- Home

- »

- Next Generation Technologies

- »

-

Product Analytics Market Size, Share & Growth Report, 2030GVR Report cover

![Product Analytics Market Size, Share & Trends Report]()

Product Analytics Market Size, Share & Trends Analysis Report By Component, By Deployment, By Organization Size, By Mode, By Application, By Vertical (BFSI, Retail & E-Commerce), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-368-2

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Product Analytics Market Size & Trends

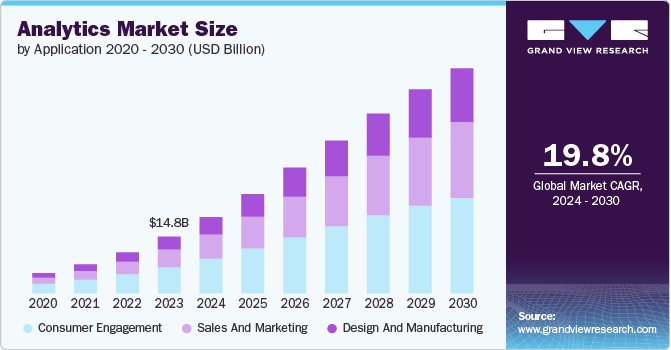

The global product analytics market size was estimated at USD 14.81 billion in 2023 and is expected to grow at a CAGR of 19.8% from 2024 to 2030. Various factors, such as the growing need to improve customer behavior management, increasing demand for advanced analytics tools, advancement in technologies, and focus on user experience, are primarily driving the growth of the product analytics market. The growing adoption of cloud-based solutions is another major factor driving market growth. Cloud-based product analytics platforms are scalable, cost-effective, and offer easy access to data for businesses of all sizes. This eliminates the need for expensive on-premises infrastructure and IT expertise, making product analytics more accessible to a wider range of companies.

Businesses are increasingly focusing on understanding customers’ buying behavior. Product analytics tools help companies track user journeys, identify pain points, and personalize the user experience, leading to higher customer satisfaction and retention. In today's digital age, user experience (UX) is a top priority for businesses. Product analytics tools help companies understand how users interact with their products and identify areas for improvement. By optimizing the UX, businesses can increase user engagement, satisfaction, and ultimately, conversion rates.

Moreover, businesses are no longer satisfied with basic data collection. They require advanced analytics tools that can provide deeper insights into customer behavior. These tools use techniques such as machine learning and artificial intelligence (AI) to uncover hidden patterns and trends in data, enabling companies to make data-driven decisions for product development, marketing strategies, and overall business operations. The rise of big data technologies has generated massive amounts of data from various sources. Product analytics platforms can ingest and analyze this data to extract valuable insights that would be impossible to glean from traditional methods. The integration of big data, AI, and machine learning is significantly propelling the product analytics market forward.

Component Insights

The solution segment led the market in 2023, accounting for over 78.0% share of the global revenue. Interactive dashboards and data visualization tools are becoming crucial. They help users easily understand complex data sets and uncover actionable insights. The ability to present data in clear and compelling ways is a major selling point for product analytics solutions. Product analytics solution providers are increasingly focusing on user adoption by offering intuitive interfaces, easy-to-use features, and robust training programs. This ensures users can leverage the full potential of the product analytics solution.

The services segment is predicted to foresee highest growth in the coming years. Businesses invest in product analytics to gain valuable insights that can improve their bottom line. Services providers can help companies define success metrics, track ROI, and ensure they're getting the most value out of their product analytics investment. Moreover, the product analytics landscape is constantly evolving with new technologies and best practices. Service providers help businesses stay contemporary by offering training on emerging trends and ensuring their data strategies are future-proof.

Deployment Insights

The cloud segment accounted for the largest market revenue share in 2023. Cloud-based solutions eliminate the need for expensive on-premises hardware and software. Businesses can pay for the resources they use, making it a cost-effective option for companies of all sizes, especially startups and SMEs. Moreover, Cloud-based solutions are accessible remotely with an internet connection. This allows teams to collaborate on data analysis remotely, fostering better communication and faster decision-making.

The on-premises segment is anticipated to exhibit a significant CAGR over the forecast period. On-premises solutions offer businesses more control over data storage and accessibility. This can be crucial for organizations that handle sensitive customer information. Some regulations mandate that data must be stored within specific geographical boundaries. On-premises solutions allow businesses to keep their data on-site or in a private cloud within the specific region, ensuring compliance with data residency requirements.

Organization Size Insights

The large enterprises segment accounted for the largest market revenue share in 2023. Large enterprises generate massive amounts of data from various sources such as customer interactions, website traffic, and internal applications. Product analytics solutions help them manage, analyze, and extract valuable insights from this complex data landscape. Moreover, product analytics helps large enterprises segment their customer base more effectively. By understanding different customer groups and their needs, businesses can tailor their marketing campaigns and product offerings for maximum impact.

The SMEs segment is anticipated to exhibit the highest CAGR over the forecast period. Numerous product analytics vendors offer subscription-based pricing models with tiered plans based on features and data volume. This allows SMEs to choose a plan that fits their budget and scales up as their businesses grow. Moreover, SMEs are increasingly recognizing the value of data-driven decision-making. Product analytics empowers them to understand customer behavior, optimize marketing campaigns, and improve product offerings for faster growth.

Mode Insights

The tracking data segment accounted for the largest market revenue share in 2023. Product analytics platforms are increasingly integrating with BI tools. This allows businesses to combine product data with other business metrics such as sales figures and marketing campaign performance to gain a holistic view of their operations and make more informed strategic decisions. Accurate and comprehensive data tracking ensures that the analysis is based on a complete picture of user behavior. Moreover, as data collection methods and technologies evolve, tracking data becomes more efficient and cost-effective, allowing for deeper analysis.

The analyzing data segment is anticipated to exhibit the highest CAGR over the forecast period. As the volume and complexity of data continues to grow, advanced analytics will play an even more critical role in the product analytics market. Businesses will increasingly seek solutions that offer explainable AI, real-time analytics, and predictive analytics. Traditionally, data analysis was the domain of data scientists. However, the rise of self-service analytics empowers various teams such as marketing and sales to access and analyze data independently. This fosters a data-driven culture within organizations and allows for faster decision-making based on insights.

Application Insights

The consumer engagement (CX) segment accounted for the largest market revenue share in 2023. By tracking engagement metrics, businesses can identify aspects of their product that lead to user drop-off. This data is crucial for optimizing consumer engagement and making the product more engaging and user-friendly. High user engagement is a strong indicator of customer satisfaction and loyalty. Product analytics helps businesses understand what drives engagement and use those insights to implement strategies to keep users actively using the product, reducing churn and increasing retention rates.

The sales and marketing segment is anticipated to exhibit the highest CAGR over the forecast period. Product analytics equips sales teams with valuable customer and product usage insights. This allows them to target lead generation, and improve sales conversations. Moreover, by optimizing campaigns and targeting the right audience with personalized messages, product analytics helps marketing teams maximize their return on investment. Product analytics helps sales and marketing teams understand customer needs and preferences better. This allows them to tailor their messaging and interactions for a more relevant and positive customer experience.

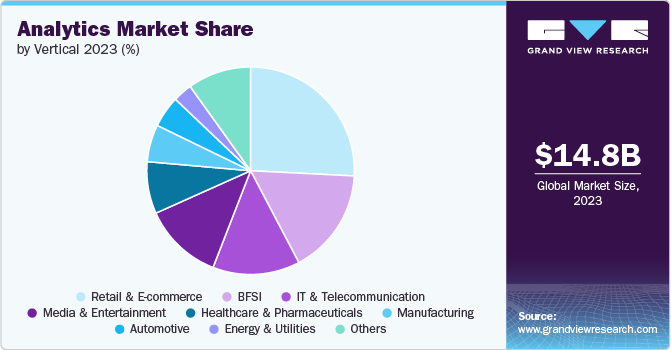

Vertical Insights

The retail & e-commerce segment accounted for the largest market revenue share in 2023. Product analytics helps retailers and e-commerce businesses understand the entire online shopping journey. This includes tracking user behavior from product discovery to purchase and post-purchase interactions. Moreover, by analyzing user behavior data, retailers can personalize product recommendations and upsell and cross-sell opportunities, leading to increased customer satisfaction and higher average order value. Furthermore, product analytics helps identify reasons for cart abandonment at various stages of the checkout process. This allows for targeted interventions to reduce cart abandonment and improve conversion rates.

The media & entertainment segment is anticipated to exhibit the highest CAGR over the forecast period. Product analytics helps track the audiences consume content such as movies, TV shows, and music. This includes analyzing viewing time, completion rates, and engagement with different content formats. By analyzing user data, media & entertainment companies can segment their audience based on demographics, interests, and viewing habits. This allows for targeted content creation, marketing campaigns, and personalized recommendations. Product analytics allows for A/B testing of different elements of content, such as trailers, thumbnails, and even storylines in interactive experiences, to see what resonates best with audiences.

Regional Insights

North America dominated with a revenue share of over 37.0% in 2023. North America boasts a well-developed technological infrastructure with high internet penetration and widespread adoption of smartphones and other connected devices. This creates a vast amount of data to be analyzed, fueling demand for product analytics solutions. Moreover, the booming e-commerce sector in North America heavily relies on product analytics to understand customer behavior, personalize the shopping experience, and optimize marketing strategies. The financial services industry in North America is seen to be using product analytics to improve fraud detection, personalize financial products, and enhance customer service experiences.

U.S. Product Analytics Market Trends

The U.S. product analytics market is anticipated to exhibit a significant CAGR over the forecast period. The U.S. boasts a highly developed technological infrastructure with widespread internet access, smartphone adoption, and a growing number of connected devices. This generates massive volumes of data, fueling the demand for advanced product analytics solutions. Moreover, the U.S. businesses are increasingly embracing data-driven decision making. Product analytics is seen as a vital tool for extracting actionable insights from customer data to optimize products, marketing campaigns, and overall business performance.

Europe Product Analytics Market Trends

The product analytics market in the European region is expected to witness significant growth over the forecast period. European consumers are highly conscious of data privacy. Product analytics solutions that prioritize user privacy and offer transparency in data usage are in high demand. Moreover, the European retail sector, including both online and brick-and-mortar stores, is leveraging product analytics tools to optimize product assortment, manage inventory effectively, and understand customer buying patterns.

Asia Pacific Product Analytics Market Trends

The product analytics market in the Asia Pacific region is anticipated to register the highest CAGR over the forecast period. The APAC region is witnessing a digital revolution, with a growing internet penetration rate and increasing smartphone adoption. This surge in digital activity creates a massive amount of data, fueling the demand for product analytics solutions. Moreover, the APAC e-commerce sector is booming, with countries such as China and India leading the charge. Product analytics helps e-commerce businesses in APAC personalize the shopping experience, optimize marketing campaigns, and boost conversion rates.

Key Product Analytics Company Insights

Key product analytics companies include Adobe Inc., Oracle, Accenture, and Google. Companies active in the product analytics market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in March 2023, Adobe Inc. introduced Adobe Product Analytics. Adobe Product Analytics software tool would enable organizations to integrate workstreams, data, and customer profiles, empowers product teams to work closely with their marketing and customer experience (CX) colleagues, and facilitates the coordination and delivery of more tailored experiences across all platforms.

Key Product Analytics Companies:

The following are the leading companies in the product analytics market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- Adobe Inc.

- Google LLC

- International Business Machines Corporation

- LatentView Analytics

- Medallia Inc.

- Mixpanel

- Oracle

- Salesforce, Inc.

- Veritone, Inc.

Recent Developments

-

In March 2024, Accenture launched IBM Sterling Intelligent, a supply chain cost optimization tool to enhance consumer transparency throughout their shopping journey. The solution enables companies to utilize data, real-time systems, and machine learning (ML), supporting a digital transformation journey from product discovery to delivery.

-

In March 2024, Oracle announced the launch of Oracle Analytics Server (OAS). This update brings more than a hundred new features that improve the analytics experience for every user in an organization. It offers new advancements that allow customers to derive more profound insights from their data and make decisions that lead to improved business results.

-

In February 2024, Medallia Inc., launched four new solutions to personalize customer and employee experiences. The solutions are Ask Athena, Intelligent Summaries, Smart Response, and Themes. These solutions will advance the ability of companies to spread insights broadly, engage employees, and customize experiences through affordable, ethical, and scalable AI and intelligent automation. Each of these four solutions will be accessible to Medallia customers via the Medallia Experience Cloud.

Product Analytics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 19.92 billion

Revenue forecast in 2030

USD 58.78 billion

Growth rate

CAGR of 19.8% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, organization size, mode, application, vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Accenture; Adobe Inc.; Google LLC; International Business Machines Corporation; LatentView Analytics; Medallia Inc.; Mixpanel; Oracle; Salesforce, Inc.; Veritone, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Product Analytics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global product analytics market report based on component, deployment, organization size, mode, application, vertical, and region.

-

Component Outlook (Revenue, USD Billion, 2017 - 2030)

-

Solution

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2017 - 2030)

-

Cloud

-

On-premises

-

-

Organization Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Mode Outlook (Revenue, USD Billion, 2017 - 2030)

-

Tracking Data

-

Analysing Data

-

-

Application Outlook (Revenue, USD Billion, 2017 - 2030)

-

Design and Manufacturing

-

Sales and Marketing

-

Consumer Engagement

-

-

Vertical Outlook (Revenue, USD Billion, 2017 - 2030)

-

BFSI

-

Retail & E-commerce

-

IT & Telecommunication

-

Automotive

-

Media & Entertainment

-

Manufacturing

-

Healthcare & Pharmaceuticals

-

Energy & Utilities

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global product analytics market size was estimated at USD 14.81 billion in 2023 and is expected to reach USD 19.92 billion in 2024.

b. The global product analytics market is expected to grow at a compound annual growth rate of 19.8% from 2024 to 2030 to reach USD 58.78 billion by 2030.

b. North America dominated the product analytics market with a share of 38.7% in 2023. North America boasts a well-developed technological infrastructure with high internet penetration and widespread adoption of smartphones and other connected devices. This creates a vast amount of data to be analyzed, fueling demand for product analytics solutions.

b. Some key players operating in the product analytics market include Accenture; Adobe Inc.; Google LLC; International Business Machines Corporation; LatentView Analytics; Medallia Inc.; Mixpanel; Oracle; Salesforce, Inc.; and Veritone, Inc.

b. Key factors that are driving the product analytics market growth include the growing need to improve customer behavior management, increasing demand for advanced analytics tools, advancement in technologies, and focus on user experience.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."