- Home

- »

- Consumer F&B

- »

-

Protein Ingredients Market Size, Share, Industry Report 2033GVR Report cover

![Protein Ingredients Market Size, Share & Trends Report]()

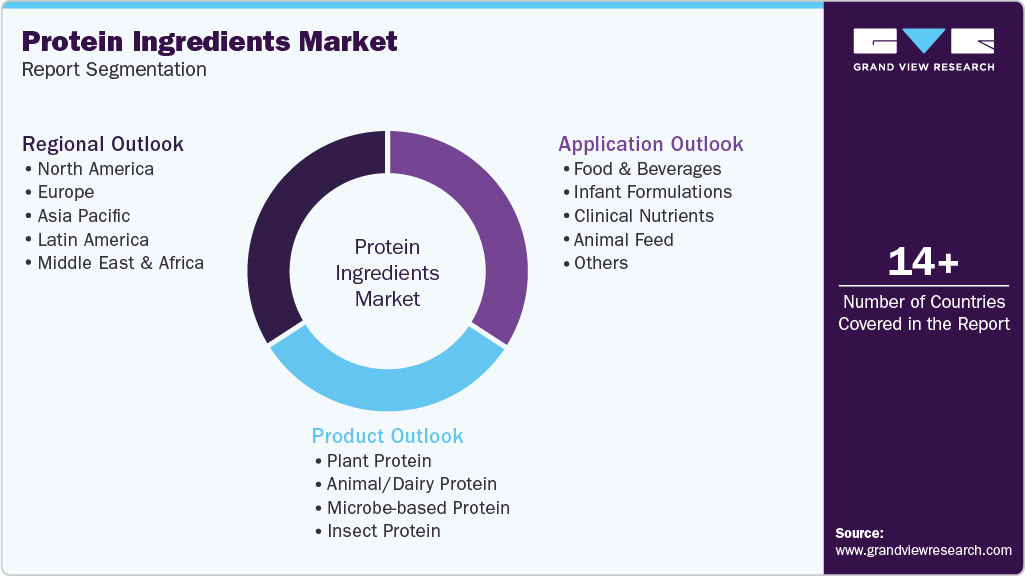

Protein Ingredients Market (2026 - 2033) Size, Share & Trends Analysis Report By Product (Plant Protein, Animal/Dairy Protein, Microbe-based Protein), By Application (Food & Beverages, Infant Formulations, Clinical Nutrients), By Region, And Segment Forecasts

- Report ID: 978-1-68038-451-2

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2021 - 2025

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Ingredients Market Summary

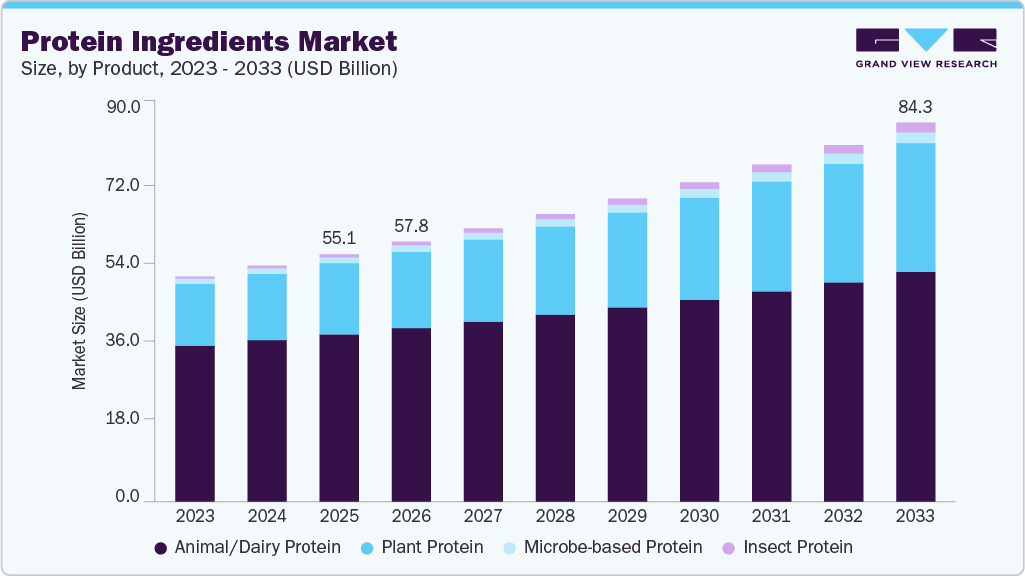

The global protein ingredients market size was estimated at USD 55.06 billion in 2025 and is projected to reach USD 84.35 billion by 2033, growing at a CAGR of 5.5% from 2026 to 2033. The global market for protein ingredients is witnessing strong and sustained growth, fueled by rising consumer awareness about the importance of protein in maintaining overall health, muscle development, and metabolic function.

Key Market Trends & Insights

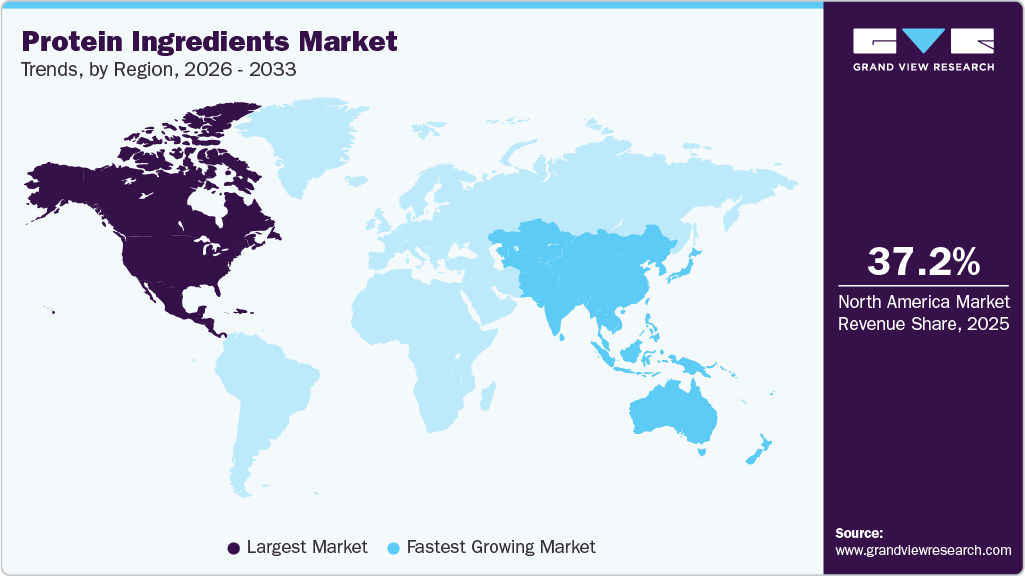

- North America dominated the global protein ingredients industry in 2025 with a share of 37.2%.

- The protein ingredients industry in the U.S. is projected to grow at a CAGR of 5.1% from 2026 to 2033.

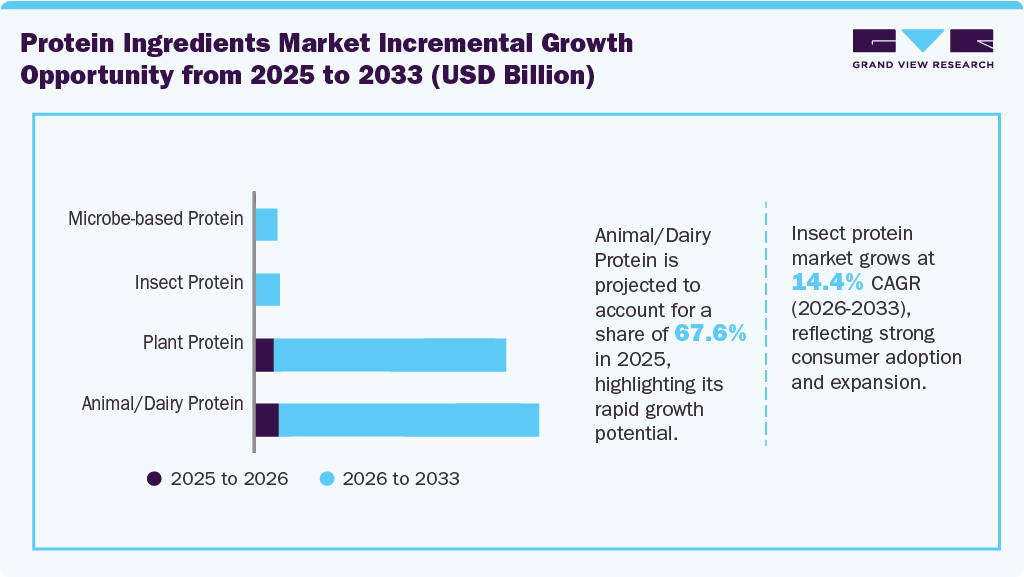

- By product, the animal/ dairy protein segment in the global protein ingredients industry accounted for a share of 67.6% in 2025.

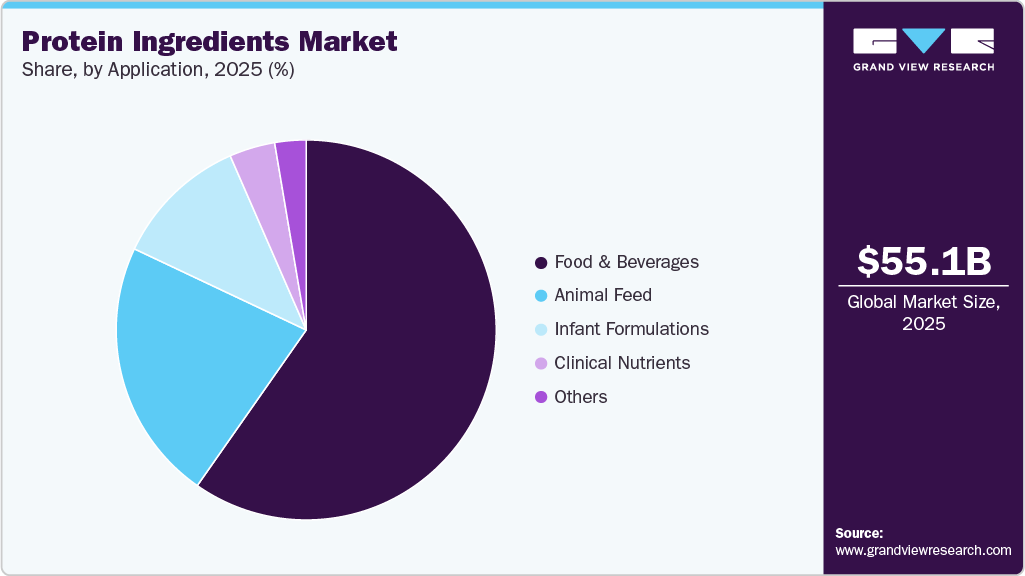

- By application, the food & beverages segment accounted for a share of 59.7% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 55.06 Billion

- 2033 Projected Market Size: USD 84.35 Billion

- CAGR (2026-2033): 5.5%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

This surge in demand is driven by shifting dietary preferences toward high-protein foods, increased fitness and sports nutrition trends, and growing interest in plant-based and clean-label products.The COVID-19 pandemic further intensified focus on health and wellness, prompting consumers to seek protein-rich solutions that support immunity, energy, and recovery. In addition, the prevalence of lifestyle-related conditions, aging populations, and the global rise in vegan and vegetarian diets are accelerating the adoption of both animal-based and plant-based protein ingredients across food, beverage, and supplement sectors.

The market is gaining momentum and experiencing strong demand due to the increasing consumption of food products such as margarine, cold cuts, bakery items, spreads, yogurt, and milk sausages, all of which incorporate protein ingredients. The growing popularity of these products among health-conscious individuals and the elderly is further driving industry growth. In addition, advancements in protein innovation by manufacturers, offering proteins with diverse amino acid profiles and targeted benefits such as satiety, muscle repair, weight management, and energy regulation are expected to create significant growth opportunities for the market.

The protein ingredient industry is driven by rising consumer awareness of health and wellness, leading to increased demand for high-protein diets. Growth in the sports nutrition and functional food sectors further fuels market expansion. In addition, the shift toward plant-based and sustainable protein sources is accelerating innovation. Urbanization and changing lifestyles also support the demand for convenient, protein-rich products.

The growing shift toward plant-based and sustainable protein sources is a key driver in the market, spurring significant innovation. Consumers are increasingly seeking eco-friendly and ethical alternatives to animal-based proteins, prompting manufacturers to develop novel plant-based formulations. According to the National Library of Medicine data, published in September 2023, oat milk contains proteins, minerals, a high quantity of fatty acids, dietary fiber, and is packed with micronutrients and offers health benefits.

Moreover, advances in food technology are enabling the creation of high-quality, functional plant proteins that meet diverse dietary needs. This trend aligns with global sustainability goals, making it a strong force shaping the future of the industry. In addition, rising vegan and flexitarian populations are expanding the consumer base for plant-derived protein ingredients. According to the National Library of Medicine, published data in April 2023, 65% of the global population is lactose intolerant, further fueling the need for protein alternative ingredients market.

In response to this growing demand, companies are investing heavily in research and development to enhance the taste, texture, and nutritional profile of plant-based proteins. Innovations such as precision fermentation and the use of novel protein sources such as algae, fungi, and insect-based ingredients are gaining traction. Partnerships between food tech startups and established food manufacturers are also accelerating product development. For instance, in February 2025, Insectika introduced an insect protein-based feed specifically formulated for Asian seabass and aquarium fish in collaboration with ICAR-CIBA (Indian Council of Agricultural Research - Central Institute of Brackishwater Aquaculture). The new feed aims to improve fish health by enhancing digestibility, palatability, and overall well-being.

Government initiatives and supportive regulatory frameworks are also playing a crucial role in boosting the plant-based protein sector. Incentives for sustainable agriculture and food innovation are encouraging companies to explore eco-friendly protein alternatives. Furthermore, increasing investments from venture capitalists in plant-based startups are driving market competitiveness and expansion. Public awareness campaigns highlighting the environmental and health benefits of plant-based diets are further influencing consumer choices. For instance, according to the data published by The Good Food Institute Asia Pacific, in March 2022 , the Federal Government invested nearly USD 113 million in plant protein processing facilities in South Australia through the Modern Manufacturing Initiative Fund. As a result, the protein ingredient market is witnessing robust growth, especially in regions prioritizing sustainability and nutrition.

The graph above depicts Americans trying to consume protein, according to the data published by the International Food Information Council’s annual survey, 2024.

In addition, insect protein ingredients are emerging as a sustainable and highly nutritious alternative in the market. Rich in essential amino acids and requiring minimal resources to produce, they offer an eco-friendly solution to meet growing protein demand. According to the UOC survey published in January 2023, research indicates that consuming insect protein in animals yields positive outcomes, including lower blood glucose and cholesterol levels, improved weight management, and enhanced diversity of gut microbiota.

Product Insights

The animal/dairy protein ingredients segment accounted for the largest share of 67.6% of the global revenues in 2025. Animal and dairy proteins continue to dominate the market due to their high bioavailability and complete amino acid profiles. The growing demand for functional foods, sports nutrition, and clinical nutrition products is fueling their usage. Consumer preference for traditional protein sources, especially in developing regions, also supports market growth. For instance, according to the data published in May 2025, HealthFocus U.S. Trend Study, a study conducted in 2024, approximately 39% of consumers stated that incorporating protein into their diet has become essential, with many choosing products like yogurts to obtain dairy protein. In addition, advancements in processing technologies have improved the taste, texture, and shelf life of dairy and animal-based protein ingredients, enhancing their appeal across food and beverage applications.

The demand for insect protein is expected to grow at a CAGR of 14.4% from 2026 to 2033. The insect protein segment is mainly driven by the demand for sustainable and eco-friendly protein alternatives, as insects require significantly less land, water, and feed compared to traditional livestock, and produce much lower greenhouse gas emissions. In addition, increasing consumer emphasis on health and nutrition fuels this growth, since insect proteins are packed with high-quality amino acids, vitamins, and minerals, and are easily digestible. In addition, major players have forged strategic collaborations in the insect protein sector to meet the rising demand for insect protein ingredients. For instance, in April 2023, Sumitomo Corporation partnered with Nutrition Technologies (NT), a Malaysian startup specializing in insect-based alternative proteins. This strategic alliance aims to utilize Sumitomo’s broad distribution network to introduce and expand the availability of insect-derived products in the Japanese market.

Application Insights

Protein ingredients for food & beverage applications accounted for the largest share of 59.7% of the globalrevenue in 2025. The food & beverages section is a major driver for the protein ingredients industry, with growing demand for high-protein snacks, meal replacements, dairy products, and fortified beverages. Consumers are increasingly seeking convenient, nutritious options that support active lifestyles and wellness goals. Protein ingredients, including plant-based, dairy, and animal sources, are being widely incorporated in products such as protein bars, shakes, yogurts, and baked goods. For instance, in February 2024, Roquette Frères launched four multi-functional, isolated, hydrolysate, and textured pea proteins under its brand NUTRALYS, designed to improve taste and refined texture. The innovation includes new formats and formulations offering high protein content for various products, such as plant-based dairy and meat alternatives, food, and beverages, such as protein drinks. Clean-label trends and functional benefits such as muscle maintenance and satiety are further enhancing their appeal across diverse consumer segments.

Protein ingredients for animal feed applications are projected to grow at a CAGR of 5.3% from 2026 to 2033, reflecting the steady expansion of the animal feed protein ingredients industry. The animal feed industry represents a significant segment of the broader protein ingredients landscape, driven by the need to enhance livestock growth, health, and productivity. Protein ingredients such as soybean meal, fishmeal, and processed animal proteins play a critical role in providing balanced nutrition in feed formulations. The rising global demand for high-quality meat, dairy, and poultry products is further boosting the adoption of protein-rich animal feed solutions. In addition, innovations in feed technology and the integration of alternative protein sources, including insect meal, are expanding opportunities for sustainable and efficient feed formulations. For instance, in May 2023, Ÿnsect launched Sprÿng, a B2B2C insect protein brand for pet food, offering sustainable ingredients such as Protein 70, recognized for its low environmental impact and high nutritional value.

Regional Insights

The protein ingredientsindustry in North America accounted for a share of 37.2% of the global revenue in 2025. The North American market is driven by high consumer awareness of nutrition, increasing demand for functional and fortified foods, and a strong sports nutrition culture. Growing interest in plant-based and clean-label products further supports market expansion. Technological advancements in food processing enhance product innovation. A well-established food industry infrastructure also accelerates product penetration.

U.S. Protein Ingredients Market Trends

The protein ingredientsindustry in the U.S. is projected to grow at a CAGR of 5.1% from 2026 to 2033.In the U.S., rising health consciousness and the popularity of high-protein diets, such as keto and paleo, are key market drivers. The country also has a strong vegan and flexitarian consumer base, fueling demand for plant and alternative proteins. Innovation in protein-rich snacks and ready-to-drink beverages adds momentum. Regulatory support and investment in food tech are further strengthening the market.

Europe Protein Ingredients Market Trends

The protein ingredientsindustry in Europe is projected to grow at a CAGR of 5.7% from 2026 to 2033. Europe's market is influenced by a rising focus on sustainability, clean-label products, and increasing vegan and vegetarian populations. Consumers are actively seeking ethical and eco-conscious alternatives to animal proteins. Functional foods and plant-based dairy alternatives are gaining popularity. Strict food regulations ensure quality and safety, enhancing consumer trust.

The protein ingredientsindustry in Germany is projected to grow at a CAGR of 6.7% from 2026 to 2033. Germany leads in Europe’s plant-based protein innovation, driven by high environmental awareness and a strong organic food market. The demand for meat alternatives and high-protein bakery and snack products is growing rapidly. The government’s support for sustainable agriculture and food labeling also helps market development. Fitness and wellness trends fuel protein supplement consumption.

The protein ingredientsindustry in the UK is projected to grow at a CAGR of 6.1% from 2026 to 2033. In the UK, the market is propelled by a health-driven shift toward flexitarian and plant-based eating habits. Consumers are embracing protein-enriched foods, especially in the snack and beverage segments. Increased interest in sports nutrition and weight management further boosts demand. E-commerce and retail support wide product accessibility.

Asia Pacific Protein Ingredients Market

The protein ingredientsindustry in the Asia Pacific is projected to grow at a CAGR of 6.3% from 2026 to 2033. Asia Pacific’s market is experiencing rapid growth due to increasing disposable incomes, urbanization, and changing dietary habits. Rising awareness of protein's health benefits, especially among the middle class, is driving demand. A growing fitness culture and expansion of functional food segments also contribute. Government support for food innovation is aiding industry expansion.

The protein ingredientsindustry in China accounted for a share of 35.1% of the regional revenue in 2025. In China, the market is expanding due to rising health consciousness, urban lifestyle changes, and the growing demand for high-quality nutrition. The government’s focus on food safety and domestic protein production supports growth. Dairy proteins remain popular, but plant-based options are gaining traction. E-commerce channels enhance market reach.

The protein ingredientsindustry in India is projected to grow at a CAGR of 7.1% from 2026 to 2033. India's market is driven by increasing awareness of protein deficiency and a growing population seeking affordable, nutritious food options. Vegetarianism is fueling demand for plant-based proteins such as soy, pea, and pulses. Rising fitness and wellness trends among urban youth contribute to supplement demand. Government nutrition programs also support protein-enriched product development.

Central & South America Protein Ingredients Market Trends

The protein ingredientsindustry in Central & South America is projected to grow at a CAGR of 4.7% from 2026 to 2033. The market is growing due to rising income levels, expanding food and beverage sectors, and a shift toward healthier diets. Brazil and Argentina lead in both production and consumption of animal and plant proteins. Increased investment in food processing infrastructure aids market development. The growing fitness industry also plays a role.

Middle East & Africa Protein Ingredients Market Trends

The protein ingredientsindustry in the Middle East & Africa is projected to grow at a CAGR of 4.4% from 2026 to 2033. The Middle East and Africa are experiencing gradual growth in the market, driven by urbanization, changing food preferences, and rising demand for fortified foods. Population growth and increasing awareness of nutrition-related health issues are key drivers. Import reliance is slowly shifting as local production capabilities improve. Halal-certified and culturally adapted protein products also support market adoption.

Key Protein Ingredients Company Insights

Established companies and emerging players in the protein ingredients industry are fostering a highly competitive landscape by focusing on product innovation, quality enhancement, and strategic pricing strategies. This competition is fueled by continuous investments in advanced processing technologies, automation, and a skilled workforce to maintain operational efficiency and comply with stringent regulatory standards. In addition, increasing consumer demand for clean-label, sustainable, and functional protein sources is reshaping market dynamics. These factors collectively drive market share shifts and encourage the development of diverse, value-added protein ingredients.

Key Protein Ingredients Companies:

The following are the leading companies in the protein ingredients market. These companies collectively hold the largest Market share and dictate industry trends.

- Glanbia Plc

- MusclePharm

- Abbott

- CytoSport, Inc.

- QuestNutrition, LLC

- Iovate Health Sciences International Inc.

- The Bountiful Company

- AMCO Proteins

- NOW Foods

- Transparent Labs

- WOODBOLT DISTRIBUTION LLC

- Dymatize Enterprises LLC

- BPI Sports

- Jym-Supplement-Science

- RSP Nutrition

- International Dehydrated Foods, Inc.

- BRF

- Rousselot

- Gelita AG

- Hoogwegt

Recent Developments

-

In December 2025, Arla Foods Ingredients launched Lacprodan CGMP‑30, a novel cheese‑gelatin‑based ingredient engineered to contain markedly reduced phenylalanine levels. By delivering a high‑quality protein source that stabilises blood phenylalanine concentrations and enhances gastrointestinal comfort, the product directly addresses the nutritional challenges faced by individuals with phenylketonuria (PKU). This launch not only broadens Arla’s portfolio of specialised, health‑focused solutions but also positions the company to capture a growing niche market, strengthen its reputation as an innovator in medical‑nutrition, and forge new partnerships with formulators of PKU‑friendly foods and supplements.

-

In July 2024, Ingredion launched a new pea protein under its brand VITESSENCE Pea 100 HD, optimized for cold-pressed bars and expanded its line of protein fortification solutions. The newly launched pea protein is rich with 84% protein content on a dry basis and functions similarly to whey or soy protein.

Protein Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 57.84 billion

Revenue Forecast in 2033

USD 84.35 billion

Growth rate

CAGR of 5.5% from 2026 to 2033

Actuals

2021 - 2025

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2026 to 2033

Report coverage

Revenue & volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; UK; Poland; China; India; Japan; Australia & New Zealand; Brazil; South Africa; UAE

Key companies profiled

Glanbia Plc; MusclePharm; Abbott; CytoSport, Inc.; QuestNutrition, LLC; Iovate Health Sciences International Inc.; The Bountiful Company; AMCO Proteins; NOW Foods; Transparent Labs; WOODBOLT DISTRIBUTION LLC; Dymatize Enterprises LLC; BPI Sports; Jym-Supplement-Science; RSP Nutrition; International Dehydrated Foods, Inc.; BRF; Rousselot; Gelita AG; Hoogwegt

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Ingredients Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2021 to 2033. For this study, Grand View Research has segmented the global protein ingredients market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Plant Protein

-

Cereals

-

Wheat

-

Wheat Protein Concentrates

-

Wheat Protein Isolates

-

Textured Wheat Protein

-

Hydrolyzed Wheat Protein

-

HMEC/HMMA Wheat Protein

-

-

Rice

-

Rice Protein Isolates

-

Rice Protein Concentrates

-

Hydrolyzed Rice Protein

-

Others

-

-

Oats

-

Oat Protein Concentrates

-

Oat Protein Isolates

-

Hydrolyzed Oat Protein

-

Others

-

-

-

Legumes

-

Soy

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

-

Pea

-

Soy Protein Concentrates

-

Soy Protein Isolates

-

Textured Soy Protein

-

Hydrolyzed Soy Protein

-

HMEC/HMMA Soy Protein

-

-

Lupine

-

Chickpea

-

Others

-

-

Roots

-

Potato

-

Potato Protein Concentrate

-

Potato Protein Isolate

-

-

Maca

-

Others

-

-

Ancient Grains

-

Hemp

-

Quinoa

-

Sorghum

-

Amaranth

-

Chia

-

Others

-

-

Nuts & Seeds

-

Canola

-

Almond

-

Flaxseeds

-

Others

-

-

-

Animal/Dairy Protein

-

Egg Protein

-

Milk Protein Concentrates/Isolates

-

Whey Protein Concentrates

-

Whey Protein Hydrolysates

-

Whey Protein Isolates

-

Gelatin

-

Casein/Caseinates

-

Collagen Peptides

-

-

Microbe-based Protein

-

Algae

-

Bacteria

-

Yeast

-

Fungi

-

-

Insect Protein

-

Coleoptera

-

Lepidoptera

-

Hymnoptera

-

Orthoptera

-

Hemiptera

-

Diptera

-

Others

-

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

Food & Beverages

-

Bakery & Confectionary

-

Beverages (Non-Dairy Alternatives)

-

Breakfast Cereals

-

Dairy Alternatives

-

Beverages

-

Cheese

-

Snacks

-

Others

-

-

Dietary Supplements/Weight Management

-

Meat Alternatives & Extenders

-

Poultry

-

Beef

-

Pork

-

Others

-

-

Snacks (Non-Dairy Alternatives)

-

Sports Nutrition

-

Others

-

-

Infant Formulations

-

Clinical Nutrients

-

Animal Feed

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

- Poland

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

- UAE

-

-

Frequently Asked Questions About This Report

b. The global protein ingredients market size was estimated at USD 55.06 billion in 2025 and is expected to reach USD 57.84 billion in 2026.

b. The global protein ingredients market is expected to grow at a compound annual growth rate (CAGR) of 5.5% from 2026 to 2033 to reach USD 84.35 billion by 2033.

b. Animal/dairy protein ingredients accounted for a revenue share of 67.6% in 2025, driven by high nutritional value, complete amino acid profiles, and strong demand from the sports nutrition and functional food sectors.

b. Some key players operating in the Global Protein Ingredients market include DuPont, Rousselot, Cargill Incorporated, ADM, Ingredion, Burcon, Tessenderlo Group, Kewpie Corporation, Roquette Freres, Barentz, Nutri-Pea, Prinova Group LLC, and The Scoular Company.

b. Key factors driving growth in the global protein ingredients market include rising health consciousness, increasing demand for high-protein diets, and the growing popularity of functional and fortified food products. Additionally, the shift toward plant-based and sustainable protein sources, advancements in extraction and processing technologies, and expanding applications across sports nutrition, personal care, and animal feed sectors are propelling market expansion worldwide.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.