- Home

- »

- Consumer F&B

- »

-

Protein Ice Cream Market Size, Share, Growth Report, 2030GVR Report cover

![Protein Ice Cream Market Size, Share & Trends Report]()

Protein Ice Cream Market (2024 - 2030) Size, Share & Trends Analysis Report By Flavor (Chocolate, Vanilla), By Distribution Channel (Online, Ice Cream Parlors), By Protein Content, By Pack Size, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-368-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Ice Cream Market Summary

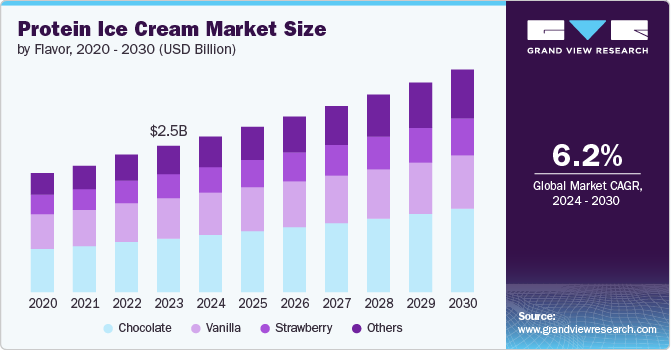

The global protein ice cream market size was estimated at USD 2.51 billion in 2023 and is projected to reach USD 3.82 billion by 2030, growing at a CAGR of 6.2% from 2024 to 2030. The market is primarily driven by the rise of fitness lifestyles, and increasing consumer demand for high-protein, nutritious treats.

Key Market Trends & Insights

- North America accounted for a revenue share of 44.51% in 2023.

- The protein ice cream market in the U.S. is expected to grow at a CAGR of 5.9% from 2024 to 2030.

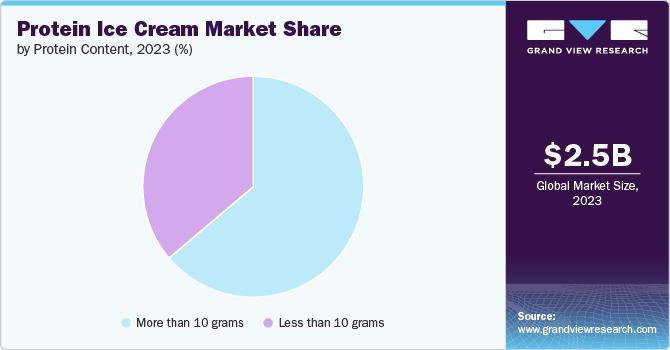

- Based on protein content, the more than 10 grams protein content segment accounted for a revenue share of 63.93% in 2023

- By distribution channel, the sales of protein ice cream through hypermarkets/supermarkets segment accounted for a revenue share of 37.28% in 2023.

- By flavor, chocolate protein ice cream segment accounted for a revenue share of 36.93% in 2023

Market Size & Forecast

- 2023 Market Size: USD 2.51 Billion

- 2030 Projected Market Size: USD 3.82 Billion

- CAGR (2024-2030): 6.2%

- North America: Largest market in 2023

Manufacturers are responding with innovative product launches and diverse flavors, catering to health-conscious consumers and traditional ice cream lovers. The growing prevalence of lactose intolerance has spurred the development of lactose-free and plant-based protein ice creams. Effective marketing strategies, convenience, portability, and clean label preferences enhance market appeal. In addition, consumer education on protein benefits, the popularity of high-protein diets, and a focus on sustainability and ethical sourcing are pivotal factors propelling the market's growth.

The burgeoning health and wellness trend is a primary driver of the market. Consumers increasingly prioritize their health, leading to a surge in demand for products that offer nutritional benefits alongside indulgence. According to a report by the International Food Information Council (IFIC), 54% of Americans are trying to consume more protein, recognizing its role in muscle repair, weight management, and overall health. Protein ice cream, which combines the appeal of a sweet treat with the functional benefits of high protein content, perfectly aligns with this trend.

The growing popularity of fitness and athletic lifestyles has significantly boosted the demand for protein-enriched foods, including ice cream. Protein is essential for muscle recovery and growth, making protein ice cream a convenient post-workout snack. The global fitness industry is thriving, with Statista reporting that the number of health club memberships in the U.S. alone reached over 64 million in 2022. This surge in fitness activities has created a substantial market for products that cater to the nutritional needs of athletes and fitness enthusiasts.

Lactose intolerance affects a significant portion of the global population, driving the demand for dairy alternatives, including protein ice cream made from plant-based sources. The National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) states that approximately 68% of the world’s population has some degree of lactose malabsorption. Manufacturers have responded by launching a variety of lactose-free and vegan protein ice cream options, using ingredients such as almond milk, soy milk, and pea protein. This diversification caters to lactose-intolerant consumers and those following vegan or plant-based diets.

Product formulation and flavor variety innovation have driven the market. Manufacturers continuously experiment with new flavors and ingredients to attract a broader consumer base. For instance, brands like Halo Top, Enlightened, and Arctic Zero have introduced unique flavors such as Sea Salt Caramel, Red Velvet, and Peanut Butter Swirl, which combine indulgence with nutritional benefits. These innovations not only appeal to health-conscious consumers but also to traditional ice cream lovers seeking novelty.

Flavor Insights

Chocolate protein ice cream accounted for a revenue share of 36.93% in 2023 and is expected to grow at the highest CAGR during the forecast period. Chocolate flavor has long been a favorite among consumers, transcending age and demographic boundaries. Its rich and indulgent taste makes it a popular choice, satisfying cravings for a sweet treat while delivering the nutritional benefits of protein ice cream. The inherent versatility of chocolate allows it to pair well with various mix-ins, such as nuts, fruits, and other flavor swirls, enhancing its appeal. In addition, chocolate's established popularity in the broader ice cream market has helped it gain a dominant position in the protein ice cream segment. Marketing strategies often leverage chocolate's universal appeal to attract health-conscious individuals and traditional ice cream lovers, further solidifying its leading market share.

Vanilla protein ice cream is expected to grow at a CAGR of 3.9% from 2024 to 2030 due to its classic and versatile profile. Known for its subtle yet rich taste, vanilla is a perfect base for various toppings and mix-ins, making it a preferred choice for consumers looking for a customizable treat. Demand for clean and simple ingredients has also propelled vanilla's popularity, as it is often perceived as a more natural and less processed option than other flavors. In addition, the growth in consumer awareness about the health benefits of protein ice cream has led to an increased interest in traditional flavors like vanilla, which are trusted and familiar. This trend is further supported by innovative product launches and marketing efforts highlighting vanilla's balanced flavor and compatibility with a healthy lifestyle.

Pack Size Insights

The 125 ml - 250 ml pack size accounted for a revenue share of 46.09% in 2023 due to its perfect balance between portion control and consumer satisfaction. This size is ideal for individual servings, making it convenient for health-conscious consumers who want to manage their caloric and protein intake without overindulging. It also aligns well with the on-the-go lifestyle, providing a quick and easy way to enjoy a nutritious treat without committing to a larger portion. Moreover, this pack size is cost-effective for consumers, offering a moderate price point that encourages trial and repeat purchases. The manageable portion size appeals to a wide range of consumers, from fitness enthusiasts seeking a post-workout snack to those simply looking for a healthier dessert option.

The more than 250 ml pack size is expected to grow at a CAGR of 4.2% from 2024 to 2030 due to the increasing demand for family-sized and multi-serving options. As consumers become more health-conscious, there is a rising trend towards purchasing larger quantities of healthier food choices for home consumption. This pack size caters to households looking to stock up on nutritious treats that can be shared among family members or enjoyed over multiple occasions. In addition, the value proposition of larger packs, offering more products for a lower per-serving cost, is attractive to budget-conscious consumers. This growth is further supported by innovations in packaging that ensure the product's quality and freshness over time, making it a practical choice for those who prefer buying in bulk. As a result, the more than 250 ml pack size is capturing a significant market share, driven by consumer preferences for convenience, economy, and shared enjoyment.

Distribution Channel Insights

The sales of protein ice cream through hypermarkets/supermarkets accounted for a revenue share of 37.28% in 2023 due to their extensive reach and infrastructure. These retail channels offer a wide variety of brands and flavors under one roof, making it convenient for consumers to compare and choose products. In addition, their ability to stock large volumes ensures consistent availability, which is crucial for meeting consumer demand. The physical presence of these stores allows for tactile experiences and impulse purchases, complemented by promotional activities that drive sales. Overall, hypermarkets and supermarkets provide a trusted shopping environment that caters effectively to both regular and health-conscious consumers.

The sales of protein ice cream through online distribution channel are expected to grow at a CAGR of 9.4% from 2024 to 2030 driven by changing consumer shopping behaviors and technological advancements. The convenience of shopping online allows consumers to browse a diverse range of products, compare prices, and read reviews from the comfort of their homes. E-commerce platforms provide access to specialty brands and niche products that may not be readily available in traditional retail outlets. Moreover, the rise of digital marketing and social media influence has expanded brand visibility and consumer awareness, driving online sales. The ability to offer personalized recommendations and seamless delivery options further enhances the appeal of online shopping for protein ice cream, making it a preferred choice for busy, tech-savvy consumers seeking convenience and variety.

Protein Content Insights

The more than 10 grams protein content category accounted for a revenue share of 63.93% in 2023 due to the increasing consumer demand for high-protein products that support fitness and health goals. Many consumers seeking protein ice cream seek a substantial protein boost, whether for muscle recovery, satiety, or general health benefits. Products with higher protein content align with these needs, offering a more significant nutritional advantage compared to those with lower protein levels. In addition, the marketing of high-protein ice cream often highlights its benefits for fitness enthusiasts and those following specific dietary regimens, such as bodybuilding or weight loss programs, further driving its popularity.

Ice cream with less than 10 grams of protein content is expected to grow at a CAGR of 5.8% from 2024 to 2030 due to its appeal to a broader audience, including those who prioritize taste and texture over maximum protein intake. This category caters to consumers seeking a balance between indulgence and health benefits, offering a more traditional ice cream experience with a moderate protein boost. The lower protein content often results in a creamier texture and a more authentic ice cream taste, which attracts those who might find higher protein versions too dense or chalky. Furthermore, these products can appeal to individuals new to protein ice cream or those who do not require high protein intake but still seek a healthier alternative to regular ice cream. Innovations in flavor and product formulation within this segment and strategic marketing emphasizing its moderate protein benefits and improved taste contribute to its growing popularity.

Regional Insights

North America accounted for a revenue share of 44.51% in 2023 due to its advanced food and beverage industry infrastructure, strong consumer awareness of health trends, and a supportive regulatory environment. The region's well-established dietary guidelines and emphasis on nutritional labeling enhance consumer confidence in protein-enriched products like ice cream. Moreover, a high prevalence of fitness-conscious lifestyles and a robust demand for convenient yet nutritious snacks contribute to the market's growth. Major brands in North America continually innovate to meet consumer preferences for healthier dessert options, driving further market expansion.

U.S. Protein Ice Cream Market Trends

The protein ice cream market in the U.S. is expected to grow at a CAGR of 5.9% from 2024 to 2030. A burgeoning health and fitness culture and high demand for convenient yet nutritionally beneficial snacks drive consumer preference for protein-enriched ice creams. Manufacturers in the U.S. are responding with innovative product formulations that cater to various dietary needs, including low-calorie, high-protein, and dairy-free options. Robust distribution networks, encompassing retail giants and online platforms, ensure widespread availability and accessibility of protein ice creams across the country. In addition, strategic marketing efforts highlighting these products' health benefits and indulgent flavors further propel market growth in the U.S.

Europe Protein Ice Cream Market Trends

The protein ice cream market in Europe is expected to grow at a CAGR of 5.6% from 2024 to 2030, driven by a growing emphasis on health and wellness coupled with increasing consumer interest in functional foods. The region's mature food industry infrastructure and stringent regulatory standards ensure the quality and safety of protein ice cream products, bolstering consumer trust. Rising awareness of dietary benefits, such as muscle recovery and weight management, among European consumers is boosting demand for protein-enriched ice creams. Innovations in product formulations, including low-calorie and sugar-free variants, cater to diverse dietary preferences and contribute to market expansion.

Asia Pacific Protein Ice Cream Market Trends

The protein ice cream market in Asia Pacific is expected to grow with a CAGR of 7.9% from 2024 to 2030. Rising disposable incomes, urbanization, and changing dietary preferences drive the region's demand for convenient and healthier food choices. In addition, increased exposure to Western diets and trends, including fitness and wellness practices, influence consumer preferences toward protein-rich products like ice cream. Manufacturers are capitalizing on these trends by introducing innovative flavors and formulations tailored to local tastes, further fueling market growth in Asia-Pacific.

Key Protein Ice Cream Company Insights

The global market is characterized by the presence of numerous players such as Halo Top, Wheyhey, Beyond Better Foods, LLC, and Ice ‘N’ Lean, among others. These companies, along with several emerging players, contribute to a competitive landscape that fosters continuous innovation. They respond to market demands with new flavors, improved nutritional profiles, and convenient packaging while focusing on health benefits and taste. This dynamic environment ensures that consumers have access to a variety of protein ice cream options that cater to their dietary needs and preferences.

Key Protein Ice Cream Companies:

The following are the leading companies in the protein ice cream market. These companies collectively hold the largest market share and dictate industry trends.

- Halo Top

- Wheyhey

- Beyond Better Foods LLC

- Advanced Organic Materials, S.A.

- So Delicious

- Arctic Zero

- Ice ‘N’ Lean

- Yasso

- Peak Protein

- Skinny Cow

Recent Developments

-

In June 2024, The Brooklyn Creamery added Protein Ice Cream Bars to its portfolio amid rising demand for fortified options. The new protein ice cream bars feature a base of the company's signature creamy ice cream and a layer of protein-rich filling. Each bar contains 10g of high-quality protein, making it a more nutritious alternative to traditional ice cream treats. The bars are available in Chocolate Peanut Butter and Vanilla Almond. They are formulated with clean, simple ingredients and are free from artificial colors, flavors, and preservatives.

-

In February 2024, Perfect Day Day, a pioneer in precision fermentation, partnered with Unilever's Breyers brand to launch Breyers Lactose-Free Chocolate ice cream. This product uses Perfect Day's dairy protein created through precision fermentation, offering a lactose-free alternative with a reduced environmental impact. The ice cream provides consumers with the same indulgent experience as traditional dairy products. It is now available nationwide in a 48-ounce tub starting this month.

-

In June 2023, Myprotein launched a new line of high-protein ice cream flavors exclusively at UK Iceland and The Food Warehouse stores. The ice cream range includes Vanilla (99 calories, 10.9g protein), Chocolate (103 calories, 10.5g protein), and Salted Caramel (106 calories, 10g protein) per 1/3 tub serving.

-

In April 2023, Smart for Life, Inc. announced the launch of a new line of high-protein ice cream bars, marking its entry into a novel functional food product category. This initiative represents Smart for Life's commitment to expanding its offerings in the Health & Wellness sector with a unique product to meet consumer demand for nutritious and enjoyable snacks.

Protein Ice Cream Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.66 billion

Revenue forecast in 2030

USD 3.82 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Flavor, protein content, pack size, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Saudi Arabia

Key companies profiled

Halo Top; Wheyhey; Beyond Better Foods LLC; Advanced Organic Materials, S.A.; So Delicious; Arctic Zero; Ice ‘N’ Lean; Yasso; Peak Protein; Skinny Cow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Protein Ice Cream Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein ice cream market report based on flavor, protein content, pack size, distribution channel, and region:

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Chocolate

-

Vanilla

-

Strawberry

-

Others

-

-

Protein Content Outlook (Revenue, USD Million, 2018 - 2030)

-

More than 10 grams

-

Less than 10 grams

-

-

Pack Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Less than 125 ml

-

125 ml - 250 ml

-

More than 250 ml

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket/Supermarkets

-

Convenience Stores

-

Ice Cream Parlors

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global protein ice cream market size was estimated at USD 2.51 billion in 2023 and is expected to reach USD 2.66 billion in 2024.

b. The global protein ice cream market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030 to reach USD 3.82 billion by 2030.

b. Chocolate protein ice cream captured a largest revenue share of 36.9%in 2023 due to its widespread consumer appeal. Its rich taste satisfies cravings while providing protein benefits. Chocolate pairs well with various mix-ins, enhancing its versatility. Its established popularity in traditional ice cream helps solidify its dominance in the protein segment, with marketing strategies leveraging its universal appeal to attract a broad audience

b. Some key players operating in protein ice cream market include Halo Top; Wheyhey; Beyond Better Foods; LLC; Advanced Organic Materials, S.A.; So Delicious; Arctic Zero; Ice ‘N’ Lean; Yasso; Peak Protein; Skinny Cow

b. Key factors that are driving the market growth include the rise of fitness lifestyles, and increasing consumer demand for high-protein, nutritious treats. Manufacturers are responding with innovative product launches and diverse flavors, catering to both health-conscious consumers and traditional ice cream lovers. The growing prevalence of lactose intolerance has spurred the development of lactose-free and plant-based protein ice creams.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.