- Home

- »

- Medical Devices

- »

-

Prosthetic Liners Market Size, Share & Growth Report, 2030GVR Report cover

![Prosthetic Liners Market Size, Share & Trends Report]()

Prosthetic Liners Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (TPE, Silicone), By Application (Upper Extremity, Lower Extremity), By End-use (Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-681-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Prosthetic Liner Market Size & Trends

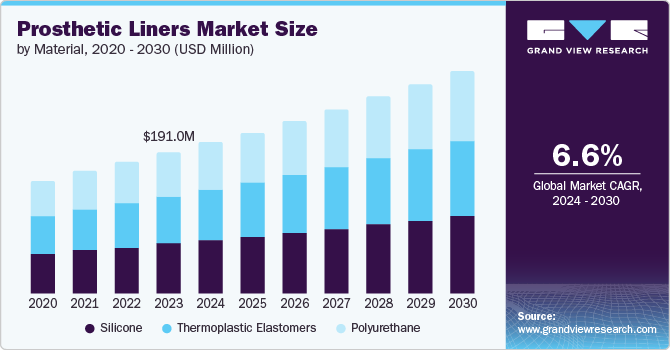

The global prosthetic liners market size was valued at USD 191.0 million in 2023 and is projected to grow at a CAGR of 6.6% from 2024 to 2030. The market is growing due to rising demand for prosthetics, advancements in liner technology, and increasing investments in novel liner development. Key features such as anatomical shaping, antibacterial properties, and user-friendly designs enhance their appeal. These innovations improve comfort and functionality, boosting market expansion during the forecast period. According to Stanford University, more than 3.5 million children suffer from sports injuries in the U.S. annually. Thus, sports-induced injury is anticipated to drive the demand for prosthetics and orthotics solutions during the forecast period.

The increasing number of different amputations worldwide is expected to drive the market in the forecast period as it is expected to increase the demand for prosthetics and prosthetic liners. For instance, according to the World Health Organization (WHO) estimates, assistive products such as prostheses and orthoses are accessible to only 1 in 10 needy people because of their high cost and lack of awareness. Thus, the demand for prosthetic liners is expected to increase in the coming years.

The availability of advanced liners with better patient experience is also expected to drive the market during the forecast period. Venter liners are advanced liners capable of reducing relative humidity, a significant challenge for a prosthetic-wearing person. For instance, in an article published in October 2023 in Nature Scientific Reports Journal, the study evaluated the relative efficacy of the vented liner-socket system and Seal-In silicone liner in lowering relative humidity caused by increased sweat. The ventilated system effectively reduced humidity without affecting the temperature on the surface of the skin liner after the activity in a climate-controlled room.

The reimbursement policies are also projected to propel the market growth over the forecast period. For instance, medical insurance in the U.S., specifically Medicare Part B, covers prosthetic devices necessary to replace a body function or part, as long as they are prescribed by a healthcare provider or supplier registered with Medicare. Anticipated government reimbursement policies are projected to drive the growth of prosthetic liners in the coming years.

Material Insights

The silicone segment dominated the market and accounted for a share of 35.5% in 2023. This high percentage can be attributed to the high benefits associated with the utilization of silicone prosthetic liners. Silicone prosthetic liners are long-lasting and easy to maintain. They are easy to operate and offer enhanced comfort for individuals of all physical activity levels. For instance, in January 2021, ALPS South, LLC. launched a silicone prosthetic liner designed for lower limb amputation that is innovative and gentle on the skin. This liner addressed specific clinical issues and drawbacks of silicone in skin-contact applications caused by the high coefficient of static friction associated with silicone polymers.

The polyurethane segment is expected to grow at the fastest CAGR of 6.8% over the forecast period. Polyurethane liners offer a precise and comfortable fit, ideal for delicate, bony, or scarred residual limbs due to their flow qualities and pressure absorption. The development of novel polyurethane liners drives anticipated segment growth. For instance, a study published in Sains Malaysiana Journal in September 2021 described the synthesis of a new prosthetic liner using polyurethane. The prosthetic liner was modified with polyurethane. A biomechanical gait analysis was carried out on the participant to assess the impact of the Pelite liner, and a custom liner made of polyurethane foam.

Application Insights

The upper extremity segment dominated the market and accounted for a share of 57.0% in 2023. The segment's growth is primarily driven by the rising incidence of upper limb amputations resulting from accidents, trauma, and various medical conditions. As the number of individuals requiring upper limb amputations increases, so does the demand for prosthetic liners that offer comfort, protection, and enhanced functionality. For instance, in September 2023, WillowWood Global LLC. launched a brand identity highlighting its expansion into diverse product lines and technologies. Recent innovations include Alpha SmartTemp gel liners to reduce sweat, META Line high-performance feet, the Alpha Control myoelectric liner for upper limb prosthetics, and the PDAC-approved INTUY Knee.

The lower extremity segment is expected to grow at the fastest CAGR of 7.1% over the forecast period. Patients with atypical residual limb shapes primarily utilize these liners. These provide a tailored outcome, featuring customized gel profiles for comfortable wear. Anticipated advantages are expected to drive the market in the forecast period. Lower extremities are the most common form of extremities.

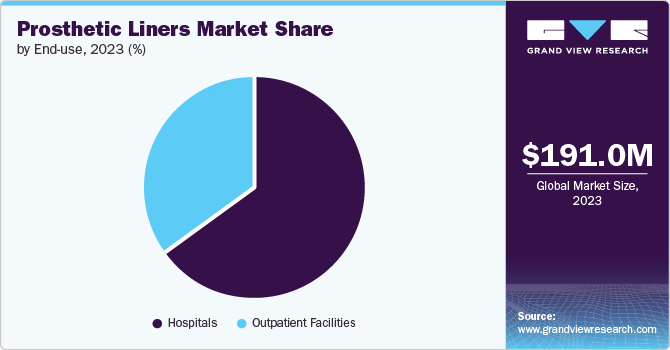

End-use Insights

The hospitals segment dominated the market and accounted for a share of 65.4% in 2023 and is expected to grow at the fastest CAGR of 6.8% over the forecast period. The segment's growth is driven by the increasing number of orthopedic surgeries in hospitals equipped with highly trained staff and advanced technology. Collaborations between hospitals and companies to improve surgical techniques further boost this trend. For instance, in May 2024, Best In Class MD (BICMD) partnered with the Hospital for Special Surgery (HSS) to launch a Bundled Surgery Program for Orthopedics, streamlining the process for worker's compensation carriers nationwide. This collaboration aims to simplify the orthopedic surgery experience for patients, providers, and payers.

The outpatient facilities segment is expected to grow significantly over the forecast period. The growth of outpatient facilities in the prosthetic liner market is driven by technological advancements that enable easier and quicker fittings, making them ideal for outpatient settings. In addition, the rising demand for non-hospital healthcare services and improved outpatient rehabilitation programs support the use and maintenance of prosthetic liners. These factors collectively enhance the accessibility and efficiency of prosthetic care.

Regional Insights

North America prosthetic liners market dominated the market with 46.3% in 2023. It is attributable to the participation of leading companies such as WillowWood Global LLC, ALPS South LLC, and other established players in the area. The companies employ different tactics such as mergers, acquisitions, partnerships, and releasing new products to sustain their leadership. For instance, in March 2024, WillowWood Global LLC., announced its acquisition of Xtremity, enhancing WillowWood's expertise in personalized solutions such as central production, liner design, and adjustable socket prosthetics.

U.S. Prosthetic Liners Market Trends

The U.S. prosthetic liner market dominated the North America market with a share of 84.9% in 2023 due to the high demand of the prosthetic liners in the country. The market is expected to experience high growth in the forecast period owing to strategic alliances of leading players to focus on outcome research. For instance, WillowWood Global LLC., the distributor of prosthetic goods, announced a strategic alliance with Reboocon Bionics B.V., the creator of the INTUY Knee, a motorized prosthetic knee. The alliance's priorities are outcomes research, exclusive distribution in the U.S. market, and collaborating on R&D to advance the next technology generation.

Europe Prosthetic Liners Market Trends

Europe prosthetic liner market was identified as a lucrative region in this industry. The growth of the market can be attributed to the increasing prevalence of chronic diseases such as diabetes and vascular conditions, which often result in limb amputations. As these conditions become more common, the demand for prosthetic liners to enhance comfort and functionality for amputees rises. According to the European Chronic Disease Alliance, in Europe, 58 million people live with diabetes, and 36 million are at risk, with 477,000 annual deaths due to complications. The disease costs health systems USD 155.6 billion annually in direct expenses.

The UK prosthetic liner market is expected to grow rapidly in the coming years due to the rising number of accidents in the country, as more individuals require limb prosthetics for rehabilitation. This increase in demand necessitates advanced prosthetic liners that offer comfort and functionality. Consequently, the market is expanding to accommodate the growing need for effective prosthetic solutions. For instance, in 2022, were 73,920 casualties reported by injury-based reporting system police forces in the UK, up from 66,236 in 2021.

Germany prosthetic liner market held a substantial market share in 2023 owing to the high demand for prosthetic liners. Rising cases of lower extremities in Germany are expected to drive the market during the forecast period.

Asia Pacific Prosthetic Liners Market Trends

Asia Pacific prosthetic liner market is expected to grow at the fastest CAGR of 8.8% over the forecast period. Increasing government initiatives, amputee rehabilitation services, and improving healthcare infrastructure are expected to drive strong regional growth. An increasing number of road accidents are expected to drive the market in the region. For instance, according to the ASIAN DEVELOPMENT BANK report, approximately 645,000 road accident fatalities are recorded in Asia Pacific every year, and approximately 18 million individuals were permanently disabled because of road accidents in the last five years.

Japan prosthetic liner market is expected to grow rapidly in the coming years due to the high demand for prosthetic liners. The high rate of limb amputation in diabetic patients in Japan is expected to drive the market. For instance, according to a study published in the JOURNAL OF FOOT AND ANKLE RESEARCH, diabetic foot disease was high in patients above 60 years of age and had HbA1c <8.0% compared to the younger population. Thus, the prevalence of diabetic foot conditions in the older population is also responsible for the rise in demand for prosthetics and prosthetic liners.

China prosthetic liner market held a substantial market share in 2023 owing to the rising incidence of diabetes and vascular diseases, which leads to higher limb amputation rates and increased demand for prosthetic liners. In addition, the growing aging population, with its higher prevalence of limb loss, further drives the need for advanced prosthetic solutions.

Latin America Prosthetic Liners Market Trends

Latin America prosthetic liner market is anticipated to grow significantly over the forecast period. Partnerships and funding from major industry players are driving the market forward. The increasing number of amputee cases is also expected to drive the market during the forecast period.

Brazil prosthetic liner market is expected to witness rapid growth in the forecast period owing to the increasing number of lower limb amputations in the country. For instance, in 2022 alone, 31,190 procedures were conducted, averaging at least 85 daily amputations. From January 2012 to May 2023, over 282,000 lower-limb amputation surgeries were performed in public hospitals across Brazil.

Middle East And Africa Prosthetic Liners Market Trends

The Middle East & Africa prosthetic liner market is anticipated to grow significantly over the forecast period. Advancements in developing novel prosthetic liners have resulted in a rise in market engagement within the region. The market in the region is also expected to record exponential growth due to increasing government spending on amputee rehabilitation and care programs.

The UAE prosthetic liner market is expected to grow significantly over the forecast period owing to various factors, such as technological advancement and rising investment in developing novel prosthetic liners in the country, which can also contribute to the market's growth.

Key Prosthetic Liners Company Insights

Some of the key companies in the prosthetic liner market include Zimmer Biomet, Blatchford Limited, Ottobock, Fillauer LLC, Knit-Rite, LLC, Össur, Ortho Europe, Streifeneder, WillowWood Global LLC., and ALPS South, LLC. Organizations in the market are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

WillowWood Global LLC. manufactures a range of prosthetic items, including liners, elevated vacuum systems, and prosthetic feet, focusing on maximizing comfort and fit. Their alpha liners, available in TPE Gel and silicone, are designed to meet diverse patient needs, including personalized options for challenging limb shapes.

-

Zimmer Biomet provides orthopedic devices and solutions, specializing in prosthetics, including advanced liners. Their prosthetic liners, utilizing innovative materials and technology, are designed to improve comfort and fit for prosthetic limbs.

Key Prosthetic Liners Companies:

The following are the leading companies in the prosthetic liners market. These companies collectively hold the largest market share and dictate industry trends.

- Zimmer Biomet.

- Blatchford Limited

- Ottobock

- Fillauer LLC

- Knit-Rite, LLC

- Össur

- Ortho Europe

- Streifeneder

- WillowWood Global LLC.

- ALPS South, LLC.

Recent Developments

-

In May 2023, WillowWood Global LLC. and Coapt LLC. introduced the Alpha Control Liner System, the first prosthetic liner with integrated electronics. This innovative liner captures muscle contraction signals and interfaces with the Coapt Complete Control system for enhanced prosthetic control.

-

In July 2022, WillowWood Global LLC., announced its acquisition of MAKstride Prosthetics. The deal is WillowWood's initial strategic acquisition after teaming up with growth-focused private equity firm Blue Sea Capital LLC in December 2021.

Prosthetic Liners Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 204.1 million

Revenue forecast in 2030

USD 299.9 million

Growth Rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Zimmer Biomet.; Blatchford Limited; Ottobock; Fillauer LLC; Knit-Rite, LLC; Össur; Ortho Europe; Streifeneder; WillowWood Global LLC.; ALPS South, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Prosthetic Liners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global prosthetic liners market report based on material, application, end-use, and region.

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Silicone

-

Thermoplastic Elastomers

-

Polyurethane

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Upper Extremity

-

Lower Extremity

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.