- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Protein Gummies Market Size, Share & Growth Report, 2030GVR Report cover

![Protein Gummies Market Size, Share & Trends Report]()

Protein Gummies Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredient (Gelatin, Plant-based Gelatin Substitute), By End-use (Adult, Kids), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-374-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Protein Gummies Market Size & Trends

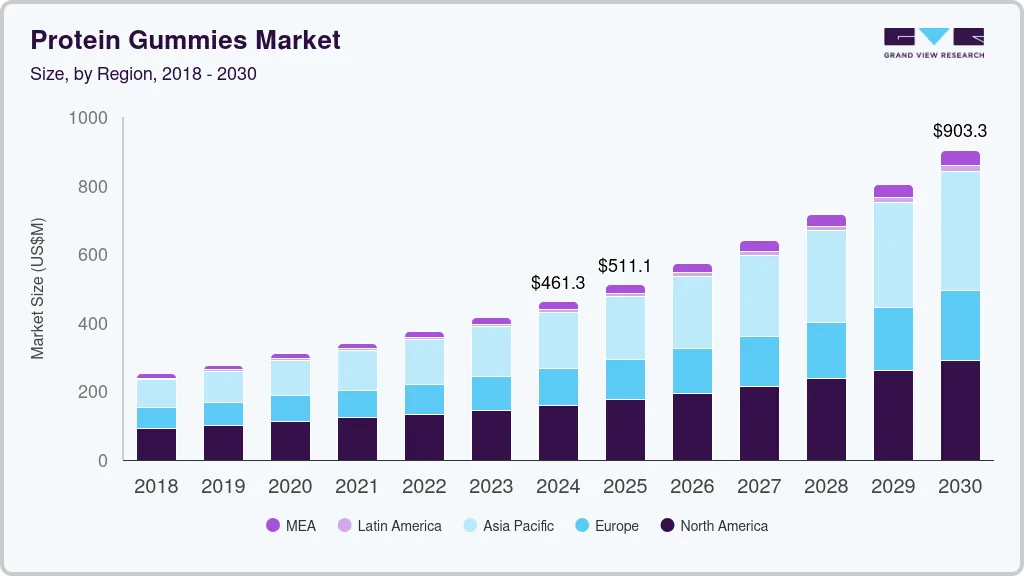

The global protein gummies market size was estimated at USD 461.3 million in 2024 and is expected to grow at a CAGR of 12.1% from 2025 to 2030. The prevailing hectic lifestyles and the number of consumers seeking a balanced diet drive the demand for protein and amino acids gummies. The gummies help consumers fulfill their daily dietary intake, especially consumers with busy lifestyles. Moreover, the rising number of consumers engaged in sports and physically demanding activities seek protein and amino acid supplements to support muscle recovery post-workout.

The increasing demand for dietary supplements to boost immunity and enhance digestion is expected to drive the market for vitamin- and protein-based gummies. According to the Health Food Manufacturers' Association (HFMA)'s Health of the Nation Survey 2020, about 71.2% of the surveyed adults in the U.K. consumed food supplements. It was also reported that about 60.7% of the surveyed respondents took food supplements for general health and well-being, followed by 24.3% for vitamin deficiency and 20.5% for joint health.

The market offers various types of protein gummies, such as sugar-free, vegan, and organic options. Sugar-free protein gummies are perfect for those looking to cut down on sugar or follow a low-carb diet. Vegan protein gummies cater to individuals on a plant-based diet, while organic protein gummies are made with organic ingredients, ensuring they are free from harmful chemicals.

The growing interest in plant-based diets and awareness of overall nutritional requirements has led to an increased demand for supplements such as gummies. The market is growing among vegans or consumers adopting a plant-based diet who require additional supplementation. These gummies help meet nutritional requirements and promote overall well-being. A notable shift in the market among the manufacturers toward incorporating plant-based ingredients like pectin, agar-agar, and other gelling agents is driving the demand for plant-based gummies. In April 2023, Gelita launched Confixx, a new type of starch-free gelatin, which would eliminate starch production and gummy drying process. This process is expected to shorten production and ensure flexible manufacturing in shorter batches.

The rise in specific dietary preferences and restrictions, such as veganism, low-carb, and organic, is driving the demand for specialized protein gummies. Consumers are seeking products that align with their dietary needs, including sugar-free, vegan, and organic options. Continuous product innovation, including new flavors, improved textures, and enhanced nutritional profiles, is attracting more consumers. Innovations in packaging and portion control are also contributing to the market growth.

Consumers are increasingly aware of the importance of protein for muscle growth, recovery, and overall health. Protein gummies offer a convenient and enjoyable way to meet daily protein requirements. The popularity of plant-based diets has fueled demand for alternative protein sources. Many protein gummies are made with vegan-friendly ingredients, such as pea, soy, and brown rice protein. To cater to consumer preferences, manufacturers are expanding the range of flavors available in protein gummies.

In April 2023, BroScienceLife launched Gym Candy, a tasty gummy-style candy that's loaded with protein, low in net carbs, and touted as the finest bro candy on the market. A bag of BroScienceLife’s Gym Candy boasts an impressive nutritional profile, containing 18g of protein mainly derived from gelatin, which is a form of cooked collagen. Additionally, it includes just 1g of fat, 100 calories, and, as noted, exceptionally low net carbohydrates.

Ingredient Insights

The gelatin segment dominated the market and accounted for a share of 68.27% in 2023. Gelatin-based gummies are the most common supplements provided by manufacturers. Factors such as the ideal texture, cost-effectiveness, and compatibility with other ingredients drive the demand for gelatin-based gummies. These attributes allow manufacturers to create functional gummies with added health benefits. Furthermore, gelatin-based gummies possess a chewy texture that appeals to consumers. For instance, in October 2023, Cargill shared its consumer research at a trade show in Las Vegas, U.S. As per its survey, 50% of respondents prefer the harder texture of gummies produced due to gelatin.

The plant-based gelatin substitute segment is expected to grow at a CAGR of 13.3% from 2024 to 2030. Consumers’ rising awareness of clean-label products and the increasing vegan populace have generated the demand for plant-based gelatin substitutes for utilization in gummies. Plant-based gummies are free of animal-derived ingredients, making them ideal for consumers following a vegan lifestyle. Several manufacturers are launching vegan or plant-based gummies to cater to the growing demand for these gummies. For instance, in July 2023, Monteloeder, S.L., a subsidiary brand of SuanNutra, innovated its Eternalyoung anti-aging botanical blend. The company elevated the brand by introducing a fruit-flavored vegan gummy into the combination of four vegan-based ingredients, enhancing the overall experience of this skincare solution.

End-use Insights

The adult segment accounted for a revenue share of 78.74% in 2023. The taste and texture of gummies are its major demand drivers. The wide availability of protein gummies in different flavors makes them more appealing than traditional supplements such as pills or capsules. Furthermore, protein gummies are also easier to consume, especially for consumers who have difficulty swallowing pills or capsules. Also, hectic lifestyles among men are an important factor driving the demand for protein gummies. Gummies are a convenient way for men to maintain their overall health and have led the market growth.

The kids segment is expected to grow at a CAGR of 13.7% from 2024 to 2030. The sweet taste of gummies and their availability in different flavors, shapes, and colors are among the key factors driving the demand for gummies among kids. Many parents opt for gummies with necessary nutrients and supplements, such as vitamins or minerals. The pleasant taste and attractive presentation of gummies make it easier for parents to convince their kids to consume these essential nutrients.

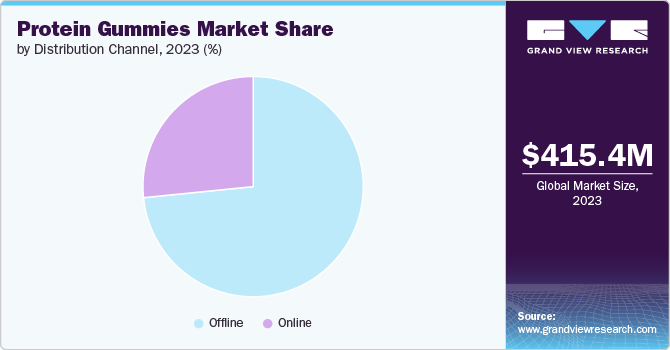

Distribution Channel Insights

Sales of protein gummies through offline retail stores accounted for a revenue share of 79.46% in 2023. Offline channels typically offer a diverse range of health and wellness products, catering to various consumer preferences and needs. The availability of gummy supplements, which are popular for their taste and ease of consumption, contributes to the attractiveness of these stores. The presence of global brands in offline stores enhances the credibility and reliability of the products available. Global brands often invest in marketing and promotion, creating awareness and driving consumer trust, which, in turn, boosts sales. Established offline retailers often build strong relationships with consumers over time, fostering brand loyalty and trust. Consumers prefer to purchase health and wellness products from familiar and reputable outlets, contributing to sustained sales.

Sales of protein gummies through online retail stores are expected to grow at a CAGR of 14.6% from 2024 to 2030. The growing demand for gummy supplements through e-commerce or online channels can be attributed to the wide availability of multiple gummy supplement brands. These channels allow market players to display their products and gain global traction from consumers, which might not be impossible in other offline channels. Moreover, these channels frequently implement dynamic pricing strategies and discounts to drive sales. These factors are considered highly favorable among consumers, encouraging them to purchase gummy supplements.

Regional Insights

North America protein gummies market captured a revenue share of over 35.07% in 2023. Growing consumer awareness and preferences for nutritional supplements and fortified food products have fueled the consumption of protein gummies in the region. Its essential role in supporting overall health, including metabolism and cardiovascular function, has contributed to its popularity among health-conscious consumers in North America. Moreover, the region's robust healthcare infrastructure and strong regulatory framework have supported the market's growth by ensuring product safety and efficacy standards. Moreover, manufacturers are increasingly tailoring gummy supplements to target specific demographics or address certain health concerns. Whether it is multivitamins for adults, prenatal vitamins for expectant mothers, or supplements targeting joint health or stress relief, this targeted approach resonates well with adults seeking personalized solutions for their unique health needs.

U.S. Protein Gummies Market Trends

The protein gummies market in the U.S. is facing intense competition due to massive product innovation from categories including cosmetics, vitamin-fortified food among others. The increased consumption of protein gummies in the U.S. can be attributed to several factors and trends. These include a growing interest in health and wellness, the appeal of gummies as a more palatable and pleasant alternative to traditional supplement formats, and the convenience associated with protein gummies, especially for children or adults who may have difficulty swallowing pills. In addition, the increasing demand for natural and organic gummy supplements offers the U.S. protein gummy market with strong growth opportunities.

Europe Protein Gummies Market Trends

The protein gummies market in Europe is expected to grow significantly during the forecast period. There is a growing emphasis on preventive healthcare in Europe, leading to an increased demand for dietary supplements, including gummy supplements, among health-conscious consumers. A wide variety of protein supplements are available in the European market: gummies fortified with gelatin and plant-based gelatin substitutes that can improve heart health and prevent cardiovascular diseases, as well as gummies infused with botanical extracts such as curcumin and cannabidiol (CBD) that offer anti-inflammatory and cancer-preventive properties. The market is witnessing various product innovations, and there is a significant demand for these protein gummy supplements, reflecting the evolving preferences of European consumers.

Asia Pacific Protein Gummies Market Trends

The protein gummies market in Asia Pacific is expected to witness a CAGR of 13.5% from 2024 to 2030. The presence of highly populated countries, such as China and India, along with several untapped markets in Southeast Asia, is expected to support the growth of the protein gummies market in the region. Gummy supplement brands are launching products catering to different demographic groups to enhance their consumer base. Rising consumer preference for healthy products in the region is anticipated to augment the demand for gummies infused with vitamins and proteins. In addition, gummies formulated from collagen and hyaluronic acid are expected to gain popularity among the female population of the country as they are beneficial for skin and hair.

Key Protein Gummies Company Insights

The protein gummies market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Protein Gummies Companies:

The following are the leading companies in the protein gummies market. These companies collectively hold the largest market share and dictate industry trends.

- Procaps Group, S.A.

- Herbaland

- Prime Health Ltd.

- Church & Dwight Co., Inc.

- SMP Nutra

- Bayer AG

- Nature’s Bounty

- SmartyPants Vitamins

- Garden of Life

- Haleon plc

Recent Developments

-

In January 2024, Smart Protein unveiled a line of science-backed, nutritionist-formulated supplements that cater to the growing demand for active wellness. In the 'Wellness' category, they have introduced a well-balanced selection of vitamins and supplements, which includes nootropics, gummies, and supergreens. These supplements, grouped under the 'Wellness' category, offer a comprehensive range of vitamins and supplements tailored to enhance overall health and well-being.

-

Kuli Kuli, a leading moringa-based food company, announced the launch of its new SuperGummies infused with proteins and vitamins at Natural Products Expo West. These innovative gummies are not only plant-based and gelatin-free, but also come packaged in pouches made from post-consumer recycled materials, demonstrating Kuli Kuli's commitment to sustainability. These gummies are a powerhouse of protein, fiber, potassium, calcium, and vitamin A, making it a delicious and healthy addition to any diet.

Protein Gummies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 511.1 million

Revenue forecast in 2030

USD 903.3 million

Growth rate

CAGR of 12.1% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Ingredient, end-use, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Brazil; and South Africa

Key companies profiled

Procaps Group, S.A., Herbaland, Prime Health Ltd. Church & Dwight Co., Inc. SMP Nutra, Bayer AG,, Nature’s Bounty, SmartyPants Vitamins, Garden of Life, Haleon plc

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein Gummies Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein gummies market report based on ingredient, end use, distribution channel, and region:

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Plant-based Gelatin Substitute

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Men

-

Women

-

Pregnant Women

- Geriatric

-

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global protein gummies market size was estimated at USD 415.4 million in 2023 and is expected to reach USD 461.3 million in 2024.

b. The global protein gummies market is expected to grow at a compounded growth rate of 11.8% from 2024 to 2030 to reach USD 903.3 million by 2030.

b. The gelatin segment dominated the protein gummies market with a share of 68.27% in 2023. Gelatin-based gummies are the most common supplements provided by manufacturers. Factors such as the ideal texture, cost-effectiveness, and compatibility with other ingredients drive the demand for gelatin-based gummies.

b. Some key players operating in the protein gummies market include Procaps Group, S.A., Herbaland, Prime Health Ltd. Church & Dwight Co., Inc. SMP Nutra, Bayer AG

b. Key factors that are driving the market growth include the increasing demand for dietary supplements to boost immunity and enhance digestion. Also, the growing interest in plant-based diets and awareness of overall nutritional requirements has led to an increased demand for supplements such as protein gummies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.