- Home

- »

- Consumer F&B

- »

-

Protein Tortilla Market Size, Share And Growth Report, 2030GVR Report cover

![Protein Tortilla Market Size, Share & Trends Report]()

Protein Tortilla Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Traditional Protein Tortillas, Low-carb/Zero-carb Protein Tortillas), By Source, By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-403-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Tortilla Market Size & Trends

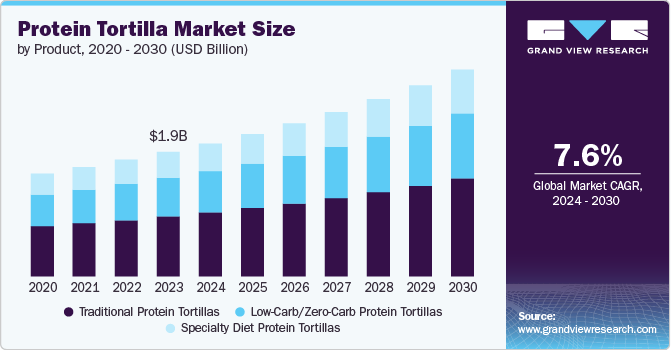

The global protein tortilla market size was estimated at USD 1.90 billion in 2023 and is expected to grow at a CAGR of 7.6% from 2024 to 2030. The market is driven by rising health consciousness and the growing popularity of high-protein diets among consumers seeking to enhance their nutritional intake and support fitness goals. The increasing adoption of specialty diets such as keto, paleo, and gluten-free further fuels the demand for protein-rich tortilla options. Innovations in food technology and ingredient sourcing have enabled the development of diverse and appealing protein tortilla products that cater to various dietary preferences, including plant-based alternatives like soy and pea protein tortillas.

Additionally, the expansion of modern retail channels and the growth of e-commerce platforms have made these products more accessible to a wider audience. The influence of social media and endorsements from fitness influencers and dietitians also play a crucial role in driving consumer interest and awareness. The rising awareness of health and wellness among consumers is a major driver of the protein tortillas market. As lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions become more prevalent, people are more conscious of their diet and nutritional intake.

Protein tortillas are seen as a healthier alternative to traditional tortillas due to their higher protein content, which supports muscle maintenance, weight management, and overall health. According to a report by the International Food Information Council (IFIC), approximately 60% of consumers are trying to get more protein in their diet. This shift in dietary focus has bolstered the demand for protein-enriched foods, including tortillas.

Health-conscious consumers are actively seeking products that offer better nutritional profiles without compromising on taste or convenience. The increasing popularity of high-protein diets, such as the Paleo, Keto, and Atkins diets, has significantly boosted the protein tortillas market. These diets emphasize the consumption of protein to promote weight loss, enhance muscle growth, and improve metabolic health. Protein tortillas align perfectly with these dietary trends, offering a versatile and convenient option for those looking to increase their protein intake.

According to the Global Wellness Institute, the global wellness economy is valued at over USD 4.5 trillion, with healthy eating, nutrition, and weight loss constituting a significant portion. As more people adopt these diets, the demand for protein-rich alternatives, including tortillas, is expected to rise. Manufacturers are capitalizing on this trend by introducing products that cater specifically to these dietary needs, ensuring they meet the taste and texture preferences of consumers.

Technological advancements in food processing and ingredient formulation have played a crucial role in the growth of the protein tortillas market. Innovations in protein extraction and fortification techniques have enabled manufacturers to enhance the protein content of tortillas without compromising their sensory qualities. This has resulted in the development of high-quality protein tortillas that retain the texture, flavor, and appearance of traditional tortillas. For instance, companies are utilizing plant-based proteins such as pea protein, soy protein, and chickpea protein to create protein tortillas that appeal to a broad range of consumers, including vegetarians and vegans.

Product Insights

Traditional protein tortillas accounted for a revenue share of 48.2% in 2023 due to their established presence and consumer familiarity. These tortillas have been a staple for a longer period, giving them a substantial lead in market penetration. Their appeal lies in the balance they strike between taste and nutritional value, offering a familiar flavor profile that resonates with a wide range of consumers, from fitness enthusiasts to those seeking healthier everyday options. Additionally, traditional protein tortillas benefit from well-established production and distribution networks, ensuring consistent availability across various regions. The simplicity and minimal ingredient list of traditional protein tortillas often translates to lower production costs, making them more affordable for a broader consumer base.

Specialty diet protein tortillas are expected to grow at a CAGR of 8.0% from 2024 to 2030. This growth can be attributed to the rising awareness and adoption of various dietary regimes like keto, paleo, and gluten-free diets. As consumers become more health-conscious and seek personalized nutrition solutions, the demand for products that cater to specific dietary needs is increasing. Specialty diet protein tortillas cater to niche markets with specific nutritional requirements, such as low-carb or high-fiber content, making them highly attractive to health-conscious consumers. The growth is also driven by the innovation in ingredient sourcing and processing technologies, allowing manufacturers to create tortillas that align with these specialty diets without compromising on taste and texture. Additionally, the surge in food allergies and intolerances has led to a greater demand for gluten-free and allergen-free options, further propelling the growth of this category.

Source Insights

Soy protein tortillas accounted for a revenue share of 35.1% in 2023 due to soy’s high protein content and its status as a complete protein source, containing all essential amino acids. This makes soy a highly desirable ingredient for creating protein-rich foods. Soy protein is also widely available and cost-effective, which translates to lower production costs and competitive pricing for the end product. Moreover, soy’s versatility allows it to be easily incorporated into various recipes without significantly altering taste or texture, which appeals to a broad consumer base. The established infrastructure for soy cultivation and processing further supports its dominance, as manufacturers have reliable access to high-quality soy protein. Besides, the growing popularity of plant-based diets has boosted the demand for soy-based products, as consumers seek sustainable and ethical protein sources.

Pea protein tortillas are expected to grow at a CAGR of 8.1% from 2024 to 2030. Pea protein is gaining recognition as a highly sustainable and environmentally friendly protein source, which aligns with the increasing consumer demand for eco-conscious products. Unlike soy, pea protein is hypoallergenic, making it a suitable option for consumers with soy or dairy allergies. The clean label appeal of pea protein, being non-GMO and often organic, attracts health-conscious consumers looking for minimally processed and natural products. The nutritional profile of pea protein, rich in essential amino acids, iron, and fiber, further supports its popularity among those seeking functional foods to support active lifestyles and overall health. Additionally, innovations in food technology have improved the taste and texture of pea protein products, overcoming previous barriers to consumer acceptance.

Distribution Channel Insights

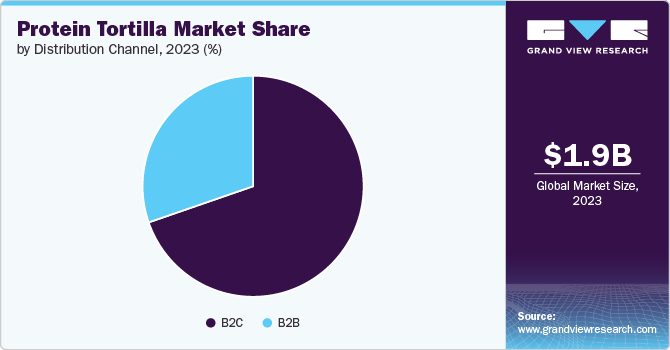

The sales of protein tortillas through the B2C channel accounted for a revenue share of 69.7% in 2023 due to the direct connection they facilitate between manufacturers and end consumers. This direct interaction allows for better consumer engagement and feedback, which can drive product innovation and improvement. B2C channels, particularly through online retail and direct-to-consumer e-commerce platforms, offer convenience and accessibility, allowing consumers to purchase protein tortillas from the comfort of their homes. The rise of health and wellness trends has also led to increased consumer interest in specialty food products, which are often more effectively marketed and sold directly to consumers through targeted online advertising and social media campaigns.

The sales of protein tortillas through B2B are expected to grow at a CAGR of 7.4% from 2024 to 2030 due to the increasing demand from food service providers, including restaurants, cafes, and institutional food services such as schools and hospitals. As the health and wellness trend permeates the food service industry, more establishments are seeking to incorporate protein-rich options into their menus to cater to health-conscious consumers. B2B partnerships allow protein tortilla manufacturers to achieve larger volume sales and establish long-term contracts, providing a steady revenue stream. Additionally, the growing trend of meal kit delivery services and ready-to-eat meal providers is driving demand for bulk purchases of protein tortillas. Innovations in packaging and shelf-life extension also make protein tortillas more attractive to food service providers, as they can be stored and used over longer periods without compromising quality.

Regional Insights

North America protein tortillas market accounted for a revenue share of 40.2% in 2023. The region has a well-established tortilla market, with tortillas being a staple in many households, particularly in Mexican-American and Hispanic communities. The high level of health consciousness among North American consumers drives demand for protein-enriched food products, including tortillas. The robust food processing and manufacturing infrastructure in North America supports large-scale production and distribution, ensuring widespread availability of protein tortillas. Additionally, the region has a high level of innovation in food technology, leading to the development of various protein tortilla formulations that cater to diverse dietary preferences and needs. Strong marketing and branding efforts by leading companies, coupled with the presence of a large number of health and fitness influencers, further drive consumer awareness and demand.

U.S. Protein Tortilla Market Trends

The protein tortillas market in the U.S. is expected to grow at a CAGR of 7.4% from 2024 to 2030, the increasing health consciousness among American consumers is a primary driver, as people seek to improve their diets with protein-rich and low-carb foods. The growing popularity of fitness and bodybuilding trends also boosts the demand for protein-enriched products to support muscle building and recovery. The rise in the number of people following specific dietary regimes, such as keto, paleo, and gluten-free diets, further fuels the demand for specialty diet protein tortillas. Additionally, the diverse culinary culture in the U.S., with a significant influence from Mexican cuisine, creates a natural demand for tortillas, making protein-enhanced versions a logical and appealing product. The extensive availability of protein tortillas in various retail channels, including supermarkets, health food stores, and online platforms, ensures easy access for consumers.

Asia Pacific Protein Tortilla Market Trends

Asia Pacific protein tortillas market is expected to grow with a CAGR of 8.4% from 2024 to 2030, due to increasing pet ownership, rising disposable incomes, and growing awareness about pet health. Rapid urbanization and a burgeoning middle class in countries like China and India are driving higher spending on pets, including dental care products. The rise in pet adoption and the growing number of pet-friendly households are contributing to the surging demand for protein tortillas. Additionally, e-commerce growth in the region is facilitating greater access to a variety of pet products, including dental chews. The APAC market is also seeing a rise in local and international brands catering to the specific needs and preferences of pet owners in different countries, further fueling its rapid expansion.

Europe Protein Tortilla Market Trends

The protein tortillas market in Europe is expected to grow at a CAGR of 7.9% from 2024 to 2030, due to the increasing consumer interest in health and fitness, coupled with a strong demand for functional and fortified food products. Europe has a high level of health consciousness, with consumers actively seeking out products that offer additional health benefits, such as high protein content. The region’s well-established food processing industry and stringent quality standards ensure the production of high-quality protein tortillas that meet consumer expectations. The growing trend of veganism and plant-based diets in Europe is also driving the demand for protein tortillas made from plant-based sources like soy and pea protein. Furthermore, the increasing awareness of gluten-free diets and the rising incidence of food allergies and intolerances contribute to the demand for specialty diet protein tortillas.

Key Protein Tortilla Company Insights

The market is characterized by the presence of numerous players, along with several emerging players, contribute to a competitive landscape that fosters continuous innovation. They respond to market demands with new products and improved nutritional profiles. This dynamic environment drives companies to focus on research and development, ensuring their products are not only effective in maintaining oral health but also appealing to both pets and their owners. Furthermore, the competitive nature of the market encourages brands to invest in marketing strategies and educational campaigns to raise awareness about the importance of dental hygiene in dogs. Collaborations with veterinarians and endorsements from pet health experts are commonly used to build credibility and trust among consumers.

Key Protein Tortilla Companies:

The following are the leading companies in the protein tortilla market. These companies collectively hold the largest market share and dictate industry trends.

- Mission Foods

- Toufayan Bakeries

- La Tortilla Factory

- Turka

- The J.M. Smucker Company

- Ole Mexican Foods

- Protiplan

- BFree Foods

- T.Marzetti (Flatout)

- Life Pro Nutrition

Recent Developments

-

In June 2024, SimplyProtein, a B Corp certified maker of plant-based protein snacks, launched its first-ever protein tortilla chips. The new Restaurant-Style Tortilla Chips come in three delicious flavors: Sea Salt, Hint of Lime, and Hint of Habanero. Each 50-gram serving of 25 chips contains 12 grams of protein, 240 calories, 12-14 grams of fat, and just 20-22 grams of carbohydrates, with no added sugar. This makes them a better-for-you option compared to soy protein tortillas tortilla chips.

-

In March 2021, PepsiCo launched a new line of Keto-friendly almond flour tortilla chips under the Hilo Life brand, aimed at addressing consumer cravings for nostalgic snacks while adhering to low-carb diets. The chips are available in three flavors: Nacho Cheese, Ranch, and Spicy Salsa. Each serving contains 9 grams of protein and only 3 grams of net carbs, with no added sugars. The chips are part of PepsiCo's strategy to expand its offerings in the health-conscious snack segment, following the brand's earlier successful launches of low-carb cheese and nut mixes in retail stores across the U.S.

Protein Tortilla Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.03 billion

Revenue forecast in 2030

USD 3.2 billion

Growth rate

CAGR of 7.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Mission Foods; Toufayan Bakeries; La Tortilla Factory; Turka; The J.M. Smucker Company; Ole Mexican Foods; Protiplan; BFree Foods; Tumaros; T.Marzetti (Flatout); Life Pro Nutrition

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Tortilla Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein tortilla market report based on the product, source, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Traditional Protein Tortillas

-

Low-carb/Zero-carb Protein Tortillas

-

Specialty Diet Protein Tortillas

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Pea Protein Tortillas

-

Soy Protein Tortillas

-

Chickpea protein tortillas

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarket/Supermarkets

-

Specialty Stores

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global protein tortillas market size was estimated at USD 1.90 billion in 2023 and is expected to reach USD 2.03 billion in 2024.

b. The global protein tortillas market is expected to grow at a compounded growth rate of 7.6% from 2024 to 2030 to reach USD 3.2 billion by 2030.

b. Traditional protein tortillas accounted for 48.2% of the revenue share in 2023 due to their long-standing presence and consumer familiarity. Their balance of taste and nutrition appeals to a wide range of consumers, from fitness enthusiasts to those seeking healthier options. Established production and distribution networks ensure consistent availability, while their simplicity and lower costs make them affordable for a broad audience.

b. Some key players operating in protein tortillas market include Mission Foods; Toufayan Bakeries; La Tortilla Factory; Turka; The J.M. Smucker Company; Ole Mexican Foods; Protiplan; BFree Foods; Tumaros; T.Marzetti (Flatout); Life Pro Nutrition

b. Increasing health consciousness among consumers has led to a growing demand for high-protein, low-carb alternatives to traditional tortillas. The rise of plant-based diets and flexitarianism is fueling interest in protein-rich vegetarian options. Busy lifestyles are boosting the appeal of convenient, nutritious wraps and sandwiches. Growing awareness of gluten intolerance and celiac disease is creating demand for gluten-free protein tortillas.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.