Probiotic Cosmetic Products Market Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care), By Distribution Channel (Pharmacy & Drug Stores, E-commerce, Others), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-272-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Probiotic Cosmetic Products Market Trends

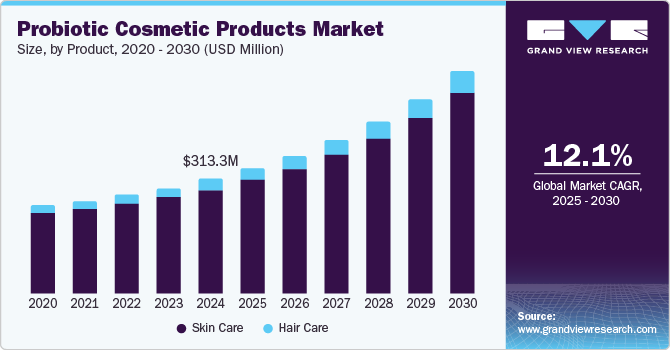

The global probiotic cosmetic products market size was valued at USD 313.3 million in 2024 and is projected to grow at a CAGR of 12.1% from 2025 to 2030. Increasing acceptance of probiotic products in dietary supplements has driven its applications in multiple areas, including skin care and cosmetics. Multiple companies have launched probiotic cosmetic products equipped with ingredients such as Lactobacillus, Bifidobacterium, and others.

An increasing number of scientific discoveries and product innovations contribute to the growth of this market. In recent years, cosmeceuticals have been experiencing advancements in terms of formulations, ingredients used in making, and more. Increasing awareness and information regarding the microbiome, its significant role in maintaining and enhancing skin health, and growing research and development efforts associated with internal homeostasis, moisture retention, and others are expected to influence the growth of this market.

Enhanced availability facilitated by the growing penetration of online shopping portals, e-commerce websites, and quick commerce platforms has also assisted this market in terms of growth. Effective marketing, delivery of information-based content, education programs deployed by the manufacturers, and brand endorsements have added growth potential to this industry.

The increasing number of individuals seeking products that support personal care and wellness regimes and ease of availability and accessibility to information regarding advanced cosmetic products add growth opportunities for this market. New product launches, collaboration with celebrities and social media influencers, recommendations by skin health professionals, and a growing customer base of the men’s grooming industry have been fueling the growth of the probiotic cosmetic market.

The entry of established beauty and personal care brands in the market, attractive portfolios aligned with changing customer preferences, and growing acknowledgment experienced by the personalized skincare sector are expected to drive demand for this market in the coming years. Additionally, the inclination towards using natural or organic products instead of products formulated only with chemical substances and additives is likely to influence this market positively during the forecast period.

Product Insights

The skincare segment dominated the global probiotic cosmetic industry with a revenue share of 90.6% in 2024. This segment is mainly influenced by factors such as growing demand from young urban consumers, increasing product launches, and the entry of multiple established cosmetic brands in the category. Significant research and development activities in probiotic cosmetic products, investments in probiotic cosmetic pilots, and research by popular brands are expected to generate growth for this segment. Enhanced availability driven by improved offline distribution and the growing digital presence of brands also influence this segment.

The hair care segment is projected to experience the highest CAGR from 2025 to 2030. This is attributed to multiple aspects, such as the increasing focus of various cosmetics brands on research and development of new hair care formulations and the growing demand for men’s hair care products worldwide. In recent years, multiple brands have focused on aligning their product portfolios with customer expectations characterized by various trends such as demand for natural or organic products, affordability, ease of use, and more. Launching newly designed Probiotic hair care range products such as shampoos, conditioners, and others by major companies also contributes to growing demand.

Distribution Channel Insights

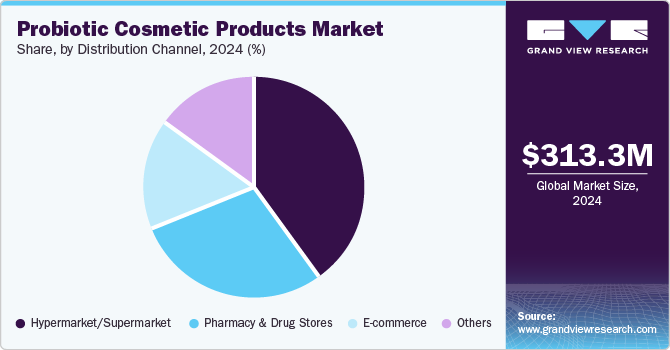

The hypermarket/supermarket segment held the largest revenue share of the global probiotic cosmetic products industry in 2024. Distribution of novel products based on emerging technology or the latest scientific discoveries through supermarkets or hypermarkets is highly preferred by major market participants as it offers enhanced brand visibility and assists in customer education. The growing popularity of organized retail brands that operate chains of hypermarkets and supermarkets built across various regions worldwide adds to the growth of this market.

The e-commerce segment is anticipated to experience the fastest CAGR during the forecast period. This segment is primarily influenced by the ease of use and convenience offered by e-commerce websites and the increasing utilization of modern technology-assisted marketing strategies such as personalized advertisements. In recent years, e-commerce industry participants such as Amazon, Alibaba, Walmart, Flipkart, and others have embraced the latest technologies, such as artificial intelligence. The newly designed marketing strategies of e-commerce businesses leverage the availability of consumer data and deploy effective marketing campaigns. The quick availability of probiotic cosmetic products through e-commerce, return and refund options, and accessibility to detailed product information has attracted many customers.

Regional Insights

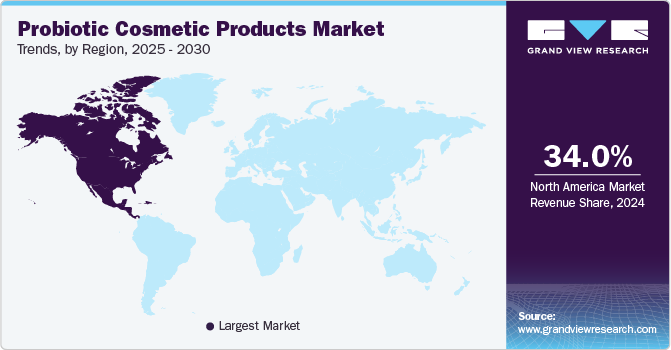

North America probiotic cosmetic products market held a revenue share of 34.0% in 2024. This market is primarily driven by factors such as the presence of multiple cosmetic industry participants in the region and growing demand from young urban users focused on embracing skin or hair wellness regimes. There has also been an increase in market penetration through the e-commerce industry.

U.S. Probiotic Cosmetic Products Market Trends

The U.S. probiotic cosmetic products market dominated the regional industry in 2024. This is attributed to a significant increase in research and development activities and the large number of companies exploring probiotic cosmetic product market opportunities. Established companies' investments in research, the availability of multiple products through online portals, and the growing acceptance of probiotic cosmetic products are expected to drive the growth of this market in the approaching years.

Europe Probiotic Cosmetic Products Market Trends

Europe probiotic cosmetic products market accounted for a significant revenue share in 2024. The presence of multiple cosmetic brands in the region significantly influences this market. Rising research activities by existing skin care manufacturers in the region and growing acceptance of probiotic ingredients are likely to generate a surge in growth for this market over the forecast period.

The probiotic cosmetic products market in Germany held the largest revenue share of the regional industry in 2024. This market is primarily influenced by increasing awareness regarding the benefits associated with the use of probiotic ingredients, growing demand for natural or organic products, and a significant increase in research activities focused on new product developments.

Asia Pacific Probiotic Cosmetic Products Market Trends

The Asia Pacific probiotic cosmetic products market is projected to experience the highest CAGR during the forecast period. This market is mainly driven by the growing focus of multiple cosmetic brands on emerging markets such as India and others. Growing demand from young consumers, increasing awareness regarding the significance of skincare and hair care in overall well-being, and significant growth experienced by companies entering the Asia Pacific market are also contributing to the growth of this regional industry.

The probiotic cosmetic products market in China held the largest revenue share of the regional industry in 2024. The growth of this market is primarily influenced by factors such as multiple production facilities in the country, the increasing focus of cosmetic brands on trials and research activities, and enhanced availability facilitated by online portals.

Key Probiotic Cosmetic Products Company Insights

Some of the key companies in the global probiotic cosmetic products industry are Esse Skincare, Estee Lauder Companies, Inc., Aurelia London (H&H Group), L’oreal S.A., and others. Growing demand and increasing acceptance for probiotic cosmetic products have stimulated multiple market participants to embrace strategies such as enhanced portfolios, improved research efforts, and collaboration with other companies.

-

Esse Skincare, one of the manufacturers in the microbiome skincare industry, offers a variety of products, including concealers, sensitive mists, protective oils, cleansers, D serum, cream cleansers, hyaluronic serum, repair oil, probiotic serums, intensity serums, more. Its probiotic cosmetic products range includes Esse Biome Mist, Esse Foundation, Esse Probiotic Serum, and others.

-

TULA Life, Inc., a company that specializes in probiotic skincare, offers a product portfolio characterized by solutions for multiple skin issues, such as acne and blemishes, aging, uneven tone, dark spots, dry skin, oily skin, sensitive skin, dull skin, and more. It also offers set and starter kits. Its products include cleansers, moisturizers, eye care, lip care, toners and face mists, body care, complexion, primers, sunscreens, masks, serums, and more.

Key Probiotic Cosmetic Products Companies:

The following are the leading companies in the probiotic cosmetic products market. These companies collectively hold the largest market share and dictate industry trends.

- Esse Skincare

- Estee Lauder Companies, Inc.

- Aurelia London (H&H Group)

- L’oreal S.A.

- TULA Life, Inc.

- EMINENCE ORGANIC SKIN CARE

- Unilever

- LaFlore Probiotic Skincare

- GLOWBIOTICS

- The Clorox Company

View a comprehensive list of companies in the Probiotic Cosmetic Products Market

Recent Developments

-

In September 2024, Unilever introduced the POND’S SKIN INSTITUTE Microbiome Analyzer, a new technology that provides personalized skincare recommendations based on an individual’s skin microbiome analysis, completed within 60 minutes. This innovation responds to the increasing consumer demand for science-based skincare solutions and utilizes Unilever’s expertise in microbiome science to generate tailored product suggestions. The Microbiome Analyzer was piloted in partnership with Watsons in the Philippines, highlighting the company’s commitment to advancing skincare technology and meeting evolving consumer needs.

-

In December 2023, L'Oréal announced the acquisition of Lactobio, a Danish company specializing in precision probiotics and microbiome research. This strategic move aims to enhance L'Oréal's expertise in microbiome science, enabling the development of innovative cosmetic solutions that incorporate live bacteria for improved skin and hair benefits. The integration of Lactobio's advanced formulations with L'Oréal's technological capabilities is expected to accelerate the creation of new beauty products based on scientific research.

Probiotic Cosmetic Products Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 341.8 million |

|

Revenue forecast in 2030 |

USD 604.8 million |

|

Growth Rate |

CAGR of 12.1% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

December 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, Australia, South Korea, Brazil, UAE |

|

Key companies profiled |

Esse Skincare; Estee Lauder Companies, Inc.; Aurelia London (H&H Group); L’oreal S.A.; TULA Life, Inc.; EMINENCE ORGANIC SKIN CARE; Unilever; LaFlore Probiotic Skincare; GLOWBIOTICS; The Clorox Company |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Probiotic Cosmetic Products Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, grand view research has segmented the global probiotic cosmetic products industry report based on product, distribution channel and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Skin Care

-

Hair Care

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket/Supermarket

-

Pharmacy and Drug Stores

-

E-commerce

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

United Kingdom

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East

-

UAE

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."