- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Psyllium Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Psyllium Market Size, Share & Trends Report]()

Psyllium Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Psyllium Seeds, Whole Psyllium Husk), By Nature (Organic, Conventional), By Application (Food & Beverages, Dietary Supplements), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-361-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Psyllium Market Summary

The global psyllium market size was estimated at USD 347.8 million in 2023 and is projected to reach USD 660.7 million by 2030, growing at a CAGR of 9.7% from 2024 to 2030. Psyllium husk, derived from Plantago ovata seeds, is recognized for its high fiber content and health benefits, including digestive health promotion and cholesterol management.

Key Market Trends & Insights

- In terms of region, North America accounted for a revenue share of over 40.8% in 2023.

- Country-wise, The market in the U.S. is expected to grow at a CAGR of 10.8% from 2024 to 2030.

- In terms of product, The whole psyllium husk accounted for a revenue share of 75.0% in 2023.

- In terms of nature, Conventional psyllium accounted for a revenue share of 85.5% in 2023.

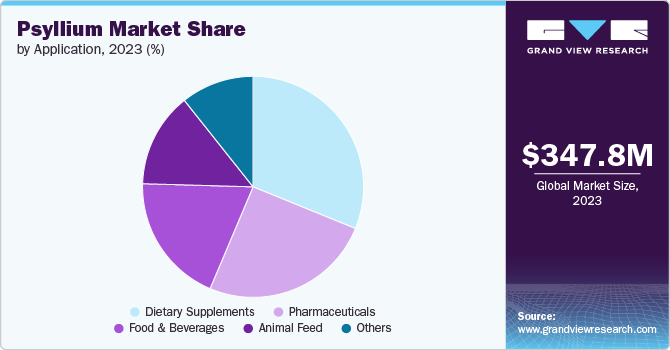

- In terms of application, dietary supplements accounted for a revenue share of 33.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 347.8 Million

- 2030 Projected Market Size: USD 660.7 Million

- CAGR (2024-2030): 9.7%

- North America: Largest market in 2023

As dietary fiber gains prominence in preventive healthcare, the demand for psyllium as a natural source of soluble fiber is expected to witness notable demand in the coming years, driving the market during the forecast period.Psyllium's health benefits, particularly its role in promoting digestive health and aiding in weight management, have contributed significantly to its market growth. Clinical studies have demonstrated psyllium's effectiveness in reducing low-density lipoprotein (LDL) cholesterol levels and improving glycemic control, making it a preferred choice among health-conscious consumers. Manufacturers are leveraging these health benefits through targeted marketing campaigns and product formulations aimed at both dietary supplement and functional food markets. The increasing consumer awareness of these benefits, coupled with rising incidences of lifestyle-related diseases, continues to drive the demand for psyllium during the forecast period.

Furthermore, psyllium is widely used as an active ingredient in laxatives, fiber supplements, and dietary fiber formulations due to its natural origin and regulatory approval for health claims related to digestive health. Manufacturers are innovating in product formulations to cater to specific health needs, such as products targeting irritable bowel syndrome (IBS) and constipation. Moreover, the demand for natural and organic ingredients in pharmaceutical and nutraceutical applications further boosts the adoption of psyllium-based products, thus, augmenting the market during the forecast period.

Regulatory support and health claims approval further plays an important role in driving the market. Regulatory agencies in key markets such as the FDA (Food and Drug Administration) in the United States and EFSA (European Food Safety Authority) in Europe have approved health claims related to psyllium's role in reducing the risk of heart disease by lowering cholesterol levels. These approvals enhance consumer confidence in psyllium products and support manufacturers in marketing their products with scientifically backed health claims. The regulatory framework also ensures product quality and safety standards, which are essential for market growth and consumer trust, further driving the psyllium market growth during the forecast period.

Furthermore, the market continues to expand geographically, driven by increasing consumer awareness and market penetration in both developed and emerging economies. North America and Europe dominate the global market due to high consumer awareness of dietary fiber benefits and strong regulatory support. However, Asia-Pacific is emerging as a significant market for psyllium, driven by growing health consciousness and dietary supplement usage in countries like India and China. Manufacturers are focusing on expanding their distribution networks and partnerships to capitalize on regional growth opportunities and strengthen their market presence globally.

Product Insights

The whole psyllium husk accounted for a revenue share of 75.0% in 2023. In the food industry, whole psyllium husk is used as a thickening agent, stabilizer, and texturizer in baked goods, cereals, snacks, and beverages. Its ability to enhance texture, moisture retention, and shelf life makes it a preferred ingredient among food manufacturers. Additionally, whole psyllium husk is also widely utilized in the pharmaceutical sector for formulating laxatives, dietary fiber supplements, and medical nutrition products. Its regulatory approvals and health claims related to digestive health and cholesterol management further support its market dominance over other psyllium forms and is further expected to have notable demand during the forecast period.

The psyllium husk powder market is expected to grow at a significant CAGR from 2024 to 2030. Psyllium husk powder is widely recognized for its high soluble fiber content and health-promoting properties, making it a preferred ingredient in dietary supplements and functional foods. The powder form offers convenience and versatility in formulation, allowing manufacturers to incorporate it into various products such as capsules, tablets, and powdered drink mixes. Consumer preference for natural and plant-based ingredients in supplements and functional foods has further fueled the demand for psyllium husk powder. These factors are expected to drive market growth for psyllium husk powder during the forecast period.

Nature Insights

Conventional psyllium accounted for a revenue share of 85.5% in 2023. According to Satnam Psyllium Industries, more than 90% of global psyllium production occurs in India. In India, farmers predominantly use conventional farming methods compared to organic methods, leading to the dominance of conventional psyllium in the market.

Furthermore, conventional farming methods typically involve higher yields and lower production costs, resulting in more affordable pricing for conventional psyllium products. This cost advantage makes conventional psyllium more accessible and attractive to a broader consumer base, including manufacturers in the pharmaceutical, dietary supplement, and food industries. These factors are expected to continue to drive demand for conventional psyllium across the world during the forecast period.

On the other hand, the organic psyllium segment is expected to grow at a significant CAGR from 2024 to 2030. Manufacturers and retailers are expanding their organic product lines to capitalize on the growing demand for organic psyllium. This includes launching organic dietary supplements, functional foods, and wellness products that prominently feature organic psyllium as a key ingredient. Furthermore, growth in organic psyllium consumption is particularly strong in North America and Europe, where consumer demand for organic products is high, further augmenting the demand and growth of organic psyllium during the forecast period.

Application Insights

Application of psyllium in dietary supplements accounted for a revenue share of 33.7% in 2023 in the market. Psyllium is widely recognized for its beneficial effects on digestive health. It is rich in soluble fiber, which helps promote regular bowel movements, relieve constipation, and improve overall gastrointestinal health. Consumers increasingly seek natural remedies like psyllium to manage digestive issues, contributing to its popularity in dietary supplements.

Furthermore, psyllium's health claims related to digestive health and cholesterol reduction have received regulatory approval in many countries, including the United States and the European Union. This regulatory support validates its efficacy and safety, boosting consumer confidence and facilitating market expansion in dietary supplements.

The application of psyllium in pharmaceuticals is expected to grow at a significant CAGR from 2024 to 2030. Psyllium's therapeutic benefits, particularly its efficacy in managing conditions such as irritable bowel syndrome (IBS), diverticular disease, and diabetes, have been supported by clinical studies. Evidence of its effectiveness in improving gastrointestinal symptoms and glycemic control has garnered interest from pharmaceutical companies seeking natural treatments.

Furthermore, Psyllium is formulated into prescription medications and over the counter (OTC) drugs targeting specific medical conditions. These formulations, often in the form of granules or powders, are regulated and marketed as therapeutic agents for gastrointestinal disorders and metabolic health. All these factors are expected to drive the sales of psyllium for the pharmaceuticals application during the forecast period.

Regional Insights

North America accounted for a revenue share of over 40.8% in 2023. North America has a notable consumer base that prioritizes health and wellness. There is a growing awareness among consumers and businesses alike regarding the health benefits of psyllium. Psyllium is widely recognized for its ability to promote digestive health, manage cholesterol levels, and support weight management. As health-consciousness continues to rise, demand for psyllium as an ingredient in dietary supplements, functional foods, and pharmaceutical products is expected to witness growth during the forecast period.

U.S. Psyllium Market Trends

The market in the U.S. is expected to grow at a CAGR of 10.8% from 2024 to 2030. The U.S. has a significant burden of chronic diseases such as obesity, diabetes, cardiovascular diseases, and gastrointestinal disorders. Psyllium's role in managing these conditions through its soluble fiber content is well-established, driving demand for psyllium ingredient among manufacturers looking to incorporate effective health solutions into their product lines, thus driving its market during the forecast period.

Europe Psyllium Market Trends

Europe is expected to grow with a CAGR of 9.8% from 2024 to 2030. Europe is experiencing demographic shifts with an aging population. Older adults prioritize health maintenance and disease prevention, driving demand for psyllium-based products that support healthy aging, cognitive function, and overall well-being, thus driving the market in the region during the forecast period.

Asia Pacific Psyllium Market Trends

Asia Pacific market is expected to grow at a CAGR of 8.7% from 2024 to 2030.Several countries in Asia Pacific, such as India, Indonesia, and the Philippines, have large youthful populations. Young adults prioritize preventive health measures and dietary supplements to maintain wellness, creating a significant market for psyllium-based products targeting digestive health and weight management.

Key Psyllium Company Insights

The global market is characterized by the presence of numerous well-established and emerging players. Manufacturers invest in research and development to innovate new psyllium formulations that cater to diverse consumer preferences and industry applications. This includes developing flavored powders, granules, capsules, and ready-to-mix products that enhance convenience and consumer acceptance. Furthermore, manufacturers are adhering to stringent quality assurance protocols and regulatory standards (e.g., GMP, FDA, EFSA) to ensure psyllium products meet safety, efficacy, and labeling requirements.

Key Psyllium Companies:

The following are the leading companies in the psyllium market. These companies collectively hold the largest market share and dictate industry trends.

- Satnam Psyllium Industries

- Virdhara International

- Premcem Gums Pvt. Ltd.

- Jyotindra International

- Abhyuday Industries

- Shree Mahalaxmi Psyllium Pvt. Ltd.

- Ispasen Remedies Private Limited

- Rajganga Agro Product Pvt. Ltd.

- Gayatri Psyllium Industries

- Shubh Psyllium Industries

- Psyllium Labs LLC

- Keyur Industries

Recent Developments

-

In February 2024, Satnam Psyllium Industries participated in the BIOFACH 2023, world's leading trade fairs for organic food and agriculture, held in Nuremberg, Germany. The company showcases its psyllium products including psyllium husk, psyllium seeds and psyllium husk powder in the exhibition in order to promoting its products and to explore international expansion opportunities, connecting with importers and distributors from various countries.

-

In February 2024, Manitoba Harvest, a prominent company in the hemp food partnered with the Brightseed, bioactives company to launch Manitoba Harvest Bioactive Fiber, which features psyllium husk fiber and Bio Gut Fiber, an ingredient Brightseed sources from upcycled hemp hulls. This fiber is made available at Whole Foods Market stores in the U.S.

-

In April 2023, Organic India USA, a company providing organic products and true wellness solutions has launched a new packaging format for its Psyllium Pre & Probiotic Fiber product. The new packaging replaces the existing pouch with a mess-free, easy-seal canister. The Psyllium Pre & Probiotic Fiber canisters are available in three flavors - Orange, Cinnamon Spice, and Original.

-

In May 2022, Amul introduced a new flavor in its ice cream portfolio called Isabcool ice cream. This innovative ice cream is made with a local ingredient known as Isabgol, or psyllium husk.

Psyllium Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 379.6 million

Revenue forecast in 2030

USD 660.7 million

Growth rate (Revenue)

CAGR of 9.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, nature, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; U.A.E.

Key companies profiled

Satnam Psyllium Industries; Virdhara International; Premcem Gums Pvt. Ltd.; Jyotindra International; Abhyuday Industries; Shree Mahalaxmi Psyllium Pvt. Ltd.; Ispasen Remedies Private Limited; Rajganga Agro Product Pvt. Ltd.; Gayatri Psyllium Industries; Shubh Psyllium Industries; Psyllium Labs LLC; Keyur Industries

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Psyllium Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global psyllium market report based on product, nature, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Psyllium Seeds

-

Whole Psyllium Husk

-

Psyllium Husk Powder

-

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Dietary Supplements

-

Pharmaceuticals

-

Animal Feed

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

U.A.E.

-

-

Frequently Asked Questions About This Report

b. Whole psyllium husk dominated the psyllium market with a share of 75.0% in 2023. The increasing demand from pharmaceutical, nutraceutical, and food industries for its natural dietary fiber properties is expected to drive its demand and growth during the forecast period.

b. Some key players operating in psyllium market include Satnam Psyllium Industries; Virdhara International; Premcem Gums Pvt. Ltd.; Jyotindra International; Abhyuday Industries; Shree Mahalaxmi Psyllium Pvt. Ltd.; Ispasen Remedies Private Limited; Rajganga Agro Product Pvt. Ltd.; Gayatri Psyllium Industries; Shubh Psyllium Industries; Psyllium Labs LLC; and Keyur Industries.

b. Key factors driving market is driven by its versatile applications in pharmaceuticals, food, and nutraceutical industries. Furthermore, growing consumer awareness of its health benefits, such as improving digestion and aiding weight management, along with increasing demand for natural dietary supplements and functional foods, further fuels market growth globally.

b. The global psyllium market size was estimated at USD 347.8 million in 2023 and is expected to reach USD 379.6 million in 2024.

b. The global psyllium market is expected to grow at a compounded growth rate of 9.7% from 2024 to 2030 to reach USD 660.7 million by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.