- Home

- »

- Consumer F&B

- »

-

Probiotic And Prebiotic Soda Market Size, Share Report 2030GVR Report cover

![Probiotic And Prebiotic Soda Market Size, Share & Trends Report]()

Probiotic And Prebiotic Soda Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Prebiotic, Probiotic), By Flavor (Fruit, Cola), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-375-1

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Probiotic And Prebiotic Soda Market Summary

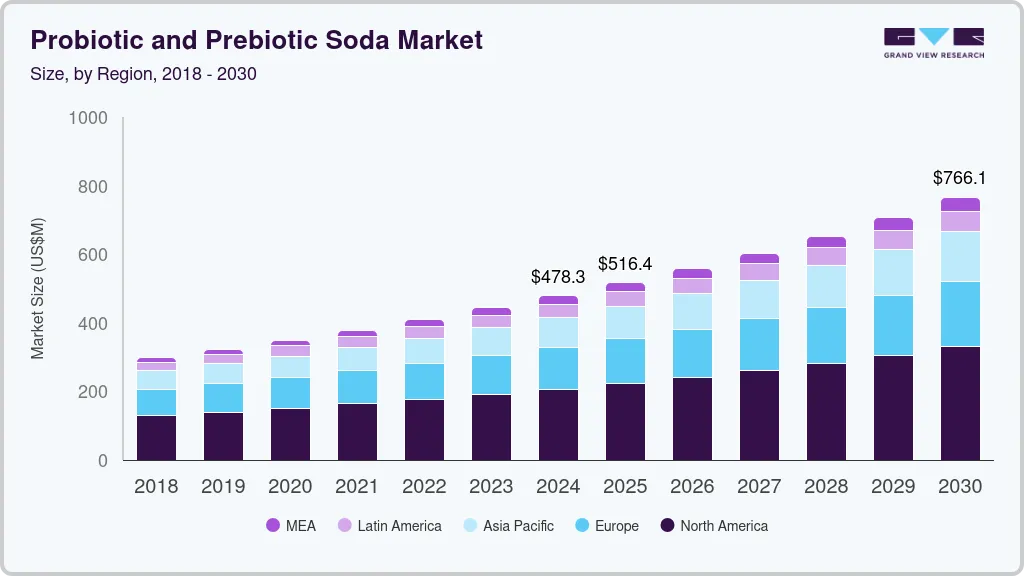

The global probiotic and prebiotic soda market size was estimated at USD 478.3 million in 2024 and is projected to reach USD 766.1 million by 2030, growing at a CAGR of 8.2% from 2025 to 2030. There is a growing consumer awareness and interest in gut health.

Key Market Trends & Insights

- The probiotic and prebiotic soda market in Asia Pacific held a share of over 18.22% of the global market in 2023.

- The U.S. probiotic and prebiotic soda market is expected to grow at a CAGR of 8.5% from 2024 to 2030.

- By product, probiotic soda accounted for a share of 54.76% of the global revenues in 2023.

- By flavor, fruit-flavored probiotic and prebiotic soda accounted for a share of 81.07% of the global revenues in 2023.

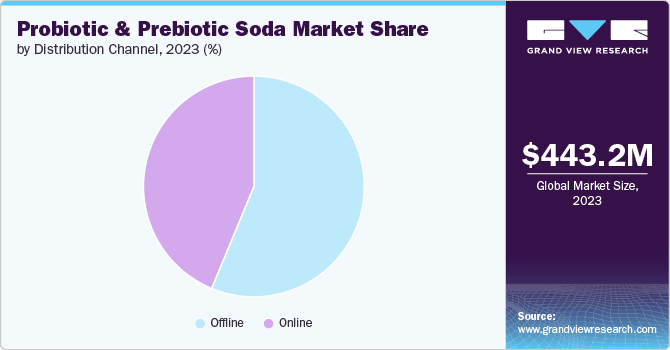

- By distribution channel, sales through offline distribution channels accounted for a share of 56.26% of the global revenues in 2023.

Market Size & Forecast

- 2024 Market Size: USD 478.3 Million

- 2030 Projected Market Size: USD 766.1 Million

- CAGR (2025-2030): 8.2%

- Asia Pacific: Largest market in 2023

Probiotics and prebiotics are recognized for their benefits in promoting digestive health, boosting immunity, and improving overall well-being. This awareness is fueled by increasing scientific research and widespread media coverage highlighting the importance of maintaining a healthy gut microbiome. As consumers become more educated about the health benefits of probiotics and prebiotics, their demand for functional beverages that provide these benefits is rising sharply. Moreover, the shift towards healthier and more natural beverage options is a significant market driver. Many consumers are moving away from sugary sodas and artificial drinks, seeking healthier alternatives. Probiotic and prebiotic sodas, often marketed as natural and health-enhancing, fit well into this trend. They cater to health-conscious consumers who are looking for beverages that not only quench their thirst but also contribute to their health goals. This shift is particularly strong among younger demographics, who are more likely to prioritize health and wellness in their purchasing decisions.

Innovation in product offerings also plays a crucial role. Companies are continuously developing new flavors, improving formulations, and creating more convenient packaging to attract a broader audience. The introduction of novel and exotic flavors helps in appealing to a wider range of taste preferences, while advances in formulation ensure that the beneficial bacteria remain viable throughout the product's shelf life. Additionally, more convenient and sustainable packaging options make these products more accessible and appealing to modern consumers.

Moreover, the rise of e-commerce and digital marketing has expanded the reach of probiotic and prebiotic sodas. Online platforms offer consumers easy access to a wide variety of these products, along with detailed information about their health benefits. Digital marketing strategies, including social media campaigns and influencer partnerships, have effectively increased product visibility and consumer engagement. This online presence complements traditional retail channels, making these health beverages more available and popular among tech-savvy and health-conscious consumers.

Product Insights

Probiotic soda accounted for a share of 54.76% of the global revenues in 2023. Consumers are becoming more knowledgeable about the health benefits of probiotics, which are known to support gut health, boost the immune system, and enhance overall well-being. This heightened awareness is driving demand for functional beverages that provide these health benefits in a convenient form.

Prebiotic soda is anticipated to grow at a CAGR of 7.9% from 2024 to 2030. Consumers are increasingly adopting a holistic approach to health, seeking functional foods and beverages that provide multiple health benefits. Prebiotic sodas are seen as a convenient way to incorporate prebiotics into the diet, supporting not only digestion but also immune function and overall well-being.

Flavor Insights

Fruit-flavored probiotic and prebiotic soda accounted for a share of 81.07% of the global revenues in 2023. These beverages cater to the growing demand for functional drinks that support gut health, combining the refreshing taste of fruit with the added advantages of probiotics and prebiotics. The preference for natural and familiar flavors like fruit over other alternatives has driven higher consumer adoption, leading to their growth in the market.

Cola-flavored probiotic and prebiotic soda are anticipated to grow at a CAGR of 9.0% from 2024 to 2030. The cola flavor remains a popular choice among consumers, combining familiarity with the perceived health benefits of probiotics and prebiotics. This makes it easier for traditional soda drinkers to transition to healthier alternatives without sacrificing taste. The blending of health benefits with a beloved flavor appeals to a broad audience, driving demand.

Distribution Channel Insights

Sales through offline distribution channels accounted for a share of 56.26% of the global revenues in 2023. These traditional retail outlets benefit from established consumer trust and the ability to offer immediate product availability. Supermarkets and hypermarkets remain popular due to their extensive reach and the ability to attract a broad consumer base with diverse product offerings.

Sales through online distribution channel are anticipated to grow at a CAGR of 8.8% from 2024 to 2030. Online platforms provide detailed product information, customer reviews, and ratings, helping consumers make informed decisions. This transparency is crucial for health products, as consumers often seek reassurance about the benefits and quality of the items they purchase.

Regional Insights

The probiotic and prebiotic soda market in North America is expected to grow at a CAGR of 8.1% from 2024 to 2030. There is a growing preference for products that support digestive health and immunity, fueled by a broader wellness movement. Additionally, the rise of clean-label products, with natural and organic ingredients, appeals to health-conscious consumers. Innovations in flavor and packaging, along with strategic marketing highlighting the benefits of gut health, are further propelling market growth. The expansion of retail and online distribution channels also facilitates wider accessibility and adoption in this region.

U.S. Probiotic And Prebiotic Soda Market Insights Trends

The U.S. probiotic and prebiotic soda market is expected to grow at a CAGR of 8.5% from 2024 to 2030. There is a significant shift towards healthier beverage options driven by consumer awareness of gut health benefits. This trend is bolstered by increasing concerns over sugar consumption and interest in beverages with functional benefits like digestive support and immune boosting properties. The popularity of natural and organic ingredients also plays a crucial role, as consumers seek products that align with their preferences for clean-label and transparent sourcing.

Asia Pacific Probiotic And Prebiotic Soda Market Trends

The probiotic and prebiotic soda market in Asia Pacific held a share of over 18.22% of the global market in 2023. Rising consumer demand for health-focused, functional beverages that provide gut health and immunity benefits. Probiotic and prebiotic sodas are seen as a convenient way to incorporate these beneficial microbes into the diet. The growing senior population in Asia-Pacific and their focus on preventive health is also contributing to the rise in probiotic and probiotic soda consumption.

Europe Probiotic And Prebiotic Soda Market Trends

The Europe probiotic and prebiotic soda market is expected to grow at a CAGR of 7.8% from 2024 to 2030. The biofuel industry also significantly influences the probiotic and prebiotic soda market in Europe. Consumers are actively seeking out beverages that not only taste good but also contribute positively to their digestive health, reflecting a shift towards preventive health care and holistic wellness approaches. This trend is influencing beverage choices across various demographic segments, from health-conscious millennials to aging populations looking to maintain vitality and wellness.

Key Probiotic And Prebiotic Soda Company Insights

The market is highly competitive, with a range of companies offering various forms. Many big players are increasing their focus on new form launches, partnerships, and expansion into new markets to compete effectively.

Key Probiotic And Prebiotic Soda Companies:

The following are the leading companies in the probiotic and prebiotic soda market. These companies collectively hold the largest market share and dictate industry trends.

- Health-Ade

- Poppi

- OLIPOP

- Culture Pop Soda

- LIVE Soda

- Humm Kombucha

- Revive Kombucha

- KeVita

- Bubly Bounce

- Genius Juice

Recent Developments

-

In August 2023, Beliv, a global beverage company, launched Mighty Pop. Each can of Mighty Pop contains 1 billion live probiotic cultures, 3 grams of prebiotic fiber, and postbiotics that support immune health, all while containing just three grams of sugar and 30 calories. Mighty Pop is USDA-certified organic and available in four flavors, including Orange Vanilla, Strawberry Hibiscus, Pineapple Grapefruit, and Berry Lime.

-

In March 2023, FHIRST, a new zero-sugar, prebiotic, and probiotic soda range, launched in the UK with three flavors: Passion Fruit, Cherry Vanilla, and Ginger Mandarin. Each serving contains 2 billion live probiotic cultures, 5 grams of prebiotic fiber, and zinc while being free from sugar, artificial ingredients, and sweeteners. FHIRST aims to promote gut, immune, and brain health, and has ambitious commercial goals, with plans for global expansion and a partnership to support biodiversity projects.

Probiotic And Prebiotic Soda Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 516.4 million

Revenue forecast in 2030

USD 766.1 million

Growth rate

CAGR of 8.2% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, flavor, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; France; China; India; Japan; Australia; South Korea; Brazil; South Africa; Saudi Arabia

Key companies profiled

Health-Ade; Poppi; OLIPOP; Culture Pop Soda;

LIVE Soda; Humm Kombucha; Revive Kombucha

KeVita; Bubly Bounce; Genius Juice

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Probiotic And Prebiotic Soda Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global probiotic and prebiotic soda market report based on the product, flavor, distribution channel and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Prebiotic Soda

-

Probiotic Soda

-

-

Flavor Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruit

-

Cola

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

Hypermarkets/Supermarkets

-

Convenience Stores

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central and South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global probiotic and prebiotic soda market size was valued at USD 443.2 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 8.2% from 2024 to 2030 to reach USD 766.1 million by 2030.

b. The global prebiotic and probiotic soda market are expected to grow at a compounded growth rate of 8.2% from 2024 to 2030 to reach USD 766.1 million by 2030.

b. There is a growing consumer awareness and interest in gut health. Probiotics and prebiotics are recognized for their benefits in promoting digestive health, boosting immunity, and improving overall well-being. This awareness is fueled by increasing scientific research and widespread media coverage highlighting the importance of maintaining a healthy gut microbiome. As consumers become more educated about the health benefits of probiotics and prebiotics, their demand for functional beverages that provide these benefits is rising sharply.

b. Dairy based probiotic and prebiotic soda accounted for a share of 62.89% of the global revenues in 2023. Dairy-based options are trusted due to their association with traditional probiotic sources like yogurt, while non-dairy options cater to the growing segment of health-conscious consumers seeking vegan and lactose-free alternatives. Additionally, innovation in flavors, convenient packaging, and increased availability through online and offline channels have contributed to the robust market share.

b. Some key players operating in the prebiotic and probiotic market are Yakult Honsha Co. Ltd., Danone S.A., Nestle SA, Chobani LLC, NextFoods, Harmless Harvest|, Bio-K Plus International Inc., GCMMF (Amul), PepsiCo, Fonterra Co-operative Group

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.