- Home

- »

- Medical Devices

- »

-

Product Design And Development Services Market Report, 2030GVR Report cover

![Product Design And Development Services Market Size, Share & Trends Report]()

Product Design And Development Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Service, (Research, Strategy, & Concept Generation, Concept & Requirements Development), By Application, By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-144-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Product Design And Development Services Market Summary

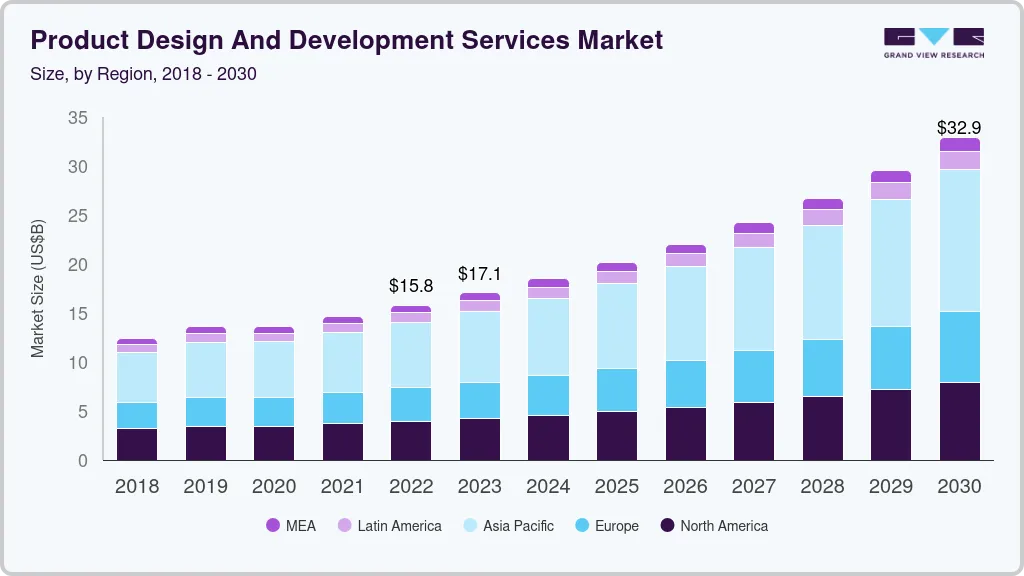

The global product design and development services market size was valued at USD 17.06 billion in 2023 and is projected to reach USD 32.93 billion by 2030, growing at a CAGR of 10.08% from 2024 to 2030. Increasing demand for quality products along with the growing complexity of product design & engineering and the need to curb associated costs are a few factors driving the market growth.

Key Market Trends & Insights

- Asia Pacific dominated the market with the largest revenue share of 41.9% in 2023.

- The product design and development services market in the U.S. held the largest share in the North America region.

- By service, the research, strategy, & concept generation segment held the largest share, accounting for over 39.00% of revenue share in 2023.

- By application, the surgical instruments segment dominated the market in 2023.

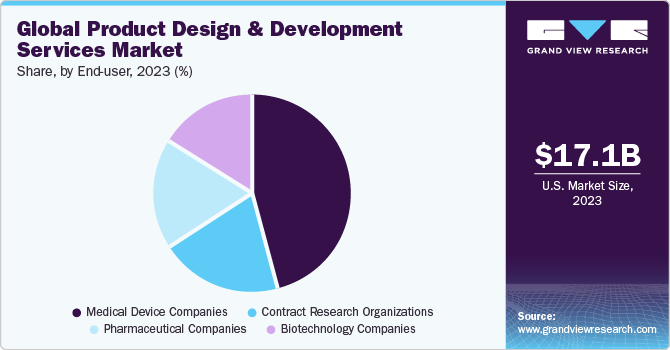

- By end-user, the medical device companies segment dominated the global market in 2023 and accounted for the largest share of over 45.00%.

Market Size & Forecast

- 2023 Market Size: USD 17.06 Billion

- 2030 Projected Market Size: USD 32.93 Billion

- CAGR (2024-2030): 10.08%

- Asia Pacific: Largest market in 2023

The development of a medical device often involves strict regulations and cutting-edge technology, which increases the level of complexity. Furthermore, the medical devices manufacturing industry is anticipated to exhibit significant growth due to the increasing geriatric population as well as health concerns and rising healthcare costs.

Rapid medical innovation has further heightened the need for medical device firms to incorporate new technologies & software into their products to keep up with market demand. As manufacturers of medical devices have incorporated software into their products, technology companies have entered into the medical device landscape to leverage market opportunity. Moreover, there has been a rise in the complexity and connectivity of a medical device thereby attributing to market growth.

Devices are gradually becoming integral to product development. Over the last few years, firms have increasingly incorporated technologies into their drug development plan. These have resulted in the production of combination products, including wireless capabilities and mobile apps for monitoring & tracking purposes. Developing a successful combination product, for instance, a medicinal product combined with a delivery system, requires an understanding of the design parameters of the system along with compatibility between the formulation and system. The rising penetration of connected devices, including wearable sensors, inhalers, and mobile apps, has created various new opportunities in the market.

Furthermore, the growing trend of home healthcare and the adoption of advanced portable devices with ease of use for better accessibility, accelerating the development of next-generation diagnostic, therapeutic, and monitoring equipment design for better compact design, versatility, and precision. These systems have a consumer-driven model for healthcare that embraces innovations, such as customized wearable devices, electronic patient records, and wireless internet-linked systems, which are anticipated to deliver intelligent, user-friendly, and convenient healthcare at home.

Further, rising customer interest in tracking & recording information regarding their health habits. Initially, the personal informatics movement also known as data journaling or health quantification gained significant popularity owing to the introduction of mobile apps that made it easier for people to keep track of miles run & calories consumed per day, among others. As several companies launched advanced devices integrated with accelerometers & sensors to capture data automatically, users are freed from filling in information on their own. Moreover, numerous companies launched wearable medical devices that cater to multiple tracking and analyzing tools such as heart & pulse rate, blood oxygen & respiration level, sleep monitoring, heat flux, galvanic skin response, etc.

Market Concentration & Characteristics

The market growth stage is medium, and pace of the market growth is accelerating. The product design and development services market is characterized by a high degree of innovation. Level of M&A activities, impact of regulations, service expansions, and regional expansions.

The product design and development services market is characterized by a high degree of innovation driven by continuous advancements in technology such as artificial intelligence, machine learning, and big data analytics. Moreover, market participants are focusing on developing novel solutions and methodologies to improve the efficiency and effectiveness of product development processes including personalized medicine, digital health technologies, advanced drug delivery systems, and novel biomaterials.

The medium level of M&A in the product design and development services market, driven by the growing need for companies to expand their capabilities, geographic presence, and service offerings. For instance, in April 2022, Integer Holdings Corporation acquired Connemara Biomedical Holdings Teoranta, including its subsidiarie Aran Biomedical. This acquisition was intended by Integer to expand its service offerings in the development and manufacturing of novel implantable medical devices.

Regulatory requirements play a significant role in shaping the product design and development services market. Stringent regulations governing the development and commercialization of healthcare products, such as drugs, medical devices, and biologics, influence companies' strategies and operational practices. Compliance with regulatory standards, such as Good Laboratory Practices (GLP), Good Clinical Practices (GCP), and Good Manufacturing Practices (GMP), is essential for market participants to ensure product safety and efficacy.

Several market participants in the product design and development services market are undertaking expansion strategies to broaden their service portfolio to meet the evolving needs of their clients. For instance, in February 2022, Planet Innovation (PI) collaborated with Lumos Diagnostics to develop a USD 17.2 million innovation hub and rapid diagnostics manufacturing facility in Victoria to locally manufacture Rapid Antigen Tests (RATS). Further, these companies integrate advanced technologies and capabilities, such as 3D printing, virtual prototyping, and predictive modeling, to provide comprehensive product development solutions.

End-of-life planning market is characterized by a medium impact of regional expansion driven by factors such as population growth, rising healthcare expenditure, and increasing demand for innovative healthcare solutions. Companies are expanding their presence in emerging markets, such as Asia-Pacific and Latin America, to capitalize on growth opportunities and access a larger customer base. Regional expansions also involve establishing partnerships, joint ventures, and collaborations with local stakeholders to navigate regulatory complexities and cultural diversity.

Service Insights

The research, strategy, & concept generation segment held the largest share, accounting for over 39.00% of revenue share in 2023. The segment is estimated to maintain its leading position over the forecast period. The segment growth is owing to extensive research required in this stage, including identification of user needs, research comparative & competitive landscape, and technology research & assessment. Further, growing investment in R&D activities is expected to boost segmental market growth opportunities. Moreover, the rising need for innovative solutions for effective diagnosis and therapeutics is further positively impacting market demand.

The process validation & manufacturing transfer segment is predicted to witness the highest CAGR over the forecast period. With growing trends of additive manufacturing and automation, it becomes highly crucial to validate processes to ensure product reproducibility & repeatability.

Application Insights

The surgical instruments segment dominated the market in 2023 and accounted for the largest share of the overall revenue. The segment is expected to maintain its position over the forecast period. This can be attributed to the complexity of these instruments, which increases the need for precise design and development. Surgical instruments need to be effective in performing surgeries and not cause any harm to patients. Moreover, growing advancements and adoption of noninvasive and minimally invasive surgeries led to an increase in the number of surgeries being performed in a year. As per the data published by the American Society for Metabolic and Bariatric Surgery, more than 279,967 bariatric surgeries were performed across the U.S. in 2022.

The consumables & accessories segment is expected to witness a higher CAGR of 11.06% over the forecast period. The segment growth is owing to the growing demand for specialized consumables and accessories to support product development and manufacturing processes. Further, increasing adoption of single-use technologies to minimize contamination risks and improve operational efficiency. Moreover, the shift towards personalized medicine and point-of-care testing is driving demand for consumables and accessories designed for specific applications and patient needs.

End-User Insights

The medical device companies segment dominated the global market in 2023 and accounted for the largest share of over 45.00% of the overall revenue and is anticipated to witness the fastest growth over the analysis timeframe. This can mainly be attributed to the increasing demand for advanced and quality medical products. In addition, there is a growing trend for small and more portable products, which requires advanced manufacturing technologies, components, and automation techniques. The changing economics of the medical industry has led to increased design & regulatory activities. For many decades, a combination of explosive medical research & innovations in surgical treatments has driven the medical device design. For instance, the development of minimally invasive surgical techniques has resulted in new classes & families of laparoscopic instruments. The expected superior patient outcomes are also becoming a driving factor for the growth of the MedTech industry.

Regional Insights

North America product design and development services market held a significant global market share in 2023. Rapid growth in the manufacturing of medical devices to meet the increasing demand for efficient healthcare in North America is expected to be one of the key factors propelling the growth of the North America product design and development services market.

U.S. Product Design And Development Services Market Trends

The product design and development services market in the U.S. held the largest share in the North America region. Increasing inclination toward medical device product design and development outsourcing by medical device manufacturers due to the requirement of high maintenance and efficient systems for the management of raw materials that help in minimizing the overall setup costs and regulatory requirements.

Asia Pacific Product Design And Development Services Market Trends

Asia Pacific product design and development services market dominated the global market in 2023 and accounted for the largest share of over 41.9% of the overall revenue. The region is also expected to grow the fastest in a projected period due to the availability of several opportunities in this region, especially in Japan, China, and India. Factors such as improvements in the regulatory framework, higher cost savings, increasing complexity in product design and a growing number of medical device companies in the region are expected to drive the market forward. Moreover, rising rates of outsourcing consulting services from developed economies to emerging economies, such as India and China and the availability of skilled workforce at a lower cost than in the US and European countries are expected to accelerate market growth.

The product design and development services market of China held the largest share in 2023 in Asia Pacific. The large market share is owing to an increase in the number of collaborations of industry players with Original Equipment Manufacturers (OEMs) present in this region. The OEMs in China majorly focus on leveraging services that help reduce product recalls and minimize the time taken for regulatory approvals. Hence, the need for outsourced proper product design and development will boost market growth potential in the country.

Japan product design and development services market is expected to grow substantially over the forecast period. Rapid technological advancements and high healthcare expenditure are some of the key factors supporting overall market growth in the country.

The product design and development services market in India is anticipated to grow at the fastest CAGR over the forecast period owing to low operational costs, the availability of industry experts, improved infrastructure, and the increase in government funding for R&D.

Europe Pharmaceutical Product Design And Development Services Market

Europe product design and development market is expected to grow substantially owing to an increase in the number of clinical trials in the region that require highly equipped medical infrastructure. The outsourcing of product design and development of medical devices leads to the optimization of resources & costs in the abovementioned scenario, facilitating greater focus on innovation capabilities.

The product design and development market of Germany held the largest market share in Europe in 2023. A large share is due to the need to control healthcare costs in the region. Moreover, the various benefits associated with outsourcing, such as optimization of R&D activities for higher productivity and more regulatory compliance, cost savings through outsourcing of product design and development services, enable easy market entry.

The UK product design and development market is anticipated to witness substantial market growth over the estimated period. The strong presence of large and small-scale medical device manufacturers in the country.

Key Product Design And Development Services Company Insights

The key companies are undertaking various market strategies, such as merger & acquisition, collaboration, regional expansion, service portfolio expansion, and competitive pricing, to sustain in the competitive environment and acquire a higher market share. For instance, In May 2023, DeviceLab partnered with Nouslogic Telehealth, Inc. to develop and commercialize next-generation remote patient monitoring systems and wireless medical devices. Such partnerships offered numerous growth opportunities to the company in a significant market.

Key Product Design And Development Services Companies:

The following are the leading companies in the product design and development services market. These companies collectively hold the largest market share and dictate industry trends.

- Ximedica (Veranex)

- DeviceLab, Inc.

- Jabil Inc.

- Flex Ltd.

- Plexus Corp.

- Celestica Inc.

- StarFish Medical

- Nordson Medical

- Planet Innovation

- Donatelle

- Cambridge Design Partnership Ltd.

- Integer Holdings Corporation

- Cirtec

- Comp14

Recent Developments

-

In November 2023, Arch Systems, the prominent provider of data, analytics, and insightful solutions for manufacturing operations collaborated with Plexus Corp. Through this partnership, Plexus Corp. gained access to the ArchFX platform across its SMT lines within production facilities across the globe to enhance the company’s industry 4.0 journey. This integration enables Plexus to capture essential analytics at several levels as well as enhance its operation capabilities.

-

In May 2023, StarFish Medical signed a license agreement with Cybeats Technologies Corp for SBOM Studio to enhance cyber security management and help adhere to FDA guidelines related to SBOMs for market approval of new products. Such partnerships broadened the company’s service offering of the company.

Product Design and Development Services Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.51 billion

Revenue forecast in 2030

USD 32.93 billion

Growth rate

CAGR of 10.08% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Services, application, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa, Kuwait

Key companies profiled

Ximedica (Veranex); DeviceLab, Inc.; Jabil Inc.; Flex Ltd., Plexus Corp.; Celestica Inc.; StarFish Medical; Nordson Medical; Planet Innovation; Donatelle; Cambridge Design Partnership Ltd.; Integer Holdings Corporation; Cirtec

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Product Design and Development Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global product design and development services market report based on service, application, end-user, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Research, Strategy, & Concept Generation

-

Concept & Requirements Development

-

Detailed Design & Process Development

-

Design Verification & Validation

-

Process Validation & Manufacturing Transfer

-

Production & Commercial Support

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Equipment

-

Therapeutic Equipment

-

Clinical Laboratory Equipment

-

Surgical Instruments

-

Biological Storage

-

Consumables

-

Others

-

-

End-User Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical Device Companies

-

Pharmaceutical Companies

-

Biotechnology Companies

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

Frequently Asked Questions About This Report

b. The global product design and development services market size was estimated at USD 17.06 billion in 2023 and is expected to reach USD 18.51 billion in 2024.

b. The global product design and development services market is expected to grow at a compound annual growth rate of 10.08% from 2024 to 2030 to reach USD 32.93 billion by 2030.

b. The research, strategy, & concept generation services segment dominated the market with a share of 39.71% in 2023. This is attributable to extensive research, business, and design strategy that generates maximum revenue.

b. Some of the players operating in the product design & development services market are Ximedica (Veranex), DeviceLab, Inc., Jabil Inc., Flex Ltd., Plexus Corp., Celestica Inc., StarFish Medical, Nordson Medical, Planet Innovation, Donatelle, Cambridge Design Partnership Ltd., Integer Holdings Corporation, and Cirtec.

b. Key factors that are driving the product design and development services market growth include low product cost, short time-to-market, well as increasing demand for quality products and healthcare.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.