- Home

- »

- Consumer F&B

- »

-

Protein Supplements Market Size, Industry Report, 2033GVR Report cover

![Protein Supplements Market Size, Share & Trends Report]()

Protein Supplements Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Protein Powders, Protein Bars), By Distribution Channel (Supermarkets, Online, DTC), By Application (Sports Nutrition, Functional Foods), By Source, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-694-3

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Supplements Market Summary

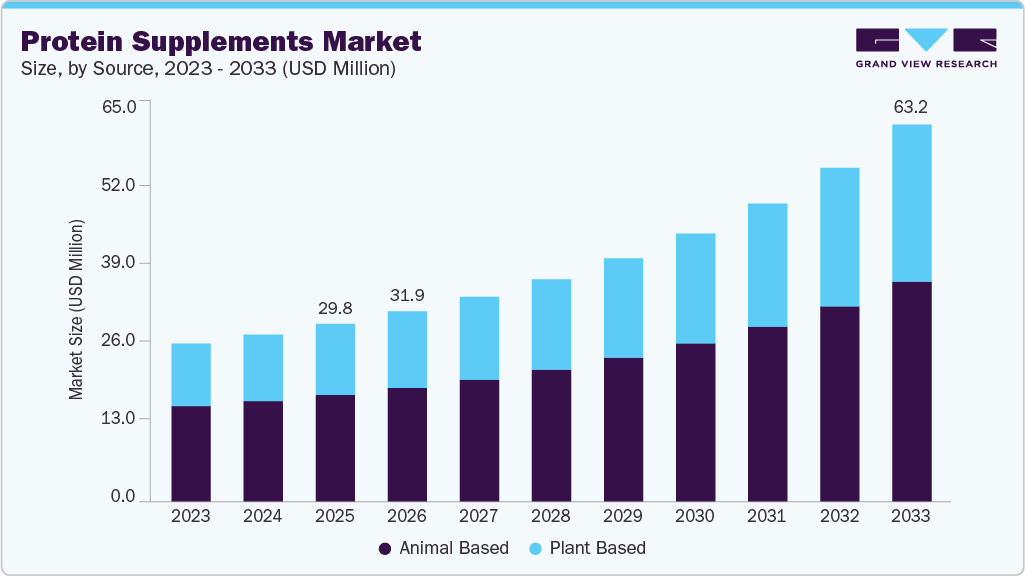

The global protein supplements market size was estimated at USD 29.78 billion in 2025 and is projected to reach USD 63.22 billion in 2033, growing at a CAGR of 10.3% from 2026 to 2033. Rising health and fitness awareness, product innovation and customization, e-commerce and digital marketing growth, and the expansion in the sports nutrition segment are some of the factors leading to the growth of the market.

Key Market Trends & Insights

- North America dominated the global protein supplements market with the largest revenue share of 40.8% in 2025.

- The protein supplements market in the U.S. accounted for the largest market revenue share in North America in 2025.

- By source, the animal-based supplements segment led the market with the largest revenue share of 59.9% in 2025.

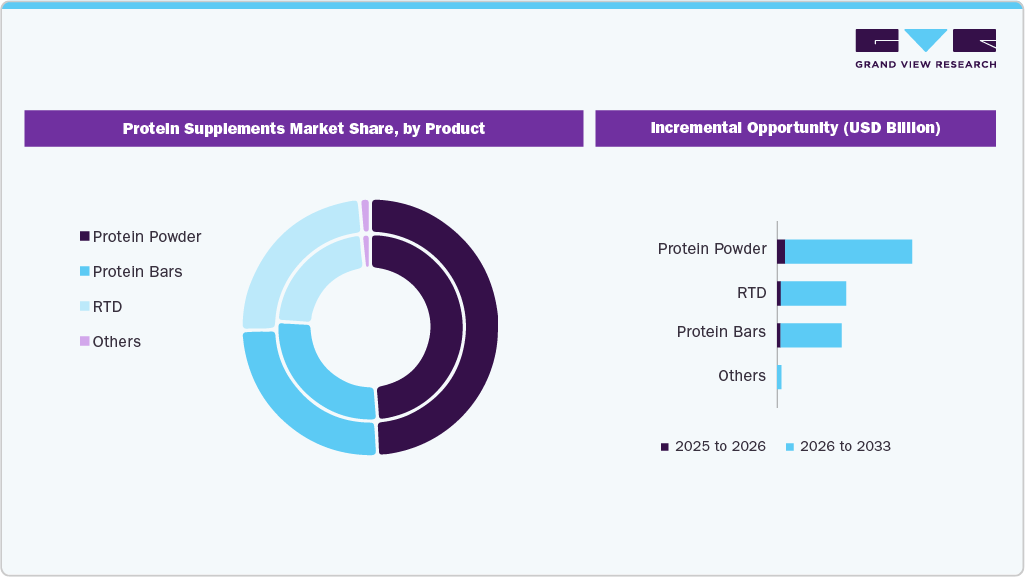

- By product, the protein powder segment accounted for the largest market revenue shareof 48.8% in 2025.

- By application, the functional food segment accounted for the largest market revenue share 50.9% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 29.78 Billion

- 2033 Projected Market Size: USD 63.22 Billion

- CAGR (2026-2033): 10.3%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

A rising number of consumers globally are seeking sustainable, animal-free, and non-GMO sources of protein. For instance, the U.S. has witnessed significant growth in the consumption of plant-based meat, driving the demand for plant-based protein ingredients. Cereal proteins and oilseed-based proteins are being used in new formulations by several manufacturers. Increasing government support for the plant-based protein industry is also contributing to market growth in North America.For instance, the Government of Canada is focused on commercializing new plant-based ingredients for food, livestock feed, and aquaculture industries. In June 2020, the Canadian Prime Minister announced a USD 100 million grant to an animal protein alternative company, Merit Functional Foods. The funds will be utilized by the company to set up its production plant in Canada. For instance, in May 2025, the U.S.-based Just One Protein brand launched nationwide at Whole Foods Market locations in the United States, offering a single-ingredient mung bean protein powder positioned as an everyday kitchen staple.

Furthermore, the application of proteins has increased in the sports nutrition and dietary supplements markets due to the growing demand for fortified ingredients, plant-based protein sources, and products with high stability and longer shelf life. Production methods influence the quality of protein ingredients and the end products, such as protein bars, protein powders, and beverages.

Certain proteins, such as wheat gluten and hemp, are associated with a starchy, bitter, and distinct aroma. The market is undergoing major improvements in manufacturing methods to address this issue and remove tetrahydrocannabinol (THC) from hemp seeds. Applied Food Sciences has improved the method of extracting protein from hemp seeds by including an additional step. Removing the outer shell of the hemp seed results in an ingredient free of the bitter and pungent flavor associated with hemp.

Moreover, microencapsulation technologies are gaining prominence in the protein supplements industry. Manufacturers use these techniques to achieve the controlled release of an ingredient in the human body. Microencapsulation of active compounds like minerals, vitamins, proteins, and omega-3s protects these compounds from oxidation reactions and loss of nutrients. Spray drying is among the most widely used techniques for encapsulating bioactive food ingredients such as fats, proteins, enzymes, and vitamins.

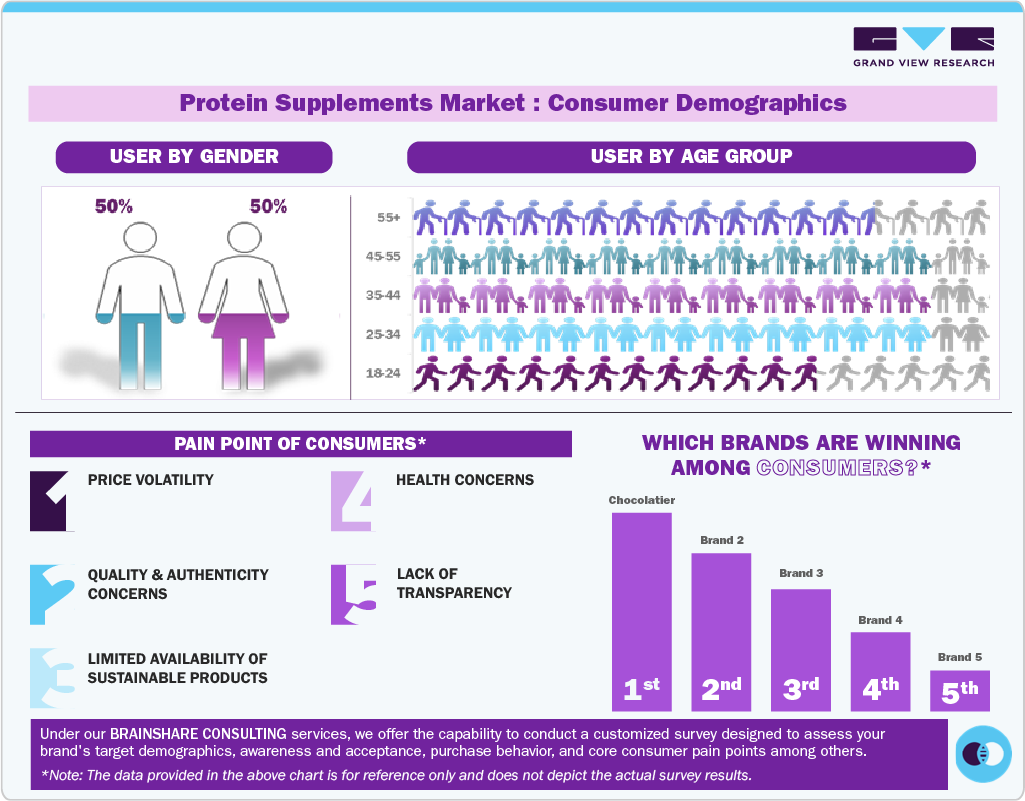

Consumer Insights for Protein Supplements

Consumers are increasingly viewing protein supplements as an essential part of a balanced diet rather than a niche fitness product. The growing awareness of protein’s role in muscle maintenance, weight control, and overall wellness has significantly expanded the consumer base beyond athletes and gym-goers. Millennials and Gen Z consumers are particularly driving demand for convenient, on-the-go formats such as protein bars, RTD shakes, and gummies. In addition, the clean-label trend is influencing preferences toward natural, minimally processed ingredients, with transparency in sourcing and nutritional content becoming key factors in purchasing decisions. Social media and influencer marketing continue to shape buying behavior and brand loyalty.

Plant-based protein supplements are gaining traction among health-conscious and environmentally aware consumers who seek sustainable and allergen-free alternatives to traditional whey or casein proteins. Female consumers represent a growing segment, driven by the use of protein products for toning and holistic wellness. Personalized nutrition and functional benefits, such as added collagen, vitamins, and probiotics, are emerging as strong purchase motivators. E-commerce platforms and subscription models are becoming preferred channels due to convenience and access to diverse product ranges. Moreover, consumers increasingly demand scientifically backed claims and certifications, emphasizing safety, efficacy, and taste innovation as decisive factors in repeat purchases and long-term brand engagement.

Source Insights

The animal-based protein supplements segment led the market with the largest revenue share of 59.9% in 2025. Whey, casein, collagen, and egg are key sources of animal proteins. The demand for animal-based protein supplements is likely to witness significant growth over the next few years owing to their many nutritional benefits. Animal sources have a higher protein concentration and are, therefore, preferred for manufacturing supplements.

The rising demand for high-value proteins is likely to drive market growth. According to Food Innovation Australia, global protein consumption grew by 40% between 2000 and 2018, mainly due to the growing population. Moreover, in March 2024, researchers in the United Kingdom published a study in the European Journal of Nutrition, citing that global protein demand could rise by over 20%. The study highlighted rising protein requirements driven by population growth, ageing demographics, and the environmental impact of traditional animal-based protein production. Primary demand for animal proteins is expected to originate from regions such as Asia and Sub-Saharan Africa.

Furthermore, innovations by casein producers are likely to support the incorporation of casein in protein supplements. For instance, in February 2021, Lactalis Ingredients launched Pronativ Native Micellar Casein, which is minimally processed with high amino acid content. This casein has a high protein density and supports bone health. According to the company, Pronativ casein is ideal for protein supplements meant for older people and the young population that has been following the healthy aging trend.

The plant-based protein segment is anticipated to register at the fastest CAGR of 10.8% during the forecast period. Rising consumer awareness regarding a healthy lifestyle is driving a shift toward new protein sources. Despite the high demand for animal-based proteins, several consumers are switching to a vegan diet owing to concerns regarding animal welfare and the meat industry’s impact on the environment. Due to increased demand, companies are developing products that cater to consumer needs. For instance, Herbalife, in August 2023, launched its plant-based supplement line, Herbalife V, in North America, featuring USDA Organic-certified and non-GMO certified products. The line included five items, such as protein shakes with 20 g of plant protein, greens boosters, and immune and digestive health formulas.

As more consumers turn to plant-based proteins, soy protein supplements have showcased immense growth potential. The United Soybean Board (USB) Soy Protein and Flexitarian Study conducted in May 2021 showed that 65% of respondents in the U.S. were more open to eating plant-based foods, with the highest interest among consumers in the age group 18-50.

Moreover, 40% of young adults actively seek to incorporate plant-based proteins into their diet, compared to only 25% of consumers seeking animal protein. According to the same survey, soy was the most preferred plant-based protein ingredient. This presents an opportunity for soy protein supplement manufacturers to capitalize on growing consumer interest and the latest trends in plant-based protein sources such as soy.

Further, the rising usage of wheat and rice in protein supplements is also favoring the growth of the segment. Ingredient manufacturers are launching innovative products in the wheat protein supplements industry and are expanding their reach through business expansions and mergers. For instance, in February 2022, PureField Ingredients, a U.S.-based wheat protein provider, completed the expansion of its facility in Kansas. The increase in capacity will help the company meet the rising demand for wheat protein-based products.

Product Insights

The protein powder segment led the market with the largest revenue share of 48.8% in 2025. The increasing consciousness toward health has driven the trend of incorporating protein powders into daily diets for weight management, muscle gain, and overall health and wellness. In addition, there is growing product demand from elite athletes, bodybuilders, and casual exercisers. Plant-based protein powders are also gaining popularity, driven by the increasing number of consumers opting for vegan or vegetarian diets.

Many companies are investing in research and development activities to offer innovative protein powder products that cater to consumers’ specific needs and preferences. For instance, the availability of protein powders that are plant-based, lactose-free, or specifically designed for women or athletes has increased in recent years.

In October 2022, Tata Consumer Products (TCP), which consolidates the food and beverage businesses of the Tata Group, expanded into the health supplements segment by introducing ‘Tata GoFit,’ a health supplement range designed specifically for health-conscious women. One of the products in the range is the Tata GoFit plant-protein powder that is simple to mix and contains probiotics beneficial for gut health. The powder is also free from lactose, soy, and added sugar.

As the market for protein powders grows, competition among manufacturers will increase, leading to a reduction in product prices, making them more accessible and affordable for a broader range of consumers. Moreover, in August 2025, SuperYou, co-founded by Celebrity Ranveer Singh, launched the “SuperYou Pro” high-performance vegan protein powder line, positioning it to meet the rapidly growing demand in the ₹4,000 crore (~ USD 455.9 Million) Indian protein supplement market. Strong online sales and mass distribution channels by companies such as The Nature's Bounty Co., Glanbia, and Iovate Health Sciences International Inc. have also increased the availability of protein powders.

The ready-to-drink (RTD) segment is expected to register at the fastest CAGR of 11.3% during the forecast period. The increasing demand for sports nutritional supplements and the growing popularity of easily consumable and readily available protein supplements are expected to drive the demand for RTD protein supplements over the forecast period.

In March 2022, MusclePharm Corporation, a global leader in sports nutrition products, announced its plan to expand in the RTD protein category by launching a new line of whey protein drinks in the summer of 2022. This high-protein beverage line was marketed under the well-established MusclePharm brand, offering more than 20g of protein per serving in various flavors.

Application Insights

The functional food segment led the market with the largest revenue share of 50.9% in 2025. Increasing awareness regarding leading a healthy and active lifestyle, coupled with a growing understanding of the relationship between exercising and maintaining a balanced and nutrient-rich diet, is driving the demand for protein-rich functional foods and beverages.

Functional foods are primarily consumed to ensure the intake of nutritional constituents essential for the human body. Rising occurrences of cardiovascular diseases owing to inactive and slow lifestyles and fluctuating dietary patterns, especially between the ages of 30 and 40, have driven consumer awareness regarding the importance of omega-3-based nutraceutical products, boosting their adoption.

The sports nutrition segment is expected to grow at the fastest CAGR of 10.1% during the forecast period. The increasing demand for sports nutritional supplements for core strength and endurance among athletes, weekend warriors, fitness enthusiasts, and professional athletes is expected to drive the segment. In addition, an increase in the number of gym-goers and rising demand for sports nutritional supplements to promote lean muscle growth, improve performance, assist in weight reduction, and boost stamina are expected to propel the segment growth.

Whey proteins exhibit prebiotic, antimicrobial, antioxidant, and hypertensive properties. In sports nutrition, protein supplements are used to manufacture various products such as low-pH clear beverages, nutritional beverages, RTD protein shakes, and dry mix beverages. All grades of whey proteins, including concentrates, isolates, and hydrolysates, have an excellent digestibility and amino acid profile. However, since hydrolyzed whey proteins are more expensive than their counterparts, most whey supplement manufacturers add a very small quantity of this ingredient to their respective formulas.

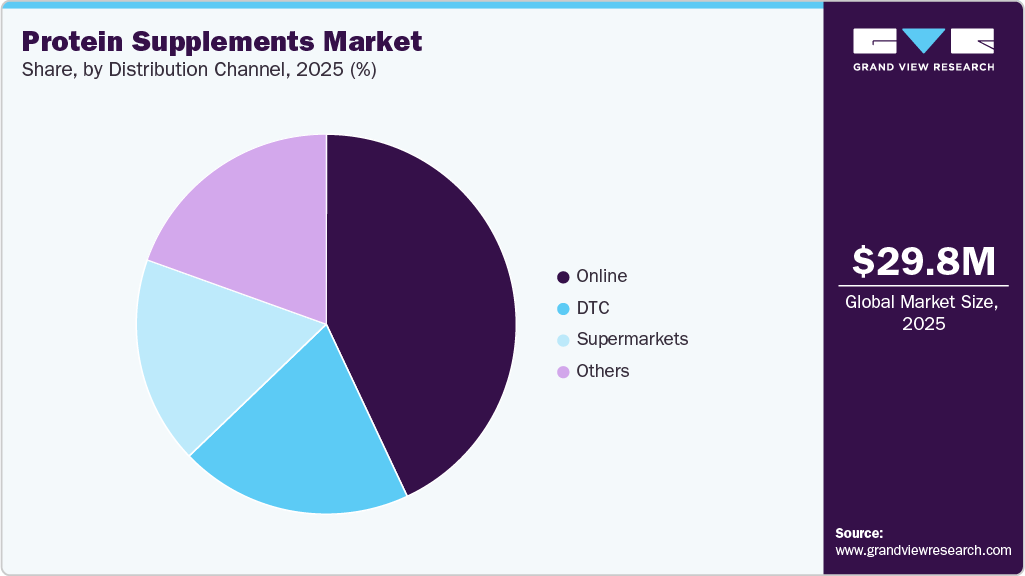

Distribution Channel Insights

The online segment led the market with the largest revenue share of 43.0% in 2025. The sales of protein supplements through the online distribution channel are expected to witness the highest growth in the coming years. Increased number of internet users, ease of access to numerous brands, fast-paced consumer lifestyle, 24/7 availability of products, convenience of shopping, and a wide range of products offered are factors driving the sales of protein supplements through online distribution channels.

The benefits to customers, including comparison in price range and the availability of numerous brands with customer reviews for the products, further drive the sales of supplements through this channel. Moreover, the presence of different discussion portals, discounts and offers, easy payment options, and various promotion strategies are projected to fuel the online sales of protein supplements over the forecast period.

The supermarkets segment is expected to register at the fastest CAGR of 11.5% during the forecast period. Supermarkets and hypermarkets conduct detailed consumer sentiment analyses to understand customer preferences for products and brands. This allows them to offer products that are most preferred by consumers and charge a premium price if customers are willing to pay for them.

Supermarkets are easily accessible and provide a convenient shopping experience for customers. They offer a variety of protein supplement options under one roof, making it convenient for customers to compare and choose the products that best meet their needs. Customers tend to trust established brands, and supermarkets and hypermarkets offer a wide selection of reputable brands in the protein supplements industry. This builds customer confidence in the products being sold and can lead to repeat purchases.

Regional Insights

North America dominated the global protein supplements market with the largest revenue share of 40.8% in 2025. The increasing interest of young and adult consumers in health and wellness trends is driving growth in the protein supplements industry. Consumers are becoming more conscious of their health and are willing to invest in products that can help them maintain or improve their overall well-being. As a result, the protein supplements industry is expected to continue growing in North America in the years to come. The high prevalence of lifestyle diseases, such as diabetes and obesity, is driving demand for products that can help manage these conditions. Protein supplements are often recommended as part of a healthy diet for individuals with these conditions.

U.S. Protein Supplements Market Trends

The protein supplements market in the U.S. accounted for the largest market revenue share in North America in 2025. The increasing obesity rate in the U.S. has contributed to the growth of the protein supplement industry. With the rising awareness of the importance of a healthy diet and regular exercise, the trend of fitness has become increasingly popular in recent years. Tapping the potential of the industry in the country, many companies are entering the market with unique product innovations. For instance, in March 2025, Dutch ingredients-startup Vivici launched its flagship precision-fermented dairy protein ingredient, Vivitein BLG, in the U.S. market. The animal-free beta-lactoglobulin is positioned for active-nutrition products, offering 86 % less water use and a 68 % smaller carbon footprint compared to conventional whey.

Europe Protein Supplements Market Trends

The protein supplements market in Europe is anticipated to grow at a significant CAGR of 10.6% over the forecast period from, owing to various factors, such as increasing emphasis on healthy living, growing trend of preventive health care, and rising demand for protein supplements from countries such as the UK and Germany.

The UK protein supplements market is expected to grow at a rapid CAGR during the forecast period, driven by rising consumer awareness of health, fitness, and nutrition. Increasing participation in gyms, sports, and lifestyle fitness activities is fueling demand for protein powders, bars, and ready-to-drink shakes. In addition, the growing popularity of plant-based and clean-label protein products is expanding the consumer base beyond traditional athletes. E-commerce growth and innovative product launches by key players, such as Myprotein and Bulk Powders, are further driving market expansion across the country. For instance, in June 2025, the UK launch of C4 Whey Protein was announced through a partnership between C4 and The Hershey Company, introducing two flavours, Hershey’s Milk Chocolate and Reese’s Peanut Butter, with 25 g of whey per serving and no added sugar.

Asia Pacific Protein Supplements Market Trends

The protein supplements market in Asia Pacific is anticipated to register at the fastest CAGR of 12.1% over the forecast period. The demand for protein supplements in Asia Pacific has been steadily increasing over the years. This can be attributed to several factors, such as the rising interest in health and fitness, growing awareness about the importance of protein intake, and the increasing prevalence of lifestyle diseases. The Asia Pacific region has a large and diverse population, with a significant portion being vegetarian or vegan. This has led to a higher demand for plant-based protein supplements such as soy protein, pea protein, and rice protein. These supplements are popular among consumers with dietary restrictions and among those who prefer plant-based options. In December 2023, Herbalife introduced over 20 unique wellness products (43 SKUs) across the Asia Pacific region, including tailored protein shakes, plant-based options, and formulations for weight management, immunity, and fitness, to meet rising consumer health consciousness.

The China protein supplements market is growing significantly, driven by increasing health consciousness, a rising middle-class population, and the growing influence of fitness and sports culture. Consumers are increasingly seeking protein-based products for muscle building, weight management, and overall wellness. The market is also benefiting from the surge in e-commerce platforms and the adoption of Western dietary habits. Moreover, the rising demand for plant-based and clean-label protein products, combined with new product innovations from both local and international brands, is expected to drive strong growth in the coming years.

Central & South America Protein Supplements Market Trends

The protein supplements market in Central & South America is growing significantly over the forecast period, driven by rising awareness of nutrition and fitness, increasing disposable income, and growing participation in sports and gym activities. Consumers are increasingly adopting protein-rich diets to support active lifestyles and achieve weight management goals. The increasing availability of protein supplements through online and retail channels, combined with the growing influence of international fitness trends, is further propelling market growth. Moreover, the demand for natural, plant-based, and clean-label protein products remains strong across the region.

The Brazil protein supplements market is fueled by the growing fitness culture, increasing number of gyms, and rising awareness about health and nutrition among young consumers. The trend toward muscle building, weight management, and sports performance enhancement is driving increased demand for products. In addition, the popularity of plant-based and natural protein sources is increasing as consumers seek cleaner and more sustainable alternatives. The expansion of e-commerce platforms and the strong presence of international brands offering innovative flavors and convenient formats are further accelerating market growth in the country. In June 2025, ioWhey Protein launched in Brazil, in partnership with local brand Nutrata, providing Brazilian consumers with access to its advanced “Ingredient Optimized” whey-protein technology through both retail and online channels.

Middle East & Africa Protein Supplements Market Trends

The protein supplements market in the Middle East and Africa is growing significantly over the forecast period, driven by rising health consciousness among people, increasing participation in sports and fitness activities, such as gym workouts, and growing disposable incomes. The expanding young population and greater awareness of nutritional benefits are boosting product adoption. In addition, the growing influence of Western dietary habits, expanding retail and e-commerce channels, and increasing availability of halal-certified protein supplements are further contributing to the market’s robust growth across the region.

The UAE protein supplements market is driven by increasing health awareness, a growing gym and wellness culture, strong government initiatives promoting healthier lifestyles under the National Strategy for Wellbeing 2031, and growing participation in sports and gym activities. The expanding expatriate population and rising disposable incomes have further boosted demand for premium protein products. In addition, the growing popularity of plant-based and clean-label supplements aligns with the country's significant shift toward wellness and sustainable living. The rapid growth of online retail platforms, fitness influencers, and nutrition-focused campaigns also plays a crucial role in promoting protein supplement consumption in the UAE. In November 2025, U.S. brand Core Nutritionals launched in the UAE through distributor Vivandi Distribution, introducing premium, fully transparent sports supplement formulations focused on strength, endurance, muscle growth, and recovery that aligned with the region’s rapidly expanding fitness market.

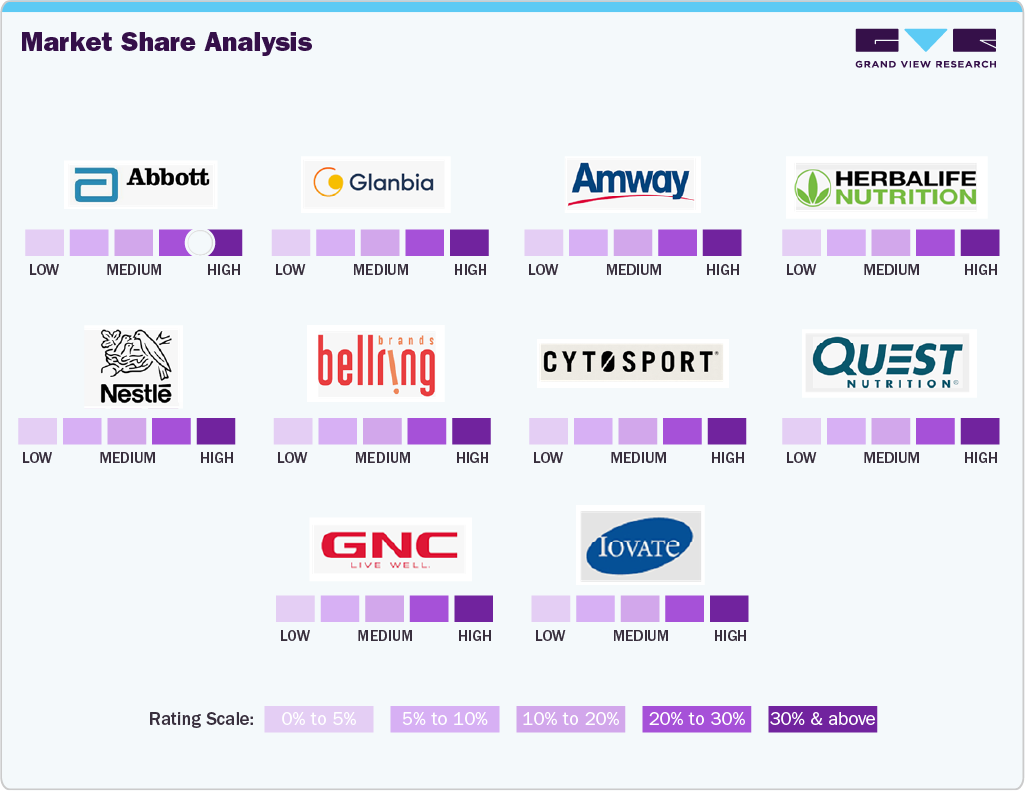

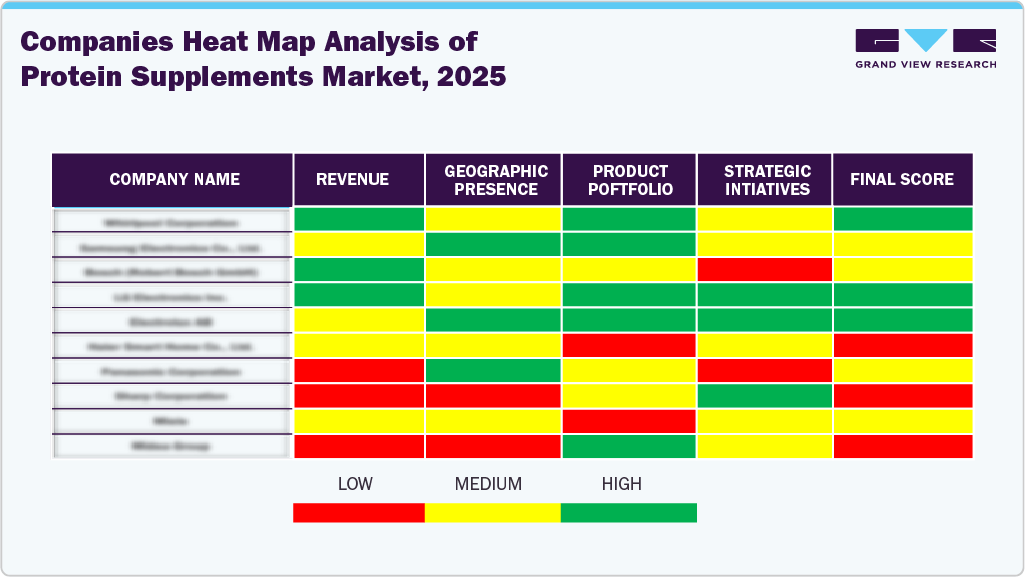

Key Protein Supplements Company Insights

The global protein supplements industry is characterized by intense competition, mainly attributed to several players operating in the market. Various companies operating in the market are presenting innovative products to cater to consumer demand. For example, in October 2022, Optimum Nutrition, a sports nutrition brand of Glanbia, launched a new plant-based protein powder called Gold Standard 100% Plant Protein. The formula is made with 100% vegan ingredients and contains 24 grams of protein to support fitness activities. The launch is in response to the growing trend of plant-based alternatives in the market. Some prominent market players in the global protein supplements industry include:

Key Protein Supplements Companies:

The following are the leading companies in the protein supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott Laboratories

- Glanbia PLC

- Amway Corporation

- Herbalife International of America Inc.

- Nestlé S.A.

- BellRing Brands

- CytoSport Inc.

- Quest Nutrition LLC

- GNC Holdings Inc.

- Iovate Health Sciences International Inc.

Recent Developments

-

In July 2025, Nestlé launched Milo Pro in Indonesia, delivering three times the protein content of traditional Milo drinks and targeting active teens and young adults in the Southeast Asia region.

-

In March 2025, GNC India, through its master-franchisee Guardian Healthcare Pvt. Limited, launched the GNC Pro Performance 100% Whey + Nitro Surge, described as India’s first whey-protein product with a cardio-protective formulation combining performance-boosting ingredients and heart-health support.

-

In February 2024, Nestlé India launched Resource Activ, a multi-benefit, high-protein nutritional drink in India designed for active millennials. The formulation included 30 g of high-quality protein, added calcium & vitamin D for bone health, hyaluronate for skin health, fibre and immunonutrients, available in a vanilla-biscuit flavour for consumption with water or milk.

-

In January 2024, the UK-based brand Smart Protein launched a premium “Active & Wellness” supplement range across 142 Tesco stores. The 12-product line covers sports nutrition (protein powders, creatine, electrolytes) and holistic wellness (nootropics, gummies, super-greens) to make premium nutrition accessible and straightforward.

Protein Supplements Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 31.86 billion

Revenue forecast in 2033

USD 63.22 billion

Growth rate

CAGR of 10.3% from 2026 to 2033

Base year for estimation

2024

Historical data

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, product, application, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; UAE

Key companies profiled

Abbott Laboratories; Glanbia PLC; Amway Corporation; Herbalife International of America Inc.; Nestlé S.A.; BellRing Brands; CytoSport Inc.; Quest Nutrition LLC; GNC Holdings Inc.; Iovate Health Sciences International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global protein supplements market based on the source, product, application, distribution channel, and region:

-

Source Outlook (Revenue, USD Million, 2021 - 2033)

-

Animal-Based

-

Whey

-

Casein

-

Egg

-

Fish

-

Others

-

-

Plant-Based

-

Soy

-

Spirulina

-

Pumpkin Seed

-

Wheat

-

Hemp

-

Rice

-

Pea

-

Others

-

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Protein Powder

-

Protein bars

-

RTD

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Sports Nutrition

-

Functional foods

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Supermarkets

-

Online

-

DTC

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global protein supplements market size was estimated at USD 29.78 billion in 2025 and is expected to reach USD 31.86 billion in 2026.

b. The global protein supplements market is expected to grow at a compound annual growth rate of 10.3% from 2026 to 2033 to reach USD 63.22 billion by 2033.

b. Animal-based protein supplements accounted for 59.9% of the revenue share in 2025. Growing demand from athletes, fitness enthusiasts, and competitive bodybuilders continues to support growth due to their high bioavailability and complete amino-acid profiles.

b. Some of the major players in the protein supplements market include Abbott Laboratories; Glanbia PLC; Amway Corporation; Herbalife International of America Inc.; Nestlé S.A.; BellRing Brands; CytoSport Inc.; Quest Nutrition LLC; GNC Holdings Inc.; and Iovate Health Sciences International Inc.

b. The rising popularity of plant-based and animal-based diets, coupled with the popularity of clean label ingredients among all age groups, is supporting the demand for the market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.