- Home

- »

- Plastics, Polymers & Resins

- »

-

Propylene Carbonate Market Size And Share Report, 2030GVR Report cover

![Propylene Carbonate Market Size, Share & Trends Report]()

Propylene Carbonate Market (2024 - 2030) Size, Share & Trends Analysis Report By End Use (Paints & Coatings, Pharmaceuticals, Cosmetics & Personal Care), By Application (Solvent, Electrolyte, Catalyst), By Region, And By Segment Forecasts

- Report ID: GVR-4-68040-394-0

- Number of Report Pages: 109

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Propylene Carbonate Market Size & Trends

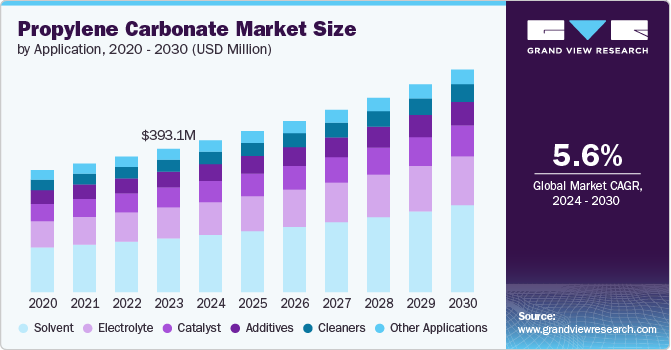

The global propylene carbonate market size was estimated at USD 393.1 million in 2023 and is expected to reach USD 610.9 million by 2030, growing at a CAGR of 5.6% from 2024 to 2030. This growth is attributed to the growing demand for lithium-ion batteries products.

Key Market Trends & Insights

- The Asia Pacific propylene carbonate market dominated with a revenue share of 34.6% in 2023.

- The U.S. propylene carbonate market is growing at a CAGR of 5.7% over the forecast period.

- Based on application, solvent segment dominated the market with a revenue share of 37.5% in 2023.

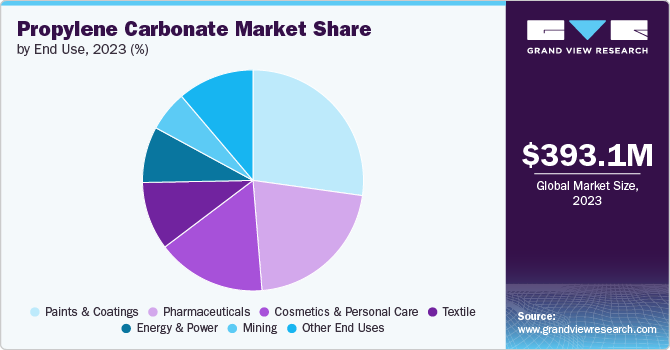

- Based on end use, the paints & coatings accounted for the largest revenue share of 27.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 393.1 Million

- 2030 Projected Market Size: USD 610.9 Million

- CAGR (2024-2030): 5.6%

- Asia Pacific: Largest market in 2023

Propylene carbonate is used as an electrolyte solvent in lithium-ion batteries due to its high boiling point, stability, and low toxicity. Furthermore, the expanding electric vehicle (EV) market and increasing demand for portable electronic devices are expected to drive the product growth in battery applications. The market is witnessing increased adoption of this product in industries like paints, coatings, and pharmaceuticals where environmental concerns are critical. Propylene carbonate is considered less hazardous compared to other solvents, making it attractive in industries facing stringent environmental regulations. In addition to this, the product is used as a solvent and carrier in cosmetics and personal care products due to its ability to enhance product stability and solubility. Therefore, rising disposable incomes and increasing consumer demand for premium personal care products are expected to fuel product growth over the coming years.

Furthermore, the development of eco-friendly production methods and sustainable sourcing of raw materials for propylene carbonate production is increasing its adoption by environmentally conscious consumers and industries seeking sustainable alternatives. Fluctuations in the prices of raw materials used in propylene carbonate production can impact production costs and profit margins, thereby creating challenges in maintaining stable pricing and profitability of manufacturers.

In addition to this, this product faces competition from alternative solvents and materials that may offer comparable or superior performance characteristics. Moreover, price competitiveness and technological advancements in substitutes could limit propylene carbonate market expansion in certain applications. Growing investments in renewable energy infrastructure create new opportunities for this product in energy storage applications. Propylene carbonate is used in renewable energy technologies such as wind and solar power systems for energy storage and efficiency enhancements. Furthermore, the development of more efficient and cost-effective production methods for the product can help in enhancing production capabilities leading to lower costs, improving product quality, and encouraging market growth.

Application Insights

Solvent dominated the market with a revenue share of 37.5% in 2023 and is further expected to grow at the fastest rate from 2024 to 2030. Propylene carbonate is highly used as a solvent in many products such as coatings, paints, sealants, adhesives, and degreasers. The product is widely used as a solvent in paints and coatings due to its high solvency power, low volatility, and ability to dissolve a wide range of resins and pigments. Furthermore, use of this product as a solvent in adhesives and sealant formulations helps in improving adhesion strength, flexibility, and moisture resistance of adhesives, making it suitable for automotive, construction, and electronics applications.

The electrolyte application of this product includes its use in supercapacitors and lithium-ion batteries. Propylene carbonate is a crucial component in the electrolyte formulation of lithium-ion batteries, where it acts as a solvent for lithium salts and electrolyte additives. It helps in enhancing battery performance by improving ionic conductivity, thermal stability, and safety. Furthermore, this product is highly used in supercapacitors as an electrolyte solvent for facilitating efficient energy storage and delivery.

End Use Insights

The paints & coatings accounted for the largest revenue share of 27.2% in 2023 due to its increasing use as a solvent in formulations and adhesive promoter in this industry. This product is excessively used as a solvent in paints and coatings formulations, especially in waterborne and high-performance coatings. Furthermore, as an adhesive promoter, it helps in enhancing adhesion properties, flexibility, and overall coating integrity, particularly in demanding environments such as automotive and aerospace applications.

Pharmaceutical end use is expected to grow at a CAGR of 5.8% over the forecast period. Propylene carbonate is utilized in pharmaceutical formulations due to its solvency and low toxicity. Therefore, growth in the pharmaceutical industry, driven by aging populations and increasing healthcare spending, is expected to boost the demand for this product. Furthermore, in textile end use, this product is used for dyeing, printing, and as a finishing agent to impart specific properties such as wrinkle resistance, water repellency, and flame retardancy.

Regional Insights

The demand for propylene carbonate in North America is expected to grow at a significant pace over the years. This demand is supported by a stringent environmental regulation and a growing preference for sustainable chemical solutions. This product is widely used as a solvent and additive in industries such as cosmetics, pharmaceuticals, and automotive fluids due to its low toxicity and biodegradability, aligning well with regulatory requirements.

U.S. Propylene Carbonate Market Trends

The U.S. propylene carbonate market is growing at a CAGR of 5.7% over the forecast period. This demand for products is increasing across various sectors due to its versatile applications and environmental benefits. It is widely used in automotive fluids, cosmetics, and pharmaceuticals, and as a solvent for industrial processes. Furthermore, the transition towards electric vehicles is a significant driver of this product demand, as it plays a crucial role in battery technology.

Asia Pacific Propylene Carbonate Market Trends

The Asia Pacific propylene carbonate market dominated in 2023 with a revenue share of 34.6% and is further expected to grow at a significant rate from 2024 to 2030. The region includes countries like China, Japan, and South Korea, which are witnessing robust increases in propylene carbonate demand driven by rapid industrialization and technological advancements. Furthermore, government initiatives supporting clean energy solutions further propel the demand for this product in the region.

Europe Propylene Carbonate Market Trends

The propylene carbonate market in Europe is experiencing a rising demand, driven by stringent environmental policies that encourage the adoption of eco-friendly chemicals. The safety and biodegradable solvent properties, make it attractive for applications in pharmaceuticals, cosmetics, and as an electrolyte solvent in lithium-ion batteries for electric vehicles.

Key Propylene Carbonate Company Insights

Some key players operating in the market are BASF SE and Huntsman International LLC:

-

BASF SE, a Germany-based chemicals manufacturing company, holds a significant position globally in the chemicals manufacturing industry. It operates through its 6 business segments namely: chemicals, surface technologies, materials, nutrition & care, industrial solutions, and agricultural solutions. BASF SE manufactures a variety of products, including those derived from mineral and natural oils, specialty emulsions, organosilicon-based solutions, as well as silicone-free and star-polymer defoamers.

-

Huntsman International LLC is a multinational chemical manufacturing company that produces a variety of chemical products such as polyurethanes, performance products, and advanced materials. The company operates in more than 100 countries with production facilities in 69 countries.

Central Drug House and Tokyo Chemical Industry Co., Ltd. (TCI) are some emerging participants in the market.

-

Tokyo Chemical Industry Co., Ltd. (TCI) is involved in the manufacturing of specialty chemicals, offering pharmaceutical, functional, and cosmetic materials along with organic laboratory chemicals. Furthermore, this company operates its facilities across Europe, Asia Pacific, and North America. A few of the company’s product portfolio is categorized into organic laboratory reagents, chemistry, materials science, life science, glycoscience, analytical chemistry, chemicals by class, and chromatography columns.

-

Central Drug House is involved in manufacturing and supplying dehydrated culture media and laboratory fine chemicals. Its product portfolio is segmented into chemicals, microbiology, plant and cell culture tested chemicals. Furthermore, its products are made available globally by an extensive network of dealers and stockiest.

Key Propylene Carbonate Companies:

The following are the leading companies in the propylene carbonate market. These companies collectively hold the largest market share and dictate industry trends.

- LyondellBasell Industries

- Shandong Depu Chemical

- BASF SE

- Empower Materials

- Huntsman International LLC.

- Dhalop Chemicals

- Tokyo Chemical Industry Co., Ltd. (TCI)

- Linyi Evergreen Chemical Co., Ltd.

- Central Drug House

- Carl Roth

Recent Developments

- In September 2022, Balaji Amines, a chemical manufacturing company received permission to start commercial production of propylene carbonate, propylene glycol, and di-methyl carbonate in its new plant located at Solapur, India. This manufacturing plant operates at the capacity of 15,000 MTA for every product.

Propylene Carbonate Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 416.3 million

Revenue forecast in 2030

USD 610.9 million

Growth rate

CAGR of 5.6% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina

Key companies profiled

LyondellBasell Industries; Shandong Depu Chemical; BASF SE; Empower Materials; Huntsman International LLC.; Dhalop Chemicals; Tokyo Chemical Industry Co., Ltd. (TCI); Linyi Evergreen Chemical Co., Ltd.; Central Drug House;Carl Roth

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Propylene Carbonate Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the industry trends in each of the segments from 2018 to 2030. For this study, Grand View Research has segmented the global propylene carbonate market based on the application, end use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Solvent

-

Electrolyte

-

Catalyst

-

Additives

-

Cleaners

-

Other Applications

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Pharmaceuticals

-

Cosmetics & Personal Care

-

Textile

-

Energy & Power

-

Mining

-

Other End Uses

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global propylene carbonate market was estimated at USD 393.1 million in 2023 and is expected to reach USD 416.3 million in 2024.

b. The global propylene carbonate market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 610.9 million by 2030.

b. Solvent dominated the market with a revenue share of 37.5% in 2023 and is further expected to grow at a fastest rate over forecast period. Propylene carbonate is highly used as a solvent in many products such as coatings, paints, sealants, adhesives, and degreasers.

b. Some prominent players in the propylene carbonate market include LyondellBasell Industries, Shandong Depu Chemical, BASF SE, Empower Materials, Huntsman International LLC., Dhalop Chemicals, Tokyo Chemical Industry Co., Ltd. (TCI), Linyi Evergreen Chemical Co., Ltd., Central Drug House, Carl Roth

b. The propylene carbonate market growth is attributed to the growing demand for the product in lithium-ion batteries. Propylene carbonate is used as an electrolyte solvent in lithium-ion batteries due to its high boiling point, stability, and low toxicity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.