- Home

- »

- Medical Devices

- »

-

PTA Balloon Catheter Market Size And Share Report, 2030GVR Report cover

![PTA Balloon Catheter Market Size, Share & Trends Report]()

PTA Balloon Catheter Market (2024 - 2030) Size, Share & Trends Analysis Report By Material Type (Polyurethane, Nylon), By Application (Peripheral Artery Disease), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-758-2

- Number of Report Pages: 85

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

PTA Balloon Catheter Market Summary

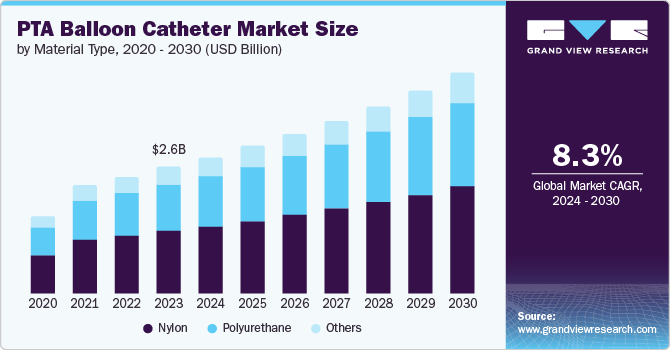

The global PTA balloon catheter market size was estimated at USD 2,652.7 million in 2023 and is projected to reach USD 4,628.3 million by 2030, growing at a CAGR of 8.3% from 2024 to 2030. The rising geriatric population, increasing prevalence of cardiovascular diseases, and a growing number of minimally invasive surgical procedures are major factors boosting the market growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Canada is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, nylon accounted for a revenue of USD 1,307.2 million in 2023.

- Polyurethane is the most lucrative material type segment, registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 2,652.7 Million

- 2030 Projected Market Size: USD 4,628.3 Million

- CAGR (2024-2030): 8.3%

- North America: Largest market in 2023

Coronary artery disease, arrhythmias, peripheral vascular disease, and congenital heart defects are major cardiovascular diseases that are prevalent across the globe. PTA balloon catheters are majorly used for the treatment of such diseases.

An increase in the number of treatment options for cardiovascular disorders, such as peripheral artery disease (PAD), which, depending on the severity of the condition, may involve the need for surgery, is fueling the market growth. Atherosclerosis, diabetes, smoking, and high blood pressure are some of the key factors responsible for rising cardiovascular diseases, especially PAD. According to a University of Washington article published in October 2023, being an age-related disease, PAD has an increased prevalence rate of more than 14.91% in patients aged 80-84 years. Moreover, 113 million people aged 40 and above population are affected by the same disease. The rise in the geriatric population is thus another factor driving the market growth.

Growing preference for minimally invasive surgeries over open surgeries can be attributed to various factors such as lower costs, minimal trauma & incision, faster recovery, and low risk of complications. The increasing prevalence of cardiovascular diseases in emerging markets such as India and Brazil, along with the rising preference and affordability of minimally invasive surgeries in these countries, is propelling market growth in emerging countries.

Furthermore, a low threat of substitutes is another driving factor. There is no significant substitute currently in the market for PTA balloon catheters. Advantages like quick inflation, high deliverability, tractability assurance, and extended treatment reach with longer-length balloons make them ideal for use, thereby leaving low scope for substitutes. The PTA balloon catheter is designed for minimally invasive procedures, owing to which it is frequently recommended by physicians.

Technology advancements have resulted in the development of innovative products, which provide better outcomes. Companies are investing in research on new technologies and their safety studies and are receiving support from governments as well. For instance, in April 2022, Terumo Corporation announced the enrolment of the first patient for the study on its latest bobby balloon guide catheter.

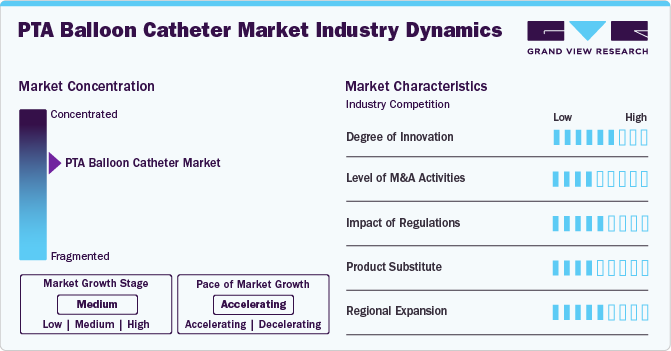

Industry Dynamics

The market is witnessing a high degree of innovation, with companies introducing advanced technologies like 3D surgical navigation devices and intravascular shock wave balloon catheter systems.

Several market players, such as Cardinal Health, Terumo Corporation, and Medtronic, are involved in mergers and acquisitions (M&A). Through M&A activity, these companies employ key strategies such as product innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing demand for minimally invasive cardiovascular interventions.

Regulations in the market have a significant impact, with changes necessitating manufacturers to adjust their products or processes accordingly. Moreover, regulations can also influence the competitive landscape in the market. Stringent regulations can create barriers to entry for new players, but they can also protect established companies from unfair competition.

Potential product substitutes in the industry include alternative interventional procedures such as atherectomy or stent placement, and non-invasive treatments like medication therapy. These alternatives may be considered based on patient-specific conditions and preferences, impacting the demand for PTA balloon catheters.

Market players are expanding regionally by entering new geographical markets, establishing partnerships with local distributors, and adapting products to meet specific regional healthcare needs.

Material Type Insights

The nylon segment held the largest share of over 49.29% in 2023 due to its unique properties that make it suitable for medical applications. One of these properties is its ability to stretch significantly when inflated. Nylon high-pressure balloons can stretch up to 100% to 800%, allowing them to fully conform to or impede the anatomy. This flexibility is particularly useful in applications where the balloon must bridge a lesion, as it allows the balloon to adjust to the shape of the vessel being treated. In addition, the thickness of the nylon balloon wall required for a given burst pressure means that the balloons have a broader profile when inserted into the body. This wider profile provides more surface area for the balloon to interact with the vessel walls, potentially improving the effectiveness of the treatment.

The polyurethane segment is expected to show lucrative growth during the forecast period. Polyurethane balloons offer excellent biocompatibility, making them safe for long-term implantation in the human body. They are also biodegradable, meaning they break down naturally over time, reducing the risk of causing adverse reactions in the body. These properties make polyurethane balloons an attractive choice for many medical procedures.

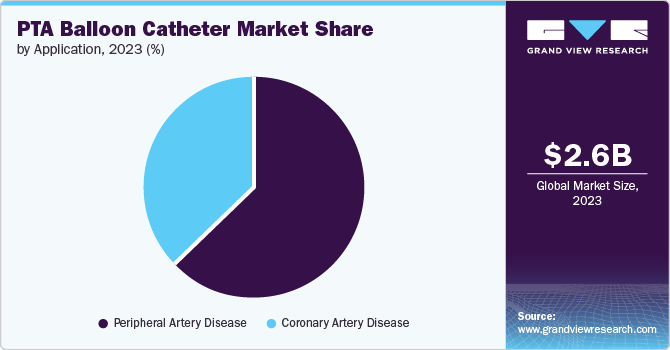

Application Insights

The peripheral artery disease segment held the largest share of 62.63% in 2023 due to the increasing prevalence of the condition. According to the AHA Journal published in June 2023, peripheral artery disease affects 200 million individuals worldwide. Moreover, the demand for PTA balloons in the treatment of PAD is further fueled by the fact that PAD is primarily caused by atherosclerotic disease, with similar risk factors as coronary artery disease. Effective diagnosis and management of atherosclerosis play a pivotal role in treating peripheral arterial disease, underscoring the significance of percutaneous transluminal angioplasty balloons as essential tools in its management. Moreover, the use of drug-eluting balloons, which deliver drugs directly to the site of inflammation, has become a common procedure in treating PAD, further driving the demand for PTA balloons in this application.

The coronary artery disease segment is expected to show lucrative growth during the forecast period due to its prevalence as a leading cause of death worldwide. For instance, as per a CDC report published in May 2024, about 375,476 people died due to coronary artery disease in 2021. CAD is often associated with a sedentary lifestyle, leading to chronic conditions such as diabetes and cardiovascular ailments. Harmful habits like lack of physical activity, excessive alcohol consumption, unhealthy eating, and smoking contribute to a growing prevalence of obesity, which in turn leads to various cardiovascular diseases. This increased demand for surgical intervention for the treatment of these disorders has increased the demand for PTA balloon catheters.

End-use Insights

The hospitals segment accounted for the largest revenue share of 40.28% in 2023 due to the increasing prevalence of cardiovascular diseases, the growing number of patient visits to hospitals for diagnosis, and the increasing number of cardiac implant procedures. Hospitals provide more advantages and options for better treatment services and equipment availability, leading to segment growth. The high number of surgeries performed in hospital settings due to credibility and the availability of highly reputed surgeons also leads to segment growth to cater to individual requirements, consolidating their stronghold in the market.

The ambulatory surgical centers segment is estimated to register the fastest CAGR over the forecast period due to the rising difficulty in acquiring an appointment and surgery dates for recovery at hospitals, coupled with the high cost of services and long hospital stay periods. These centers offer lower costs, faster discharge times, and easier appointment scheduling compared to traditional hospitals. As a result, they have gained popularity among patients seeking medical treatment.

Regional Insights

North America PTA balloon catheter market dominated with a share of 47.95% in 2023, owing to the favorable reimbursement policies, the introduction of new technologically advanced equipment & the presence of several key manufacturers. For instance, in January 2024, Summa Therapeutics, LLC introduced its new Finesse Injectable balloon catheter, indicating a substantial milestone in medical advancement. This innovative technology has been utilized in modern first-in-human injectable angioplasty procedures aimed at treating patients afflicted through below-the-knee (BTK) peripheral artery disease (PAD).

U.S. PTA Balloon Catheter Market Trends

The PTA balloon catheter market in the U.S. accounted for the largest share in the North America region in 2023. The key factors for the growth of the market are advanced healthcare infrastructure and the increasing prevalence of peripheral arterial disease. According to the Vascular Disease Management article published in April 2023, the prevalence of peripheral artery disease (PAD) in the U.S. surged to 21.0 million individuals in 2020. Estimates based on demographic shifts, particularly the aging population, indicate that by 2030, the number of people affected by PAD is expected to reach 23.8 million.

Europe PTA Balloon Catheter Market Trends

The PTA balloon catheter market in Europe held the second-largest revenue market share during the year 2023. Europe has a robust healthcare system, witnessing a shift from in-patient to out-patient care due to the growing presence of several medical equipment companies offering catheters in the region.

The Germany PTA balloon catheter market dominated the European region, with the highest revenue share of 26.45% in 2023. The increasing prevalence of cardiac disorders is expected to improve the demand for catheters to treat narrowing arteries in patients.

The PTA balloon catheter market in the UK held the second-largest market share in 2023. The prevalence of cardiovascular diseases, such as coronary artery disease, ischemic heart disease, and other heart-related disorders in the UK is expected to increase the demand for PTA balloon catheter devices.

The France PTA balloon catheter market is anticipated to witness a significant CAGR of 6.93% during the forecast period. The market growth in France is driven by the rising incidence of cardiovascular diseases, the growing number of hospitals and clinics, and lifestyle changes in the population.

Asia Pacific PTA Balloon Catheter Market Trends

The Asia Pacific PTA balloon catheter market is expected to grow at the fastest rate during the forecast period. This is attributed owing to the increase in the prevalence of cardiovascular diseases along with an increase in healthcare spending. As per BioMed Central, one in every five adults in China suffers from cardiovascular disease. Furthermore, the aging populations in countries such as Japan & China, as well as growing disposable incomes, are expected to drive market expansion in the region. The growth of health tourism in developing nations is also contributing to the market growth in the region.

China PTA balloon catheter market accounted for the second largest share in the Asia Pacific region in 2023 due to its rapidly growing healthcare sector, expanding medical infrastructure, and a large patient population. The country has witnessed substantial economic development, allowing for increased healthcare spending and investment in advanced medical technologies. Moreover, China's commitment to healthcare reform and improvement of medical services has driven the adoption of innovative medical devices like PTA balloon catheters, thereby contributing to the market growth.

The PTA balloon catheter market in Japan held the largest market share in the Asia Pacific region. The increasing incidence of lifestyle-related diseases, such as obesity and smoking-related conditions, is driving the demand for PTA procedures. In addition, the region has a huge number of geriatric population, and the population is prone to CVD cases, which boost the growth of the market.

The India PTA balloon catheter market is experiencing significant growth, driven by several key factors. The rising prevalence of cardiovascular diseases in India is boosting the demand for minimally invasive treatment options like PTA balloon catheters. Moreover, advancements in healthcare infrastructure and an increasing focus on improving access to healthcare services fuel market growth across urban and rural areas.

Latin America PTA Balloon Catheter Market Trends

The PTA balloon catheter market in Latin America is growing due to several factors. The increasing adoption of advanced medical technologies and techniques in the region drives the growth of the market. Economic development and rising disposable incomes allow for greater investment in healthcare. In addition, collaborations between local healthcare providers and international medical device companies facilitate the introduction of innovative products.

Brazil PTA balloon catheter market is expanding due to several distinct growth drivers. The rising number of cases like diabetes and hypertension significantly increases the need for angioplasty procedures. Moreover, enhanced healthcare infrastructure and increasing investments in the medical sector are facilitating the adoption of advanced medical devices.

MEA PTA Balloon Catheter Market Trends

The PTA balloon catheter market in MEA is expected to grow lucratively. The increasing prevalence of obesity and sedentary lifestyles in urban areas is leading to higher incidences of vascular diseases, driving the need for PTA balloon catheters. In addition, partnerships between local governments and international health organizations are enhancing healthcare delivery and infrastructure.

South Africa PTA balloon catheter market held a 22.6% share in 2023. An increase in health insurance coverage and reimbursement policies is driving patients' access to cardiovascular procedures like angioplasty. Moreover, the implementation of targeted public health campaigns is raising awareness about the importance of early detection and treatment of cardiovascular diseases.

Key PTA Balloon Catheter Company Insights

Some of the key players operating in the industry include Medtronic, Cardinal Health and Boston Scientific Corporation. Company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, Andratec and Natec Medical are some of the emerging market players in the PTA balloon catheter industry. These market players are continuously focused on niche segments, leveraging specialized technologies to differentiate themselves.

Key PTA Balloon Catheter Companies:

The following are the leading companies in the PTA balloon catheter market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic

- Tuermo Corporation

- Cardinal Health

- Boston Scientific Corporation.

- Natec Medical

- Cook Medical

- Biotronik

- Surmodics, Inc.

- Andratec

Recent Developments

-

In January 2024, Cook Medical declared that its Slip-Cath Beacon Tip hydrophilic selective catheter is accessible for utilization in both the U.S. and Canada.

-

In June 2023, Cook Medical announced the availability of its Advance Serenity hydrophilic percutaneous transluminal angioplasty balloon catheter product line in new size options and locations.

-

In March 2023, BrosMed declared the CE MDR approval for its Tiche 0.035 High-Pressure PTA Balloon Dilatation Catheter, designed for addressing severely calcified peripheral vascular disease and challenging AV cases under the European Medical Device Regulation (MDR).

PTA Balloon Catheter Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.87 billion

Revenue forecast in 2030

USD 4.63 billion

Growth Rate

CAGR of 8.32% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

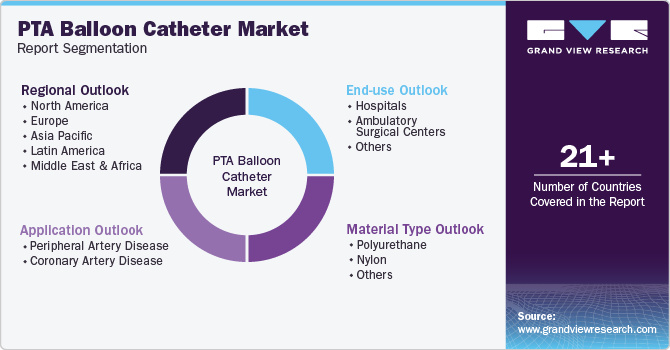

Segments covered

Material type, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Boston Scientific Corporation; Cardinal Health; Medtronic plc; Natec Medical; Terumo Corporation; Cook Medical, Biotronik, AndraTec and Surmodics, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PTA Balloon Catheter Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global PTA balloon catheter market report based on material type, application, end-use, and region:

-

Material Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyurethane

-

Nylon

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Peripheral Artery Disease

-

Coronary Artery Disease

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global PTA balloon catheter market size was estimated at USD 2.65 billion in 2023 and is expected to reach USD 2.87 billion in 2024.

b. The global PTA balloon catheter market is expected to grow at a compound annual growth rate of 8.32% from 2024 to 2030 to reach USD 4.63 billion by 2030.

b. North America dominated the PTA balloon catheter market with a share of 47.95% in 2023. The presence of advanced healthcare infrastructure, rising incidence of PAD, and the presence of well-established manufacturers of PTA catheters are some of the key factors boosting the market growth.

b. Some key players operating in the PTA balloon catheter market include Medtronic plc; Terumo Corporation; Cardinal Health; Boston Scientific Corporation; Natec Medical; and Surmodics, Inc

b. Key factors that are driving the PTA balloon catheter market growth include the rising prevalence of cardiovascular diseases, the growing geriatric population, and an increasing number of minimally invasive surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.