- Home

- »

- Consumer F&B

- »

-

Protein Puffs Market Size, Share And Trends Report, 2030GVR Report cover

![Protein Puffs Market Size, Share & Trends Report]()

Protein Puffs Market Size, Share & Trends Analysis Report By Source (Animal-based, Plant-based, And Mixed Sources), By Packaging (Single-serve Packs, Multi-serve Bags And Bulk Packaging), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-378-0

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Protein Puffs Market Size & Trends

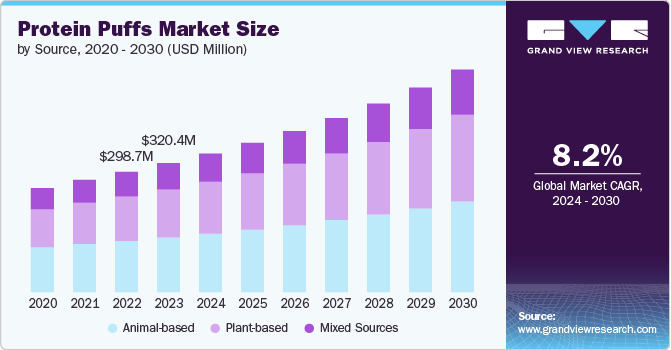

The global protein puffs market size was estimated at USD 320.36 million in 2023 and is anticipated to grow at a CAGR of 8.2% from 2024 to 2030. Protein puffs offer a palatable and easy way to satisfy hunger pangs while boosting protein intake, appealing to fitness enthusiasts, busy professionals, and anyone looking for a quick and nutritious snack. The growing popularity of low-carb and ketogenic diets, as protein puffs often fit into these dietary restrictions is driving the market growth. This consumer-driven demand attracts a diverse range of companies to enter the market, resulting in a wide array of flavors, textures, and ingredient combinations, offering consumers a wealth of options.

The market is evolving beyond simple snacks, with manufacturers introducing innovative variations to cater to specific dietary needs and preferences. Gluten-free, vegan, and organic options are gaining traction, reflecting the increasing awareness and demand for specialized dietary products. The market is also witnessing the emergence of protein puffs with added functional ingredients, such as probiotics, fiber, and antioxidants, further enhancing their nutritional value and appeal. Moreover, the rise of online platforms and direct-to-consumer brands is facilitating wider accessibility and brand awareness, contributing to the market's rapid growth.

Factors such as increasing demand for convenient and healthy snacks, the expanding popularity of protein-rich diets, and the growing trend of personalized nutrition are anticipated to create numerous opportunities for the protein puffs industry growth. Moreover, the focus on clean-label ingredients, sustainable sourcing, and transparent manufacturing practices will also play a crucial role in shaping the market landscape. Moreover, consumers are increasingly seeking out clean-label products with natural ingredients and minimal processing. The trend towards plant-based diets is also driving the demand for protein puffs, as they can offer a delicious and convenient way to incorporate plant-based protein into the diet.

Manufacturers are experimenting with a wide range of flavor profiles, including savory, sweet, and spicy options, as well as incorporating fruit and vegetable flavors. Another significant trend is the emphasis on sustainability, with manufacturers sourcing ingredients responsibly and reducing their environmental impact. This includes using recycled packaging, minimizing waste, and promoting fair trade practices. Consumers are increasingly conscious of the environmental footprint of their food choices, and protein puff brands that align with these values are likely to gain traction.

Technological advancements and innovations are reshaping the protein snacks market. Extrusion technology, which is used to shape and texture protein puffs, has undergone significant improvements. Advanced extrusion systems allow for precise control over the shape, texture, and density of protein puffs, enabling manufacturers to create a wide range of innovative products. In addition, the development of novel protein sources, such as insect protein and microalgae protein, is creating opportunities for new and unique protein puff products. Furthermore, the advancements in packaging technology are leading to innovative solutions that preserve freshness, extend shelf life, and offer greater convenience for consumers.

Source Insights

Based on source, the animal-based segment led the market with the largest revenue share of 42.47% in 2023.Animal-based protein puffs are typically made from whey protein, casein, or egg white protein. These proteins are highly bioavailable and provide a complete amino acid profile, making them an excellent source of essential nutrients. Moreover, animal-based protein puffs often have a savory or sweet flavor, making them more appealing to a wider range of consumers. Besides, they are highly preferred by gym enthusiasts, athletes, and fitness-conscious individuals seeking a quick and easy way to replenish their protein intake after workouts or to supplement their daily protein needs.

The plant-based segment is anticipated to witness at the fastest CAGR of 8.9% from 2024 to 2030, driven by the surging popularity of veganism and vegetarianism. Consumers are increasingly seeking plant-based alternatives to traditional protein sources, driven by ethical concerns, environmental sustainability, and health benefits. Plant-based protein puffs offer a convenient and delicious way to incorporate plant-based protein into the diet, making them a popular choice among health-conscious consumers. The segment is further boosted by the growing awareness of the environmental impact of animal agriculture, with plant-based protein sources offering a more sustainable alternative.

Packaging Insights

Based on packaging, the multi-serve segment led the market with the largest revenue share of 48.95% in 2023. The multi-serve bags offer a convenient and cost-effective way for consumers to purchase protein puffs. These bags typically contain several servings of the product, making them ideal for families or individuals who consume the snack regularly. By purchasing a multi-serve bag, consumers can save money compared to buying multiple single-serve packages. This segment is further driven by the growing trend of snacking as a meal replacement, particularly among individuals with busy lifestyles who are seeking a quick and nutritious option. The versatility of multi-serve bags allows for easy sharing and makes them ideal for social gatherings and events.

The single-serve segment is estimated to grow at the fastest CAGR of 8.7% from 2024 to 2030, driven by the growing trend of on-the-go snacking and the need for convenient, portable packaging options. This segment caters to consumers who are always on the move and looking for quick, nutritious snacks to keep them energized throughout the day. Single-serve packs offer the perfect solution, as they are easy to carry and can be consumed at any time, making them an ideal choice for busy individuals. Moreover, single-serve packs provide a pre-measured portion of protein puffs, making it easier for consumers to keep track of their calorie and macronutrient intake. This is particularly beneficial for individuals who are following a specific diet plan, such as a low-carb, high-protein diet.

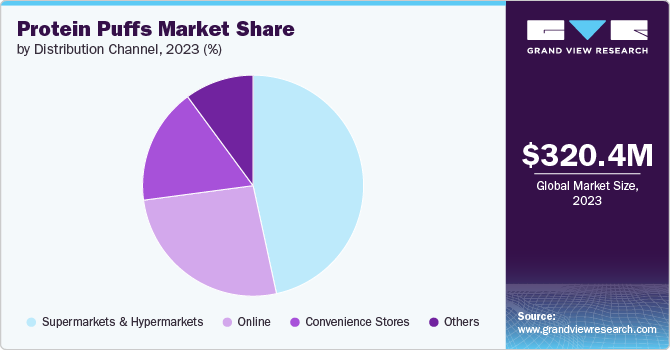

Distribution Channel Insights

Based on distribution channel, the supermarkets & hypermarkets segment led the market with the largest revenue share of 46.59% in 2023. Supermarkets and hypermarkets are popular distribution channels for protein puffs due to their wide reach and ability to cater to a large customer base. These retail outlets offer a wide variety of products, making it easy for consumers to compare and choose from different brands and flavors of protein puffs. In addition, supermarkets and hypermarkets often have dedicated health and wellness sections, where protein puffs are prominently displayed, making it easy for consumers to find and purchase these products.

The online retail stores segment are estimated to grow at the fastest CAGR of 9.1% from 2024 to 2030. This segment benefits from the increasing accessibility of online shopping, coupled with the convenience of having a wide range of protein puff brands and flavors delivered directly to consumers' doorsteps. The online environment also allows for personalized recommendations, detailed product information, and consumer reviews, further influencing purchase decisions. This segment is witnessing the rise of direct-to-consumer brands that are leveraging social media and influencer marketing to reach a wider audience and build strong brand loyalty.

Regional Insights

North America dominated the protein puffs market with the revenue share of 33.39% in 2023, driven by a strong emphasis on health and fitness, coupled with a preference for convenient and portable snacks. The region boasts a robust and diverse snacking culture, with consumer’s constantly seeking new and exciting options. This has paved the way for protein puffs to become a staple in grocery stores, convenience stores, and online retailers alike. Notably, the North American market is characterized by a high level of product innovation, with brands constantly introducing new flavors, textures, and functional ingredients. This focus on product differentiation and catering to specific dietary needs, such as gluten-free and vegan options, is further driving market growth.

U.S. Protein Puffs Market Trends

The protein puffs market in the U.S. is expected to grow at the fastest CAGR of 8.3% from 2024 to 2030. The U.S. market is characterized by a strong focus on natural and organic ingredients, with consumers actively seeking protein puffs made with clean-label formulations. This demand for transparency and natural ingredients is driving the growth of smaller, niche brands that prioritize quality and sustainability. In addition, the growing trend of plant-based diets is fostering the development of protein puffs derived from sources like pea protein, soy protein, and quinoa, catering to a growing segment of the market.

Europe Protein Puffs Market Trends

The protein puffs market in Europe is expected to grow at the fastest CAGR of 7.0% from 2024 to 2030, driven by the growing trend towards convenience and on-the-go snacking. With busy lifestyles and increasingly hectic schedules, consumers are looking for snacks that are easy to eat on the go and that can help keep them full and satisfied between meals. Protein puffs, which are lightweight and portable, make an ideal snack for those who are looking for convenient and nutritious options.

Asia Pacific Protein Puffs

The protein puffs market in the Asia Pacific is expected to grow at the fastest CAGR of about 9.3% from 2024 to 2030, driven by the growing awareness of the health benefits of protein, particularly among fitness enthusiasts and health-conscious consumers. This demand is amplified by increasing urbanization and rising disposable incomes, enabling consumers to prioritize health and wellness through premium snacks. Moreover, the region's burgeoning health and fitness culture, fueled by social media influencers and rising participation in sports, further fuels the demand for protein-rich snacks.

Key Protein Puffs Company Insights

Hormel Foods Corporation, Quest Nutrition, LLC, Taali Foods India, Twin Peaks Ingredients, Hippeas, Inc., Muscle Nation, In Good Hands, The Hershey Company, G Fuel, and Come Ready Foods LLC are some of the dominant players operating in the market. The global market is characterized by intense competition. Key players in the market are actively innovating and expanding their product offerings to meet the evolving needs of consumers. They are introducing new flavors and variations, such as vegan, gluten-free, and keto-friendly options. Partnerships are playing a crucial role in expanding market reach, with brands collaborating with gyms, fitness studios, and health food retailers to create strategic distribution channels and build brand awareness. In addition, manufacturers are exploring new flavors and textures to enhance consumer appeal, with offerings ranging from savory to sweet and crispy to chewy varieties.

Key Protein Puffs Companies:

The following are the leading companies in the protein puffs market. These companies collectively hold the largest market share and dictate industry trends.

- Hormel Foods Corporation

- Quest Nutrition, LLC

- Taali Foods India

- Twin Peaks Ingredients

- Hippeas, Inc.

- Muscle Nation

- The Hershey Company

- G Fuel

- In Good Hands

- Come Ready Foods LLC

Recent Developments

-

In August 2023, One Brands entered the savory snack segment with the launch of One Puff, a protein-packed cheese puff product. This move signals One Brands' ambition to diversify its product portfolio and cater to a wider consumer base seeking healthy and flavorful snacking options. The launch of One Puff marks One Brands' entry into a new and potentially lucrative segment of the snack food industry

-

In August 2023, G FUEL Energy launched a new protein puffs snack line with a white cheddar flavor. This innovative snack combines the energy boost of G FUEL with the savory crunch of puffed corn, meeting the needs of consumers seeking both nutrition and flavor

-

In December 2022, Hormel Foods Corp acquired 29% stake in PT Garudafood Putra Putri Jaya Tbk, one of the largest food and beverage companies in Indonesia. This strategy helped the company to leverage the strengths and capabilities of both companies and accelerate its market growth in the Indonesia

Protein Puffs Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 344.24 million

Revenue forecast in 2030

USD 552.58 million

Growth rate

CAGR of 8.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Source, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; South Africa

Key companies profiled

Hormel Foods Corporation; Quest Nutrition, LLC; Taali Foods India; Twin Peaks Ingredients; Hippeas, Inc.; Muscle Nation; In Good Hands; The Hershey Company; G Fuel; Come Ready Foods LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Protein Puffs Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein puffs market report based on source, packaging, distribution channel, and region:

-

Source Outlook (Revenue, USD Million; 2018 - 2030)

-

Animal-based

-

Plant-based

-

Mixed sources

-

-

Packaging Outlook (Revenue, USD Million; 2018 - 2030)

-

Single-serve Packs

-

Multi-serve Bags

-

Bulk Packaging

-

-

Distribution Channel Outlook (Revenue, USD Million; 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global protein puffs market was estimated at USD 320.36 million in 2023 and is expected to reach USD 344.24 million in 2024.

b. The global protein puffs market is expected to grow at a compound annual growth rate of 8.2% from 2024 to 2030 to reach USD 552.58 million by 2030.

b. North America dominated the protein puffs market with a share of 33.39% in 2023. The increasing health consciousness among consumers, coupled with a growing preference for protein-rich snacks, is a major demand driver. Consumers are seeking alternatives to traditional, high-calorie snacks and are actively incorporating protein into their diets for weight management, muscle building, and overall health.

b. Some of the key market players in the protein puffs market are Hormel Foods Corporation, Quest Nutrition, LLC, Taali Foods India, Twin Peaks Ingredients, Hippeas, Inc., Muscle Nation, Redbarn Pet Products LLC, The Hershey Company, G Fuel, and Come Ready Foods LLC.

b. The protein puffs market has experienced significant growth in recent years, driven by the growing awareness of the health benefits associated with plant-based proteins is driving the demand for protein puffs. Moreover, the rise of e-commerce platforms has expanded the reach of protein puffs manufacturers, making these products more accessible to consumers globally.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."