- Home

- »

- Next Generation Technologies

- »

-

Public Safety And Security Market Size & Share Report, 2030GVR Report cover

![Public Safety And Security Market Size, Share & Trends Report]()

Public Safety And Security Market (2025 - 2030) Size, Share & Trends Analysis Report By Solution, By Application (Emergency Services, Homeland Security, Critical Infrastructure Security), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-138-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Public Safety And Security Market Summary

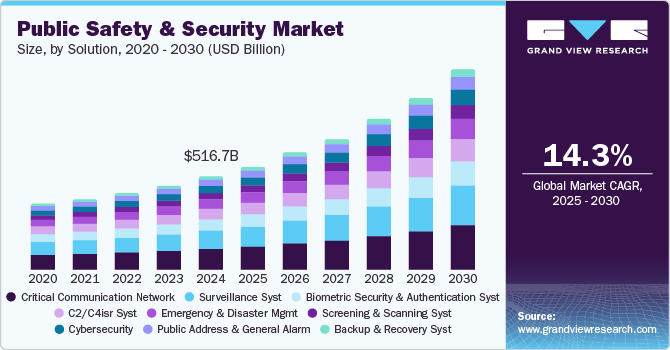

The global public safety and security market size was valued at USD 516.68 billion in 2024 and is projected to reach USD 1,124.77 billion by 2030, growing at a CAGR of 14.3% from 2025 to 2030. Growing concerns regarding public data security, increasing incidents of unauthorized surveillance, the rise in adoption of advanced technologies, and the focus of organizations and governments on developing robust security networks are some of the key growth drivers for this market.

Key Market Trends & Insights

- North America dominated the global public safety and security market with a revenue share of 38.7% in 2024.

- The U.S. public safety and security market held the largest revenue share of the regional in 2024.

- Based on solution, the critical communication network segment held the largest share of 21.7% in 2024.

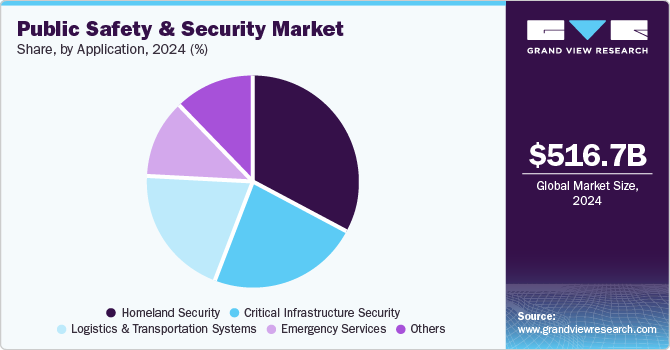

- Based on application, the homeland security segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 516.68 Billion

- 2030 Projected Market Size: USD 1,124.77 Billion

- CAGR (2025-2030): 14.3%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

In addition, they are increasing safety and security requirements for critical infrastructures such as transportation, utilities, communication, food and agriculture, energy, and more. Availability and accessibility of modern technologies such as Artificial Intelligence (AI), Internet of Things (IoT), Machine Learning (ML), and others have significantly shaped the dynamics of this market in recent years. For instance, in November 2024, Meta, one of the key technology and innovation companies, announced that it is making LLaMA (Large Language Model Meta AI) available for government agencies and contractors in the U.S. This is considered a noteworthy development in global public safety and role of AI in it.

Initiatives taken by companies and governments regarding the development and delivery of combined efforts to enhance overall public safety and security are also adding to the growth opportunities of this market. For instance, in August 2024, member states in the United Nations finalized a draft of a newly developed convention against cybercrime. It is aimed at establishing and strengthening international cooperation in the fight against crimes committed through the utilization of information and communication technology.

Incidents of violence, the rising occurrence of public property damages after protests or riots in major cities or provinces, continuous attempts to gain unauthorized access to sensitive government information, increasing data thefts and breaches, acts of terrorism, and civil conflicts have also encouraged companies and governments to invest more in capacity enhancements, leading to the growth of the market.

For instance, in February 2024, FirstNet Authority, an agency that operates and monitors an interoperable public safety broadband network in the U.S., and its network partner, AT&T, a key company in the telecom and internet technology industry, joined forces to announce a USD 6.3 billion investment aimed at delivering full-scale 5G capabilities, expanding mission-critical services, and improving coverage.

Solution Insights

The critical communication network segment held the largest revenue share of 21.7% in 2024. Information and communication technology is vital in the seamless flow of businesses and governments. Unceasing growth in the use of smartphones, the reliance of consumers and businesses on internet connections, the dependency of critical infrastructure management on high-performance secured networks, and the essential role of communication networks in the uninterrupted flow of multiple world dynamics, including industries, governance, communities, economies, and more, are some of the key growth driving factors for this market.

The emergency and disaster management segment is projected to experience the fastest CAGR during the forecast period. The severe impact of climate change, rising incidents of terrorist attacks in Western countries, acts of violent crimes in multiple countries, series of protests in numerous regions, and growth in the occurrence of natural disasters such as landslides, earthquakes, floods, droughts, volcanic eruptions, heat waves and others emergencies have driven the demand for emergency and disaster management. In addition, technology enhancements are also fueling growth in this market. For instance, in April 2024, The European Emergency Number Association (EENA) launched an AI special project designed to run in seven European countries. This includes Portugal, Finland, Germany, Sweden, North Macedonia, Italy, and Spain.

Application Insights

The homeland security segment dominated the global public safety and security market in 2024. The Homeland Security Department participates in multiple public safety and security functions, such as counter-terrorism operations, disaster management, availability of emergency helpline communications, immigration control, border security, cybersecurity, intelligence sharing, infrastructure protections, and more. Partnerships with local authorities, official contracts for businesses, and government aid are expected to enhance growth for this segment.

Logistics and transportation systems are expected to experience the fastest CAGR from 2025 to 2030. Safety and security of transportation networks, stations, ports, airports and other service infrastructure is significant for governments and organizations in its strategy implementation for public safety and security. Incidents of terrorism and crime driven by use of different transportation means, growing use of logistics network in supply and availability of unauthorized and illegal weapon, tools and resources linked with crime, presence of multiple foreign travelers on international airports and primary role of logistics and transportation in establishment and maintenance of law & order in every region are expected to drive growth of this segment during forecast period.

Regional Insights

North America dominated the global public safety and security market with a revenue share of 38.7% in 2024. This is attributed to the focus of government agencies on public safety and security, growing investments in the sector, the emergence of modern technology tools supported by innovation and excellence, increasing requirements for border security enhancements, the presence of many immigrants in the region, and more.

U.S. Public Safety And Security Market Trends

The U.S. public safety and security market held the largest revenue share of the regional industry in 2024. The presence of robust security infrastructure comprises multiple participants such as the National Security Agency, Central Intelligence Agency, The United States Department of Homeland Security, The United States Department of Defense, the United States Coast Guard, The Federal Bureau of Investigation, U.S. Customs and Border Protection, The Transportation Security Administration, Federal Emergency Management Agency, National Cyber Security Centre and others play a vital role in the growth of this market. In addition, multiple companies that manufacture tools, weapons, technologies, equipment, and accessories used by security and law enforcement personnel add to the growth opportunities of this market.

Europe Public Safety And Security Market Trends

Europe public safety and security market held significant revenue share of the global industry in 2024. The presence of armed conflict in the region’s neighborhood, a large share in international trade, the robust tourism industry in the area, rising threats experienced by Europe from terrorist organizations, cyber-attacks, protests, crime, and more requirements for strong law enforcement initiatives, and focus of government on enhanced public safety and security are factors driving the growth of this market. In addition, according to UNHCR, in 2023, Europe hosted nearly 30 % of all refugees worldwide.

Germany public safety and security market dominated the regional market for public safety and security in 2024. This market is primarily driven by increasing security threats, government investments in enhancements of security capabilities and public safety infrastructure, cyber security concerns, and private sector participation. Foreign policy and efforts to strengthen defence ties with India are also expected to influence this market during the forecast period.

Asia Pacific Public Safety And Security Market Trends

Asia Pacific public safety and security market is expected to experience the fastest CAGR in 2024. This market is driven by the large presence of terrorist activities in the region, growing concerns regarding public safety, highly populated countries such as China and India, the large number of vacancies in security and law enforcement agencies, and rising requirements for protection against cyber security.

China public safety and security market dominated the regional industry in 2024. Strict safety and security regulations in the country, technological advancements attained by the public safety and security market participants, and a focus on improving emergency response and growing incidents of natural calamities in the country are expected to generate significant growth. In August 2023, nearly 16 cities and provinces in northeastern parts of China experienced heavy rainfall and flooding driven by Typhoon Doksuri, the fifth consecutive typhoon in the Pacific in 2023. During the same period, Beijing experienced its highest rainfall in the history of 140 years, nearly 60% of average annual rainfall within 83 hours.

Key Public Safety And Security Company Insights

Some of the key companies operating in the public safety and security market are Cisco Systems, Inc., Honeywell International Inc., NEC Corporation, Thales Group, General Dynamics Corporation, and others. Key players are adopting strategies such as technology advancements, innovation, portfolio enhancements, and more to address growing competition and increasing demand for this market.

-

Cisco Systems, Inc., one of the key companies in communication technologies, offers a range of solutions regarding public safety and security, such as digital platforms, Video Surveillance Managers, network solutions, a cybersecurity product portfolio, IP cameras, the Cisco IP Interoperability and Collaboration System (IPICS), and more.

-

Huawei Technologies Co., Ltd., a key market participant in the technology and innovation industry, offers a variety of products associated with safety and security, such as cyber security and privacy protection, network security, video cloud solution, crisis and disaster management solutions, and others.

Key Public Safety And Security Companies:

The following are the leading companies in the public safety and security market. These companies collectively hold the largest market share and dictate industry trends.

- Motorola Solutions, Inc.

- Cisco Systems, Inc.

- Honeywell International Inc.

- NEC Corporation

- Thales

- IBM

- Huawei Technologies Co., Ltd.

- tyco (Johnson Controls)

- General Dynamics Corporation

- Siemens

Recent Developments

-

In October 2024, omniQ Corp, a major industry participant in AI solutions, announced its continued partnership with key biometrics technology company NEC Corporation. The collaboration aims to deliver modern technology and innovation in public safety and security markets over the next few years.

-

In July 2024, Cisco Systems Inc., one of the prominent companies in the public safety and security technologies market, and HTX (Home Team Science and Technology Agency), a statutory board operated by Singapore’s Ministry of Home Affairs, signed a Memorandum of Understanding (MOU) to pilot 5G and AI technologies to assist the homeland security department in Singapore.

-

In May 2024, NEC X, Inc., a venture studio based in Silicon Valley that assists early-stage start-ups in high-quality product development and other areas, announced its latest investment in Multitude Insights. This AI-powered solution provider facilitates enhanced collaboration and improved case resolution for first responders and law enforcement agencies.

Public Safety And Security Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 576.63 billion

Revenue forecast in 2030

USD 1,124.77 billion

Growth rate

CAGR of 14.3% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Solution, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, India, Japan, Australia, South Korea, Brazil, KSA, UAE, South Africa

Key companies profiled

Motorola Solutions, Inc.; Cisco Systems, Inc.; Honeywell International Inc.; NEC Corporation; Thales; IBM; Huawei Technologies Co., Ltd.; tyco (Johnson Controls); General Dynamics Corporation; Siemens

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Public Safety & Security Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global public safety and security market report based on solution, application, and region:

-

Solution Outlook (Revenue, USD Million, 2018 - 2030)

-

Biometric Security & Authentication System

-

Critical Communication Network

-

C2/C4isr System

-

Surveillance System

-

Screening & Scanning System

-

Emergency & Disaster Management

-

Cybersecurity

-

Public Address & General Alarm

-

Backup & Recovery System

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Emergency Services

-

Homeland Security

-

Critical Infrastructure Security

-

Logistics & Transportation Systems

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

KSA

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.