- Home

- »

- Biotechnology

- »

-

Protein Crystallization Market Size & Growth Report, 2030GVR Report cover

![Protein Crystallization Market Size, Share & Trends Report]()

Protein Crystallization Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables, Software & Services), By Technology (X-ray Crystallography, Cryo-electron Microscopy), By End-user, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-031-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global protein crystallization market size was valued at USD 1.14 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 8.25% from 2023 to 2030. Protein crystallization is the method of obtaining a protein crystal by the addition of precipitating agents and monitoring the conditions such as pH, temperature, and ionic strength of the solution. One of the most important applications of crystallization is to support structural biology investigations by using x-ray diffraction crystallography. This process helps researchers to visualize the 3-dimensional structures of proteins. In addition, crystallization is an effective method to create pure proteins that are contamination free, thus offering an alternative means of separation and purification to preparative chromatography. Hence the method has a variety of applications in industries, including drug development, purification & separation, scale-up, formulation, medicinal chemistry, and drug delivery.

The sudden outbreak of COVID-19 led to an upsurge in research and development activities to design vaccines and drugs. Hence, it was important for the researchers to study the structure, function, and pathogenesis of the virus. The 3-chymotrypsin-like protease was the first protein of the SARS-CoV-2 whose structure was determined using the protein crystallography methods. Researchers at Creative Bio structure used X-ray crystallography technology to study the crystal structure of the protein to identify the potential drug target.

The mutations associated with the novel coronavirus can be identified using protein crystallography. Furthermore, crystal structures of the SARS-CoV-2 spike are co-crystallized with antibodies to advance the understanding of the immunogenicity of the disease. Thus, COVID-19 had a positive impact on the market due to the increased uptake of crystallography techniques for COVID-19-related research.

Several emerging players in the proteomics space are receiving funding and investments to advance proteomics applications. For instance, in January 2023, Evosep, a proteomics technology company, received an investment of USD 40 million from Novo Holdings to provide a high-throughput proteomics solution. In addition, several investments under government initiatives are increasing the adoption of protein crystallization in research and development activities of proteomics.

For instance, in August 2020, the University of Arkansas for Medical Sciences received a federal grant of USD 10.6 million from the National Institute of Health to expand its proteomics resources for research and development. Thus, rising funding for proteomics research is expected to boost the market during the forecast period.

Moreover, in recent years, an increasing number of individuals have been utilizing protein-based drugs owing to their advantages such as low toxicity, high potency & specificity, and high tolerance by the human body. In addition, key players in the market are entering into partnerships and collaborations to develop protein-based therapeutics at more affordable costs for patients. For instance, in October 2021, Absci and EQRx entered into a partnership to expand the therapeutic potential of proteins by using an AI-powered discovery and development platform. Thus, such initiatives are anticipated to boost the adoption of crystallization methods in the study period.

Furthermore, technological advancements in crystallization techniques such as cell-free protein crystallization methods are anticipated to offer lucrative opportunities for the market during the estimated timeframe. For instance, in October 2022, researchers at the Tokyo Institute of Technology developed novel cell-free protein crystallization.

The technique provides major developments in the field of structural biology by enabling the analysis of unstable proteins that cannot be studied using other conventional methods. Such advancements help researchers to develop novel and better versions of protein crystals to treat various diseases, ranging from muscular dystrophy to cancer, thereby fueling the market.

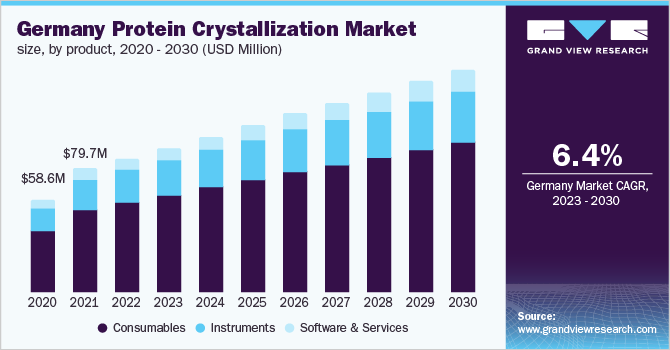

Product Insights

The consumables segment held the largest market share of 67.17% in 2022. Consumables include reagents & kits/screens, microplates, and other products to support the crystallization methods. Crystallization kits for proteins provide an efficient screening method for determining the optimal solubility conditions for protein crystallization. These kits also provide reagents required for rapid screening to determine the appropriate condition for the crystallization of purified protein samples.

Several key players in the market are offering a wide range of consumables. For instance, Corning Incorporated offers Corning Next Generation CrystalEX Microplates for 96-well High Throughput Sitting Drop Protein Crystallization. Hence, advanced consumable offerings by the key players, coupled with recurring costs, are expected to boost the segment.

The software & services segment is anticipated to expand at the fastest CAGR of 10.21% during the forecast years. Software is used in crystallization experiments processes, from design and dispensing to analysis and image viewing. For instance, ROCK MAKER software offered by FORMULATRIX helps in creating multiple screen experiments for one or more proteins in less than a minute. It also helps in the comparison of the images captured and assigns scores.

Such software capabilities are likely to boost segment growth during the forecast period. Moreover, several players are offering protein crystallization services, thereby expected to fuel the segment growth. For instance, Creative Biolabs offers crystallization services including purification, biophysical characterization, crystallization screening & crystal optimization to accelerate research projects.

Technology Insights

The X-ray crystallography segment held the largest share of 53.42% in 2022. X-ray crystallography is the most favored technology for the structure determination of biological macromolecules and proteins. It involves crystallizing proteins, pummeling them with X-rays, and recreating their structure from the resulting tell-tale patterns of diffracted light.

The technology offers several advantages such as a two-dimensional view that gives an indication of the 3-D structure of a protein. In addition, X-ray crystallography is relatively simple, cost-effective, offers better diffraction, reduces radiation damage to crystals, and provides the possibility of safe storage, transport, and reuse of crystals. Such capabilities of the technology are boosting the segment.

The cryo-electron microscopy segment is projected to expand at the highest CAGR of 11.94% during the forecast period. In comparison with traditional technologies such as NMR and X-ray crystallography, cryo-electron microscopy has several benefits such as being suitable for proteins and their complexes of large molecules, not requiring crystals, decreasing radiation damage, and maintaining the functional state and native activity of the samples, including post-translational modifications.

In addition, cryo-electron microscopy requires a minimal amount of sample, suitable for structural analysis of membrane proteins such as GPCR and their complexes, and multiple conformational states can be captured in a single experiment. Hence, advantages associated with cryo-electron microscopy are expected to drive the segment during the study period.

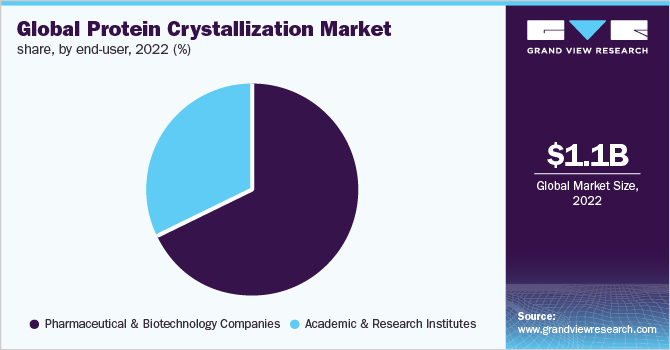

End-user Insights

The pharmaceutical and biotechnology companies segment held the highest revenue share of 67.60% in 2022. Protein crystallization methods have two major roles in structural biology, including in silico drug design and controlled drug discovery. The in silico drug design protein crystallography ascertains the 3-D structure of a molecule. The formation of protein crystals results in more accurate 3-D protein structures. These quality crystals can ultimately lead to a better understating of biological function and enhanced drug design in pharmaceutical and biotechnology companies.

Furthermore, the pharmaceutical and biotechnology companies segment is also anticipated to expand at the fastest pace with a CAGR of 8.33% during the forecast period. The information gathered from the 3-D structures of proteins can be used for understanding disease mechanisms, optimizing pharmaceutical drug design, and identifying drug targets. Transformative therapeutics developed using protein crystallography include the leukemia drug Gleevec and HIV protease inhibitors.

In addition, another potential application of the method is in biologics formulation by decreasing the viscosity of proteins in the crystalline form to create a higher concentration of effective protein-based therapeutics. Such applications of protein crystallization in pharma & biotech companies are expected to significantly drive the segment.

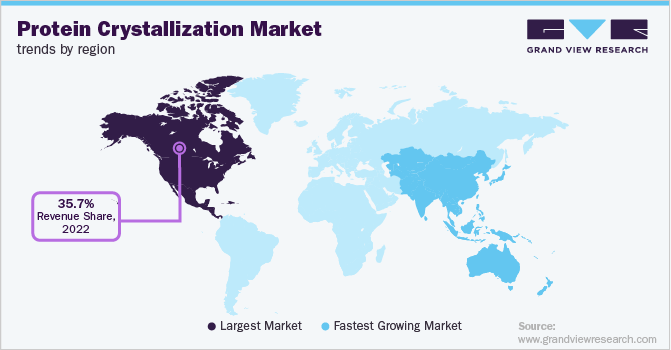

Regional Insights

North America held the largest share of 35.71% in the global market in 2022. This large share can be attributed to increased investments in private companies, government assistance, and favorable regulations. The region majorly focuses on research being done in the area of drug discovery, and proteomics structure prediction, thereby propelling the growth of the market. The presence of innovators and key operating players has resulted in higher penetrations of the products in the region.

For instance, in December 2020, Corning Incorporated received a USD 15.0 million contract from the U.S. Department of Defense and the U.S. Department of Health and Human Services for increasing the production of robotic liquid handling instruments. This helped the company to improve its market position within the North American region.

Asia Pacific region is estimated to expand at the fastest CAGR of 10.81% during 2023-2030. This high progression can be attributed to the extensive growth in the pharmaceutical and biotechnology industries of emerging economies such as China and India. This region's profitable expansion is also attributed to ongoing government support for the development of the pharmaceutical sector in developing countries. Moreover, ongoing research in the fields of cancer & infectious illnesses such as COVID-19 is expected to drive significant growth for the protein crystallization market within the region.

Key Companies & Market Share Insights

The protein crystallization industry is growing at a rapid pace due to multiple strategic initiatives implemented by the operating players involved. For instance, in July 2022, METTLER TOLEDO announced the expansion of its manufacturing operations in Vacaville, U.S. This initiative is expected to boost the company’s protein crystallization offerings in Vacaville. Some of the key companies in the global protein crystallization market include:

-

Rigaku Corporation

-

FORMULATRIX

-

METTLER TOLEDO

-

Corning Incorporated

-

Greiner Bio-One International GmbH

-

HAMPTON RESEARCH CORP

-

Jena Bioscience GmbH

-

Bruker

-

Creative Proteomics

-

Molecular Dimensions

Protein Crystallization Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.23 billion

Revenue forecast in 2030

USD 2.14 billion

Growth rate

CAGR of 8.25% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion, CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, technology, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Rigaku Corporation; FORMULATRIX; METTLER TOLEDO; Corning Incorporated; Greiner Bio-One International GmbH; HAMPTON RESEARCH CORP; Jena Bioscience GmbH; Bruker; Creative Proteomics; Molecular Dimensions

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

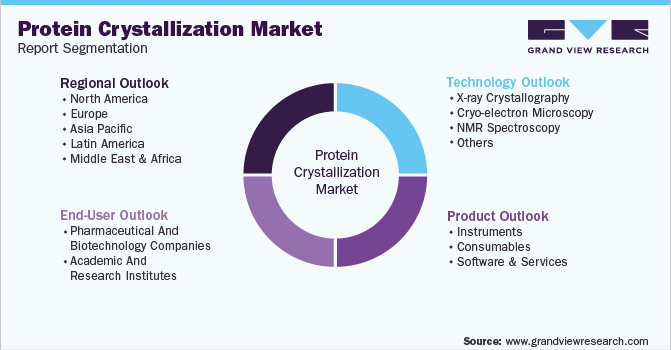

Global Protein Crystallization Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global protein crystallization market report based on the product, technology, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Liquid Handling Instruments

-

Crystal Imaging Instruments

-

-

Consumables

-

Reagents & Kits/Screens

-

Micro Plates

-

Others

-

-

Software & Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

X-ray Crystallography

-

Cryo-electron Microscopy

-

NMR Spectroscopy

-

Others

-

-

End-User Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical And Biotechnology Companies

-

Academic And Research Institutes

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global protein crystallization market size was estimated at USD 1.14 billion in 2022 and is expected to reach USD 1.23 billion in 2023.

b. The global protein crystallization market is expected to grow at a compound annual growth rate of 8.25% from 2023 to 2030 to reach USD 2.14 billion by 2030.

b. The X-ray crystallography segment held the largest share of 53.42% in 2022. The X-ray crystallography is most favored technology for structure determination of biological macromolecules and proteins.

b. Some key players operating in the protein crystallization market include Rigaku Corporation; FORMULATRIX; METTLER TOLEDO; Corning Incorporated; Greiner Bio-One International GmbH; HAMPTON RESEARCH CORP; Jena Bioscience GmbH; Bruker; Creative Proteomics; Molecular Dimentions

b. Rising demand for protein-based therapeutics, increasing funding & investments in proteomics research, and technological advancements in protein crystallography techniques are key factors driving the market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."