- Home

- »

- Consumer F&B

- »

-

Probiotics Market Size, Share & Growth Analysis Report 2030GVR Report cover

![Probiotics Market Size, Share & Trends Report]()

Probiotics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Ingredient (Bacteria, Yeast), By Distribution Channel, By End Use (Human Probiotics, Animal Probiotics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-093-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Probiotics Market Summary

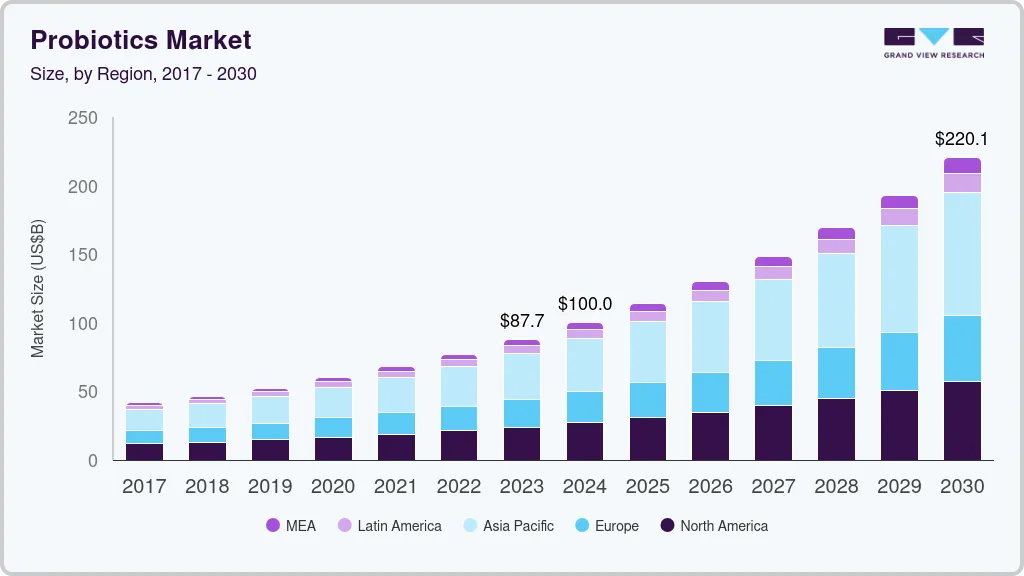

The global probiotics market size was valued at USD 87.70 billion in 2023 and is projected to reach USD 220.14 billion by 2030, growing at a CAGR of 14.1% from 2024 to 2030. Growing consumer awareness about the importance of gut health and its connection to overall well-being has significantly driven the demand for probiotics.

Key Market Trends & Insights

- The Asia Pacific region accounted for the largest revenue share of 38.5% in 2023.

- The India probiotics market held a significant market share in APAC in 2023.

- Based on product, the probiotic food & beverage segment dominated the market with a revenue share of over 61.2% in 2023.

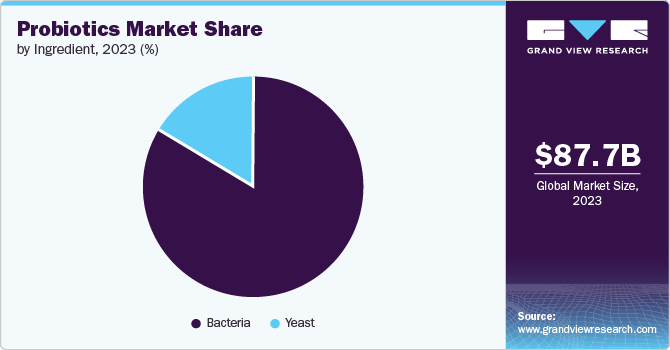

- Based on ingredient, the bacteria-based ingredient segment held the largest revenue market share in 2023.

- Based on end use, the human probiotic segment held the largest revenue market share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 87.70 Billion

- 2030 Projected Market Size: USD 220.14 Billion

- CAGR (2024-2030): 14.1%

- Asia Pacific: Largest market in 2023

- MEA: Fastest growing market

As scientific research continues to highlight the gut microbiome's critical role in maintaining digestive health, immune function, and even mental well-being, more people are recognizing the value of incorporating probiotics into their daily routines. Probiotics, known for their ability to balance the gut flora, are increasingly used to prevent digestive disorders such as irritable bowel syndrome (IBS) and support overall immune health. This awareness has led to increased consumption of probiotic-rich foods, beverages, and supplements as consumers seek natural and effective ways to enhance their health proactively.

Favorable regulatory frameworks in various regions and the approval of health claims for probiotics by reputable authorities such as the European Food Safety Authority (EFSA) and the U.S. Food and Drug Administration (FDA) have significantly bolstered market growth. These regulatory endorsements provide a robust foundation for the probiotics market by ensuring that products meet stringent safety and efficacy standards, enhancing consumer confidence. When regulatory bodies validate the health benefits of probiotics, it not only legitimizes the claims made by manufacturers but also reassures consumers about the quality and effectiveness of these products. This regulatory support helps to build trust and credibility, making consumers more likely to choose and consistently use probiotic products.

Consumers across the world are largely focused on improving gut and microbiome health. According to a survey conducted by the International Food Information Council (IFIC), in 2021, 70% of the respondent’s consumed yogurt for general health and wellness. However, 60% of the respondents believed it was good for enhancing digestive health. It is anticipated that probiotics in dairy products, such as yogurt, will witness high penetration as they are known to control intestinal flora. Fast-paced lifestyles have led to increased health issues and gut problems, compelling consumers to increasingly focus on preventive healthcare.

Product Insights

The probiotic food & beverage segment dominated the market with a revenue share of over 61.2% in 2023. Manufacturers are increasingly fortifying food and beverage products with enzymes and probiotics. This is attributed to consumer demand for food items with higher nutritional and fiber content. Digestive ingredients such as probiotics are widely used in fish oil and yogurt to reduce the risk of gut health issues. The increasing awareness of improving quality of life and the rise in disposable incomes have prompted consumers to adopt probiotics to solve their health issues. Manufacturers are expanding their businesses in response to the growing demand for probiotics in foods and beverages. For instance, in August 2022, Korea's Hy Co, formerly known as Korea Yakult, announced its expansion into probiotic business categories to include a broader range of products.

The probiotic dietary supplements segment is expected to grow at the fastest CAGR of 14.2% during the forecast period. The growing inclination toward wellness programs on account of increasing health-related issues, such as blood pressure, unhealthy lifestyles, obesity, and improper diet, is expected to drive the growth of the probiotics dietary supplement industry. These supplements help build a strong immune system to treat several gastrointestinal diseases, dental caries, and breast cancer. Furthermore, many adults and children in the U.S. take one or more dietary supplements like probiotics to get adequate amounts of essential nutrients to enhance their health.

Ingredient Insights

The bacteria-based ingredient segment held the largest revenue market share in 2023. These products offer numerous health benefits for both humans and animals. They serve as aflatoxin adsorbents, contribute to the prevention of colon cancer, and aid in preventing oral diseases, urinary tract infections, respiratory infections, bowel ailments, and other bacterial infections within the body. The market is experiencing growth due to the increasing popularity of functional foods, the adoption of probiotic ingredients in developing economies, and rising disposable incomes. In May 2023, Lesaffre's Gnosis introduced an enhanced quality specification for its well-established probiotic bacteria, LifeinU L. rhamnosus GG.

Yeast-based probiotics is expected to grow at significant CAGR during the forecast period. These products offer several advantages over bacterial probiotics, particularly in treating intestinal manifestations, gastric acidity, and diarrheas. Yeast-based dietary supplements are popular as they contain significant amounts of proteins, amino acids, vitamin B, and peptides. Furthermore, probiotic yeast is considered safe for consumption across all age groups. In September 2021, Angel Yeast launched a strain of yeast probiotic Saccharomyces boulardii Bld-3. It is effective in combating diarrhea while simultaneously enhancing the digestive and immune systems in both children and adults.

End Use Insights

The human probiotic segment held the largest revenue market share in 2023. The aging population is increasing globally, and this rapid rise is likely to lead to an increase in the number of chronic diseases, which, in turn, is expected to boost the need for microbes such as probiotics to control the threat of the leading chronic diseases such as colon cancer, inflammatory bowel disease (IBD) and diarrheal diseases. In October 2021, Qingdao Vland Biotech Group Co. and ADM announced they had established a joint venture to meet China's increasing demand for human probiotics. This joint venture specializes in producing and distributing human probiotics, leveraging the experience and expertise of ADM and Vland. By integrating a comprehensive range of technological, commercial, and production capabilities, the joint venture aimed at catering to the market's diverse needs.

Demand of probiotics in the animal feed market is expected to grow at significant CAGR over the forecast period. There has been a rise in the adoption of probiotics in farm animals' feeds in the past few years. The use of probiotics in animal feed has shown significant results in improved immune systems, animal performance, and digestion. The increasing focus on animal welfare and the desire to reduce the use of antibiotics in animal husbandry have further fueled the demand for animal probiotics. In August 2021, Chr. Hansen introduced an innovative range of live probiotics for pet foods and supplements. These probiotics help promote optimal digestion, enhance immunity, and improve pets' overall well-being.

Distribution Channel Insights

Hypermarkets/supermarkets held the highest revenue market share in 2023. The presence of a wide variety of probiotics in one place and the ease of purchasing have contributed to the dominance of supermarkets & hypermarkets as a distribution channel in the market in recent years. The regulatory framework surrounding probiotics is significant in their distribution through pharmacies and drugstores. Probiotic supplements are often categorized as over-the-counter (OTC) products, which can be conveniently purchased without a prescription. This classification makes probiotics readily available in pharmacies and drugstores, increasing their accessibility to consumers.

The online stores segment is expected to grow at the fastest CAGR over forecast period. The convenience and accessibility offered by online shopping have contributed to the rising popularity of online purchases of probiotics. Online shopping allows consumers to browse and compare a wide range of probiotic products from the comfort of their homes without visiting physical stores. In January 2021, HempFusion Wellness expanded its distribution on Amazon by establishing a distinctive e-commerce store within the platform. This strategic move enabled HempFusion's renowned probiotic supplement brand, Probulin, to enhance brand awareness while boosting sales and providing comprehensive product information for its extensive range of scientifically formulated offerings.

Regional Insights

The Asia Pacific region accounted for the largest revenue share of 38.5% in 2023. Consumers in this region increasingly seek healthy products because of rising awareness regarding fitness and maintaining good digestive health. Rising disposable incomes, improving the standard of living, and increasing acceptance of functional foods are the major factors driving the industry's growth. In addition, the growing importance of gut health in overall well-being has increased demand for products that maintain a healthy gut microbiome. Probiotic supplements are seen as a convenient and effective way to introduce beneficial bacteria into the gut and thus have become increasingly popular among health-conscious consumers in the region.

The India probiotics market held a significant market share in APAC in 2023. The functional foods and beverages market in India is expanding rapidly, with probiotics being a significant component. Consumers are increasingly seeking products that offer additional health benefits, leading to the inclusion of probiotics in a variety of food and beverage products like yogurts, smoothies, and dietary supplements.

North America Probiotics Market Trends

The growing interest in natural and organic products in North America reflects a broader shift towards health-conscious and environmentally sustainable living. Consumers are increasingly scrutinizing the ingredients in their products, with a strong preference for items free from synthetic additives, chemicals, and genetically modified organisms (GMOs). This trend is particularly evident in the probiotics market, where there is a rising demand for probiotics derived from natural, organic, and non-GMO sources. As a result, manufacturers are responding by developing and launching products that align with these preferences, such as organic yogurts, non-GMO supplements, and naturally fermented foods. These products cater to health-conscious consumers and appeal to those concerned about environmental sustainability and ethical sourcing. The emphasis on natural and organic probiotics has thus become a key driver of market growth, attracting diverse consumers who prioritize health and sustainability in their purchasing decisions.

U.S. Probiotics Market Trends

Rising awareness of healthy lifestyles and increasing disposable incomes are pivotal factors driving the growth of the probiotics market in US and its member countries. As consumers become more informed about the importance of maintaining a balanced diet and overall wellness, there is a heightened focus on incorporating products that support long-term health, such as probiotics, which are known for their benefits in improving digestive health, boosting immunity, and enhancing overall well-being. This awareness is further amplified by widespread access to health information through digital platforms, healthcare providers, and wellness influencers. Rising disposable incomes across the region enable consumers to spend more on premium health and wellness products, including high-quality probiotic foods, beverages, and supplements. This combination of health consciousness and financial capability is driving greater demand for probiotic products, as people are increasingly willing to invest in their health and prioritize preventative care, driving market growth across the U.S.

Europe Probiotics Market Trends

The European Probiotic Association (EPA) plays a crucial role in the growth of the probiotics industry in Europe through its initiatives, such as providing comprehensive guidelines and organizing educational webinars. These guidelines ensure that probiotic products meet stringent quality and safety standards, which are essential in a market where consumer trust is paramount. By setting these high standards, the EPA helps foster consumer confidence in probiotic products, reassuring them that what they are purchasing is both safe and effective. This trust, in turn, drives the increased usage and demand for probiotics across Europe. Additionally, the clear and well-defined guidelines provided by the EPA empower manufacturers to develop high-quality probiotic formulations, ensuring consistency and reliability in product offerings. The educational webinars and resources offered by the EPA further contribute to market growth by informing both consumers and industry stakeholders about the benefits and proper use of probiotics, thereby expanding the consumer base and encouraging innovation within the industry.

UK probiotics market is expected to grow at fastest CAGR in Europe region in the forecast period. The UK probiotics market is characterized by continuous innovation, with companies investing heavily in research and development to stay ahead in a competitive landscape. This innovation manifests in several ways, such as creating new probiotic strains that target specific health needs, including gut health, immunity, and mental well-being. In addition to developing new strains, companies are also improving delivery methods, such as microencapsulation, to enhance the stability and efficacy of probiotics, ensuring that they survive the digestive process and deliver maximum benefits.

MEA Probiotics Market Trends

MEA probiotics market is expected to grow at a significant CAGR during the forecast period. The expansion of the pharmaceutical and nutraceutical sectors in the Middle East and Africa (MEA) region is significantly driving the growth of the probiotics market by enabling the development of highly specialized probiotic supplements. As these industries grow, they increasingly focus on creating products that address specific health concerns, such as enhancing immunity, supporting women's health, and promoting pediatric wellness. These targeted probiotics are formulated with strains that have been researched and proven to provide specific benefits, making them appealing to consumers looking for practical solutions to their health needs. For instance, immunity-boosting probiotics are becoming particularly popular due to global health challenges as people seek to strengthen their immune systems. Probiotics designed for women may focus on maintaining vaginal health or balancing hormones, while pediatric probiotics are developed to support the digestive and immune systems of children. The rise of these tailored products is meeting the growing consumer demand for personalized health solutions, leading to increased adoption of probiotics in the MEA region and contributing to the overall market growth.

Key Probiotics Company Insights

Some of the key companies in the probiotics market includeArla Foods, BioGaia, DuPont De Nemours, Inc., Mother Dairy Fruit & Vegetable Pvt. Ltd. and others. Organizations are focusing on innovative and efficient trail running shoe offerings to increase the consumer base. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

Arla Foods is a global dairy company. The company has a strong presence in the probiotics market, offering a range of products that cater to health-conscious consumers. Arla Foods' probiotic offerings include probiotic yogurts, fermented milk drinks, and cheese, all of which are fortified with beneficial probiotic strains that support digestive health and overall well-being.

-

Mother Dairy Fruit & Vegetable Pvt. Ltd. offers probiotic-rich yogurts and drinks, such as "B-Activ Probiotic Dahi" and "Nutrifit," which are designed to support gut health by incorporating beneficial live cultures. These products cater to the growing consumer demand for functional foods that provide additional health benefits beyond basic nutrition.

Key Probiotics Companies:

The following are the leading companies in the probiotics market. These companies collectively hold the largest market share and dictate industry trends.

- Arla Foods

- BioGaia

- Chr. Hansen Holding A/S

- Danone

- DuPont De Nemours, Inc.

- General Mills, Inc.

- i-Health, Inc.

- Lallemand Inc.

- Lifeway Foods Inc.

- Mother Dairy Fruit & Vegetable Pvt. Ltd.

- Kerry Group plc

- Nestle S.A.

- Probi AB

- Yakult Honsha Co., Ltd.

Recent Developments

-

In April 2022, Symrise, a r producer of cosmetic ingredients, launched SymFerment, a cutting-edge ingredient designed to enhance skin care with its moisturizing and smoothing properties. Developed in collaboration with Probi, a leading manufacturer of probiotics for the healthcare and food industries, SymFerment represents a significant advancement in sustainable cosmetic technology.

-

In July 2021, Symrise introduced SymReboot OC, a probiotic ingredient designed explicitly for oral care applications. This innovative product aims to enhance oral hygiene by harnessing the benefits of probiotics to support a balanced oral microbiome. SymReboot OC represents a significant advancement in oral care technology, offering a natural solution to improve oral health and freshness.

Probiotics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 99.97 billion

Revenue forecast in 2030

USD 220.14 billion

Growth Rate

CAGR of 14.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

August 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, ingredient, end use, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, India, Japan, Australia & New Zealand, South Korea, Brazil, and Saudi Arabia

Key companies profiled

Arla Foods, BioGaia, Chr. Hansen Holding A/S, Danone, DuPont De Nemours, Inc., General Mills, Inc., i-Health, Inc., Lallemand Inc., Lifeway Foods Inc., Mother Dairy Fruit & Vegetable Pvt. Ltd., Kerry Group plc, Nestle S.A., Probi AB, Yakult Honsha Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Probiotics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the probiotics market report based on product, ingredient, end use, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Probiotic Food & Beverages

-

Dairy Products

-

Non-Dairy

-

Cereals

-

Baked Food

-

Fermented Meat

-

Dry Foods

-

-

Probiotic Dietary Supplements

-

Food Supplements

-

Nutritional Supplements

-

Specialty Supplements

-

Infant Formula

-

-

Animal Feed

-

-

Ingredient Outlook (Revenue, USD Million, 2018 - 2030)

-

Bacteria

-

Yeast

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Human Probiotics

-

Animal Probiotics

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets / Supermarkets

-

Pharmacies / Drugstores

-

Specialty Stores

-

Online Stores

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global probiotics market size was estimated at USD 87.70 billion in 2023 and is expected to reach USD 99.97 billion in 2024.

b. The global probiotics market is expected to grow at a compound annual growth rate of 14.1% from 2024 to 2030 to reach USD 220.14 billion by 2030.

b. Probiotic food & beverage was the dominant product segment in terms of revenue, occupying over 61.2% in 2022 and is expected to experience significant growth over the forecast period. Growing awareness regarding the health benefits of fermented food products has been driving the demand for probiotic food & beverages.

b. Some of the key players in the probiotics market include Arla Foods, BioGaia, Chr. Hansen Holding A/S, Danone, DuPont De Nemours, Inc., General Mills, Inc., i-Health, Inc., Lallemand Inc., Lifeway Foods Inc, Mother Dairy Fruit & Vegetable Pvt. Ltd, Kerry Group plc, Nestle S.A., Probi AB, and Yakult Honsha Co., Ltd.

b. The growing awareness about the health benefits of probiotics, such as improved gut health and overall digestive function, is anticipated to boost the growth of the probiotics market across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.