- Home

- »

- Next Generation Technologies

- »

-

Public Cloud Market Size & Share, Industry Report, 2033GVR Report cover

![Public Cloud Market Size, Share & Trends Report]()

Public Cloud Market (2026 - 2033) Size, Share & Trends Analysis Report By Service (IaaS, PaaS, SaaS), By Enterprise Size (SMEs, Large Enterprises), By End Use (BFSI, Manufacturing, Healthcare, Retail & Consumer Goods), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-215-0

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Public Cloud Market Summary

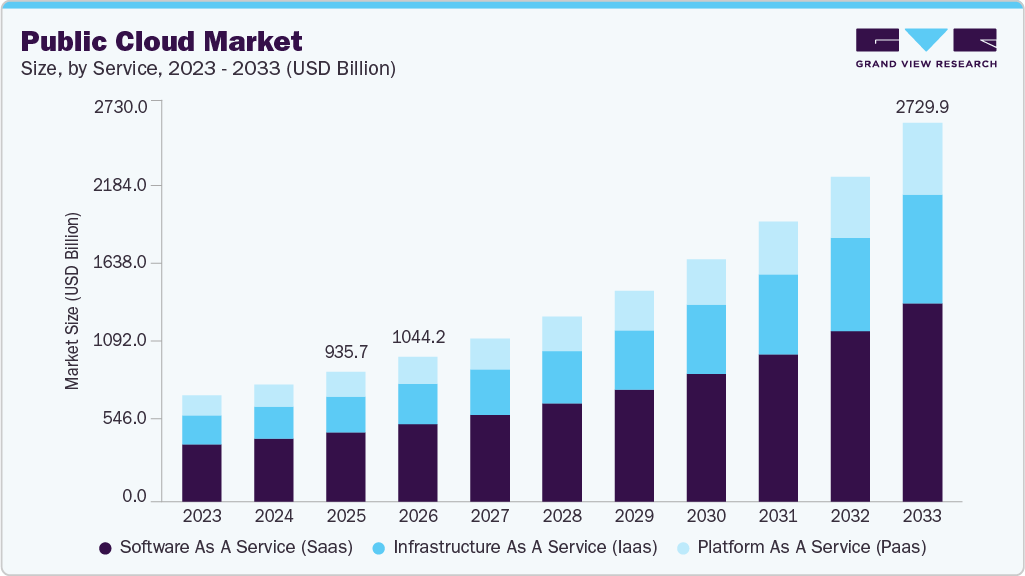

The global public cloud market size was estimated at USD 935.71 billion in 2025 and is projected to reach USD 2,729.95 billion by 2033, growing at a CAGR of 14.7% from 2026 to 2033. In recent years, businesses across different sectors have been modernizing their operations, and this shift has naturally pushed them toward public cloud solutions.

Key Market Trends & Insights

- North America public cloud dominated the global market with the largest revenue share of 38.7% in 2025.

- The public cloud industry in the U.S. is expected to grow significantly over the forecast period.

- By service, the Software as a Service (SaaS) segment led the market and held the largest revenue share of 53.6% in 2025.

- By enterprise size, the SMEs segment held the largest revenue share in 2025.

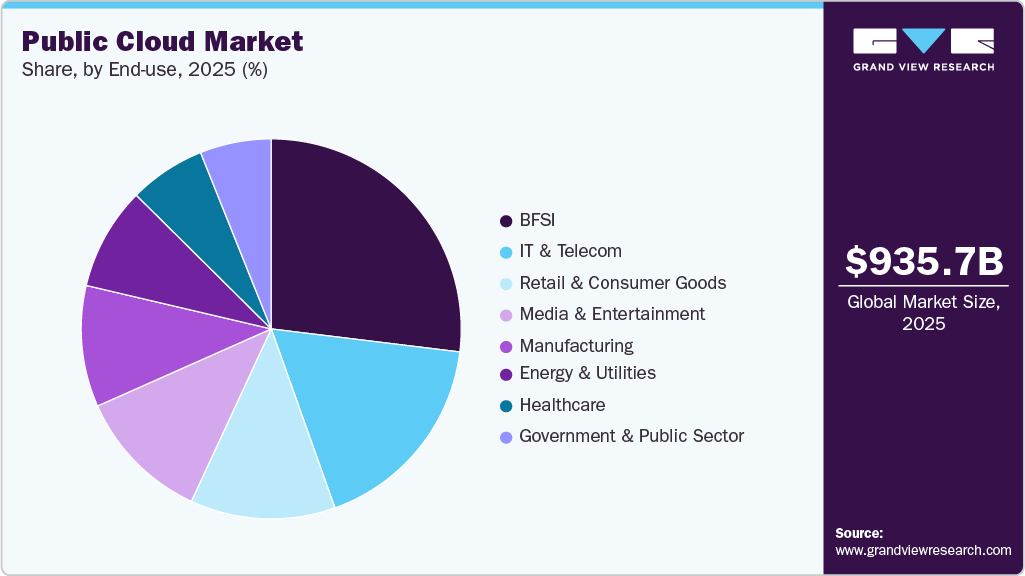

- By end use, the BFSI segment held the largest revenue share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 935.71 Billion

- 2033 Projected Market Size: USD 2,729.95 Billion

- CAGR (2026-2033): 14.7%

- North America: Largest market in 2025

- Asia Pacific: Fastest Growing Market

Companies are choosing these services because they help reduce IT costs, accelerate the rollout of new tools, and offer the flexibility to scale resources as needed. Today, organizations rely on the public cloud for everything from storing data and running emails to supporting applications and expanding computing power as their needs grow.The growing adoption of newer technologies, such as AI, machine learning, and similar tools, has prompted more companies to shift toward cloud services as they seek to enhance their technical capabilities. Businesses today rely heavily on data for making everyday decisions, and they need quick insights, ample storage space, and seamless communication across various channels. All these needs have made public cloud services an essential choice for many organizations.

In recent years, companies across various industries have updated their operations and enhanced their systems by leveraging new technology. This includes things like better ways to follow rules, store and protect data, recover information after problems, improve networks, and analyze data faster. For instance, in December 2025, SAP announced the successful digital transformation of Birla Opus Paints, a key business of Grasim Industries Ltd. under the Aditya Birla Group. As part of its plan to build a modern and scalable paints enterprise, Birla Opus adopted SAP’s integrated cloud solutions to create a strong digital foundation across its operations.

The growing popularity of online streaming and on-demand video is also supporting the public cloud market. Entertainment and media companies are turning to the public cloud because it enables them to deliver more personalized content and handle the high traffic associated with live and high-quality streaming. Cloud services allow these companies to scale quickly, manage their workflows more easily, offer tailored user experiences, cut down on infrastructure costs, and strengthen security. These benefits are expected to drive even stronger cloud adoption in the entertainment and media sector in the coming years.

The use of cloud technology by e-commerce websites is also contributing to the growth of the industry. Online shopping platforms often experience significant growth in traffic and sales during busy seasons, and cloud services enable them to quickly expand capacity to handle the surge. After the demand goes back to normal, businesses can scale down and only pay for what they used. As more and more retail sites migrate their systems to the cloud to enhance performance and establish sustainable business models, demand for public cloud services continues to increase. For instance, in October 2025, Tencent Cloud partnered with eMAG, a major e-commerce player in Central and Eastern Europe, to support its digital growth. By using Tencent Cloud’s advanced infrastructure and AI capabilities, eMAG can handle peak traffic more efficiently, improve customer experiences, and scale its services securely as demand increases.

Service Insights

The Software as a Service (SaaS) segment dominated the market with a revenue share of 53.6% in 2025. This segment is primarily influenced by factors such as accessibility without local installations, remote monitoring, reduced burden on IT teams through seamless upgrades, cost efficiency achieved through subscription-based payments, and the availability of diverse SaaS applications. Businesses from various industries are focusing on adopting emerging technologies to enhance user experiences and achieve operational efficiencies. SaaS offerings play an important role in these digital transformation processes.

The Infrastructure as a Service (IaaS) segment is expected to grow at the fastest CAGR during the forecast period. Growth of this segment is primarily influenced by the rapid rate of digital transformation activities in multiple industries, including banking, financial services and insurance, IT & telecom, retail, manufacturing, and others. Companies prefer to adopt pay-as-you-go models as they allow minimal investments in hardware and software. The cost efficiency achieved by accommodating Infrastructure as a Service (IaaS) has been attracting multiple small and medium-sized enterprises to this segment. SMEs prefer renting servers, storage systems, virtual machines, and other equipment, and only pay for support, licenses, and other services, as they opt for public cloud services.

Enterprise Size Insights

The large enterprises segment is anticipated to witness significant growth over the forecast period. This growth is mainly driven by the need to handle large-scale technology deployments and manage complex operations across multiple locations. Large enterprises prefer public cloud services because they reduce upfront investment, support remote access and monitoring, and facilitate easier management of dispersed teams. These organizations also rely on cloud platforms to adopt advanced technologies such as AI and IoT, which require scalable and flexible infrastructure.

The SME segment is expected to experience the fastest CAGR of 15.7% from 2026 to 2033, driven by factors such as the inclination of small and medium-scale businesses to adopt a pay-as-you-go-based service, the unavailability of investment funds for private cloud deployments, and the availability of multiple services tailored by industry experts specifically for SMEs. Private cloud services necessitate paying for hardware, virtual machines, and servers, which adds to operational costs. SMEs prefer renting equipment and servers for only the specified time, while paying for licenses, subscriptions, support, and more. These aspects are expected to grow in this segment during the forecast period.

End Use Insights

The BFSI segment dominated the market and accounted for the largest revenue share in 2025, driven by the sector’s accelerated shift toward digital operations. Banks, financial institutions, and insurance providers are increasingly relying on digital channels such as mobile banking apps, online payment platforms, and web-based services, which have significantly expanded their data footprint. Public cloud solutions enable BFSI companies to securely store and process large volumes of sensitive data while ensuring high availability and performance. In addition, cloud platforms support critical applications, disaster recovery, fraud detection, real-time analytics, and the deployment of advanced technologies such as AI and machine learning. The flexibility, scalability, and cost efficiency offered by public cloud services make them well-suited to meet the operational, security, and compliance requirements of the BFSI sector.

The manufacturing segment is anticipated to grow at the fastest CAGR of 16.6% during the forecast period. The growth of this segment is primarily driven by factors such as technological transformations in the industry, fueled by the rapid adoption of automation solutions and the integration of emerging technologies, including AI and IoT, across multiple business functions. Numerous manufacturing businesses worldwide focus on reducing operational costs by incorporating advanced technologies and enhancing productivity by reducing human involvement. For instance, in August 2024, BMW AG, one of the key companies in the automotive industry, announced the successful testing of a humanoid robot in the Spartanburg plant of the company. Such technological advancements and integration with existing and newly innovated equipment are expected to generate a greater need for public cloud services in the manufacturing industry.

Regional Insights

The public cloud industry in North America dominated the global market in 2025, with a revenue share of 38.7%. The growth is primarily influenced by factors such as the presence of numerous key companies in the region, such as Google, Microsoft, Amazon, and others, growing digital transformation initiatives embraced by businesses operating in North America, and increasing demand for cloud services related to storage, data analytics, hosting, deployments, and more.

U.S. Public Cloud Market Trends

The U.S. public cloud industry held the largest revenue share of the regional industry in 2025. This market is primarily driven by factors such as early adoption trends in technology advancements, continuous growth in the integration of tools and systems powered by AI and IoT across multiple industries, and the increasing adoption of public cloud services by SMEs in the country. Small and medium-scale businesses, which support nearly 4 million jobs, are the backbone of the country's economy. Public cloud services empower SMEs' growing embrace of modern technologies, as SMEs prefer renting servers and other equipment while relying on the pay-as-you-go model for related transformations. The increasing application of SMEs from various sectors such as IT & telecom, manufacturing, retail, healthcare, and others is expected to fuel growth in this market during the forecast period.

Europe Public Cloud Market Trends

The public cloud industry in Europe is expected to grow at a significant CAGR over the forecast period. This is attributed to efforts by European nations and companies to attain digital sovereignty to control data and accomplish the ability to act independently in the modern digital world, growing investments by tech companies in the region, and the rapid rate of digital transformation activities. For instance, in May 2024, Amazon Web Services (AWS), revealed plans to invest approximately USD 8.68 billion in the AWS European Sovereign Cloud by 2040. As part of this initiative, AWS planned to establish its first cloud region in Germany’s state of Brandenburg, with operations planned to commence by the end of 2025. These factors are expected to generate an upsurge in demand for public cloud services in the area from 2026 to 2033.

The UK public cloud industry is expected to grow at a significant CAGR over the forecast period, driven by strong digital adoption across industries and increasing demand for scalable IT infrastructure. Businesses in sectors such as BFSI, retail, healthcare, and government are increasingly moving workloads to the cloud to improve efficiency, support remote working, and enable data-driven decision-making. In addition, rising investments in digital transformation, the expansion of data centers, and growing adoption of advanced technologies such as AI and analytics are further supporting public cloud adoption across the UK.

The public cloud industry in Germany is expected to register a significant CAGR over the forecast period. This is driven by factors such as multiple large enterprises operating in automotive, manufacturing, defense, personal care, retail, and other industries undergoing digital transformations and intelligence upgrades. The increasing adoption of automation, including modern technologies such as IoT and AI, as well as the inclination towards using public cloud solutions to ensure cost-effectiveness, is projected to drive this market's growth.

Asia Pacific Public Cloud Market Trends

The public cloud industry in the Asia Pacific is expected to witness the fastest CAGR from 2026 to 2033, driven by factors such as the growing application of public cloud technology in SMEs operating in the region, the rapid pace of digital transformations in countries such as India, China, and others, the availability of multiple service providers within the area, and the concentration of large enterprises from manufacturing, automotive, food & beverages industries to reduce costs through technology integrations.

The Japan public cloud industry is expected to grow significantly in the coming years. The domestic market has witnessed significant developments in recent times, reflecting the country's growing reliance on digital infrastructure. With a strong technological landscape and increasing internet penetration, Japanese businesses across various sectors are turning to CDNs to optimize digital content and service delivery.

The public cloud industry in India held a significant revenue share of the regional industry. This is mainly driven by the industry's increasing digital transformation activities, growing dependence on data, availability of cost-effective public cloud solutions and services offered by key companies from various regions, and a large number of SMEs focusing on deploying modern technology solutions.

The China public cloud industry held a significant market share in 2025, supported by rapid digitalization across enterprises and strong adoption of cloud services by internet, e-commerce, and manufacturing companies. Businesses are increasingly using public cloud platforms to support big data analytics, AI applications, and scalable online services. In addition, government initiatives promoting digital infrastructure, along with the presence of major domestic cloud providers, have further accelerated cloud adoption across various industries in China.

Key Public Cloud Company Insights

Key players operating in the public cloud industry are Alibaba Cloud, Amazon Web Services, Inc., Broadcom, DigitalOcean, LLC., Fujitsu, Google, Huawei Cloud Computing Technologies Co., Ltd., IBM, and others. The companies are focusing on various strategic initiatives, including new product development, partnerships & collaborations, and agreements to gain a competitive advantage over their rivals.

-

Oracle is a global technology company recognized for its enterprise software, databases, and cloud computing solutions. Its Oracle Cloud Infrastructure (OCI) offers a full range of public cloud services, including IaaS, PaaS, SaaS, and multicloud solutions that help organisations build, run, and scale applications worldwide. Oracle’s cloud services support high performance, strong security, and a broad global presence, making it a key player in the public cloud market.

-

DigitalOcean is a U.S.-based cloud provider focused on simple and affordable public cloud services for developers, startups, and small-to-medium businesses. It offers infrastructure tools, including virtual servers (Droplets), managed databases, Kubernetes, storage, and app hosting, that help users build and scale applications easily. With a global footprint of data centers, DigitalOcean supports rapid deployment and growth across markets worldwide.

Key Public Cloud Companies:

The following are the leading companies in the public cloud market. These companies collectively hold the largest market share and dictate industry trends.

- Alibaba Cloud

- Amazon Web Services, Inc.

- Broadcom

- DigitalOcean, LLC.

- Fujitsu

- Huawei Cloud Computing Technologies Co., Ltd.

- IBM

- Microsoft

- Oracle

- OVH SAS

- Salesforce, Inc.

- SAP

- Tencent

- Vultr

Recent Developments

-

In December 2025, Amazon Web Services (AWS) announced major public cloud advancements at its re:Invent 2025 event, unveiling powerful new technologies such as autonomous Frontier agents, the Trainium3 UltraServers AI training infrastructure, expanded Amazon Nova AI models, and AI Factories for hybrid cloud deployments, strengthening its cloud service capabilities for real-time AI and enterprise workloads.

-

In December 2025, Wipro expanded its strategic partnership with Google Cloud to advance enterprise productivity and global digital transformation using Gemini Enterprise. Wipro is deploying Gemini Enterprise across core internal functions and will also support joint customers in scaling secure, production-ready AI solutions. The collaboration strengthens Wipro’s AI-led services and reinforces Google Cloud’s enterprise AI adoption worldwide.

-

In November 2025, Google Cloud announced plans to launch a new public cloud region in Türkiye as part of a USD 2 billion investment in collaboration with Turkcell. This hyperscale cloud region will bring advanced cloud services, support AI innovation, improve data security, and meet growing local demand with high-performance, low-latency infrastructure for enterprises and public sector organizations.

-

In November 2025, Oracle announced the opening of its second public cloud region in Italy, located in Turin, to support growing demand for AI and cloud services. The new region enables enterprises, startups, and public sector organizations to access Oracle’s advanced cloud, generative AI, and multicloud capabilities, with TIM Enterprise serving as the hosting partner.

Public Cloud Market Report Scope

Report Attribute

Details

Market size in 2026

USD 1,044.16 billion

Revenue forecast in 2033

USD 2,729.95 billion

Growth rate

CAGR of 14.7% from 2026 to 2033

Actual data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2026 to 2033

Report application

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Service, enterprise size, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East and Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; India; Japan; Australia; South Korea; Brazil; UAE; The Kingdom of Saudi Arabia; South Africa

Key companies profiled

Alibaba Cloud; Amazon Web Services, Inc.; Broadcom; DigitalOcean, LLC.; Fujitsu; Google; Huawei Cloud Computing Technologies Co., Ltd.; IBM; Microsoft; Oracle; OVH SAS; Salesforce, Inc.; SAP; Tencent; Vultr

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Public Cloud Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the public cloud market report based on service, enterprise size, end use, and region.

-

Service Outlook (Revenue, USD Billion, 2021 - 2033)

-

Infrastructure as a Service (IaaS)

-

Platform as a Service (PaaS)

-

Software as a Service (SaaS)

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2021 - 2033)

-

SMEs

-

Large Enterprises

-

-

End Use Outlook (Revenue, USD Billion, 2021 - 2033)

-

BFSI

-

IT & Telecom

-

Retail & Consumer Goods

-

Manufacturing

-

Energy & Utilities

-

Healthcare

-

Media & Entertainment

-

Government & Public Sector

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Key factors driving the growth of the public cloud market include digital transformation among industries, rising penetration of internet & mobile devices across the world, and an increase in consumption of big data. Moreover, the rise in the internet of things (IoT), edge computing, 5G, and the use of real-time analytics enabled by artificial intelligence are also expected to boost the utility of the public cloud.

b. The global public cloud market size was estimated at USD 935.71 billion in 2025 and is expected to reach USD 1,044.16 billion in 2026.

b. The global public cloud market is expected to witness a compound annual growth rate of 14.9% from 2026 to 2033 to reach USD 2,765.44 billion by 2033.

b. Software as a Service (SaaS) accounted for the largest market share of 53.6% in 2025 owing to its flexible costs, easy maintenance, and enterprise size. Moreover, user spending on business intelligence SaaS applications, growth of technologies such as machine learning, and IoT will also propel the growth of the market.

b. Some key players operating in the public cloud market include Alibaba Cloud; Amazon Web Services, Inc.; Broadcom; DigitalOcean, LLC.; Fujitsu; Google; Huawei Cloud Computing Technologies Co., Ltd.; IBM; Microsoft; Oracle; OVH SAS; Salesforce, Inc.; SAP; Tencent; Vultr

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.