- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Probiotic Gummies Market Size And Share Report, 2030GVR Report cover

![Probiotic Gummies Market Size, Share & Trends Report]()

Probiotic Gummies Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Digestive Support, Immune Support), By End Use, By Distribution Channel (Offline, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-362-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Probiotic Gummies Market Size & Trends

The global probiotic gummies market size was estimated at USD 869.9 million in 2024 and is expected to grow at a CAGR of 14.7% from 2025 to 2030. The increasing incidence of digestive problems is expected to boost the market for probiotic gummies. These gummies are designed to address gut health and microbial balance, offering effective relief for issues like antibiotic-associated diarrhea and gut inflammation. In response to the growing demand for digestive health solutions, numerous manufacturers are introducing probiotic gummies. For instance, in March 2023, Goli Nutrition Inc. unveiled a multi-functional probiotic gummy that incorporates prebiotics, probiotics, and postbiotics. These gummies are formulated to promote a healthy gut microbiome and enhance immune system support.

Manufacturers are expanding their probiotic gummy offerings by including a wider variety of probiotic strains beyond the traditional Lactobacillus and Bifidobacterium. This diversification allows for targeting specific health needs more effectively. For instance, gummies now contain strains like Saccharomyces boulardii, known for its benefits in managing diarrhea and gut infections.

In addition, these ingredients help improve sleep quality, reduce oxidative stress, and boost the production of melatonin, which is crucial for regulating sleep. The multiple benefits offered by these gummies have compelled manufacturers to launch these supplements.

Nowadays, nutritional supplement providers are increasingly forming partnerships to develop integrated versions of supplements that combine the benefits of probiotics. These collaborations address diverse human needs and enhance the overall effectiveness of these nutritional supplements. In October 2023, UK-based Clasado Biosciences and U.S.-based ingredient distributor Stratum Nutrition partnered to launch a probiotic-postbiotic gummy supplement in the SupplySide West trade show in Las Vegas, U.S. The gummy includes LBiome, a Lactobacillus LB postbiotic ingredient from Stratum and Clasado’s Bimuno galactooligosaccharide (GOS) prebiotic ingredient.

Application Insights

Digestive support probiotic gummies accounted for a market share of 65.5% of global revenues in 2023. Growing consumer awareness about the connection between gut health and overall well-being has fostered interest in digestive support products. For example, the increased recognition of the gut-brain axis and its impact on mental health has led to a greater demand for probiotics that promote a healthy gut microbiome. This has encouraged the demand for probiotic gummies aimed at improving digestive health and related wellness.

The immune support probiotic gummis market is projected to grow at a significant CAGR from 2024 to 2030. Increased awareness of the importance of a robust immune system has fueled interest in immune support supplements. This trend is exemplified by the rising number of consumers seeking products that can strengthen their immune defenses, particularly during times of seasonal illness or heightened health concerns. Immune-support probiotic gummies, known for their potential to promote a balanced immune response through gut health, align with this trend and are increasingly sought after by health-conscious individuals.

End Use Insights

Adults accounted for a market share of 78.9% of the global revenues in 2023. Adults often experience digestive issues such as bloating, irregularity, or antibiotic-related gut disturbances. Probiotic gummies formulated with strains like Lactobacillus acidophilus or Bifidobacterium lactis can help support digestive balance and alleviate these concerns. Brands specifically targeting adult digestive health needs have seen increasing demand for their probiotic gummy products.

The probiotic gummies for kids are projected to grow at a considerable CAGR from 2024 to 2030. The sweet taste of gummies and their availability in different flavors, shapes, and colors are among the key factors driving the demand for probiotic gummies among kids. The pleasant taste and attractive presentation of gummies make it easier for parents to convince their kids to consume these essential nutrients.

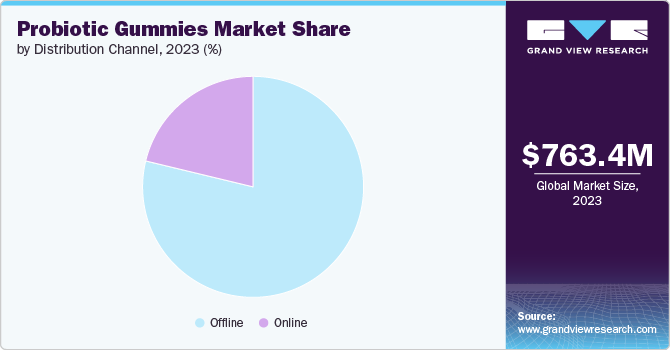

Distribution Channel Insights

Sales of probiotic gummies through offline channels accounted for a share of 78.8% of the global revenues in 2023. Offline retail channels usually provide a wide assortment of health and wellness items, accommodating different consumer tastes and requirements. The inclusion of gummy supplements, favored for their flavor and simple ingestion, adds to the appeal of these physical stores. Moreover, the inclusion of internationally recognized brands in these offline outlets elevates the trustworthiness and dependability of the offerings. These global brands frequently allocate resources towards marketing and promotional activities, fostering awareness and consolidating consumer confidence, ultimately leading to increased sales.

The sales of probiotic gummies through online channels are anticipated to register the highest CAGR from 2024 to 2030. The increasing interest in probiotic gummies via e-commerce or online platforms can be attributed to the extensive array of brands accessible. These platforms enable companies to showcase their products and attract a global audience of consumers, which might be challenging through traditional offline avenues. Additionally, these channels often utilize flexible pricing approaches and promotional offers to stimulate purchases. These aspects are greatly appreciated by consumers, motivating them to buy probiotic gummies.

Regional Insights

The probiotic gummies market of North America accounted for a share of 36.6% of the global revenue in 2023. The market's growth is fueled by the escalating understanding of dietary supplements and the consequent surge in spending on health and wellness products. The appeal of probiotic gummies is on the rise because of their convenience and enjoyable flavor, particularly favored by adults who encounter challenges with swallowing pills or dislike the taste of conventional supplements. Furthermore, producers are progressively customizing gummy supplements to cater to distinct demographic groups or tackle specific health issues.

U.S. Probiotic Gummies Market Trends

The U.S. probiotic gummies market is projected to register a significant CAGR from 2024 to 2030. With a heightened focus on overall wellness, consumers are increasingly seeking products that support digestive health, immunity, and nutrient absorption. The convenience of gummies, which are easier to consume than pills or capsules, appeals to both adults and Pregnant Women. For example, brands like Olly and SmartyPants have capitalized on this trend by offering a variety of probiotic gummies that are marketed for their health benefits and enjoyable flavors.

Europe Probiotic Gummies Market Trends

The probiotic gummies market of Europe is projected to grow at a considerable CAGR from 2024 to 2030. Europeans are increasingly prioritizing gut health and overall well-being, influenced by growing scientific evidence linking gut microbiota to various health benefits. The aging demographic, particularly in countries like Germany and Italy, is more susceptible to digestive issues, driving the demand for probiotic supplements. The preference for easy-to-consume, tasty supplements makes gummy formats popular, as seen with brands like Nature's Way and Garden of Life expanding their presence in Europe.

Asia Pacific Probiotic Gummies Market Trends

Asia Pacific probiotic gummies market is projected to grow at a CAGR of 16.3% from 2024 to 2030. Increasing awareness of the health benefits of probiotics, such as improved digestion and enhanced immunity, is driving demand, especially in countries like China, Japan, and India. Urbanization and hectic lifestyles are leading consumers to seek convenient health solutions, making probiotic gummies an attractive option due to their ease of consumption and appealing taste.

Key Probiotic Gummies Company Insights

The market is characterized by a mix of established dietary supplement brands, emerging startups, and pharmaceutical companies, all vying for market share through product innovation, quality, and branding.

Key Probiotic Gummies Companies:

The following are the leading companies in the probiotic gummies market. These companies collectively hold the largest market share and dictate industry trends.

- Culturelle

- Florastor

- Nature's Bounty

- SmartyPants Vitamins

- Church & Dwight Co., Inc. (Vita Fusion)

- Garden of Life

- NatureWise

- Now Foods

- The Procter & Gamble Company (Align)

- Nature Made (Pharmavite )

Recent Developments

-

In October 2023, Garden of Life expanded its well-received Vitamin Code line with a new range of gummy supplements. Consisting of seven products tailored to various needs, these gummies, like the rest of the Vitamin Code line, provide vitamins and minerals within a whole food base derived from raw fruits and vegetables. Moreover, they contain probiotics and enzymes, key elements noted throughout the Vitamin Code collection.

-

In July 2022, Pharmavite, the manufacturer of Nature Made gummies, revealed its plan to expand a gummy production facility in Ohio, U.S. The company invested USD 200 million to construct the new facility and acquire machinery and equipment. The gummy production facility is likely to drive the production of gummies and create new job opportunities in the region.

-

In June 2022, Vitafusion, a subsidiary brand of Church & Dwight Co., Inc., collaborated with American actress Tiffany Haddish to release 2-in-1 gummies-Multi + Immune Support and Multi + Beauty-targeting immune health and beauty. These gummies feature biotin and retinol (or vitamin A RAE) to support hair, skin, and nails.

Probiotic Gummies Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 992.3 million

Revenue forecast in 2030

USD 1.97 billion

Growth rate

CAGR of 14.7% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia; Brazil; South Africa

Key companies profiled

Culturelle; Florastor; Nature's Bounty; SmartyPants Vitamins; Church & Dwight Co., Inc. (Vita Fusion); Garden of Life; NatureWise; Now Foods; The Procter & Gamble Company (Align); Nature Made Pharmavite

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Probiotic Gummies Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global probiotic gummies market report based on application, end use, distribution channel, and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Digestive Support

-

Immune Support

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Men

-

Women

-

Pregnant Women

-

Geriatric

-

-

Kids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global probiotic gummies market size was estimated at USD 763.4 million in 2023 and is expected to reach USD 869.9 million in 2024.

b. The global probiotic gummies market is expected to grow at a compounded growth rate of 14.6% from 2024 to 2030 to reach USD 1.97 billion by 2030.

b. Digestive support probiotic gummies accounted for a market share of 65.5% of global revenues in 2023. Growing consumer awareness about the connection between gut health and overall well-being has fostered interest in digestive support products.

b. Some key players operating in the probiotic gummies market include Culturelle, Florastor, Nature's Bounty, SmartyPants Vitamins, Church & Dwight Co., Inc. (Vita Fusion), Garden of Life, NatureWise, Now Foods, The Procter & Gamble Company (Align), Nature Made Pharmavite )

b. Key factors that are driving the probiotic gummies market growth include increasing incidence of digestive problems. These gummies are designed to address gut health and microbial balance, offering effective relief for issues like antibiotic-associated diarrhea and gut inflammation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.