Programmatic Digital Out-Of-Home Market Size, Share & Trends Analysis Report By Programmatic Platforms (Demand-Side Platforms, Supply-Side Platforms), By Location, By End-use, By Format, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-317-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

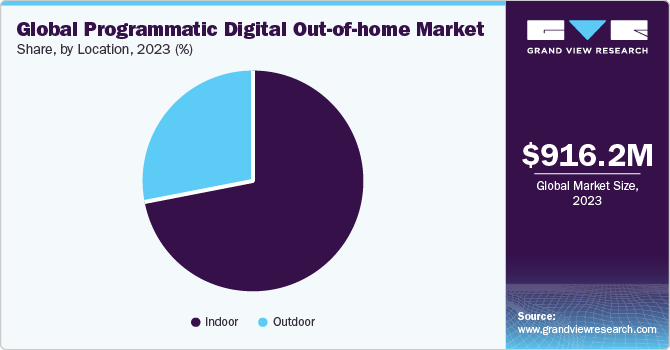

The global programmatic digital out-of-home market size was estimated at USD 916.2 million in 2023 and is projected to grow at a CAGR of 31.5% from 2024 to 2030. The market growth is driven by the increasing digitalization of outdoor advertising infrastructure, such as the widespread installation of digital billboards and interactive displays. Moreover, the rise of smart cities and the proliferation of connected devices enhance the ability to collect and utilize real-time data, making programmatic advertising more precise and impactful. The COVID-19 pandemic also played a role in highlighting the importance of digital flexibility, as advertisers sought more agile solutions to adapt to rapidly changing conditions.

The market is revolutionizing the traditional out-of-home advertising landscape by integrating the flexibility and precision of digital advertising with the expansive reach of outdoor media. programmatic digital out-of-home (pDOOH) leverages programmatic technology, allowing advertisers to dynamically deliver targeted content to digital billboards, transit displays, and other outdoor digital screens based on real-time data and audience insights. This approach enhances the relevance and impact of advertisements by tailoring messages to specific demographics, times of day, weather conditions, and even real-time events.

The automation and data-driven capabilities of pDOOH reduce the complexities and inefficiencies associated with traditional OOH advertising, making it more accessible and effective for a broader range of advertisers. In addition, advancements in AI and machine learning are further optimizing ad placements and performance measurement, contributing to the sector's robust growth and increasing attractiveness to brands seeking high engagement rates in public spaces.

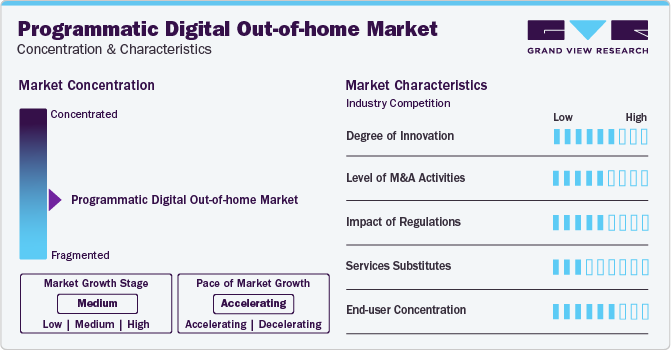

Market Concentration & Characteristics

The pDOOH industry is characterized by a high degree of innovation. The market has attracted substantial investment, reflecting its growing importance in the advertising ecosystem. Advertisers' increased spending is driven by the proven effectiveness of DOOH advertising in reaching large and diverse audiences. The sector's growth is also supported by the expanding network of digital screens in various environments, such as urban centers, transportation hubs, retail locations, and more. This proliferation of screens enhances the visibility and reach of programmatic digital out-of-home (pDOOH) campaigns.

A prominent trend in the M&A landscape is the strategic acquisition of technology companies by established advertising firms and media companies. These acquisitions aim to enhance technological capabilities, particularly in areas such as data analytics, programmatic advertising platforms, and digital display technologies. By acquiring specialized tech firms, larger companies can integrate advanced solutions into their operations, improving the efficiency and effectiveness of their pDOOH offerings.

One of the most critical aspects of the global market's regulatory environment is data privacy. Programmatic advertising relies heavily on data to target specific audiences, making compliance with data protection laws essential. Regulations such as the California Consumer Privacy Act (CCPA) in the U.S. set strict guidelines on how personal data can be collected, used, and stored. Companies operating in the pDOOH space need to ensure they have robust data protection policies and practices in place to avoid big fines and reputational damage.

Traditional OOH advertising includes static billboards, posters, transit ads, and other non-digital formats. These mediums have long been a staple of the advertising industry due to their high visibility and ability to reach a broad audience in public spaces. While they lack the dynamic and interactive features of pDOOH, traditional OOH is often more cost-effective and doesn't require the technological infrastructure that digital formats do.

The market serves diverse end users, primarily concentrated in key sectors such as retail, automotive, entertainment, food and beverage, travel, and financial services. Retailers use pDOOH to attract customers and boost sales through dynamic, location-based ads. The automotive industry targets potential buyers with impactful digital billboards. Entertainment and media companies promote films and events in high-traffic areas. Food and beverage brands leverage programmatic digital out-of-home (pDOOH) near dining spots to influence dining choices. Travel and tourism entities advertise in transit hubs, inspiring travel plans. Financial services utilize pDOOH for brand visibility and promotional campaigns.

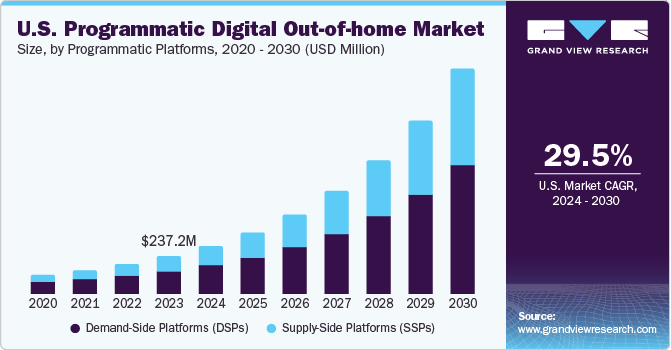

Programmatic Platforms Insights

Based on programmatic platforms, the demand-side platforms (DSPs) segment led the market with the largest revenue share of 56.3% in 2023. The efficiency and automation capabilities of DSPs allow advertisers to seamlessly plan, buy, and optimize ad campaigns across multiple digital outdoor screens from a single interface. This consolidation streamlines the process, reducing operational complexities and enabling more strategic and responsive advertising. Furthermore, DSPs are equipped with advanced targeting and real-time bidding (RTB) technologies, which enhance the precision and relevance of ad placements.

The supply-side platforms (SSPs) segment is predicted to foresee at a significant CAGR during the forecast period. The growth in the SSP segment is driven primarily by the increased adoption of programmatic technologies by outdoor media owners, who are seeking to enhance their revenue streams by offering more dynamic and flexible advertising solutions. Furthermore, the expanding network of digital billboards and displays across urban landscapes provides a vast amount of premium inventory. SSPs enable media owners to efficiently manage and sell this inventory programmatically, ensuring high fill rates and optimizing ad placements through real-time bidding processes.

Location Insights

Based on location, the indoor segment led the market with the largest revenue share of 72.4% in 2023. The proliferation of digital screens in high-traffic indoor locations such as shopping malls, airports, transit hubs, gyms, and office buildings has created a dense network of advertising opportunities. In these settings, audiences are captive and tend to spend considerable time, making them ideal for targeted and engaging ad campaigns. Furthermore, the rise of smart buildings and IoT integration has also played a significant role. Advanced technologies enable dynamic content delivery and real-time campaign adjustments, further boosting the appeal of indoor pDOOH.

The outdoor segment is predicted to foresee at a significant CAGR during the forecast period. The proliferation of digital billboards, transit displays, and other outdoor screens expanded the inventory available for programmatic advertising. In addition, advancements in technology, including AI and real-time data analytics, optimized ad placements and audience targeting. The scalability and visibility of outdoor advertising further contributed to its dominance, attracting advertisers seeking to maximize their reach and impact in public spaces.

End-use Insights

Based on end use, the real estate segment led the market with the largest revenue share of 15.3% in 2023. The ability to deliver targeted and contextually relevant ads in these environments, based on demographic and behavioral data, made these locations highly attractive to advertisers. The integration of IoT and smart building technologies further enhanced the appeal by allowing for dynamic content updates and real-time audience analytics. As urbanization and smart city initiatives continued to grow, the real estate segment's contribution to the programmatic digital out-of-home (pDOOH) market became increasingly significant, driving its substantial share of global revenue.

The government segment is anticipated to witness at a significant CAGR over the forecast period. Governments at various levels are increasingly adopting pDOOH for public information campaigns, emergency alerts, and community announcements, leveraging the extensive reach and real-time capabilities of digital screens in public spaces. Moreover, the implementation of smart city initiatives played a significant role. These projects often include the installation of digital signage networks as part of broader efforts to enhance urban infrastructure and services. These digital networks enable governments to deliver targeted messages based on real-time data, such as traffic conditions, weather updates, and public safety alerts, improving the effectiveness of public communication.

Format Insights

Based on format, the billboards segment led the market with the largest revenue share of 67.2% in 2023. The widespread adoption of digital billboards in high-visibility locations, such as highways, urban centers, and major intersections, significantly increased the available inventory for programmatic advertising. These locations offer extensive reach and high-frequency exposure, making them highly attractive to advertisers seeking to maximize their audience engagement.

The street furniture segment is anticipated to grow at the fastest CAGR over the forecast period. The integration of digital displays into everyday urban infrastructure, such as bus shelters, kiosks, benches, and newsstands, provides a widespread network of advertising opportunities in high-traffic pedestrian areas. These locations offer consistent visibility and extended engagement times as people wait for public transportation or pass by frequently, making them ideal for targeted advertising campaigns.

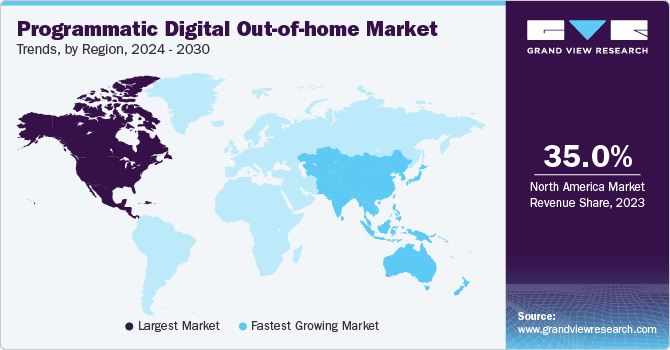

Regional Insights

North America dominated the programmatic digital out-of-home market with the largest revenue share of 35.0% in 2023. The region's advanced digital infrastructure and high adoption rates of new technologies facilitated the widespread implementation of digital advertising screens across various urban environments. Major cities in the U.S. and Canada, such as New York, Los Angeles, and Toronto, have embraced digital billboards, transit displays, and intelligent street furniture on a large scale, creating abundant opportunities for pDOOH campaigns. In addition, the strong presence of leading technology companies and digital advertising firms in North America drives innovation and adoption of programmatic solutions.

U.S. Programmatic Digital Out-of-home Market Trends

The programmatic digital out-of-home market in U.S. is expected to grow at the fastest CAGR of 29.5% from 2024 to 2030. The continued digitalization of outdoor advertising infrastructure across the country, including the expansion of digital billboards, transit displays, and interactive screens, provides a broader canvas for advertisers to engage with their target audiences. Furthermore, the shift towards digitization accelerated by the COVID-19 pandemic, along with changing consumer behavior patterns favoring outdoor activities and local experiences, contributed to the market growth in the U.S.

The Canada programmatic digital out-of-home market held a significant share in the North American in 2023. The increasing digitalization of urban landscapes across Canada, with the deployment of digital billboards, transit displays, and interactive screens in major cities, expanded advertisers' opportunities to reach their target audiences effectively. In addition, the growing demand for programmatic advertising solutions, which offer flexibility, scalability, and efficiency in ad buying and targeting, contributed to the market growth in Canada.

Europe Programmatic Digital Out-of-home Market Trends

The pDOOH market in the Europe is expected to witness at a significant CAGR over the forecast period. The region boasts a highly developed digital infrastructure, with widespread deployment of digital signage and advertising displays in key urban centers across countries like the UK, Germany, and France. This extensive network provides ample opportunities for targeted and engaging pDOOH campaigns. In addition, Europe has seen rapid adoption of programmatic advertising technologies, driven by advancements in data analytics, AI, and real-time bidding platforms.

The UK programmatic digital out-of-home (pDOOH) market held a significant share in the Europe in 2023. The continued expansion and modernization of DOOH infrastructure across the country, including the deployment of digital billboards, transit displays, and interactive screens in high-traffic urban areas, provided advertisers with enhanced opportunities to engage effectively with their target audiences.

The programmatic digital out-of-home (pDOOH) market in Germany is expected to grow at the fastest CAGR from 2024 to 2030. Germany boasts a highly developed digital infrastructure, with extensive deployment of digital signage and advertising displays in major cities and urban centers. This widespread availability of digital screens provides ample opportunities for advertisers to engage with their target audiences effectively.

Asia Pacific Programmatic Digital Out-of-home Market Trends

The pDOOH market in the Asia Pacific is anticipated to register at the fastest CAGR over the forecast period. The region's rapid urbanization and population growth have created vast opportunities for advertisers to reach a large and diverse audience through digital out-of-home advertising. Major cities in countries like China, Japan, South Korea, and Australia have witnessed significant investments in digital signage and advertising infrastructure, bolstering the market growth.

The India programmatic digital out-of-home market held a significant share in the Asia Pacific in 2023. India's rapid urbanization and increasing digitalization are creating a conducive environment for the adoption of DOOH advertising solutions. With the expansion of urban centers and the development of smart cities, there is a growing demand for innovative advertising mediums to engage with the urban population.

The programmatic digital out-of-home market in China held a significant share in the Asia Pacific in 2023. China's rapid urbanization and the expansion of its middle-class population are driving increased consumer spending and demand for innovative advertising solutions. With the development of smart cities and the deployment of digital infrastructure, there is a growing opportunity for advertisers to engage with urban audiences through pDOOH advertising.

The Japan programmatic digital out-of-home market held a significant share in the Asia Pacific in 2023. The country's major cities, such as Tokyo, Osaka, and Nagoya, are densely populated and feature extensive transportation networks and commercial hubs, offering ample opportunities for advertisers to reach a large and diverse audience through pDOOH campaigns.

Middle East & Africa Programmatic Digital Out-of-home Market Trends

The programmatic digital out-of-home market in Middle East & Africa is anticipated to grow at the fastest CAGR over the forecast period. The region's increasing urbanization and economic development are driving the demand for innovative advertising solutions to effectively engage with urban populations. Advancements in technology, including the availability of affordable digital signage solutions and the proliferation of mobile devices, are driving the adoption of pDOOH in the MEA region. This enables advertisers to deliver dynamic and interactive content, enhancing the effectiveness of their campaigns.

The KSA programmatic digital out-of-home market held a significant share in the Middle East and Africa in 2023. The rapid urbanization and economic development in the region are driving increased investments in digital infrastructure, including the deployment of digital signage and advertising displays in urban areas and commercial hubs. This expansion creates new opportunities for advertisers to engage with their target audiences through DOOH advertising.

Key Programmatic Digital Out-Of-Home Company Insights

Key pDOOH companies include JCDecaux Group, Stroer SE & Co. KGaA, Clear Channel Outdoor Holdings, Inc. Companies active in the global market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in April 2024, VIOOH, a marketplace specializing in digital out-of-home advertising, unveiled its second collaboration with a programmatic media owner in mainland China. The company launched real-time transactions for local programmatic Digital Out-of-Home (pDOOH) inventory through a partnership with Beijing Top Result Metro Advertising Co., Ltd. This launch intends to provide pDOOH access to customers in the Beijing Metro and Shanghai Metro.

Key Programmatic Digital Out-Of-Home Companies:

The following are the leading companies in the programmatic digital out-of-home market. These companies collectively hold the largest market share and dictate industry trends.

- JCDecaux Group

- Stroer SE & Co. KGaA

- Clear Channel Outdoor Holdings, Inc.

- Outfront Media Inc.

- oOh!media Limited.

- Lamar Advertising Company

- Broadsign International LLC.

- Focus Media

- Crimtan

- Daktronics Dr.

Recent Developments

-

In February 2024, JCDecaux Group, the leading outdoor advertising company globally, unveiled the introduction of the inaugural global airport pDOOH offer. This groundbreaking solution enables brands and agencies to implement targeted, dynamic, effortlessly, and contextualized advertising campaigns across the company's programmatic-enabled airports. Leveraging the VIOOH SSP and over 30 DSPs, including Displayce where it is already accessible, this innovation marks a significant advancement in airport advertising strategies

-

In December 2023, Hivestack Technologies Inc. announced the launch of its operations in Sweden. This expansion allows brands, agencies, omnichannel DSPs, and media owners both locally and globally to access the Hivestack platform and its suite of solutions for the first time. They can now plan, activate, measure, and drive revenue from programmatic DOOH campaigns in Sweden

-

In May 2024, Broadsign International, Inc. revealed its acquisition of OutMoove, a digital OOH (DOOH) ad tech provider based in the Netherlands. This acquisition encompasses OutMoove’s business operations and DOOH demand-side platform (DSP) technology. It will allow OutMoove to concentrate on expanding its distinct OOH specialist agency workflows and global support services while granting Broadsign access to OutMoove’s specialized expertise and OOH clientele

Programmatic Digital Out-Of-Home (pDOOH) Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1,187.4 million |

|

Revenue forecast in 2030 |

USD 6,148.8 million |

|

Growth rate |

CAGR of 31.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Programmatic platforms, location, end use, format, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; Mexico; UAE; South Africa; KSA |

|

Key companies profiled |

JCDecaux Group; Stroer SE & Co. KGaA; Clear Channel Outdoor Holdings, Inc.; Outfront Media Inc.; oOh!media Limited.; Lamar Advertising Company; Broadsign International LLC.; Focus Media; Crimtan; Daktronics Dr. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Programmatic Digital Out-Of-Home (pDOOH) Report Market

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global programmatic digital out-of-home market report based on programmatic platforms, location, end use, format, and region:

-

Programmatic Platforms Outlook (Revenue, USD Million, 2017 - 2030)

-

Demand-Side Platforms (DSPs)

-

Supply-Side Platforms (SSPs)

-

-

Location Outlook (Revenue, USD Million, 2017 - 2030)

-

Indoor

-

Outdoor

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Automotive

-

Financial Services

-

Government

-

Media & Entertainment

-

Retail & E-commerce

-

Real Estate

-

Restaurants

-

Others

-

-

Format Outlook (Revenue, USD Million, 2017 - 2030)

-

Billboards

-

Street Furniture

-

Transit

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global programmatic digital out-of-home market size was estimated at USD 916.2 million in 2023 and is expected to reach USD 1,187.4 million in 2024.

b. The global programmatic digital out-of-home market is expected to grow at a compound annual growth rate of 31.5% from 2024 to 2030 to reach USD 6,148.8 million by 2030.

b. North America dominated the programmatic digital out-of-home market with a share of 35.0% in 2023. The region's advanced digital infrastructure and high adoption rates of new technologies facilitated the widespread implementation of digital advertising screens across various urban environments.

b. Some key players operating in the programmatic digital out-of-home market include JCDecaux Group; Stroer SE & Co. KGaA; Clear Channel Outdoor Holdings, Inc.; Outfront Media Inc.; oOh!media Limited.; Lamar Advertising Company; Broadsign International LLC. Focus Media; Crimtan; Daktronics Dr.

b. Key factors that are driving the programmatic digital out-of-home market growth include rising demand for dynamic and real-time advertising, and higher investment in programmatic advertising platforms.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."