- Home

- »

- Consumer F&B

- »

-

Protein-fortified Noodles & Pasta Market Size Report, 2030GVR Report cover

![Protein-fortified Noodles & Pasta Market Size, Share & Trends Report]()

Protein-fortified Noodles & Pasta Market Size, Share & Trends Analysis Report By Product (Pasta, Noodles), By Type (Dried, Instant), By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-384-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

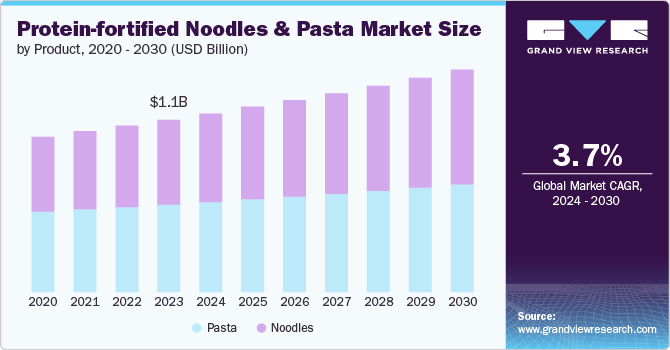

The global protein-fortified noodles & pasta market size was estimated at USD 1.05 billion in 2023 and is expected to grow at a CAGR of 3.7% from 2024 to 2030. The market is experiencing robust growth driven by the increasing consumer awareness of the importance of protein in the diet. As health consciousness rises globally, there is a growing demand for functional foods that offer added nutritional benefits, including higher protein content. Consumers are seeking out protein-fortified noodles and pasta as convenient, tasty options to boost their daily protein intake without significantly altering their dietary habits.

Another significant driver is the expanding vegan and vegetarian population. With more people adopting plant-based diets, there is a heightened demand for alternative protein sources. Protein-fortified noodles and pasta, which can be enriched with plant-based proteins such as peas, soy, and lentils, cater to this market segment. The rise in flexitarian diets, where consumers seek to reduce meat consumption without fully eliminating it, also supports this trend.

In addition, the increasing incidence of lifestyle-related diseases such as obesity, diabetes, and cardiovascular conditions has led to a shift towards healthier eating patterns. Consumers are actively looking for food products that support weight management and overall well-being. Protein-fortified noodles and pasta offer a balance of essential nutrients, making them appealing to health-conscious individuals seeking to manage their weight and maintain muscle mass.

The market is also influenced by innovations in food processing and ingredient technology. Advances in these areas have enabled manufacturers to develop high-quality, protein-fortified products with improved taste, texture, and shelf life. The use of novel protein sources and fortification techniques has broadened the appeal of these products, making them more acceptable to a wider consumer base.

Furthermore, the growing popularity of convenience foods is boosting the demand for ready-to-cook and ready-to-eat protein-fortified noodles and pasta. Busy lifestyles and the need for quick, nutritious meal options are driving this trend. The expanding retail landscape, with the proliferation of supermarkets, hypermarkets, and online grocery platforms, has also made these products more accessible to consumers worldwide.

Product Insights

The protein-fortified pasta market captured a share of 50.8% in 2023. This dominance can be attributed to its versatility and widespread acceptance across various cuisines globally. Pasta's ability to seamlessly integrate into both traditional and modern dishes makes it a preferred choice for health-conscious consumers seeking to enhance their meals with added protein.

Additionally, the perception of pasta as a wholesome and filling option, often associated with balanced meals, gives it an edge over noodles, which are sometimes viewed as a quicker, less substantial meal alternative. The higher shelf stability and better texture retention of protein-fortified pasta also contribute to its popularity, ensuring that consumers can enjoy a satisfying and nutritionally enhanced dining experience. These factors collectively position protein-fortified pasta as a leading choice in the protein-enriched food segment.

The protein-fortified noodles market is expected to grow at a CAGR of 4.4% from 2024 to 2030. This growth is driven by the increasing health consciousness among consumers who are seeking convenient yet nutritious meal options. Protein-fortified noodles offer a quick and easy way to incorporate additional protein into the diet, appealing to busy individuals and families.

Furthermore, the growing popularity of plant-based and high-protein diets is boosting the demand for these fortified products. Manufacturers are also focusing on product innovation, introducing new flavors and formulations to cater to diverse taste preferences and dietary needs. The expanding distribution channels, including e-commerce and health-focused retail outlets, are making protein-fortified noodles more accessible to a broader audience, further fueling market growth.

Type Insights

Protein-fortified instant noodles & pasta accounted for a revenue share of 60.3% in 2023. Thissubstantial share is driven by the rising demand for quick, nutritious meal solutions that fit into busy lifestyles. Instant noodles and pasta offer the convenience of rapid preparation without compromising on the added health benefits of increased protein content. The appeal of these products spans across various consumer demographics, from working professionals to health-conscious individuals and families seeking to enhance their nutritional intake efficiently.

Moreover, the continued innovation in flavors, ingredients, and packaging has broadened the market reach, making protein-fortified instant noodles and pasta a preferred choice for those looking for a balance between convenience and health. The strong performance of this market segment highlights the growing trend towards functional and easy-to-prepare foods, meeting the evolving dietary needs and preferences of modern consumers.

The protein-fortified dried noodles & pasta is expected to grow at a CAGR of 6.5% from 2024 to 2030, reflecting increasing consumer preference for health-oriented pantry staples. This growth is propelled by the rising awareness of the benefits of high-protein diets and the ongoing trend towards healthier eating habits. Dried noodles and pasta, known for their longer shelf life and ease of storage, provide a convenient option for consumers seeking nutritious meal components that are readily available.

The market is also benefiting from the innovation in protein fortification techniques, which enhance the nutritional profile without compromising taste and texture. Additionally, the expansion of e-commerce platforms and health food stores is making these products more accessible to a wider audience. As consumers continue to prioritize health and convenience, the demand for protein-fortified dried noodles and pasta is expected to grow steadily, driving market expansion over the forecast period.

Distribution Channel Insights

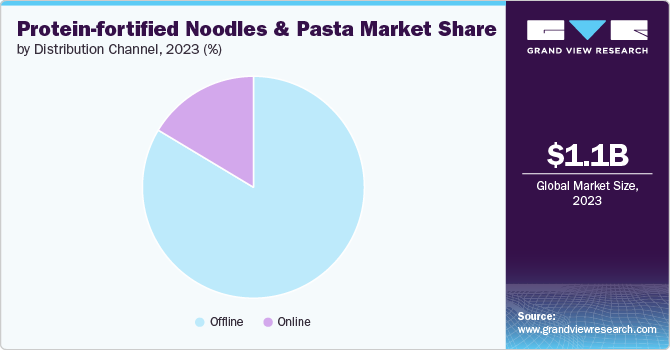

Sales of protein-fortified noodles & pasta through offline distribution accounted for a revenue share of 83.6% in 2023. This dominance highlighting the continued importance of traditional retail in the food industry. Supermarkets, hypermarkets, and grocery stores remain crucial points of purchase for consumers, providing the convenience of immediate availability and the ability to inspect products before buying. These physical retail outlets also benefit from the trust and familiarity they have built with customers over time.

In addition, offline channels often offer promotional activities, in-store tastings, and personalized customer service, enhancing the shopping experience and encouraging purchases. The presence of protein-fortified noodles and pasta in well-established offline retail networks ensures wide accessibility and visibility, contributing significantly to their market penetration and revenue. Despite the rise of online shopping, the substantial revenue share from offline sales underscores the enduring preference for purchasing food items in person.

Sales of protein-fortified noodles and pasta through online distribution channels are projected to grow at a CAGR of 5.0% from 2024 to 2030, reflecting a significant shift in consumer purchasing behavior. This growth is driven by the increasing adoption of e-commerce platforms, which offer the convenience of home delivery and a wider selection of products. The rising penetration of the internet and smartphones, coupled with the growing comfort of consumers in making online purchases, supports this trend.

In addition, online retailers often provide detailed product information, customer reviews, and competitive pricing, which are attractive to health-conscious consumers looking for specific dietary options like protein-fortified foods. Subscription services and the ability to quickly compare products and prices further enhance the appeal of online shopping for protein-fortified noodles and pasta. As digital transformation continues to reshape the retail landscape, the online distribution channel is poised to become an increasingly important avenue for market growth in this segment.

Regional Insights

The protein-fortified noodles & pasta market in North America captured a revenue share of 32.2% in 2023. This substantial market share can be attributed to several factors, including the high level of health consciousness among consumers in North America, who are increasingly seeking functional foods that offer added nutritional benefits. The region's well-developed food industry infrastructure and widespread availability of protein-fortified products in supermarkets, health food stores, and online platforms further drive market growth.

In addition, the increasing popularity of plant-based and high-protein diets, fueled by rising awareness of the benefits of protein for overall health and wellness, supports the robust demand for protein-fortified noodles and pasta. North America's proactive approach to adopting food innovations and dietary trends positions it as a leading market for protein-enriched food products, reflecting a strong consumer preference for convenient, nutritious, and functional food options.

U.S. Protein-fortified Noodles & Pasta Market Trends

The U.S. protein-fortified noodles and pasta market is experiencing notable trends driven by evolving consumer preferences and dietary habits. One significant trend is the increasing demand for high-protein diets, fueled by growing health awareness and the desire for functional foods that support muscle maintenance, weight management, and overall wellness. Consumers are actively seeking out protein-fortified options as a convenient way to boost their protein intake without overhauling their entire diet.

Another trend is the rise of plant-based proteins, as more consumers adopt vegetarian, vegan, or flexitarian lifestyles. This shift is driving innovation in the protein-fortified noodles and pasta segment, with manufacturers introducing products enriched with plant-based proteins such as peas, lentils, and chickpeas. These plant-based alternatives not only cater to dietary preferences but also appeal to environmentally conscious consumers.

The U.S. market is also seeing increased interest in clean-label and non-GMO products. Consumers are scrutinizing ingredient lists and favoring products that are perceived as healthier and more natural. This trend is pushing manufacturers to develop protein-fortified noodles and pasta with minimal additives and transparent labeling.

Convenience remains a key driver in the U.S. market. Busy lifestyles and the demand for quick, nutritious meal solutions are boosting the popularity of ready-to-cook and ready-to-eat protein-fortified noodles and pasta. These products are particularly appealing to working professionals, students, and families who prioritize time efficiency without compromising on nutrition.

Europe Protein-fortified Noodles & Pasta Market Trends

In Europe, the protein-fortified noodles and pasta market is witnessing several distinctive trends that cater to diverse consumer preferences and dietary habits across the region. One prominent trend is the increasing emphasis on sustainability and ethical sourcing. European consumers are increasingly concerned about the environmental impact of their food choices, leading to a growing demand for sustainably sourced ingredients in protein-fortified products. Manufacturers are responding by incorporating responsibly sourced proteins and promoting eco-friendly packaging solutions, aligning with Europe's strong commitment to environmental stewardship.

Another key trend in the European market is the rise of premiumization. Consumers are willing to pay a premium for high-quality, artisanal, and gourmet protein-fortified noodles and pasta. This trend is driven by a desire for authenticity, unique flavor profiles, and superior nutritional value. Manufacturers are innovating with premium ingredients, such as specialty grains and heritage wheat varieties, to cater to this discerning consumer segment.

Health and wellness continue to be pivotal drivers in the European protein-fortified noodles and pasta market. There is a growing awareness of the role of protein in maintaining muscle mass, promoting satiety, and supporting overall health. As a result, there is a steady demand for products that offer higher protein content without sacrificing taste or texture. European consumers are increasingly seeking out functional foods that align with their health goals, including weight management and improved nutritional balance.

Asia Pacific Protein-fortified Noodles & Pasta Market Trends

The protein-fortified noodles & pasta market in Asia Pacific is expected to witness a CAGR of 4.6% from 2024 to 2030. The protein-fortified noodles and pasta market in the Asia Pacific region is poised for steady growth, projected to achieve a compound annual growth rate (CAGR) of 4.6% from 2024 to 2030. This growth trajectory is driven by several factors unique to the region. One significant driver is the increasing urbanization and changing dietary patterns among the burgeoning middle-class population. As urban lifestyles become more hectic, there is a rising demand for convenient yet nutritious food options like protein-fortified noodles and pasta, which offer quick preparation and enhanced nutritional benefits.

Another key driver is the growing awareness of health and wellness across Asia Pacific countries. Consumers are becoming more health-conscious and are actively seeking products that support their dietary goals, including increasing protein intake. Protein-fortified noodles and pasta cater to this demand by providing a convenient source of protein, appealing to individuals looking to maintain or improve their overall health.

Additionally, the cultural affinity for noodles and pasta in many Asian countries contributes to the market's growth. These products are staples in Asian cuisine and are widely accepted as versatile meal options that can be adapted to local tastes and preferences. The integration of protein fortification into these traditional dishes enhances their nutritional value without compromising on flavor or texture, making them appealing to a broad consumer base.

Key Protein-fortified Noodles & Pasta Company Insights

The competitive landscape in the market is characterized by a mix of global players and regional manufacturers, each vying for market share through innovation, product differentiation, and strategic partnerships. Major players leverage their brand recognition and substantial resources to invest in research and development, continuously improving product formulations to meet consumer demand for healthier and more nutritious options. They often introduce new flavors, fortification techniques, and packaging innovations to differentiate their offerings and maintain market leadership.

At the same time, regional and local manufacturers play a significant role, particularly in catering to specific cultural preferences and dietary habits. These companies often focus on niche markets, offering products tailored to local tastes and dietary requirements. They may emphasize natural ingredients, traditional recipes, or specific health benefits to appeal to discerning consumers seeking authenticity and quality.

Innovative startups and niche players are also contributing to the competitive landscape by introducing novel concepts and ingredients. These companies often specialize in plant-based proteins, gluten-free formulations, or organic ingredients, targeting health-conscious consumers looking for alternatives to conventional products.

Key Protein-fortified Noodles & Pasta Companies:

The following are the leading companies in the protein-fortified noodles & pasta market. These companies collectively hold the largest market share and dictate industry trends.

- Barilla Group

- Brami

- Nestlé S.A.

- Banza

- The Only Bean

- Mille Supergrain

- Borgatti's

- PESCANOVA

- Kaizen Food Company

- Vite Ramen

Recent Developments

-

In June 2024, the Gym Kitchen launched protein instant noodles. The range, which includes main-stream curry and chicken & mushroom variants, packs a powerful punch of protein, with each cooked pot providing at least 23g and a maximum of 288 kcal.

-

In March 2024, Barilla launched Cellentani, a new addition to its line of Protein+ pastas. The corkscrew shape is made from golden wheat, chickpeas, lentils, and peas and contains 17 grams of protein and 10 grams of fiber per 3.5 oz serving.

Protein-fortified Noodles & Pasta Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.09 billion

Revenue forecast in 2030

USD 1.36 billion

Growth rate

CAGR of 3.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/ Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; U.K.; Italy; Spain; China; Japan; India; South Korea; Brazil; and South Africa

Key companies profiled

Barilla Group; Brami; Nestlé S.A.; Banza; The Only Bean; Mille Supergrain; Borgatti's; PESCANOVA; Kaizen Food Company; and Vite Ramen

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Protein-fortified Noodles & Pasta Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global protein-fortified noodles & pasta market report based on product, type, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pasta

-

Noodles

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Dried

-

Instant

-

Frozen/ Canned

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global protein-fortified noodles & pasta market size was estimated at USD 1.05 billion in 2023 and is expected to reach USD 1.09 billion in 2024.

b. The global protein-fortified noodles & pasta market is expected to grow at a compounded growth rate of 3.7% from 2024 to 2030 to reach USD 1.36 billion by 2030.

b. The protein-fortified noodles & pasta market in North America captured a revenue share of 32.2% in 2023. This substantial market share can be attributed to several factors, including the high level of health consciousness among consumers in North America, who are increasingly seeking functional foods that offer added nutritional benefits.

b. Some key players operating in the market include Barilla Group, Brami, Nestlé S.A., Banza, The Only Bean, Mille Supergrain, Borgatti's, PESCANOVA, Kaizen Food Company, and Vite Ramen

b. Consumers are actively looking for food products that support weight management and overall well-being. Protein-fortified noodles and pasta offer a balance of essential nutrients, making them appealing to health-conscious individuals seeking to manage their weight and maintain muscle mass.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."