- Home

- »

- Consumer F&B

- »

-

Protein-fortified Food Products Market Size Report, 2030GVR Report cover

![Protein-fortified Food Products Market Size, Share & Trends Report]()

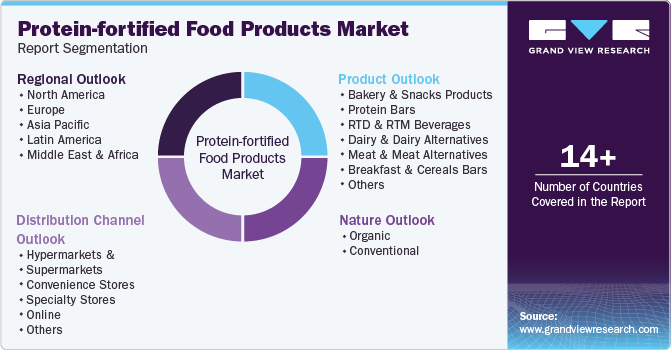

Protein-fortified Food Products Market Size, Share & Trends Analysis Report By Nature (Organic, Conventional), By Product, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-386-5

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Protein-fortified Food Products Market Trends

The global protein-fortified food products market size was estimated at USD 66.8 billion in 2023 and is expected to grow at a CAGR of 6.2% from 2024 to 2030. With increasing health consciousness and busy lifestyles, consumers seek convenient, easy-to-consume protein-rich food products. This has fueled the growth of protein-fortified snacks, beverages, and ready-to-eat meals. The popularity of plant-based diets has led to a surge in demand for plant-based protein sources, such as soy, pea, and rice proteins. Manufacturers are fortifying various food products with these plant-based proteins to cater to vegan and vegetarian consumers.

Increasing awareness regarding health, wellness, and nutrition, especially among Gen-Z and millennials, is a major factor driving the demand for healthier and more nutritious foods, including protein-fortified food products. In July 2021, EIT Food launched a report titled ‘Our Food, Our Food System’, which included a survey conducted on 18-24-year-olds from some European countries. According to the findings of the study, approximately 72% of the participants stated that healthy eating was an integral part of their physical and mental health, and more than 50% claimed that they tracked their food consumption. Such habits indicate a growing focus on overall health and wellness, benefiting the protein-fortified food products market.

Many critical private and public players in the market have been launching various campaigns to help raise awareness regarding the importance of protein in the diet and emphasize the benefits of nutritious foods. Such initiatives drive consumer demand for protein-fortified food products. For instance, in October 2023, Steadfast Nutrition, an Indian sports nutrition and wellness brand, introduced its ‘Make India Protein Efficient’ campaign to help address the challenge of protein deficiency in the country. Through a national campaign video, Steadfast Nutrition focused on the adverse effects of protein deficiency on health and the benefits of adding macronutrients to daily diets. Numerous athletes and nutritionists participated in this campaign to educate people about India’s problem of protein deficiency, wherein a significant portion of the Indian population is unaware that their diet lacks protein.

The rise of flexitarianism has led to increased demand for plant-based proteins as consumers seek alternatives to traditional animal-based sources. Plant-based proteins have gained popularity among health-conscious consumers, with pea, oat, soy, and almond proteins being particularly appealing in various applications such as bars, snacks, and beverages.

While flexitarians make up a significant portion of the consumer base, brands that offer plant- and animal-based proteins can attract a broader following. Formulating products with plant-based proteins presents unique challenges related to taste and texture, which must be addressed to meet consumer expectations. As per the 2022 Food and Health Survey, Americans have prioritized various areas to alleviate or handle stress, with the foremost ones being sleep at around 41%, exercise at around 40%, dietary habits at 30%, and mental well-being at 30%. Of those who opted for dietary adjustments, the prevalent changes include striving for healthier eating habits (54%), emphasizing healthy practices over weight management (over 37%), and adhering to particular eating patterns or diets (over 36%).

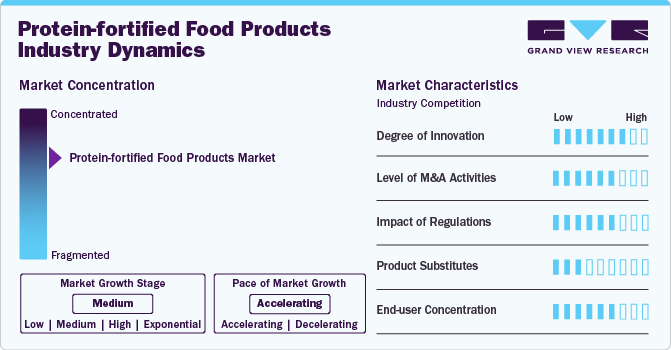

Market Concentration & Characteristics

In the protein-fortified food products market, technology trends drive innovation, leading to new product development and ensuring their sustainability. One significant trend is the use of advanced processing techniques to enhance the nutritional profile of food products. Microencapsulation protects sensitive nutrients like proteins during processing, ensuring their efficacy and bioavailability in the final product. For instance, in February 2022, Britvic entered into a USD 1.07 million (£1m) innovation partnership with Xampla, a company backed by the University of Cambridge, to develop technology to protect its vitamin-fortified drinks. The technology built by Xampla uses pea protein to create microscopic capsules in the liquid that protect vitamins.

Protein-fortified food products are growing significantly owing to the rising demand for nutritious and healthy food as consumers increasingly prioritize health and wellness. Manufacturers respond to this trend by introducing protein fortification across various food and beverage offerings. This includes traditional sports nutrition products and everyday items such as snacks, bread, baking mixes, beverages, and meat alternatives. For instance, in August 2023, ZENB, a Japan-based company offering plant-based, gluten-free products, launched grain-free pasta products formulated with yellow peas across the U.S. The pasta includes 21 grams of protein and 12 grams of fiber per 100 grams. The diversification of protein-enriched products suggests a growing consumer interest in functional foods that support long-term health goals.

The market is significantly influenced by stringent regulatory frameworks governing manufacturing standards, sustainability practices, and consumer safety measures. The Food and Drug Administration of the U.S. introduced the Food Fortification Policy (21 CFR104.20) in the 1980s to outline a set of principles that would serve as a model for the rational addition of essential vitamins, minerals, and protein. The policy further discouraged the addition of nutrients to foods indiscriminately.

End-user concentration for protein-fortified food products can vary significantly depending on several factors, such as the target market, dietary needs, and product type. Protein-fortified products for the general population might have a moderate protein concentration, typically ranging from 5-15 grams per serving. This concentration boosts protein without overwhelming those who may not have high protein requirements.

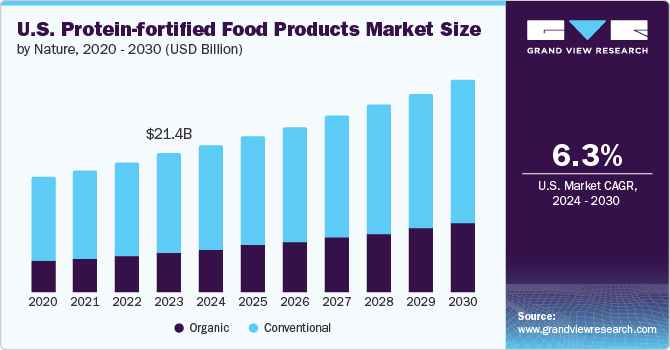

Nature Insights

The conventional protein-fortified food products segment accounted for a share of 25.3% of the total revenue in 2023. The easy availability of conventional protein-fortified food products, backed by new product launches and innovation by key market players, is further expected to drive segmental growth. For instance, in January 2024, General Mills Inc. brand Yoplait introduced a line of high-protein, low-sugar yogurt snacks. The product has various flavors, such as vanilla, cherry, peach, strawberry, and mixed berry. In addition, these products can be easily found in various grocery stores, supermarkets, and other markets, making them easier for the general public to purchase. This accessibility ensures that individuals living in urban and rural areas can access them.

The organic protein-fortified food products segment is projected to grow at a CAGR of 8.5% from 2024 to 2030. The increasing preference for organic and clean-label products due to rising health and environmental concerns is a major driver for segmental growth. According to a study published by ScienceDirect (Elsevier B.V.) in December 2023, organic fruits and vegetables have approximately 27% more vitamin C and zero pesticide residues than conventionally grown foods. Such benefits are expected to drive the adoption of organic ingredients in various food products.

Product Insights

The protein segment accounted for a share of 21.2% in 2023. Protein bars are a convenient and quick option for protein and calories that can help increase daily intake of essential nutrients without much hassle and offer a more filling alternative to less nutritious snack foods. The ease of consumption offered by protein bars and the ability to provide a quick energy boost make them an attractive choice for on-the-go snacking, driving their popularity and contributing to the overall segment growth. In addition, protein bars also provide a healthy and protein-packed snack option, making them suitable for athletes who require high nutrition intake and energy. For instance, according to a study published in the Multidisciplinary Digital Publishing Institute (MDPI) in January 2024, protein bars fortified with minerals, vitamins, and antioxidants have around 20 g of protein per serving and have low carbohydrate and sodium content. These bars are hence considered beneficial nutritional supplements for athletes.

The sports & nutrition supplements segment is projected to grow at a CAGR of 4.4% from 2024 to 2030. The increasing emphasis on preventive health and the desire to improve physical well-being drives the demand for sports and nutrition supplements, including tablets, gummies, and pills. The rise in the health-conscious population, which is more inclined to use dietary supplements as a precautionary measure, drives product demand. In addition, athletes often turn to sports supplements to improve their fitness levels and enhance their performance. The increasing research and development efforts and the launch of innovative products by key players are further expected to boost market growth. For instance, in February 2024, Nestlé launched Resource Activ, a high-protein supplement in India, to address nutritional gaps and meet the wellness needs of active millennials nationwide. Similarly, in 2023, Vinatura Supplements, a brand of healthy supplements, was launched in the U.S. to help provide high-quality supplements and promote healthy living.

Distribution Channel Insights

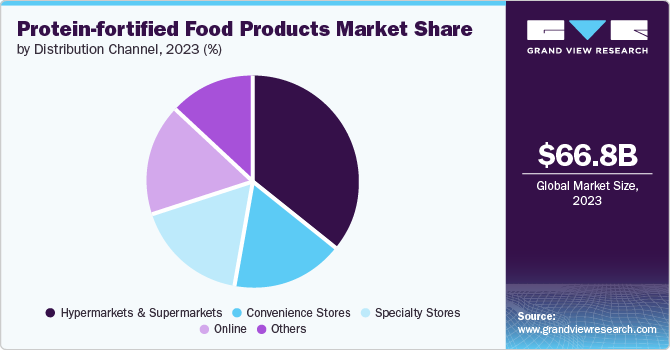

The supermarkets and hypermarkets segment accounted for 35.7% of the protein-fortified food products market in 2023. Supermarkets and hypermarkets are gaining popularity due to their multiple options and the convenience of buying everything in a single place. The availability of various products also enables customers to choose from numerous options according to their preferences, dietary requirements, and budget.

The online distribution channel segment is projected to grow at a CAGR of 7.3% from 2024 to 2030. Online channels offer advantages to both brands and customers, as they eliminate mediator and storage costs and add a personalized shopping experience. These also provide brands insights into consumer preferences through integrating big data analytics and help improve their product portfolios. Key players in the protein-fortified food market are shifting to online sales channels to expand their customer base and sales. For instance, in June 2023, General Mills Inc. announced an increase of around 24% in e-commerce retail sales in the U.S. in fiscal ’23, enabled by its use of data and analytical capabilities to assess and improve online presence. In addition, in November 2021, Nestle announced its plans to increase its e-commerce sales from approximately 13% in 2020 to 25% by 2025. These development strategies by key players are likely to drive online demand for fortified foods over the forecast period.

Regional Insights

North America held a share of over 34.7% of the global market in 2023. Companies have been actively expanding their presence in the U.S. market through acquisitions of smaller firms, increasing their protein production capacities, and broadening their product offerings. Players such as Agropur, Anchor Ingredients, and Hilmar Cheese have notably enhanced their production capabilities during the review period. This continuous focus on product innovation and diversification has led to increased sales volume. In August 2023, Anchor Ingredients announced the acquisition of a grain handling facility in North Dakota. The new facility is being constructed to offer increased storage for raw materials and a larger area for processing ingredients and is expected to broaden its range of ingredients and enhance its processing capabilities.

U.S. Protein-fortified Food Products Market Trends

The protein-fortified food products market in the U.S. is expected to grow at a CAGR of 6.3% from 2024 to 2030. Consumers in the U.S. are increasingly focused on living healthier lifestyles and making more conscious choices about the foods they consume. This health-conscious behavior has led to a growing interest in functional foods that offer nutritional benefits, including protein fortification. The per capita consumption of milk protein in the U.S. registered an increase from nearly 74 g to 80 g per day between 2018 and 2022. The U.S. dairy industry has been focusing on innovation and introducing new products to meet customer demands.

Asia Pacific Protein-fortified Food Products Market Trends

The Asia Pacific protein-fortified food products market is expected to grow at a CAGR of 7.2% from 2024 to 2030. In Asia Pacific, probiotics are commonly associated with yogurt and sour milk products, which are in high demand in the probiotic food and drinks market. Consumers in the region are increasingly looking for healthier alternatives to staple foods, such as high-protein rice and milk. The demand for high-protein snack bars, once considered a niche product primarily favored by bodybuilders and athletes, is now on the rise among the general population seeking an additional energy source.

Therefore, companies actively participate in diverse strategies, including product launches, to hold a strong position in the protein-fortified food products market. For instance, in May 2023, Uncle Tobys introduced a new protein muesli bar in four flavors. Each bar contains 20% protein, equivalent to 7 grams per bar. These bars are sold in five packs and can be purchased at supermarkets. The flavors offered include Raspberry, Caramel, Dark Chocolate, Lemon with a Yoghurty Drizzle, Double Chocolate, and Goji and White Chocolate.

Key Protein-fortified Food Products Company Insights

The protein-fortified food products market is expected to witness moderate competition owing to the presence of numerous players across the industry. Owing to changing consumer trends, many companies are expanding their product portfolio to gain a competitive edge in the market. Some of the key players are WK Kellog Co.; MYPROTEIN - The Hut.com Ltd.; Mars Inc.; General Mills Inc.; and Nestlé.

Key Protein-fortified Food Products Companies:

The following are the leading companies in the protein-fortified food products market. These companies collectively hold the largest market share and dictate industry trends.

- General Mills

- 1440 Foods

- Bellring Brands, Inc.

- Caveman Foods LLC

- Kellogg Company

- Nestlé

- Mondelez International

- Glanbia

- GNC Holdings

- Mars Inc.

- Naturell India Pvt. Ltd

- FULFIL

- Bright Life Care Private Ltd.

- SFD S.A.

- MYPROTEIN - The Hut.com Ltd.

- Asahi Group Holdings, Ltd.

Recent Developments

Manufacturers are resorting to strategies such as increasing production capabilities, launching new vehicles in the market, and forming partnerships.

-

In January 2024, the WK Kellog Co launched Eat Your Mouth Off, a new line of vegan cereal with chocolate and fruity tastes. The cereal puffs have 22 grams of plant-based protein, 0 grams of sugar, and 2 grams of carbohydrates per serving. The brand lists canola oil, lentil protein, oat fiber, soy protein isolate, and pea protein isolate as ingredients

-

In October 2023, MYPROTEIN - The Hut.com Ltd. announced a multi-year collaboration with Chupa Chups, a global confectionary brand, to offer a new range of products in the UK and Europe, which includes Myprotein Impact Whey, Layered Bars, and Clear Whey in the Chupa Chups flavors

-

In March 2024, MYPROTEIN - The Hut.com Ltd. launched Jimmy's x MYPROTEIN Iced Coffee in collaboration with Jimmy’s, the iced coffee brand. This product is designed to meet consumers' on-the-move demand and increase the company's ready-to-drink offerings

Protein-fortified Food Products Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 70.88 billion

Revenue Forecast in 2030

USD 101.62 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; Sweden; The Netherland; Poland; Belgium; China; Japan; India; Australia & New Zealand; South Korea; Vietnam; Indonesia; South Africa; Brazil

Key companies profiled

General Mills; 1440 Foods; Bellring Brands, Inc.; Caveman Foods LLC; Kellogg Company; Nestlé; Mondelez International; Glanbia; GNC Holdings; Mars Inc.; Naturell India Pvt. Ltd.; FULFIL; Bright Life Care Pvt. Ltd.; SFD S.A.; MYPROTEIN - The Hut.com Ltd.; Asahi Group Holdings, Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Protein-fortified Food Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the protein-fortified food products market report based on nature, product, distribution channel, and region:

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Organic

-

Conventional

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bakery & Snacks Products

-

Cookies

-

Chips

-

Cereals

-

Breads

-

Sweet Goods (Muffins, Pastries, etc.)

-

-

Protein Bars

-

Sports Nutrition Bars

-

Meal Replacement Bars

-

Others

-

-

RTD & RTM Beverages

-

RTD Shakes

-

RTD Smoothies

-

RTM Powders

-

-

Dairy & Dairy Alternatives

-

Yogurt

-

Milk

-

Cheese

-

-

Meat & Meat Alternatives

-

Protein Jerky

-

Meat Alternatives

-

-

Breakfast & Cereals Bars

-

Frozen & Refrigerated Foods

-

Protein Ice Creams

-

Frozen Meals

-

-

Baby Food & Infant Formula

-

Baby Food

-

Infant Formula

-

-

Sports & Nutrition Supplements

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Specialty Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

The Netherland

-

Poland

-

Belgium

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

Vietnam

-

Indonesia

-

-

MEA

-

South Africa

-

-

Latin America

-

Brazil

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The global protein-fortified food products market size was estimated at USD 66.8 billion in 2023 and is expected to reach USD 70.88 billion in 2024.

b. The global protein-fortified food products market is expected to grow at a compounded growth rate of 6.2% from 2024 to 2030, reaching USD 101.62 billion by 2030.

b. The conventional segment dominated the protein-fortified food products market with a share of 74.7% in 2023. The easy accessibility and affordability of conventional food are driving the segmental growth of these products.

b. Some key players operating in the protein-fortified food products market include General Mills, 1440 Foods, BELLRING BRANDS, INC., Caveman Foods LLC, Kellogg Company, Nestlé, Mondelez International, and Glanbia.

b. Increasing awareness regarding health, wellness, and nutrition, especially among Gen-Z and millennials, is a major factor driving the demand for healthier and more nutritious foods, including protein-fortified food products.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."