Public Key Infrastructure Market Size, Share & Trends Analysis Report By Component, By Deployment, By Enterprise Size, By Application, By Industry Vertical, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-164-1

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Public Key Infrastructure Market Trends

The global public key infrastructure market size was valued at USD 4.57 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 19.9% from 2023 to 2030. The market growth can be attributed to the growing demand for strong digital security, increasing cyber threats, and increased web and online engagement during the COVID-19 pandemic. Moreover, organizations are rapidly implementing several technical innovations, such as virtualization, workplace mobility, and cloud storage, to improve business operations. As large amounts of enterprise data from the cloud can be easily accessible on mobile devices, enterprises can operate and handle more efficiently and effectively in real time. These factors would create the demand for public key infrastructure during the forecast period.

As a result of better use of the cloud and the growth of new technologies, enterprises are being driven to establish Identity Access Management (IAM) systems due to an increase in fraudulent and criminal activities. It supports the deletion of dormant accounts, the detection of policy infractions, and the elimination of improper access privileges. Moreover, lower production costs make application administration simple; centralizing process time for connectivity and identity modifications improves user reliability, provides application holders with easier access to sign-in, signup, and user management processes, and implements procedures and policies related to user verification and prerogatives. These factors are expected to further drive the public key infrastructure market during the forecast period.

Cloud computing and applications helped small and medium-sized businesses to gain easier access to powerful technologies at a cheaper cost. To support Shadow IT operations in businesses, a Cloud Access Security Broker (CASB) Shadow IT solution discovers, interprets, or secures cloud services. In organizations, cloud access security brokers are used to improve data security control. For instance, in April 2022, Symantec, a provider of data-centric hybrid security, integrated its Data Loss Prevention (DLP) solution with CloudSOC, a cloud access security broker, to create an end-to-end enterprise DLP solution that includes Shadow IT integration with user authentication/multifactor authentication/SSO integrations, custom dashboards and reports, and secure web gateways and firewalls. These factors would further drive the public key infrastructure market during the forecast period.

Component Insights

The Hardware Security Modules (HSM) segment accounted for a significant market share of over 18% in 2022. HSM protects PKI from being breached, enables the creation of keys throughout the PKI lifecycle, and ensures the scalability of the whole security architecture. With the constant threat of cyber threats, the growing number of machines used to conduct digital transactions must be assured, so that the critical information must be protected from attacks. Further, hardware devices secure all processes by generating, managing, and protecting the keys used for encrypting and decrypting sensitive critical data. These factors would further drive the segment market during the forecast period.

The services segment is anticipated to grow at a CAGR of around 21% during the forecast period. The growth of the segment can be attributed to the increasing safety and security concerns and growing cloud adoption for digital signature services. PKI services help organizations meet these requirements by classing data, automating data extraction, and verifying the processes while ensuring data security and privacy. For instance, nowina.lu, a software company, offers Digital Signature Services (DSS) that assists organizations in transitioning from paper-based processes to digital workflows and improving the digital experience by prioritizing interoperability.

Deployment Insights

The on-premises segment dominated the global PKI market in 2022. In order to prevent data loss and privacy issues, on-premises security solutions, including active directories, encryption key management, access control rules, and authentication, are widely used across several industry verticals as part of their security strategy. These necessitate the deployment of hardware security modules throughout the organization's distributed computing system to assure data security, policy administration, and adherence to compliance standards.

The cloud segment is anticipated to grow at a CAGR of over 22% during the forecast period.Various enterprises seek to use the cloud as it provides cost savings and increases operational efficiencies. The cloud environment enables enterprises with limited infrastructure and expertise to offer comprehensive data security solutions. Cloud solutions' agility, scalability, and cost-effectiveness enable enterprises to implement data security solutions. Further, with more severe regulatory regulations, small and medium-sized businesses are widely using cloud-based services to supply a variety of services to their consumers.

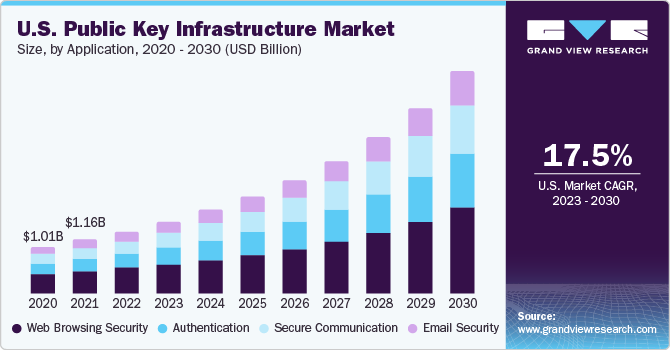

Application Insights

The email security segment accounted for the largest revenue share in 2022. Several organizations rely solely on the default security controls offered by email server platforms such as Google and Microsoft. These include email encryption solutions, email DLP solutions, email sandboxing, and Secure Email Gateways (SEGs), among others. They provide methods of protecting sensitive data from being accessed by unauthorized parties. Further, implementing an effective enterprise email security system can proactively block content based on pre-defined conditions. For instance, they can prevent large images from being received and negatively impacting email server traffic.

The authentication segment is anticipated to grow at a CAGR of over 20% during the forecast period. Further, organizational structures are becoming more complex, more people and devices are assigned unique identities across networks to authenticate and validate access credentials and identities. The workforce is becoming more mobile, and the Bring-Your-Own-Device (BYOD) policy encourages employees to use mobile apps. Further, developments in e-commerce and consumer desire for mobile computing, businesses are developing mobile applications that customers can use to access their products. Besides, scattered IT environments and shifting scenarios, organizations have become more vulnerable to cyber threats, fueling demand for digital identity solutions.

Enterprise Size Insights

Large enterprises segment dominated the global market revenue, with a market share of more than 58% in 2022. Large enterprises have the capital to invest in several security solutions as compared to small & medium enterprises. Data security and privacy are top priorities for large businesses as they transition to a more digital environment. Further, large organizations have a range of data to safeguard, including customer information, supply chain data, financial records, and other company data, as well as the requirement to adhere to a variety of legal and compliance mandates.

The Small & Medium Enterprises (SMEs) segment is anticipated to grow at a CAGR of around 22% during the forecast period. SMEs rely extensively on cloud infrastructure solutions for comparatively easier market entrance as they provide low capital inputs, scalability, shorter time to market, and pay-per-use models. SMEs are gradually evolving into digital firms with a diverse range of specialized solutions across all industries. This digital integration, cloud architecture, and increasing volume of data housed by SMEs create new potential dangers to data privacy and security. These data privacy concerns, combined with governmental regulations to protect data, will drive SMEs to embrace more advanced security solutions, ensuring segment growth.

Industry Vertical Insights

The BFSI segment is anticipated to hold the largest revenue share of the global market in 2022. The segment growth can be attributed to the increased digitalization of financial and welfare services, increasing online transactions, and increasing adoption of cloud-based deployment solutions. The banking sector is a house of a large volume of data, such as Social Security Numbers (SSN), personal information, and payment card details, among others, thereby prompting the industry to deploy security measures to protect such data. Moreover, financial institutions are required to uphold the integrity of data throughout the lifecycle. It can be maintained by enforcing several security policies, such as encryption software and data masking.

The healthcare segment is anticipated to grow at a CAGR of nearly 22% during the forecast period. The segment growth can be attributed to the higher adoption of advanced cyber security solutions, increasing integration of Internet of Things (IoT)-enabled medical devices, and rising adoption of connected devices and smartphones. Leveraging PKI, IoT devices can be authenticated across systems, as it encrypts sensitive information and protects from malicious actors even in the event of a data breach or compromise. For instance, in May 2023, Vaultree, a security solution provider, launched Data-In-Use Encryption solution for healthcare industry. The solution provides full-scale protection of critical patient data, even in the event of a breach, while maintaining operational efficiency and performance.

Regional Insights

North America dominated the global in 2022, with the U.S. at the forefront. The regional growth can be attributed to the increasing number of SMEs, establishment of major IT hubs in the region, and aggressive investments made by the governments to strengthen the cyber security infrastructure. Furthermore, as a result of fast digitization and increased internet usage, Intellectual Property of businesses and people alike have become vulnerable to theft and infringement. Due to security threats, businesses must deploy data-protection measures, such as encryption software which allows businesses to protect their Intellectual Property and other sensitive data.

Asia Pacific is anticipated to grow at a CAGR of around 22% during the forecast period. Asia Pacific is witnessing an increase in cyberattacks, which can be attributed to the rapid digitalization coupled with inadequate cybersecurity training, regulations and awareness for data security.

While ransomware remains one of the preferred modes of cyberattacks, cybercriminals are gradually shifting from ransomware to crypto-jacking, which happens to be a simpler, more profitable, and less risky method of intrusion. As reported by Microsoft, crypto-jacking is five times more prevalent in India than the global average, and India encounters the second highest crypto-jacking incidents in Asia Pacific. Furthermore, developed countries such as Singapore, Japan, New Zealand, South Korea, and Australia are more prone to crypto-jacking risks. However, these countries, being strong digital economies, are well-positioned to deal with and mitigate cyber threats. These factors would drive the regional public key infrastructure market during the forecast period.

Key Companies & Market Share Insights

The key players operating in the public key infrastructure market include GlobalSign, Entrust Corporation, Microsoft Corporation, eMudhra, HID Global Corporation, AppViewX, and Google LLC, among others to broaden their product offering, companies utilize a variety of inorganic growth tactics, such as regular mergers acquisitions, and partnerships.

In September 2023, eMudhra Limited, a security solution provider, launched Advanced/Qualified Electronic Signatures (AES/QES) under its flagship product, emSigner. With this integration, the signing process becomes more streamlined efficient, which allows users access their identity attributes, while accelerating the signing process in emSigner’s paperless workflow solution.

Key Public Key Infrastructure Companies:

- Amazon Web Services, Inc.

- AppViewX

- DigiCert, Inc..

- eMudhra Limited

- ENIGMA Information Protection Systems

- Entrust Corporation

- FutureX

- GlobalSign

- Google LLC

- HID Global Corporation

- Keyfactor

- Microsoft Corporation

- Sectigo

- SSL.com

- STORMSHEILD

- WISeKey International Holding Ltd

Public Key Infrastructure Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 5.39 billion |

|

Revenue forecast in 2030 |

USD 19.20 billion |

|

Growth rate |

CAGR of 19.9% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, consumer behavior analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, enterprise size, application, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; South Korea; Brazil; Mexico; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

GlobalSign; Entrust Corporation; DigiCert, Inc.; Microsoft; HID Global Corporation; Google; Amazon Web Services, Inc.; AppViewX; Sectigo; FutureX; Keyfactor; SSL.com; eMudhra Limited; STORMSHEILD; ENIGMA Information Protection Systems; WISeKey International Holding Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Public Key Infrastructure Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global public key infrastructure (PKI) market report based on component, deployment, enterprise size, application, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware Security Modules (HSM)

-

Solutions

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Small & Medium Enterprises (SMEs)

-

Large Enterprises

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Web Browsing Security

-

Email Security

-

Secure Communication

-

Authentication

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & Telecom

-

Government & Defense

-

Media and Entertainment

-

Retail

-

Healthcare

-

Manufacturing

-

Education

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global public key infrastructure Market size was estimated at USD 4.57 billion in 2022 and is expected to reach USD 5.39 billion in 2023.

b. The global public key infrastructure market is expected to grow at a compound annual growth rate of 19.9% from 2023 to 2030 to reach USD 19.20 billion by 2030.

b. Based on component, the solutions segment dominated the market in 2022 with a share of over 50% owing to the increasing concerns about data protection and the widespread technological transition which significantly boosts demand for security solutions.

b. The key players in this industry are GlobalSign, Entrust Corporation, DigiCert, Inc., Microsoft, HID Global Corporation, and others.

b. Key factors that are driving the public key infrastructure market growth include the increasing adoption of enterprise key management among IT and security professionals, growing adoption of smart technologies and distributed applications, and the advent of 5G.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."