Pulse Flour Market Size, Share & Trends Analysis Report By Product (Pea, Lentil, Chickpea), By Application (Bakery & Snacks, Dairy, Beverages), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-1-68038-162-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Pulse Flour Market Size & Trends

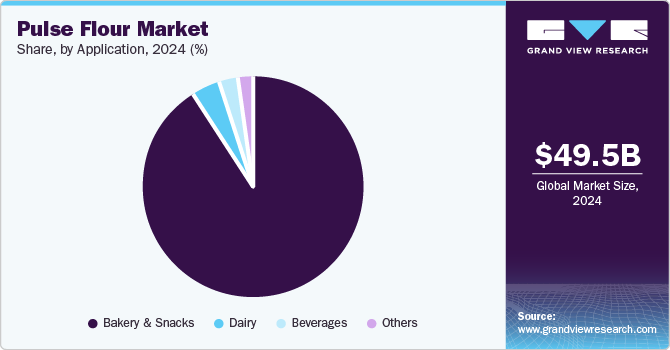

The global pulse flour market size was valued at USD 49.55 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2030. Unique characteristics such as significant fiber content, lower fat content, gluten free formulation, higher protein content, presence of micronutrients, etc. primarily drive the increasing utilization of pulse flour. Furthermore, the growing use of pulse flours in bakery and confectionery recipes, increasing inclusion in household use, and ease of availability through offline retail are projected to drive demand for this market.

Growing inclusion of pulse flour in bakery and confectionary businesses, increasing utilization by urban households, expanding availability and accessibility backed by organized retail stores and quick commerce platforms, and rising awareness regarding the role that pulse flour might play in enhancing individual health and fitness have generated an upsurge in demand for this market in recent years.

The entry of various consumer goods industry participants in the pulse flour retail business also contributes to the growth opportunities. Lifestyle changes, increasing mindfulness about food ingredients and their contents, and consumers' rising focus on embracing healthy dietary patterns also play vital roles in the growing demand for pulse flour. In addition, trends such as veganism and plant-based diets are leading to a significant increase in the utilization of pulse flours.

Increasing demand for plant-based proteins also has a noteworthy influence on this market. Recognition of the nutritional and environmental benefits associated with pulse flours, growing utilization in the manufacturing of various consumer goods and processed food products, and rising inclination among food and beverage industry participants to include pulse flours in formulation are projected to develop growth trends for this market in approaching years.

For instance, in October 2024, Nestlé, one of the prominent companies in the food and beverages industry, launched culinary innovations emphasizing protein, such as Maggi Nutri-licious Chatpata Besan Noodles in the Indian market. The product contains 34.3% Bengal gram flour. Such innovations are expected to enhance demand for pulse flours from commercial applications.

Product Insights

Based on products, the chickpea flour segment held a significant market revenue share, accounting for 27.6%, in 2024. Extensive utilization of chickpea flour in Indian, Burmese, Nepali, Bangladeshi, Caribbean, and Sri Lankan cuisines, the growing availability of various convenient packaging sizes and products offered by numerous brands, increasing use in industries such as bakery & confectionary, food & beverages, ready to eat food products, restaurant & hospitality, animal feed, and others are some of the key growth driving factors. Innovation has a significant influence on the development of this segment. Chickpea-based comfort food manufacturing company, Banza, offers a range of ready-to-make/cook products such as protein waffles, mac & cheese, pasta, pizza, and others made out of chickpeas.

Pea flour is expected to experience the fastest CAGR of 7.3% from 2025 to 2030. This is attributed to its increasing use in product formulation, such as bread, pancakes, muffins, cookies, cakes, and others. Its characteristics, such as low carbohydrates, lower oil absorptions, lesser calorie content, higher protein content, and suitability for sweet or savory baking products, make it a preferred choice for various commercial applications.

Application Insights

Application of pulse flour in bakery and snacks segment dominated the global pulse flour industry in 2024. The inclusion of chickpea flour and other pulse flours as one of the key ingredients in multiple bakery products such as bread, cakes, pizza bases, tortillas, flatbreads, pancakes, and others, and snacks such as falafel, crackers, cakes, and traditional recipes in numerous world cuisines primarily driving the growth of this segment. Increasing demand from households, restaurants, hotels, and other users is expected to generate more growth opportunities.

Numerous commercial food processing companies and private volunteer organizations (PVO) have been researching the use of pulse flour in formulations of beverages to deliver healthy alternatives for emulsifiers. Increasing consumer awareness regarding gluten intake and its harmful effects is anticipated to bolster demand for the product in fortified gluten-free drinks.

Regional Insights

North America pulse flour industry dominated the global market with revenue share of 28.0% in 2024. This market is primarily driven by factors such as growing awareness regarding the gluten-free characteristics of pulse flour, the rising number of health-conscious customers seeking non-meat protein supplies, increasing utilization by bakery and snack product manufacturers, and innovation by emerging companies in the food and beverage industry.

U.S. Pulse Flour Market Trends

The U.S. pulse flour market held the largest revenue share of the regional industry in 2024. The U.S. has multiple brands that provide chickpea flour and other pulse flours, extensively used as key ingredients in households and commercial spaces. The presence of a diverse population that engages in the cooking of numerous cuisines significantly influences this market.

Europe Pulse Flour Market Trends

Europe was identified as one of the key regions for the global pulse flour industry in 2024. This is attributed to the increasing inclusion of pulse flours in making breads, cakes, pancakes, flatbreads, cookies, and other bakery products. The growing commercial application also drives this market. In addition, growing awareness regarding the importance of high protein intake and the large number of customers seeking plant-based protein sources in daily meals are adding to the growth opportunities of this market.

The UK pulse flour market held the largest revenue share. The growth in mindfulness regarding dietary preferences, the increasing number of customers shifting to protein-rich diets, the growing availability of products through retail and e-commerce businesses, and the ease of use and convenience offered by the product are some of the key growth driving factors.

Asia Pacific Pulse Flour Market Trends

Asia Pacific pulse flour industry is projected to grow at the fastest CAGR of 6.2% from 2025 to 2030. This market is primarily driven by the roots of using pulse flour in traditional cuisine recipes and growing demand from restaurants and small and medium-scale businesses. Increasing inclusion in bakery and snacks, rising awareness regarding protein-rich, low-calorie characteristics of pulse flours, and more.

India pulse flour market will hold the largest revenue share of the regional industry in 2024. This market is mainly influenced by factors such as increasing demand from household users and commercial users such as hotels, restaurants, and small-scale businesses offering snacks and bakery products, growing availability through offline retail and quick commerce platforms, and the presence of multiple companies offering pulse flours of different forms in different packaging size for various purposes.

Key Pulse Flour Company Insights

Some of the key companies operating in the global pulse flour industry are Ingredion Incorporated, ADM, Best Cooking Pulses Inc., AGT Food & Ingredients, Harvest Innovations, and others. To address the challenges of modern business environments and growing demand, companies have adopted strategies such as innovation, research and development, growing collaborations, and more.

-

ADM, one of the key companies in the nutrition industry, offers products and solutions related to nutrition for humans, animals, and pets, industrial solutions, and services, including transportation and logistics for crops, while accommodating the role of mediator between farmers and consumers.

-

Avena Foods Limited, a major market participant in the food ingredients industry, offers a range of products and solutions, including pulses and pulse ingredients, purity protocol oat ingredients, specialty millet ingredients, and more.

Key Pulse Flour Companies:

The following are the leading companies in the pulse flour market. These companies collectively hold the largest market share and dictate industry trends.

- Ingredion Incorporated

- ADM

- Avena Foods Limited

- AGT Food and Ingredients Inc.

- Ganesh Consumer Products Limited

- Tata Consumer Products

- ARDENT MILLS

- Bob’s Red Mill Natural Foods

Pulse Flour Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 53.28 billion |

|

Revenue forecast in 2030 |

USD 71.93 billion |

|

Growth rate |

CAGR of 6.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, South Korea, Australia & New Zealand, Brazil, South Africa |

|

Key companies profiled |

Ingredion Incorporated; ADM; Avena Foods Limited; AGT Food and Ingredients Inc.; Ganesh Consumer Products Limited; Tata Consumer Products; ARDENT MILLS; Bob’s Red Mill Natural Foods |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Pulse Flour Market Report Segmentation

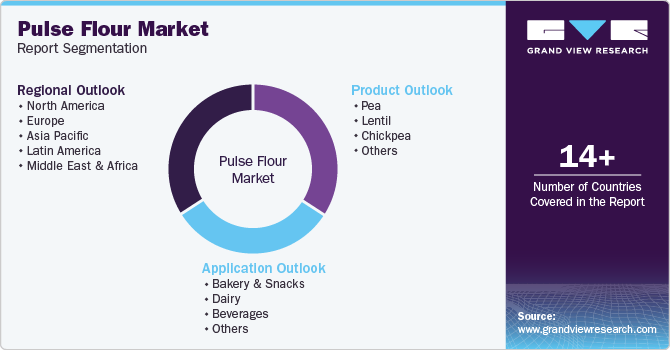

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand view research has segmented the global pulse flour market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pea

-

Lentil

-

Chickpea

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery & Snacks

-

Dairy

-

Beverages

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia & New Zealand

-

-

Latin America

-

Brazil

-

-

MEA

-

South Africa

-

Saudi Arabia

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."