Process Mining Software Market Size, Share & Trends Analysis Report By Component (Software, Services), By Deployment, By Application, By Industry Vertical (BFSI), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-377-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Process Mining Software Market Trends

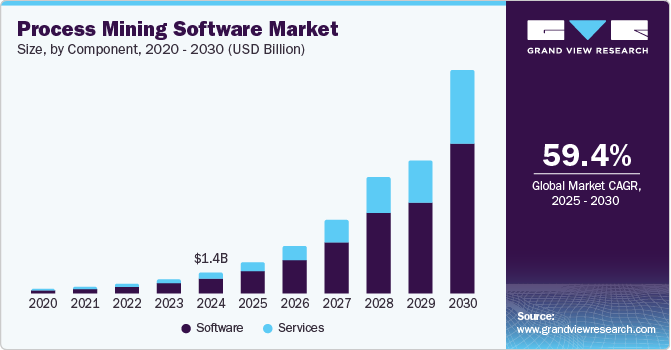

The global process mining software market size was valued at USD 1.43 billion in 2024 and is expected to expand at a CAGR of 59.4% from 2025 to 2030. This growth is attributed to the rising digital transformation initiatives, increased adoption of cloud-based solutions, and the need for enhanced business process optimization. In addition, organizations are leveraging process mining to streamline operations, ensure compliance, and improve efficiency. Integration with advanced technologies such as AI and machine learning further boosts demand by enabling predictive insights and real-time monitoring. Furthermore, the growing complexity of corporate processes and data-driven decision-making needs fuel market expansion globally.

Process mining software is a tool that analyzes event log data to uncover inefficiencies, bottlenecks, and opportunities within business processes, enabling optimization and automation. The market's growth is fueled by the integration of robotic process automation (RPA) with process mining, allowing businesses to streamline operations and enhance productivity while minimizing costs. This combination accelerates digital transformation as organizations increasingly adopt automation to manage both front-end and back-end activities. RPA’s ability to sustain operational efficiency, especially during remote work scenarios, has further amplified demand.

Another key driver is the rising focus on operational efficiency, as organizations aim to reduce costs by identifying process inefficiencies. Digital transformation initiatives also play a critical role by integrating advanced technologies such as artificial intelligence (AI) and machine learning (ML), which enhance the capabilities of process mining tools for predictive analytics and real-time monitoring. In addition, compliance and risk management requirements in regulated industries such as healthcare and finance have created opportunities for process mining software to ensure adherence to legal standards.

The market is witnessing growth through new product launches and innovations. For instance, in August 2023, Microsoft announced the availability of Power Automate Process Mining. It emphasizes how this tool, enhanced with AI, helps businesses optimize processes, reduce costs, and improve efficiency.

Component Insights

The software segment led the market and accounted for the largest revenue share of 73.2% in 2024, primarily driven by the increasing demand for tools that provide granular insights into business processes. These solutions enable organizations to visualize workflows, identify inefficiencies, and optimize operations effectively. In addition, the integration of advanced technologies like artificial intelligence and automation enhances their functionality, making them indispensable for digital transformation initiatives. Furthermore, the shift towards cloud-based deployments has amplified adoption, offering scalability, cost-effectiveness, and real-time monitoring capabilities, which are critical for modern business environments.

The service segment is expected to grow at a CAGR of 53.2% over the forecast period, owing to the rising adoption of cloud-based process mining solutions requiring regular updates and maintenance to ensure secure and efficient operations. In addition, professional services, including training, integration, and support, are increasingly sought after to maximize the software’s potential.

Deployment Insights

The cloud segment held the largest market share of 66.0% in 2024, driven by its flexibility, scalability, and cost-efficiency. Cloud-based solutions enable businesses to access real-time insights and manage processes remotely, making them ideal for organizations of all sizes. Furthermore, the ability to integrate with other cloud services and provide continuous updates enhances operational efficiency. Moreover, the rising adoption of digital transformation initiatives and the demand for secure, easily deployable solutions have further accelerated the shift toward cloud-based deployments.

The on premise segment is expected to grow at a significant CAGR of 40.9% over the forecast period, primarily attributed to the need for enhanced data security and control over critical business information. In addition, large organizations, particularly those in highly regulated industries, prefer on-premise solutions to meet stringent compliance requirements. These deployments allow businesses to customize software according to their specific needs while maintaining complete ownership of their infrastructure. Furthermore, on-premise systems are favored for their reliability in environments with limited internet connectivity, ensuring uninterrupted access to process mining tools and data analytics.

Application Insights

The transactional procurement segment dominated the global process mining software industry, with the largest revenue share of 22.3% in 2024. This growth is attributed to the need to streamline purchase-to-pay processes and reduce inefficiencies. Process mining enables businesses to analyze event logs, identify bottlenecks, and automate repetitive tasks like approvals and invoice matching. In addition, by eliminating manual interventions, organizations can reduce lead times, enhance accuracy, and lower procurement costs. Furthermore, the integration of process mining with supplier systems improves communication and compliance, ensuring smoother operations and fostering stronger supplier relationships.

Category management is expected to grow at a lucrative CAGR of 50.9% from 2025 to 2030, driven by the need for operational efficiency and a changing retail landscape. In addition, retailers and CPG companies use category management software to streamline planning and optimization processes, leveraging data analytics for insights into customer behavior and market trends. This enables data-driven decisions, boosts efficiency, and enhances category performance.

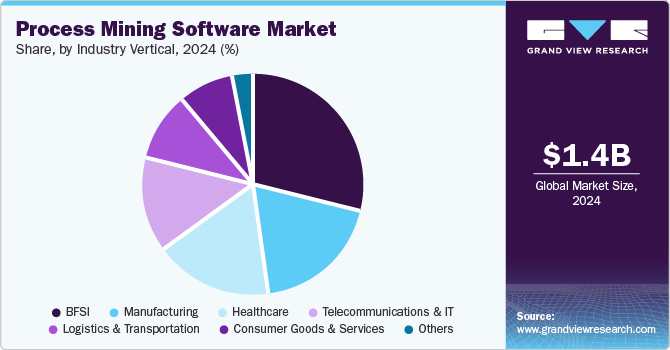

Industry Vertical Insights

The BFSI segment held the dominant position in the market and accounted for the largest revenue share of 29.0% in 2024, primarily driven by the increasing adoption of digital technologies to enhance operational efficiency and customer experience. In addition, financial institutions leverage process mining to streamline workflows, identify inefficiencies, and ensure compliance with regulatory standards. Furthermore, by analyzing transaction data, banks can optimize processes such as loan approvals and fraud detection. Moreover, the growing competition among financial service providers has accelerated the need for advanced tools to improve decision-making and deliver personalized services.

The consumer goods and services segment is expected to be the fastest growing segment, with a CAGR of 53.9% over the forecast period, owing to the rising need for process optimization in supply chain management and customer service operations. Process mining also helps improve customer satisfaction by identifying bottlenecks in order fulfillment and returns processes. Moreover, the increasing focus on digital transformation and the integration of automation technologies further drive the adoption of process mining in this sector.

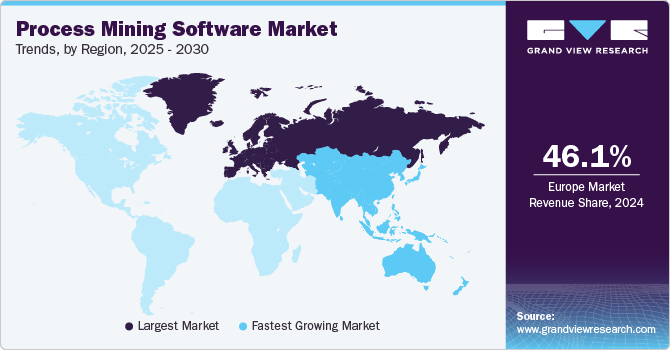

Regional Insights

Europe's process mining software market dominated the global market and accounted for the largest share of 46.1% in 2024. This growth is attributed to the region’s rapid adoption of digital transformation and automation technologies. Businesses are increasingly utilizing process mining to enhance operational efficiency, comply with stringent regulations, and improve customer experience. In addition, the presence of key market players and supportive government initiatives for digital innovation further accelerate growth. Furthermore, industries such as manufacturing, BFSI, and retail are leveraging process mining tools to optimize workflows, reduce costs, and maintain a competitive edge in the evolving business landscape.

UK Process Mining Software Market Trends

The process mining software market in the UK dominated the European market with the largest revenue share in 2024, primarily driven by the rising demand for advanced analytics to streamline business processes. In addition, organizations across sectors such as finance, healthcare, and logistics are adopting these tools to ensure compliance and enhance decision-making. Also, the focus on integrating AI and machine learning into process mining solutions has further fueled adoption. Moreover, the UK’s robust technology infrastructure and emphasis on innovation create a favorable environment for businesses to deploy process mining software for operational excellence.

Asia Pacific Process Mining Software Market Trends

Asia Pacific process mining software market is expected to grow at the fastest CAGR of 63.2% over the forecast period, owing to increasing investments in cloud infrastructure and digital transformation initiatives. Countries in this region are adopting these tools to improve process compliance and optimize resource utilization. Furthermore, the emergence of startups and small enterprises leveraging affordable cloud-based solutions also contributes to market expansion. Moreover, industries such as manufacturing and retail are using process mining to enhance supply chain operations and meet growing consumer demands efficiently.

North America Process Mining Software Market Trends

North America process mining software market is expected to witness substantial growth over the forecast period, driven by the region’s strong emphasis on technological advancements and data-driven decision-making. In addition, the integration of AI and IoT with process mining has amplified its adoption across large enterprises. Furthermore, the increasing need for automation in managing complex workflows has made process mining software a critical component of digital transformation strategies.

The growth of the process mining software market in the U.S. is expected to be driven by high demand for advanced technologies that optimize business operations. Industries such as finance, healthcare, and retail are leveraging these tools to gain actionable insights into workflows and improve productivity. Furthermore, the widespread adoption of cloud-based solutions has further accelerated growth by offering scalability and real-time analytics. Moreover, the U.S.’s focus on integrating AI-driven automation into business processes positions it as a leader in adopting innovative process mining solutions.

Key Process Mining Software Company Insights

Key players in the global process mining software industry include ABBYY Solutions Limited, Celonis GmbH, Fluxicon BV, and others. These companies adopt various strategies such as mergers and acquisitions, partnerships, and product innovations to enhance their market presence. In addition, they also focus on expanding their product portfolios, integrating advanced technologies such as AI and machine learning, and strengthening their global reach. Furthermore, these companies invest in research and development to create advanced solutions that address evolving customer needs.

-

ABBYY Solutions Limited develops solutions that provide end-to-end visibility into workflows, enabling organizations to optimize operations and make data-driven decisions. ABBYY operates in the process intelligence segment, catering to industries seeking to enhance efficiency, reduce costs, and improve compliance.

Key Process Mining Software Companies:

The following are the leading companies in the process mining software market. These companies collectively hold the largest market share and dictate industry trends.

- ABBYY Solutions Limited

- Celonis GmbH

- Fluxicon BV

- Hyland Software, Inc.

- myInvenio, an IBM Company

- QPR Software Plc

- Signavio

- Software AG

- UiPath, Inc.

Recent Developments

-

In May 2023, Pegasystems launched Pega Process Mining, a Process Mining Software solution that integrates AI-powered capabilities and generative AI-ready APIs. This tool helps users identify and fix process inefficiencies within the Pega Platform, enhancing workflow optimization.

Process Mining Software Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.13 billion |

|

Revenue forecast in 2030 |

USD 21.92 billion |

|

Growth Rate |

CAGR of 59.4% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

March 2025 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, deployment, application, industry vertical, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Germany, UK, France, Italy, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa |

|

Key companies profiled |

ABBYY Solutions Limited; Celonis GmbH; Fluxicon BV; Hyland Software, Inc.; Minit; myInvenio, an IBM Company; QPR Software Plc; Signavio; Software AG; UiPath, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Process Mining Software Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global process mining software market report based on component, deployment, application, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Cloud

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Strategic Sourcing

-

Contract Management

-

Category Management

-

Transactional Procurement

-

Supplier Management

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

Manufacturing

-

Healthcare

-

BFSI

-

Consumer Goods & Services

-

Telecommunications & IT

-

Logistics & Transportation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."