Process Analytical Technology Market Size, Share & Trends Analysis Report By Product, By Technique, By Monitoring Method, By Application, By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-983-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Process Analytical Technology Market Trends

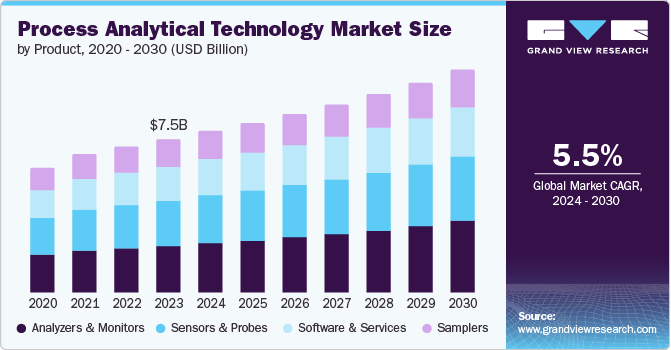

The global process analytical technology market was valued at USD 7.53 billion in 2023 and is expected to grow at a CAGR of 5.5% from 2024 to 2030. The increased need for high-quality products in pharmaceuticals and biotechnology sector has resulted in the integration of process analytical technology (PAT) in manufacturing drugs, vaccines and antibiotics. Moreover, PAT lowers downtime, enhances productivity and allows for quicker process development and scaling in various industries.

PAT is used in the planning, examination and regulation of pharmaceutical production processes by identifying control parameters that impact the critical quality traits. The rise in PAT usage was triggered due to the COVID-19 pandemic. The active participants in the advanced manufacturing sector have implemented PAT to assist in making drugs and other important items such as hand sanitizers, masks and gloves.

PAT is commonly utilized in the pharmaceutical industry and increasing research and development spending is expected to drive the need for these technologies. Real-time analytics is gaining increasing importance in industries such as chemical, pharmaceutical and food and beverage. PAT provides producers with immediate production process information, enabling them to quickly make decisions and simplify their operations.

Moreover, the potential for growth in PAT is increasing technological advancements such as digital twins and artificial intelligence in the market. Artificial intelligence utilizes correction mechanisms in pharmaceutical manufacturing to enable autonomous control and provide automated feedback in the industry. Furthermore, digital twins are virtual representations of actual manufacturing systems that gather data from monitoring devices to adapt manufacturing processes and conduct analysis.

Product Insights

Analyzers held a dominant share of 30.7% in 2023. PAT analyzers enhance the monitoring of processes and enhance control over the manufacturing of medicinal products. The increase in drug discovery research, along with strict regulations on drug safety is driving the use of analyzers and fueling market demand.

The sensors and probes segment is expected to grow at a CAGR of 5.5% over the forecast period. They are utilized in the production process to assess product quality parameters, providing real-time data access for prompt decision-making in product development & manufacturing.

Technique Insights

Spectroscopy held the largest share in 2023. Spectroscopy is a suitable technology for examining various stages of a sample. Its specificity in identifying components makes it widely utilized in the pharmaceutical industry for both quantitative and qualitative analyses. Furthermore, spectroscopy is widely employed in PAT to help analyze atomic structure and modify drug structures for improved efficacy.

Chromatography is anticipated to grow at a CAGR of 5.6% over the forecast period. Chromatography methods are utilized to measure critical quality attributes (CQAs). Technological developments in chromatography are expected to drive growth in the segment in the upcoming years.

Monitoring Method

In-line dominated the market with a share of 42.4% in 2023. In-line is a technique for monitoring data in real-time, offering both qualitative and quantitative information. Real-time data on pH, dissolved CO₂, dissolved oxygen, ORP, conductivity and temperature are transmitted to PLC/SCADA systems for automated monitoring and control. The method of in-line monitoring is used to measure these factors during the process, eliminating the need for manual intervention over an extended period of time and supplying reliable and precise data in industrial manufacturing.

The on-line segment is expected to grow at a CAGR of 6.4% during the forecast period. In this monitoring technique, a sample is taken away from the production process using a bypass flow. Process sensors measure the sample automatically in the by-pass. Benefits of online techniques include reduced product variability, automatic feedback with quality control features and removal of delays linked to other monitoring methods. The benefits of online methods are expected to drive growth in the segment and aid in the growth of the PAT market.

Application Insights

The small molecules segment dominated the market in 2023. PAT plays crucial role in improving small molecule product quality by providing insights into manufacturing processes that were previously not accessible through traditional methods. Real-time data analysis enables immediate adjustments to ensure products consistently meet desired specifications. Implementing PAT in small molecule production can lead to cost reduction through improving efficiency process optimization, minimizing waste and process optimization.

The large molecules segment is expected to grow rapidly during the forecast period. This growth is due to the increased focus on personalized medicine and biopharmaceuticals and rise in production of large molecules, creating a need for more sophisticated analytical technologies like PAT. The complexity of manufacturing processes for large molecules such as biologics production, requires advanced monitoring and control systems such as PAT to guarantee product quality and consistency, leading to a significant market growth.

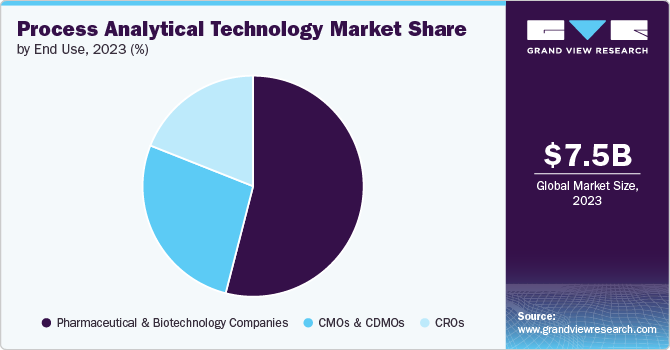

End Use Insights

Pharmaceutical and biotechnology companies held majority of the market share in 2023. In these companies, PAT is used to constantly analyze the manufacturing process to monitor physical and/or chemical quality attributes. It is also used for quality control and assessing the stability of active ingredients in pharmaceuticals.

CMOs and CDMOs are projected to witness a CAGR of 7.1% during the forecast period. Integration of PAT allows for the incorporation of a diverse range of procedures and goods. Furthermore, powerful data analytics tools can assist CMOs and CDMOs in cutting costs, while still upholding product quality and meeting regulatory standards. In addition, PAT helps in minimizing losses caused by off-track processes, reduces mistakes and eradicates batch failures. These benefits are expected to boost the use of PAT in CMOs and CDMOs, leading the market growth in the coming years.

Regional Insights

North America process analytical technology market dominated the market with a share of 38.9% in 2023 as it is home to numerous significant biotechnology and pharmaceutical firms. The quick expansion of the pharmaceutical and biotechnology sector, along with substantial spending on research and development, as well as regulatory support for using PAT in industries, are factors contributing to the market growth.

U.S. Process Analytical Technology Market Trends

The U.S. process analytical technology market dominated the North America market with a share of 86.2% in 2023 due to its growing use of advanced analytics technology and process optimization technology. The R&D in the field of PAT and large number of leading pharmaceutical industries in the country are drivers for the U.S. market growth.

Europe Process Analytical Technology Market Trends

Europe process analytical technology market was identified as a lucrative region in 2023. The market's expansion is fueled by the rising emphasis on optimizing processes and the increasing need for high-quality products. Regulations are strict within Europe's pharmaceutical and biotech sectors which is leading to a rising use of PAT to meet compliance standards.

Process analytical technology market in UK is expected to grow rapidly in the coming years due the growing focus on innovation and technological developments in industries such as pharmaceuticals and biotechnology.

The Germany process analytical technology market held a substantial market share in 2023. This is due to the increasing adoption of quality by design (QbD) principles in pharmaceutical industries to ensure product quality and process efficiency.

Asia Process Analytical Technology Market Trends

Asia Pacific market is anticipated to witness the fastest CAGR during the forecast period due to the rising government investments in biotechnology and regulations in pharmaceutical and biotechnology industries.

The process analytical technology market in India held a substantial market share in 2023 due to several factors such as India’s expanding healthcare infrastructure and initiatives undertaken by government for adoption of advanced technologies.

Key Process Analytical Technology Company Insights

Some of the key companies in the Process Analytical technology (PAT) market include Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; Bruker Corporation; PerkinElmer, Inc. and Carl Zeiss AG (Zeiss Group). Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Process Analytical Technology Companies:

The following are the leading companies in the process analytical technology market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Repligen Corporation

- Bruker Corporation

- Agilent Technologies, Inc.

- ABB Ltd.

- Danaher Corporation (Ab Sciex LLC)

- PerkinElmer, Inc.

- Emerson Electric Co.

- Sartorius AG

- Mettler-Toledo

- Shimadzu Corporation

- Hamilton Company

- Carl Zeiss AG (Zeiss Group)

Recent Developments

-

In June 2022, Merck, announced the collaboration with Agilent Technologies to enhance Process Analytical Technologies (PAT). This collaboration is expected to fill the industry gap in downstream Process Analytical Technologies (PAT).

-

In May 2022, Agilent announced a collaboration agreement with APC Ltd, a small and large molecule process development solutions provider. The aim of the collaboration is to combine their technologies to offer unique workflows to clients that supports automated process analysis through liquid chromatography (LC).

Process Analytical Technology Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.91 billion |

|

Revenue forecast in 2030 |

USD 10.91 billion |

|

Growth rate |

CAGR of 5.5% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors and trends |

|

Segments covered |

Product, technique, monitoring method, application, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Mexico, Canada, UK, Germany, Spain, France, Italy, Denmark, Sweden, Norway, China, India, Japan, South Korea, Thailand, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait. |

|

Key companies profiled |

Thermo Fisher Scientific Inc.; Agilent Technologies, Inc.; Danaher Corporation (Ab Sciex LLC); Bruker Corporation; PerkinElmer, Inc.; ABB Ltd.; Carl Zeiss AG (Zeiss Group); Emerson Electric Co.; Mettler-Toledo; Shimadzu Corporation; Sartorius AG; Hamilton Company; Repligen Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Process Analytical Technology Market Report Segmentation

This report forecasts revenue growth at the global, regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global process analytical technology market report based on product, technique, monitoring method, application, end use and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Analyzers

-

Sensors & Probes

-

Samplers

-

Software & Services

-

-

Technique Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spectroscopy

-

NIR Spectroscopy

-

Raman Spectroscopy

-

NMR Spectroscopy

-

Mass Spectroscopy

-

Others

-

-

Chromatography

-

Liquid Chromatography

-

Gas Chromatography

-

-

Particle Size Analysis

-

Electrophoresis

-

Others

-

-

Monitoring Method Outlook (Revenue, USD Billion, 2018 - 2030)

-

On-line

-

In-line

-

At-line

-

Off-line

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small Molecules

-

Large Molecules

-

Manufacturing Applications

-

Other Applications

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

CROs

-

CMOs & CDMOs

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Thailand

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."