals aged 60 or older live in Asia and the Pacific, representing about 60% of the global older population. Technological advancements in PFA are enhancing treatment options for age-related cardiac conditions, further boosting market growth. In January 2024, Abbott announced that over 30 patients in Australia were treated with its Volt Pulsed Field Ablation (PFA) System for atrial fibrillation (AFib). This marked a key step in a study evaluating the system’s safety and effectiveness, with plans for more procedures in Asia Pacific and Europe, and pending U.S. trial approval.

China pulsed field ablation market is growing, and the prevalence of cardiac arrhythmias in China is rising due to factors such as an aging population, sedentary lifestyles, and increasing rates of obesity and hypertension. Specifically, atrial fibrillation (AFib), a prevalent cardiac arrhythmia, is becoming more common. This growing burden of disease is anticipated to drive increased demand for effective treatment options.In June 2024, an article in Aging Medicine discussed catheter ablation's effectiveness for atrial fibrillation in China, highlighting potential complications from conventional methods. It introduced pulsed field ablation (PFA) as a promising alternative, offering superior tissue selectivity and reduced damage to non-target areas.

The pulsed field ablation market in Japan is experiencing growth driven by technological advancements. Japan, with one of the fastest-growing elderly populations globally, saw its population decline by 820,000 in September 2022, while the number of seniors aged 65 and older rose by 60,000, reaching a record 36.27 million. As the population ages, the susceptibility to cardiac arrhythmias and other heart-related conditions increases, driving demand for advanced treatments. In January 2024, Biosense Webster, Inc. announced that the Japanese Ministry of Health approved its VARIPULSE Platform for treating drug-resistant recurrent paroxysmal atrial fibrillation with pulsed field ablation. This platform consists of the VARIPULSE Catheter, TRUPULSE Generator, and is integrated with the CARTO 3 System, providing a user-friendly workflow and real-time visualization.

Latin America Pulsed Field Ablation Market Trends

The Latin America pulsed field ablation marketis expanding due to rising healthcare awareness and the increasing prevalence of atrial fibrillation (AFib). Enhanced awareness and growing AFib rates are driving demand for advanced treatment options like PFA in the region. In October 2024, an article published in the European Heart Journal explored the comparison between Pulsed Field Ablation (PFA) and Cryoballoon Ablation (CBA) in treating atrial fibrillation (AF) in Brazil. The study found PFA to be associated with fewer periprocedural complications and shorter procedure times compared to CBA.

Brazil PFA market is growing as the country increasingly embraces advanced cardiac treatment technologies. PFA offers a safer, more precise method for treating atrial fibrillation, a major heart rhythm disorder. In April 2024, an article in Heart Rhythm O2 discussed a study comparing pulsed-field ablation (PFA) and thermal ablation (TA) for atrial fibrillation patients in Brazil. The findings indicated that PFA resulted in shorter procedure times and better efficacy while demonstrating lower rates of (peri) esophageal injury, but higher tamponade rates compared to TA.

Middle East And Africa Pulsed Field Ablation Market Trends

The pulsed field ablation market in the Middle East and Africais expanding due to a rise in cardiovascular diseases (CVDs), including cardiac arrhythmias like atrial fibrillation (AFib) and ventricular tachycardia (VT). Contributing factors include sedentary lifestyles, unhealthy diets, and an aging population. This growing disease burden is driving trends in the PFA market, with increased demand for advanced treatment solutions. In November 2024, Sheikh Shakhbout Medical City performed Abu Dhabi's first pulse field ablation for atrial fibrillation, successfully treating two patients whose symptoms persisted despite traditional therapies. The multidisciplinary team opted for this innovative procedure over increasing medication doses.

Saudi Arabia pulsed-field ablation (PFA) market is expanding with the adoption of advanced heart treatment technologies. The minimally invasive nature of PFA, which targets irregular heart rhythms, is gaining traction due to its safety and effectiveness. In February 2024, Johns Hopkins Aramco Healthcare (JHAH) introduced pulsed-field ablation (PFA) technology for treating atrial fibrillation. JHAH is the first in the Eastern Province to implement this technology, achieving an 80% success rate with no complications in initial treatments, leading to quicker recovery times.

Key Pulsed Field Ablation Company Insights

The competitive scenario in the industry is high, with key players holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, acquisitions, mergers, and regional expansion to serve the unmet needs of their customers.

Key Pulsed Field Ablation Companies:

The following are the leading companies in the pulsed field ablation market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- Abbott

- Medtronic

- Biosense Webster, Inc. (Johnson & Johnson Services, Inc.)

- Adagio Medical Inc.

- Kardium

- Jia Jing Electronic Co., Ltd.

- Pulse Biosciences Inc

- CardioFocus

- Acutus Medical, Inc

Recent Developments

-

In November 2024, the FDA granted approval to Johnson & Johnson MedTech for the VARIPULSE Platform, aimed at treating paroxysmal Atrial Fibrillation (AFib) that is resistant to medication. This innovative platform integrates PFA therapy with the CARTO 3 System, a top-tier solution for 3D electroanatomical cardiac mapping.

-

In October 2024, Boston Scientific Corporation announced FDA approval for the FARAWAVE NAV Ablation Catheter, designed for treating paroxysmal atrial fibrillation (AF). This approval also includes clearance for the FARAVIEW Software, enhancing cardiac ablation visualization when used with the FARAPULSE Pulsed Field Ablation (PFA) System and Boston Scientific's OPAL HDx Mapping System.

-

In May 2024, Medtronic received approval from Japanese health authorities for its Pulsed Field Ablation (PFA) system. This authorization enables Medtronic to market and utilize its advanced ablation technology in Japan, marking a significant milestone in the company’s expansion within the Japanese medical device market.

-

In February 2024, Biosense Webster, Inc. received European CE mark approval for its VARIPULSE system, aimed at treating AFib using pulsed field ablation. The platform includes the VARIPULSE Catheter, the TRUPULSE Generator, and the CARTO 3 System, offering a comprehensive solution with real-time visualization and feedback features.

Pulsed Field Ablation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 1.5 billion |

|

Revenue forecast in 2030 |

USD 6.2 billion |

|

Growth rate |

CAGR of 33.1% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Components, indication, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Boston Scientific Corporation; Abbott; Medtronic; Biosense Webster, Inc. (Johnson & Johnson Services, Inc.); Pulse Biosciences, Inc.; Kardium; Jia Jing Electronic Co., Ltd.; Adagio Medical Inc; CardioFocus; Acutus Medical, Inc; |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pulsed Field Ablation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pulsed field ablation market report based on the components, indication, end use, and region.

-

Components Outlook (Revenue, USD Million, 2018 - 2030)

-

Catheters

-

Generators

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Atrial Fibrillation

-

Non-atrial Fibrillation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Inpatient Facilities

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pulsed field Ablation market size was estimated at USD 913.1 million in 2024 and is expected to reach USD 1.5 billion in 2025.

b. The global pulsed field Ablation market is expected to grow at a compound annual growth rate of 33.1% from 2025 to 2030 to reach USD 6.2 billion by 2030.

b. The inpatient facilities segment held the largest share of 63.9% in 2024. Inpatient facilities are increasingly providing comprehensive care for patients with cardiac arrhythmias through advanced diagnostic testing, medication management, and interventional procedures, including pulsed-field ablation (PFA).

b. The key players operating in the pulsed field ablation market are Boston Scientific Corporation; Abbott; Medtronic; Biosense Webster, Inc. (Johnson & Johnson Services, Inc.); Pulse Biosciences, Inc.; and Kardium; Jia Jing Electronic Co., Ltd

b. Pulsed field ablation's non-thermal mechanism significantly reduces the risk of damaging surrounding tissues, which has been a major limitation of conventional ablation techniques like radiofrequency and cryoablation. This unique advantage has led to growing interest from both healthcare providers and patients, accelerating its adoption in clinical settings.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."