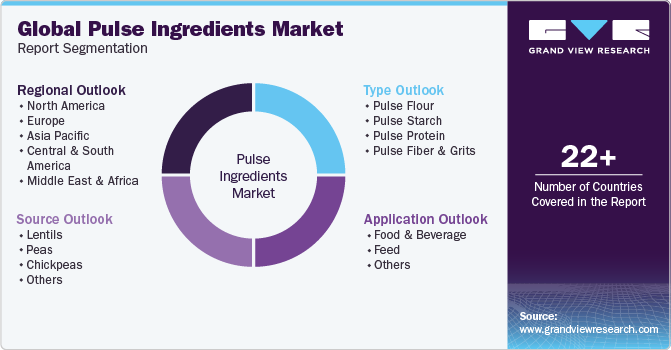

Pulse Ingredients Market Size, Share & Trends Analysis Report By Source (Peas, Chickpea, Lentils), By Type (Pulse Flour, Pulse Starch), By Application (Food & Beverage, Feed), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-225-7

- Number of Report Pages: 145

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Pulse Ingredients Market Size & Trends

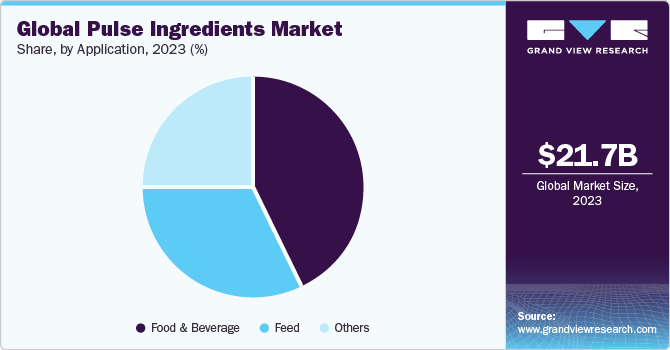

The global pulse ingredients market size was estimated at USD 21.74 billion in 2023 and is expected to grow at a CAGR of 3.1% from 2024 to 2030. Consumers are increasingly prioritizing nutritious options in their diets. Pulse-based ingredients offer a compelling solution due to their rich nutritional profile. They are naturally high in protein, fiber, vitamins, and minerals, making them an attractive choice for health-conscious individuals looking to enhance their diet with wholesome, nutrient-dense foods. Moreover, the clean label movement has gained significant traction as consumers seek food products with transparent ingredient lists and minimal processing.

Pulse-based ingredients align well with this trend, as they are often perceived as clean and minimally processed. With clear ingredient declarations and recognizable sources, pulses appeal to consumers who prioritize transparency and authenticity in their food choices. In addition, with the increasing prevalence of dietary preferences and restrictions, including gluten-free, vegetarian, and non-GMO diets, there is a growing demand for food products that cater to these needs. Pulse ingredients offer versatile options that accommodate various dietary preferences without compromising taste or nutritional quality.

Pulse ingredients can used as gluten-free flour alternatives, a plant-based protein source, or a meat substitute; pulses provide a versatile solution for formulating products that appeal to a diverse range of dietary requirements. Furthermore, the shift towards plant-based diets and growing popularity of plant-based proteins are boosting product demand. For consumers seeking alternatives to traditional animal-derived proteins for health, ethical, and environmental reasons, pulses offer an attractive solution. They are an excellent source of plant-based protein, enabling food manufacturers to develop products that cater to the growing demand for plant-centric diets while providing the protein content consumer’s desire.

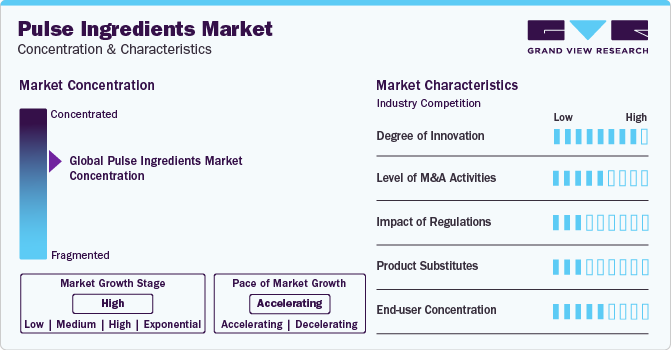

Market Concentration & Characteristics

Innovation plays a significant role in the pulse ingredients market, driving efforts to improve production processes, enhance product functionalities, and explore new applications. Technological advancements in extraction methods, including creating modified pulse ingredients with specific properties, demonstrate the industry's commitment to innovation.

The market has experienced noteworthy M&A activities, reflecting the industry's pursuit of strategic partnerships and market consolidation. Mergers and acquisitions are often driven by a desire to achieve economies of scale, expand market reach, or access complementary technologies.

Adhering to strict quality standards and complying with health and safety regulations are essential for market participants. Furthermore, changing environmental regulations may influence sourcing practices, waste management, and processing methods. With consumers and industries increasingly emphasizing sustainability, regulatory frameworks promoting eco-friendly practices and responsible sourcing are expected to affect the market. This will necessitate companies to adjust and adhere to evolving standards.

Source Insights

The chickpeas source segment held a market share of 36.6% in 2023 and is projected to retain the leading position throughout the forecast period. With the increasing adoption of plant-based diets for health, ethical, and environmental reasons, there is a growing demand for plant-based protein alternatives. Chickpeas, being legumes, provide an excellent source of plant-based protein, making them appealing to individuals following vegetarian, vegan, or flexitarian diets. For instance, General Mills, a key player in the food ingredient industry, is experimenting with the transformation of non-soy legumes like chickpeas into a substance referred to as liquefied legume material. This innovative material is intended to serve as a legume-based alternative to dairy milk in products, such as cheese or yogurt, and it can also function as an egg substitute in mayonnaise and dressings. In response to the high demand, several companies are launching chickpea-based ingredients.

In November 2023, Israel-based ChickP announced the launch of a chickpea protein isolate with 90% pure chickpea protein content. The product is ideal for plant-based cheese products, providing high protein content while maintaining taste and texture. The pea ingredients market is expected to witness a CAGR of 4.1% from 2024 to 2030. Pea-based ingredients offer functional properties that improve baked goods' texture, moisture retention, and overall quality. The ability of pea flour and pea fiber to enhance dough yield, viscosity, texture, and mouthfeel makes them valuable ingredients for bakery applications. This functionality drives their adoption by food manufacturers looking to improve the performance of their products while maintaining or enhancing their nutritional profiles.

Type Insights

The pulse flour type segment held a market share of 35.4% in 2023, establishing its dominance in the market. Pulse flours are marketed as healthier alternatives due to their higher protein content, rich levels of soluble and insoluble fiber, and resistant starch. As consumer awareness of health and nutrition increases, there is a growing demand for products that offer these nutritional benefits. In addition, Bakers are increasingly adopting pulse flours because of their natural composition, cost-effectiveness, and nutritional advantages over additives like gums. This preference aligns with consumer demands for cleaner-label products with recognizable, wholesome ingredients. In September 2021, Ingredion, Inc. announced the launch of Prista, a range of pulse concentrates and flours.

This new line includes Homecraft Prista P 101 pea flour, Vitessence Prista P 155 pea protein concentrate, and Vitessence Prista P 360 fava bean protein concentrate. These ingredients are produced using a proprietary deflavoring process, which helps mitigate the bitter taste and raw plant flavor commonly found in traditional dry-milled pulse ingredients. The pulse protein market is expected to grow at the fastest CAGR of 5.9% from 2024 to 2030. Pulse proteins offer functional properties that contribute to the quality and performance of bakery products. Their water-holding capacity and ability to provide structure can help enhance dough texture, improve moisture retention, and reduce breakage in baked goods. This functional versatility makes pulse proteins attractive ingredients for achieving desired product characteristics in bakery formulations.

Application Insights

In 2023, the food and beverage segment dominated the market with a revenue share of 43.1%. Within the food industry, there is a growing demand for nutritious food and beverage options. Pulses, such as peas, lentils, chickpeas, and beans, are naturally rich in protein, fiber, vitamins, and minerals, making them attractive ingredients for health-focused formulations. The nutritional benefits of pulse ingredients align with consumer preferences for foods that support overall well-being and contribute to a balanced diet.

The product demand in the feed industry is expected to grow at a CAGR of 1.2% from 2024 to 2030. With the increasing demand for protein in animal diets, there is a need for alternative protein sources to supplement or replace traditional protein sources, such as soybean meal and fish meal. Pulses offer a sustainable and cost-effective alternative to these protein sources.

Regional Insights

North America is expected to witness a CAGR of 1.5% from 2024 to 2030. The clean label movement, emphasizing transparency and simplicity in ingredient lists, is gaining traction in North America. Pulses are perceived as natural, minimally processed ingredients that align with clean-label standards. As consumers seek foods with recognizable ingredients, the demand for pulse ingredients as clean-label alternatives to synthetic additives and stabilizers is increasing.

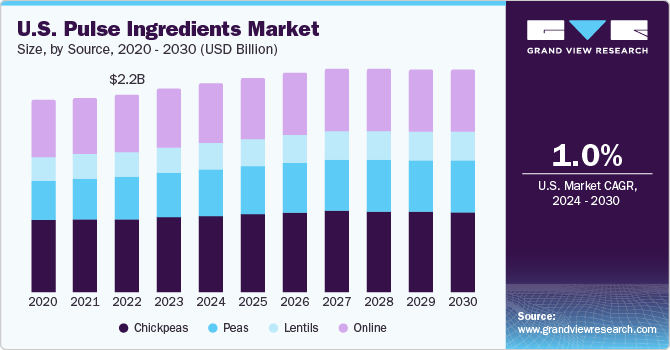

U.S. Pulse Ingredients Market Trends

The U.S. pulse ingredients market is expected to grow at a CAGR of 1.0% from 2024 to 2030 owing to the growing awareness of the health benefits associated with pulses, such as lentils, chickpeas, and various beans, which are rich in protein, fiber, and other essential nutrients.

Asia Pacific Pulse Ingredients Market Trends

The pulse ingredients market in Asia Pacific captured the largest revenue share of over 33.4% in 2023. Many countries in the region are working towards achieving food security and self-sufficiency goals. Pulses are considered a valuable crop for enhancing food security, as they are nutritious, adaptable to various growing conditions, and can be stored for extended periods. Governments and agricultural organizations are promoting the cultivation and consumption of pulses to improve food security and reduce dependency on imported food products.

Key Pulse Ingredients Company Insights

The pulse ingredients market is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Key players continuously engage in research and development activities to enhance the functional properties of pulse ingredients, catering to the diverse needs of industries, such as food & beverages, pharmaceuticals, and chemicals. This focus on innovation allows market leaders to differentiate their products, gain a competitive edge, and respond effectively to changing market demands.

Key Pulse Ingredients Companies:

The following are the leading companies in the pulse ingredients market. These companies collectively hold the largest market share and dictate industry trends.

- Ingredion Inc.

- Cargill Inc.

- Roquette Frères

- Emsland Group

- ADM

- The Scoular Company

- Coscura

- Puris

- Axiom Foods, Inc.

- AGT Food & Ingredients

- AM Nutrition

Recent Developments

-

In November 2022, Uralchem Innovation, a subsidiary of Uralchem based in Russia, inaugurated a pilot plant dedicated to producing pea isolate. This isolate, derived from yellow peas, is a refined natural vegetable protein with multiple applications across the food industry

-

In October 2021, InnovoPro, an Israeli foodtech firm specializing in chickpea protein concentrate, introduced a chickpea protein, TVP (texturized vegetable protein), aimed at assisting food manufacturers in enhancing meat analogue products like burgers, nuggets, and meatballs

Pulse Ingredients Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 22.78 billion |

|

Revenue forecast in 2030 |

USD 27.30 billion |

|

Growth rate |

CAGR of 3.1% from 2024 to 2030 |

|

Actuals |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Source, type, application, and region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; Japan; South Korea; Australia & New Zealand; India; Brazil; South Africa |

|

Key companies profiled |

Ingredion Inc.; Cargill Inc.; Roquette Frères; Emsland Group; ADM; The Scoular Company; Coscura; Puris; Axiom Foods, Inc.; AGT Food & Ingredients; AM Nutrition |

|

Customization scope |

Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, or segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pulse Ingredients Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pulse ingredients market report on the basis of source, type, application, and region:

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Lentils

-

Peas

-

Chickpeas

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pulse Flour

-

Pulse Starch

-

Pulse Protein

-

Pulse Fiber & Grits

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverage

-

Bakery & Confectionery

-

Snacks

-

Dairy

-

Beverages

-

-

Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

Australia & New Zealand

-

South Korea

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pulse ingredients size was estimated at USD 21.74 billion in 2023 and is expected to reach USD 22.78 billion in 2024.

b. The global pulse ingredients is expected to grow at a compounded growth rate of 3.1% from 2024 to 2030 to reach USD 27.3 billion by 2030.

b. Pulse flour dominated the market with a share of 35.4.4% in 2023. pulse flours are marketed as healthier alternatives due to their higher protein content, rich levels of soluble and insoluble fiber, and resistant starch. As consumer awareness of health and nutrition increases, there is a growing demand for products that offer these nutritional benefits.

b. Some key players operating in white Pulse ingredients market are , such as Ingredion Incorporated ;Cargill Inc.; Roquette Frères; Emsland Group; ADM; The Scoular Company; Coscura; Puris; Axiom Foods, Inc.; AGT Food & Ingredients; AM Nutrition

b. The evolving landscape of health and dietary trends plays a significant role in driving the demand for pulse ingredients..

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."